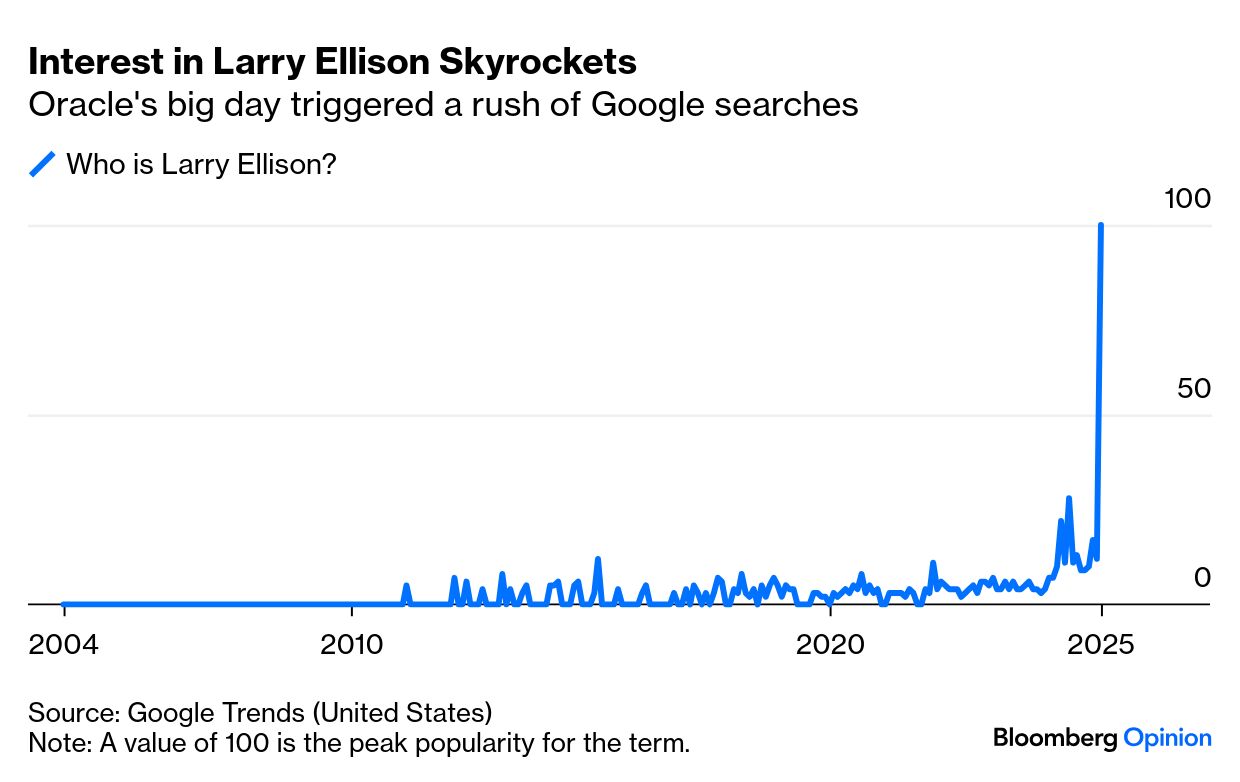

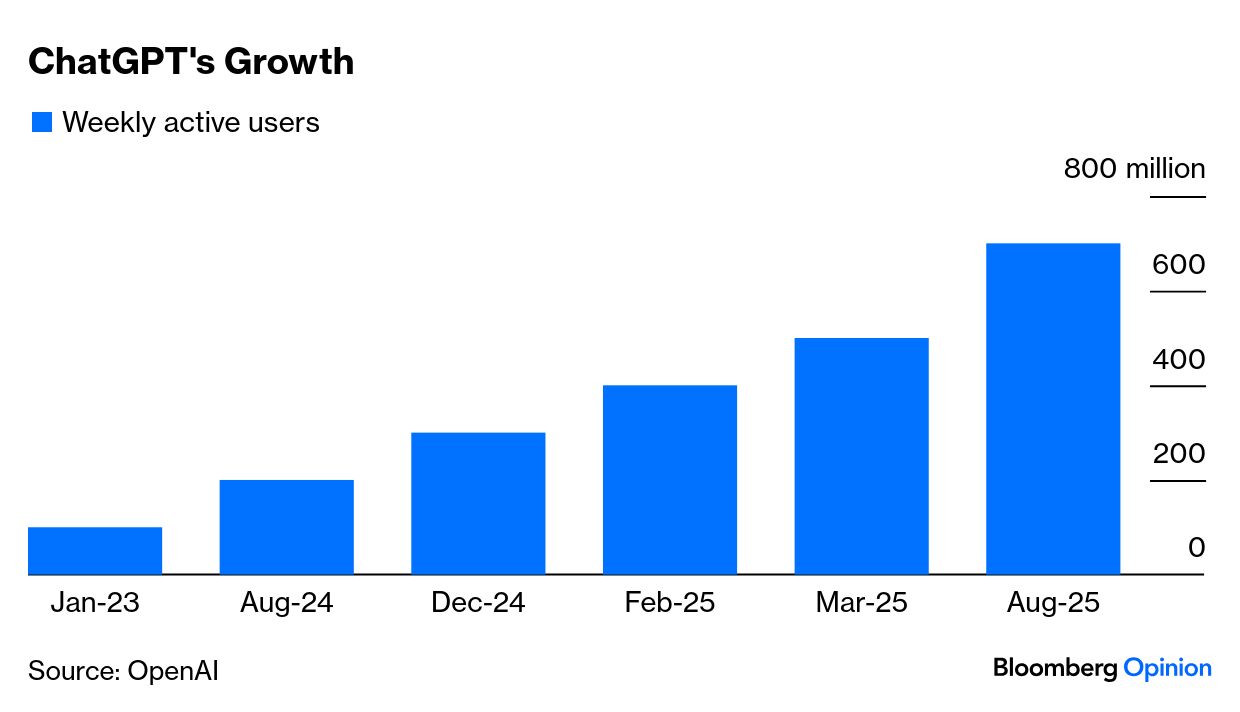

| This is Bloomberg Opinion Today, a squishier value proposition of Bloomberg Opinion’s opinions. On Sundays, we look at the major themes of the week past and how they will define the week ahead. Sign up for the daily newsletter here. For the last couple of years, I have eagerly picked up the check at every meal. No, I am not a generous person, a fact well established in this column. I do it for the ping. The clang. The boing. That amazing sound when you oh-so-casually drop your Apple Card on the table and all heads turn as titanium hits wood or marble. Everybody knows you didn’t only treat them to dinner, but are super-cool as well: Despite the cool factor, the card hasn’t been much of a hit — Goldman Sachs, which backs Apple’s finance venture in a foolish turn toward commercial banking — is trying to dump it on JPMorgan Chase. The design of it may offer a clue why. Jony Ive and his graphics gremlins — in one of the greatest-ever triumphs of form over function — decided that putting any information, save for a name, on the credit card would mar their masterpiece. There’s no number on the front or back. No CV code either. No expiration date. I am not making this up. Watch the super-pretentious video here. See the even more pretentious instructional page on how to clean (!!) your Apple Card. Again, not making this up.  If, for some reason, you want your account number to, you know, use the card over the phone or set up an Amazon account or sign up for Bloomberg.com [1] or any of the zillion other things that a credit card is meant to do, you need to take out your iPhone, show your face, open the wallet, choose the digital version of the titanium masterpiece, show your face again, and click a little credit-card icon in the upper-right corner which takes you to a new page with card number. Yeah, the clang seems to be the whole point. Who could possibly want such a thing? Me, of course. And 12 million other captives of Cupertino cool. Last week was our annual celebration of early-adopter insanity: the Worldwide Developers’ Conference and attendant “Apple Event.” And we got … well, not exactly an early Christmas. “Apple Inc. introduced the 5.64 mm-thick iPhone Air to answer those critics who say that at 7.95 mm, the new iPhone 17 is too thick, a certified whopper. If you can locate any of those critics, please send them to me because I don’t believe they exist,” writes Dave Lee. “Nor do I believe many consumers will care about thickness when they learn the iPhone Air means sacrificing things they worry about more than any other factor: battery life and a more-capable camera.” I’m not gonna be a guinea pig. “The iPhone Air, then, might be a consumer-testing and market research opportunity for Apple ahead of some truly large upgrades coming next year,” adds Dave. “The iPhone Air makes use of Apple’s own wireless chip and modem. Spinning up the supply chain that produces them will be useful as Apple prepares for products like the highly anticipated folding iPhone, which will ultimately feel like two iPhones fused together.” Man oh man I am excited for that. A Kool Kidz version of the Samsung Galaxy Z Fold7 just as I turn 60 and my eyesight fades and fingers fumble. But the big mystery at Apple isn’t about silly credit cards or sideways flip-phones. It is: Why has Tim Cook lagged his competitors so badly on AI, and even stood silently as Meta poached genius after genius from his development team? “There are two ways to look at this state of affairs. One is that Apple is in disarray, its AI products don’t work because it has been caught napping on the next great tech revolution and is hemorrhaging talent as a result,” Dave writes in a separate column. “Another is that Cook is exercising restraint as others in Silicon Valley lose their heads.” Perhaps standing still is the best way to get ahead. “Every investor knows not to put all your eggs in one basket. So why is Silicon Valley betting on just one way to build artificial intelligence? This year the world’s four largest tech firms will spend $344 billion on AI, mostly on data centers used to train and run so-called large language models (LLMs),” warns Parmy Olson. “But history is full of people who got fixated on a single ‘winning’ approach to tech, only to fall behind when the landscape suddenly shifted. Think of BlackBerry’s devotion to the physical keyboard before Apple Inc. crushed it with touchscreens, or Yahoo’s big bet on portals while Google quietly dominated search.” Or, uh, whatever seems to be happening here:  It’s clear the investing class isn’t buying Parmy’s argument. Rather, it is buying what Oracle is selling and in the process making Larry Ellison the richest man in the world. “[Oracle’s] shares surged 36%, the most since 1992, after the company signed ‘significant cloud contracts with the who’s-who of AI,’” writes Shuli Ren. “Unfortunately, Oracle’s drastic melt-up also raises the uncomfortable question of whether sell-side analysts know how to value tech companies in the AI era. After all, the improvement of the technology’s capabilities can be non-linear, and investment professionals need to incorporate this aspect in their models without making their forecasts look outlandish.” The truth is, nobody — not even ChatGPT — knows what this chart is going to look like in 2035:  Does $100 billion count as outlandish? Because after “months of protracted negotiations between OpenAI and Microsoft Corp. have finally led to… an agreement about an agreement that will help the AI upstart carve a path towards greater independence,” reports Parmy in a separate column. The supposedly nonprofit entity devoted to bettering mankind will get a “poisoned chalice” of equity in the 12 digits. That’s 12 more than my Apple Card has. Bonus Magic Number Reading: What’s the World Got in Store? - FOMC rate decision, Sept. 17: The Fed Is Doing What It’s Been Told — John Authers

- FedEx earnings, Sept. 18: FedEx Has More to Worry About Than Tariffs and a Freight Slump — Thomas Black

- London fashion week begins, Sept. 18: Kering’s New CEO Has the Toughest Job in Luxury — Andrea Felsted

In her Oracle column, Shuli has a timely question and a pertinent answer: “What’s the fair value of a tech company? This question no longer has good answers when artificial intelligence is rapidly altering the investing landscape.” Amid the market cap insanity at Oracle, Nvidia, Broadcom and the like, one still has to wonder, what exactly is AI good for? Catherine Thorbecke found a wonderful use for Vidu, a Chinese-made “reference image” editing platform: “In seconds,” she explains, “I created an image of President Donald Trump holding up a bedazzled Labubu doll by combining two separate shots I found online. (My request for President Xi Jinping doing the same was rejected.)” Political satire is just the tip of the iceberg. “The real consumer breakthrough for AI may not be chatbots, but tools that alter the images we hold closest,” adds Catherine. “If you’ve ever had a photo that didn’t turn out quite right, they promise to instantly fix that without the need for a reshoot. But they go far beyond just glamourizing selfies: Family members who missed a reunion can be added, as could your favorite celebrity.” Indeed, maybe tech companies have to focus less on the cutting edge and more on the UX, or what used to be called having fun. “While businesses grapple with how best to plug generative AI tools into their systems (as they’ve naturally done with every other technology wave in history, from PCs to smartphones to social media) individuals have been embracing the technology,” writes the tireless Parmy in a third (!!!) column. “Some of AI’s biggest winners so far are companies who are chasing squishier value propositions like entertainment and camaraderie. A study by Harvard Business Review earlier this year found that the three most popular use cases for generative AI were therapy and companionship, organizing life and ‘finding purpose.’” OpenAI may have snagged $100 billion, but is it finding purpose or losing it? Note: Please send unpoisoned chalices and feedback to Tobin Harshaw at tharshaw@bloomberg.net |