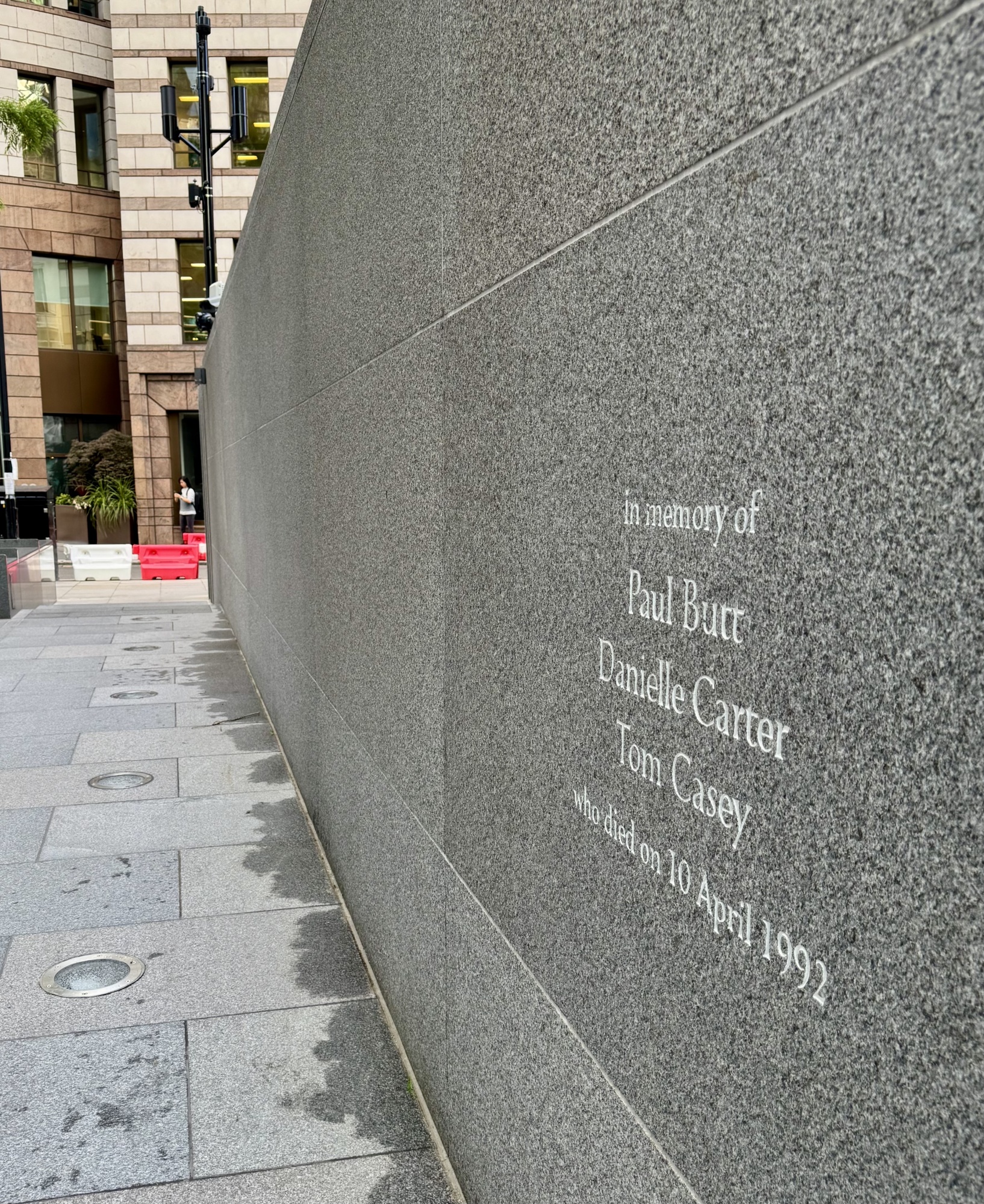

| This is Bloomberg Opinion Today, a far-ranging ramble through Bloomberg Opinion’s opinions. Sign up here. When Mountains Turn to Water | It’s not been a good couple of weeks for India. On Aug. 1, the US announced that it would impose a 25% tariff on imports from the country. That was followed by a punitive and additional 25% — what President Donald Trump has called a “secondary tariff” — for New Delhi’s continuing purchase of Russian oil, which Washington says is helping to finance Moscow’s invasion of Ukraine. The fallout from Trump’s trade neologism may spread beyond India, says Andy Mukherjee. “Secondary sanctions impose a cost on third parties for allegedly enabling bad behavior by someone else. If a US bank, port, ship, or company is prohibited from engaging in a transaction involving the Russian financial system, then a secondary sanction can make it potentially illegal for non-Americans, too.” Andy concludes: It’s really a sanction, and it will shake the seemingly monolithic power of India’s Prime Minister Narendra Modi. Consider this, says Andy: “State-owned Indian refiners are already pulling back from the Russian trade. If they start showing up on the [official sanctions blacklist], it would become difficult for others to do business with them. No amount of nationalistic bluster can mitigate the seriousness of that threat. To lose access to the US currency or the Western-controlled banking system would be a far bigger setback than a 50% tariff. Even large Indian tycoons will not want to needle Trump.” Adding insult to injury, the US seems to have realized that China — India’s archrival in Asia — is too big to bully. Says Mihir Sharma: “Policymakers who would welcome a US trade war against China feel very differently about an America that shies away from that confrontation to pummel India instead. Beijing emerges with its status enhanced, the only country that can take on Trump.” (Andreas Kluth believes the US will come to regret throwing India under the bus.) The potential for meltdown seems to have manifested in India’s environment. The state of Uttarakhand, which includes gorgeous stretches of the Himalayas, has once again been subjected to fatal flash floods from melting mountain ice, unrestrained by woodlands cut down for tourist development. A huge national park surrounds the stunning twin peaks of Nanda Devi, but it is the religious sites farther west — along streams that feed the holy river Ganges — that have helped make the environment even more fragile. The pilgrims have been inspired by Modi’s own pious visits to the area. Writes David Fickling: “He’s visited the mountain shrines multiple times and thrown his weight behind 860 billion rupees ($9.8 billion) of road and railway projects linking the four towns [at the center of pilgrimage]. … Building roads, railways, hotels, restaurants and shops to serve the booming tourist trade results in deforestation and the dumping of excavated earth into river valleys. That speeds the path of rainfall from the clouds into the narrow channels that carry it away downstream, increasing the risk of damaging floods.”  View of a river valley, from 7,800 ft. above sea level, in Uttarakhand, 2017. Photograph by Howard Chua-Eoan/Bloomberg I had the privilege of visiting Uttarakhand eight years ago to see the southern edges of the rooftop of the world. Back then, locals were saying there was much less snow in the heights as in years past and that the glaciers seemed to be in retreat. But there is still enough ice to cause deadly mayhem, if the temperatures rise and the landscape no longer provides cover. Forget K-Pop. Stop the K-Drama. Bring on K-Ball! | When I was trying to figure out an English football team to root for last year, the superstar presence of Son Heung-min on the team roster almost made me opt for Tottenham Hotspur. Eventually, I picked Chelsea (I know, I know, the teams have a visceral hatred for each other), but still had a very soft spot for the South Korean forward. After all, he was not just a Tottenham god, but probably the greatest East Asian football player ever. Now, Sonny — as he’s nicknamed — is taking his skill and his aura to California and the 11-year-old Los Angeles Football Club. His contract is reportedly worth $26 million, which is more than the entire salary of the rest of the LAFC. Paul J. Davies says it’s a perfect move for Son, the club and Major League Soccer. “His name might be less familiar to many Americans than Lionel Messi or David Beckham, but in South Korea and among its diaspora, his celebrity and reputation are almost unsurpassed. Son’s move should be a shot in the arm not just for LAFC on the pitch, but also for MLS as the sport scrambles to build interest and capitalize on next year’s FIFA World Cup being held in the US, Canada and Mexico.” Los Angeles — and Southern California as a whole — is also home to the largest community of Koreans outside of Asia. It’s going to be a lot of fanatical fun in the Southland. I can’t wait for him to start — and I can root for him without enraging my mates who cheer for Chelsea. “When a bet goes wrong, investors are often tempted to hold on, convincing themselves that their short-term trade was always meant to be a long-term position. The self-delusion is easiest in commodity markets: Their cyclical nature means that, inevitably, what’s high will eventually be low and vice versa. It just takes patience — and the stomach to withstand losses for as long as it takes. With oil benchmarks down almost 20% over the last two years, upbeat investors are, out of necessity, waiting. … But waiting for a recovery will require a ton of forbearance, and incur significant opportunity costs. That’s particularly true for anyone who bought at $100-plus a barrel, given that crude today hovers around $65.” — Javier Blas in “The Bullish Case for Oil Is Real — But Far, Far Away.”  “No longer the most populous nation and confronted with projections that its citizenry will dwindle significantly in a couple of generations, China is trying something new. The message is more telling than the substance. Beijing announced last week it will subsidize households to have children. Babies born after Jan. 1 this year will receive 3,600 yuan ($500) annually until age three. ... They may not do a huge amount for China’s population, but they provide people with money to spend. [President Xi Jinping] and his predecessors have been trying to shift the engine of the economy more toward consumption and away from exports and investment.” — Daniel Moss in “China’s Baby Benefits Are Tiny. That Isn’t the Point.” Ick! Plastic’s become your brain food. — Lara Williams How World War III didn’t happen. — Tobin Harshaw Let’s pay all the lawyers — even more! — Chris Bryant The solution isn’t banning teens from YouTube. — Catherine Thorbecke I’m not afraid of flying. You’re afraid of flying! — Howard Chua-Eoan China’s national team that buys the dip. — Shuli Ren What’s good for Italy isn’t good for Germany. — Marcus Ashworth Walk of the Town: Lost Girls, Centuries Apart | When I lived in Tower Hill — across from the Tower of London — I used to walk to work via a street called St. Mary Axe to contemplate the way history had conflated itself there. One theory for the brutal name — among many — goes back to a now vanished parish church in the area called “St. Mary, St. Ursula and Her 11,000 Virgins.” A hatchet supposedly used by the Huns to martyr the Roman noblewoman Ursula and her multitude of maiden attendants was once a relic in the church. That legend finds an echo in a burial on the site: that of a Roman girl whose remains were found 30 years ago when the foundation was being prepared for 30 St. Mary Axe — the crystalline blue building known today as the Gherkin, designed by the architect Norman Foster. Forensic scientists from the Museum of London estimate she was 13 to 15 years old and died between 350 and 400 CE. In the year 410, the Roman Emperor Honorius sent a letter to his subjects in Britain, informing them that the empire was withdrawing from the island. She was reinterred by the Gherkin a couple of years after its completion — with a dedication in English and Latin carved in stone.  By the grave of the unknown Roman girl. Photograph by Howard Chua-Eoan/Bloomberg The discovery of the unnamed young woman from Roman London came as the area around St. Mary Axe was being rehabilitated. It had been wrecked by the explosion of a one-ton bomb set by the Irish Republican Army at 9:30 pm on April 10, 1992. Three people died, including 15-year-old Danielle Carter, who was sitting in a car with her sister, waiting for their father to get off work.  The memorial to the victims of the 1992 IRA bomb. Photograph by Howard Chua-Eoan/Bloomberg Her name has been carved into the gray stone wall on the north side of the same plaza where the grave of the unknown Roman girl lies. Sometimes, it’s an effort just to keep your head above water.  “Relax. You don’t have to get into a twist over every crisis.” Illustration by Howard Chua-Eoan/Bloomberg Notes: Please send convoluted arguments and feedback to Howard Chua-Eoan at hchuaeoan@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |