Morning Briefing: Asia

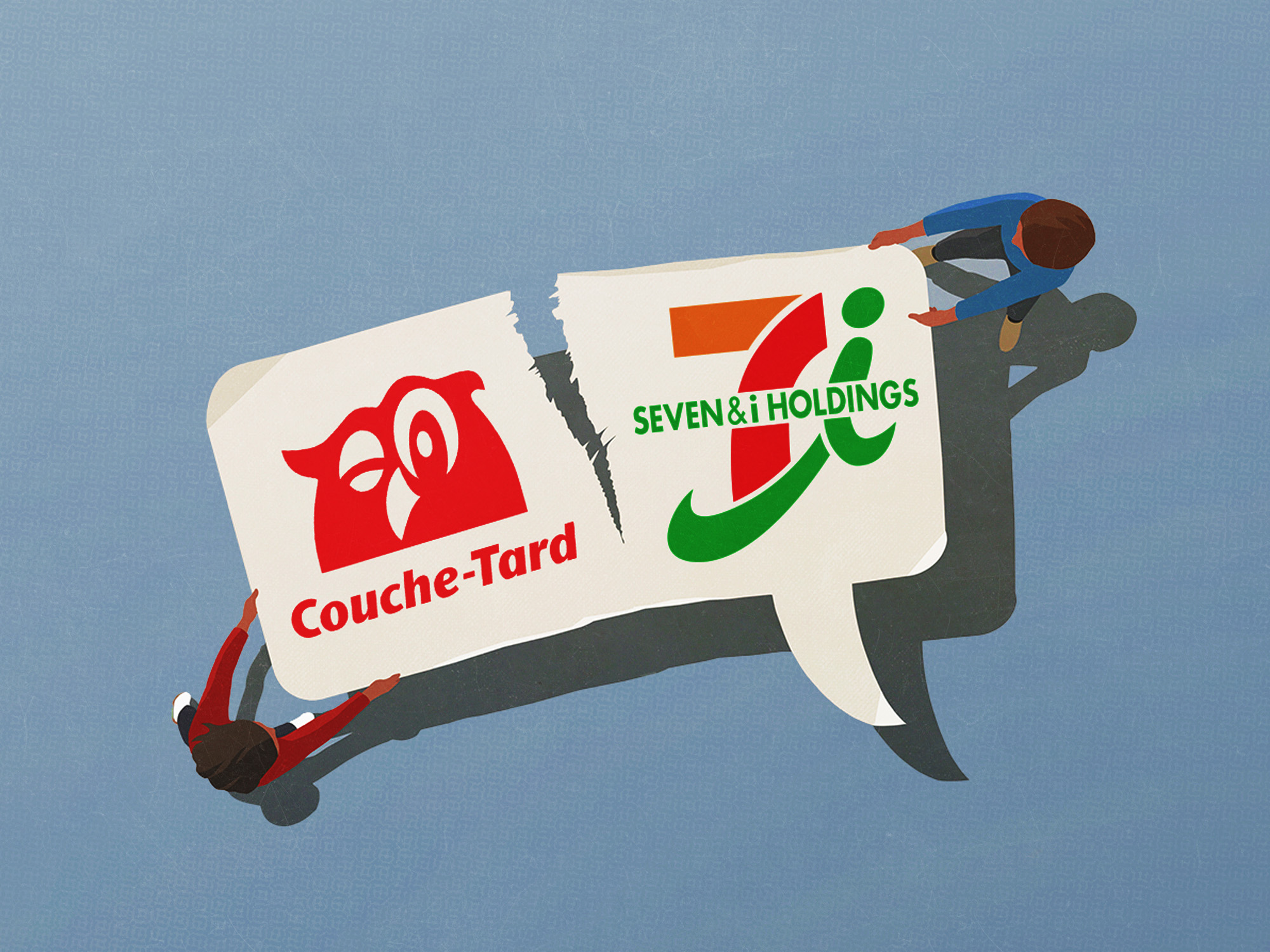

| Bloomberg Morning Briefing Asia | | | | Good morning. Netflix doesn’t disappoint. Couche-Tard’s abandoned bid for Seven & i exposes mounting pressures in its own business. And $17,000 made-in-China Chevys are winning hearts in Mexico. Listen to the day’s top stories. | | | Markets Snapshot | | | | Market data as of 05:34 pm EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | | | Netflix topped Wall Street’s lofty expectations with second-quarter results that exceeded estimates in every major metric. Revenue grew to $11.1 billion and earnings jumped to $7.19 a share. The company also raised its forecast for full-year sales and profit margins. The world’s most popular paid streaming service has managed to thrive while rival media companies are unloading assets and cutting costs. The S&P 500 notched another record, buoyed by solid retail sales and a drop in jobless claims that signal the world’s largest economy is holding up. Morgan Stanley’s Mike Wilson sees a bull market building in equities, but warns the S&P 500 may face “short and shallow” dips. Bets that Federal Reserve rate cuts are coming will also add to the rally, according to JPMorgan’s Ilan Benhamou. | | | | | Robotaxi team-up. Uber is joining forces with electric vehicle maker Lucid Group and self-driving tech startup Nuro to roll out a robotaxi fleet. The ride-sharing giant plans to launch its first vehicle late next year in an unidentified major US city, with a goal of deploying at least 20,000 over the next six years. Tesla—long working on its own robotaxis—should watch out, according to Bloomberg Opinion’s Liam Denning. Travel freeze. Wells Fargo suspended travel to China after one of its bankers was blocked from leaving the country. Chenyue Mao, a Shanghai-born, Atlanta-based managing director in trade financing, was prohibited from exiting the Asian nation after entering in recent weeks, a person familiar said. AI takes a bite. Amazon cut jobs in its cloud-computing division, becoming the latest tech giant to reduce headcount amid rising artificial intelligence costs. Chief Executive Officer Andy Jassy said in June that he expected the company’s workforce to shrink in the next few years as AI takes more tasks. | | | | Deep Dive: We Need to Talk | |  Illustration: Daybreak/Getty Images Alimentation Couche-Tard pulled the plug on its pursuit of Japan’s Seven & i as the Canadian retailer’s ambitions gave way to mounting pressure within its own business. The yearlong chase ended in acrimony, with Couche-Tard claiming Seven & i’s founding Ito family was never open to talks, and blaming the board for a “calculated campaign of obfuscation and delay.” - Couche-Tard’s investors may have seen it coming. According to BMO Capital Markets analyst Tamy Chen “most investors already assumed a low probability of a transaction.”

- The real test begins. Now, Seven & i investors are skeptical about whether the company can actually deliver value through a sweeping overhaul—including plans to sell off less-profitable retail units, list its US business, execute a ¥2 trillion share buyback, and hand the reins to newly appointed Chief Executive Officer Stephen Dacus.

- Who else is losing? Wall Street banks—from Goldman Sachs to Morgan Stanley are missing out on millions in fees after Couche-Tard abandoned its bid. Goldman Sachs had been advising on its ¥6.77 trillion ($46 billion) offer, while Morgan Stanley was acting as Seven & i’s adviser.

- Bloomberg Opinion’s Gearoid Reidy thinks the deal was doomed from the start. By withdrawing its bid, Couche-Tard revealed just how unprepared it always was.

| | | | | | | | | Shigeru Ishiba’s failure to land a US trade deal may cost him his job, Gearoid Reidy writes. But with tariffs looming and chaos deepening, few in the LDP want to replace him. | | | More Opinions |  | |  | | | | | |  A Chevy Aveo at a showroom in Mexico City. Photographer: Jeoffrey Guillemard/Bloomberg Made-in-China Chevys—costing just about $17,000—are winning hearts in Mexico, offering a wallet-friendly (and fuel-efficient) option at a price that US buyers can only dream of, as Trump’s tariffs keep such imports out of the market. About 65% of GM’s sales in Mexico are brought in from the Asian nation. | | | | |