| | In a report shared exclusively with Semafor, the largest US bank explains why and how it’s advising ͏ ͏ ͏ ͏ ͏ ͏ |

| |   New York City New York City |   Baku Baku |   Budapest Budapest |

| Net Zero |  |

| |

|

- JPMorgan’s new energy paradigm

- Defending Musk’s pay

- Lessons from last COP

- EPA gives up

- Big Oil’s spending problem

China is stockpiling crude oil — and grid-scale batteries. |

|

Climate Week NYC used to be a boring annual sideshow to the UN General Assembly. In the last few years those roles reversed, as Climate Week exploded into a must-visit global melange of climate tech innovators and financiers. But as I write below, recently momentum seems to have been sapped from the energy transition. Is that a fictive political narrative, pushed by those with a stake in legacy industries, or a real and well-founded response to the changing realities of global conflict and energy demand? Next week might be a chance to tell — and judging by the approximately one billion events listed by our friends at CTVC and NY Climate Tech, it seems safe to say that it will be another high-octane, high-caffeine, high-alcohol, high-hustling week. I’m looking forward to it, especially my own events, starting on Tuesday evening with our Nights of Net Zero cocktail party on the AI energy challenge, and concluding Thursday night with our traditional Net Zero reader happy hour, which tends to be my favorite part of the week. Hope to see you there! |

|

JPMorgan’s new energy paradigm |

| |  | Tim McDonnell |

| |

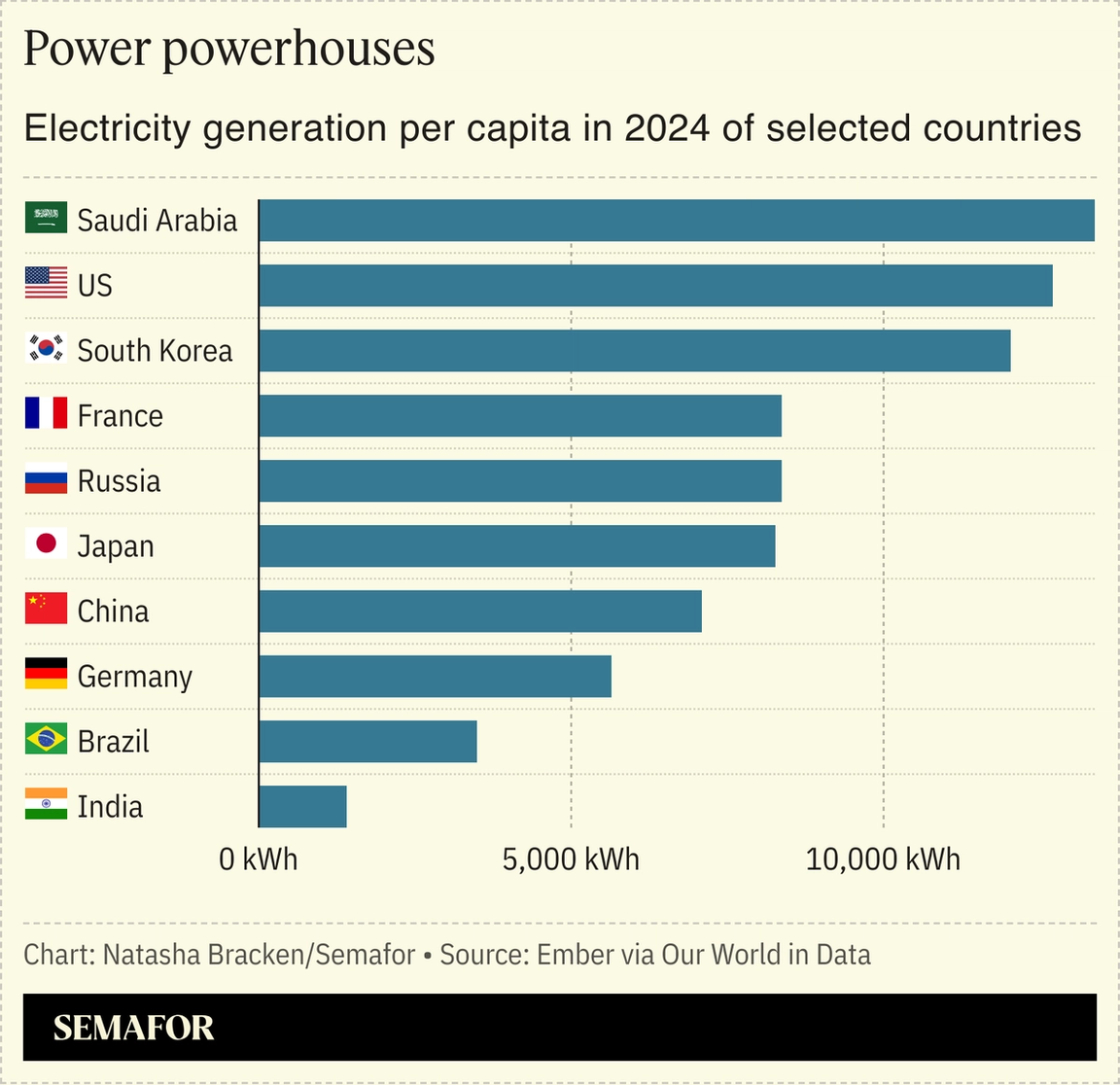

The global energy transition is forging ahead, fracturing old trade alliances and generating new forms of geopolitical leverage that all companies need to be more attuned to, JP Morgan believes.  In a report shared exclusively with Semafor, two top researchers at the largest US bank argue the global economy is moving into a “new energy security age” that will see the relative power of fossil fuels wane, but not disappear, and a wider range of assets — including critical minerals, electric grids, nuclear technology, and investments in R&D — come to define what really constitutes energy “dominance.” The US could still fare very well in this scenario if it takes advantage of the full resources at its disposal, not just oil and gas, they write. The bank is advising its clients to take that change seriously, Sarah Kapnick, its global head of climate advisory, told Semafor. “As a bank, some of the things that we’ve taken for granted about energy over the last few decades are changing,” she said. “The rug has been pulled out from under us, and we need to think about how to have growth under this different regime.” |

|

| | Liz Hoffman and Reed Albergotti |

| |

Robyn Denholm. Christine Chen/Reuters Robyn Denholm. Christine Chen/ReutersTesla’s board chair said she isn’t convinced that Elon Musk’s conservative political turn has hurt the company’s car sales and defended a blockbuster pay package that has drawn criticism from governance scolds and the pope. Musk’s stint in the White House, subsequent split from the president, and continued embrace of right-wing causes have alienated consumers across the political spectrum, polls have repeatedly found. That sentiment has coincided with plummeting sales of Teslas, particularly in Europe. Denholm is giving interviews to explain the board’s decision to award Musk a pay package that could be worth $1 trillion if the company hits milestones for market capitalization, profits, and vehicle production. Tesla says the high headline figure is the cost of keeping Musk focused on Tesla, rather than on his other companies, including SpaceX and Neuralink, or on politics. Tesla’s board members “have access to a lot of information, and it’s not conclusive one way or another,” Robyn Denholm said in an interview Monday. “Could there be some impact? There could be, but there were other factors as well,” she said, including Tesla’s decision to shut down and retool its main factory this summer. |

|

| | Prashant Rao and Alexis Akwagyiram |

| |

Protestors in Belem ahead of COP30. Wagner Santana/Reuters. Protestors in Belem ahead of COP30. Wagner Santana/Reuters.Protecting multilateral efforts to combat global warming is the chief challenge facing the upcoming COP30 climate summit, the head of last year’s COP told Semafor, as Washington prepares to withdraw from the Paris Agreement. Mukhtar Babayev made the comments after attending talks by African leaders looking to secure $50 billion a year in a new continental climate solutions initiative. “The main challenge is… how to protect a multilateral process, how to protect the climate agenda, and how to have very ambitious plans,” Babayev said in an interview, referring to Washington’s refusal to send negotiators to November’s COP30 meeting in Brazil. Babayev said African leaders had shown a commitment to cooperate with international organizations, and pointed to Ethiopia and Nigeria as two countries that had shown leadership on climate discussions, noting that both nations had put themselves forward to host COP32 in 2027. |

|

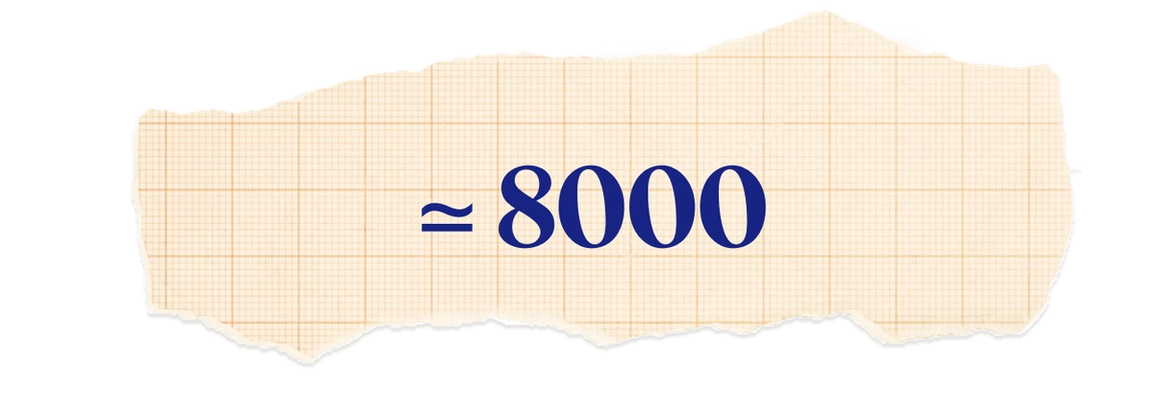

The number of US facilities that will no longer have to report annual emissions of carbon dioxide, methane, and other greenhouse gases. On Friday, the Environmental Protection Agency proposed scrapping a 2010 program that requires polluters to disclose their greenhouse gas emissions — the country’s most comprehensive tracking system. EPA Administrator Lee Zeldin called the program “bureaucratic red tape,” and added that data collection “has no material impact on improving human health and the environment.” Critics counter that without this data, governments can’t identify emission sources — or reduce them. The move has puzzled many since ending the program would bar every company, including oil firms, from accessing federal subsidies for capturing carbon or producing hydrogen fuel. —Natasha Bracken |

|

Big Oil’s spending problem |

Eli Hartman/Reuters Eli Hartman/ReutersThe oil and gas industry is spending about $500 billion a year just to maintain consistent production from existing wells, a new International Energy Agency report found, as global fossil fuel reserves run down more quickly than previously expected. The report found that 90% of the industry’s annual capital spending on drilling since 2019 “has been dedicated to offsetting production declines rather than to meet demand growth.” That trend can be largely attributed to the industry’s increasing reliance on fracking for shale oil and gas, which demands ongoing spending to remain operational. The report cautions that less investment may be needed in the future as oil and gas demand declines, and the IEA has repeatedly warned that the global economy is moving toward an oversupply of fossil fuels. But for now, the report indicates, oil and gas companies need more capital just to keep up — a message that will likely be welcomed by the industry’s advocates. |

|

New Energy- The UK’s largest electricity supplier signed a deal with a Chinese wind turbine manufacturer that could lead to the first Chinese-made turbines installed in the country.

- The IEA cut its 2030 projection for low-emissions hydrogen development by nearly a quarter, citing cancellations, cost challenges, and political uncertainty.

- China aims to nearly double its new energy storage capacity by 2027.

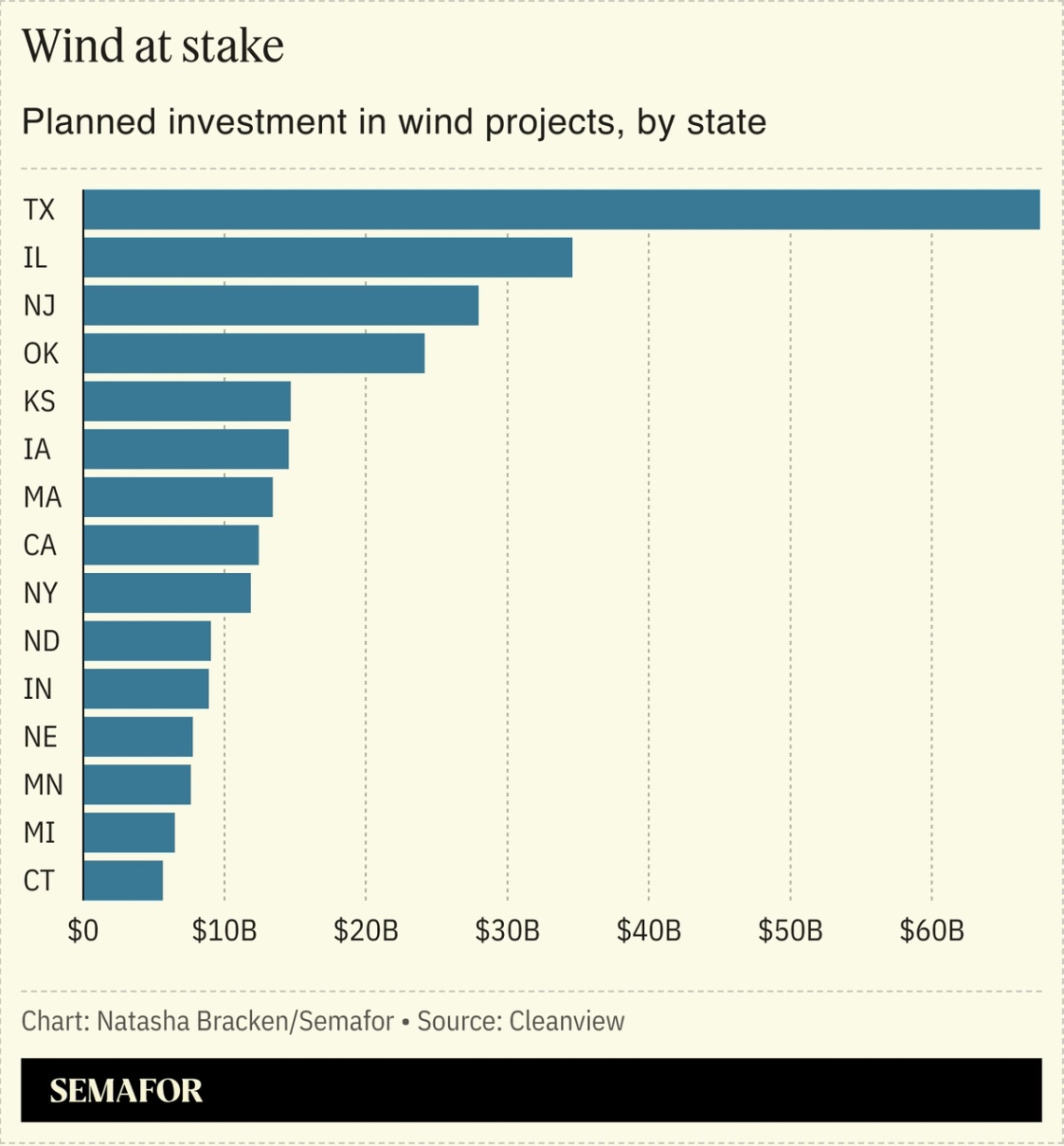

- The Trump administration asked a judge to revoke approval of a wind farm off the coast of Maryland, marking the latest assault on wind energy by the White House.

- Wind developer Ørsted announced it would sell new shares at a 67% discount in a $9.4 billion rights issue, as it looks to strengthen its finances after Trump cancelled its US projects.

- The US energy secretary said the country should increase its uranium reserves to reduce reliance on Russia, which currently provides about a quarter of the enriched uranium needed to power US nuclear reactors.

Fossil FuelsTech- Google selected Shell as its renewable energy manager in the UK to help meet its goal of running entirely on clean energy by 2030, as the company unveiled plans for a new data center in the country.

Politics & Policy- The Trump administration’s efforts to block clean energy projects, at a time of rising energy demand, will inevitably drive up costs for Americans, Bloomberg’s editorial board argued.

- State lawmakers sent Gov. Gavin Newsom a package of bills aimed at curbing California’s energy costs, including measures to expand oil drilling and limit utilities’ wildfire liabilities.

EVsCOP30- Soaring accommodation and participation costs at this year’s COP30 are sidelining poorer nations, despite their heightened vulnerability to climate change.

|

|

|