Australia Briefing

| Happy Friday, it’s Carmeli here in Sydney. The ASX looks set to open higher this morning, but first here’s the latest news to take you into | | | | Happy Friday, it’s Carmeli here in Sydney. The ASX looks set to open higher this morning, but first here’s the latest news to take you into the weekend.

Today’s must-reads: | | | | |

What finally tipped the $19 billion Santos takeover over the edge? Trust frayed over reports of a methane leak that bidders led by Abu Dhabi National Oil Co. learned of through the media, not the company. The late-stage breakdown — Santos’ third failed deal under CEO Kevin Gallagher — wiped A$3 billion off the firm’s market value yesterday.

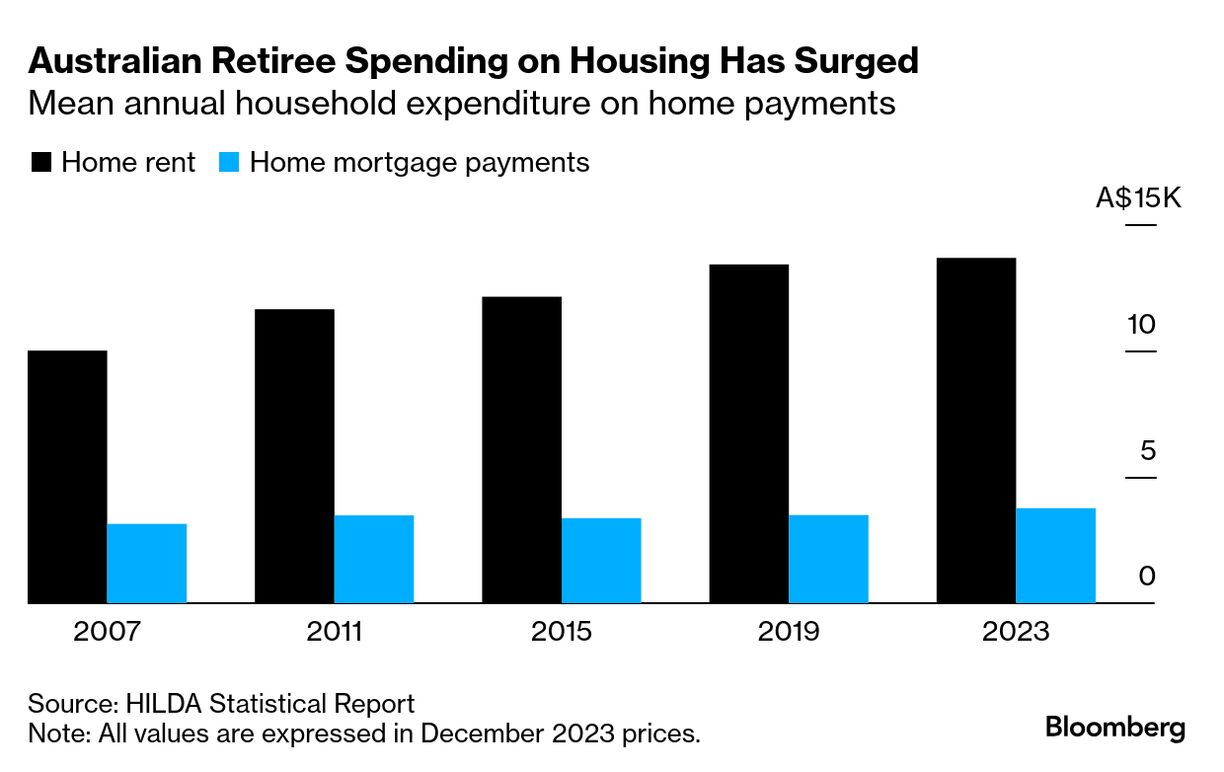

More Australian retirees are renting than ever, as soaring housing costs and longer working lives expose the limits of the nation’s much-lauded pension system. The portion of retirees living in private rentals has doubled over the past two decades to 12%, according to a government-funded survey out Friday.

Victoria wants to make working from home a legal right for two days a week – a move that could reshape how many Australians work. In our latest podcast, Chris Bourke speaks with Trent Wiltshire from the Grattan Institute about whether legislating hybrid work makes sense, what it would mean for businesses and workers, and how the debate reveals a growing divide in Australia’s workforce. Subscribe to The Bloomberg Australia Podcast on Apple, Spotify, on YouTube, or wherever you listen. The Reserve Bank of Australia’s most trusted model of the neutral cash rate — the level that neither stimulates or restrains the economy — implies a “significant downward revision” to its estimates, according to internal documents released exclusively to Bloomberg. Meanwhile, unemployment held steady last month even as the economy shed jobs with fewer people looking for work. Australia pledged to cut greenhouse gas emissions within a range of 62% to 70% by 2035, as one of the world’s largest fossil fuel exporters aims to deliver on pledges to accelerate climate action. The proposed cuts come as the nation also moves ahead with expansions in its coal and natural gas sectors. The Australian Securities & Investments Commission has temporarily banned La Trobe Financial Asset Management Ltd. from marketing its US private credit fund, citing concerns that the product may not be “suitable” for consumers. | | | | | Here’s what my colleague, market strategist Mike “Willo” Wilson says happened while we were sleeping… Big tech stocks led US indexes higher and Treasury yields rose on positive jobless claims data and as Donald Trump indicated he may further extend the China trade truce. The dollar jumped, pressuring the Aussie. The Kiwi tumbled after weak GDP data boosted the odds of a 50-basis-point RBNZ cut next month to about one-in-three. Today’s economic calendar is light, with the Bank of Japan’s rate decision the regional highlight. ASX futures imply a strong start for Australian stocks. As Willo mentioned, Trump indicated an extension to his trade truce with Chinese President Xi Jinping when the leaders speak on Friday, in addition to brokering a sale for TikTok’s US operations. Trump and Xi are due to speak at 9 p.m. in Beijing about a framework agreement unveiled this week to shift control of TikTok’s US operations from its Chinese parent ByteDance to a consortium of American investors.  Xi Jinping and Donald Trump in 2017. Photographer: Fred Dufour/AFP/Getty Images Meanwhile, Trump and UK Prime Minister Keir Starmer unveiled a new technology partnership at a business roundtable Thursday, where they were joined by executives highlighting efforts to deepen ties on artificial intelligence and digital assets. The UK leader pulled out all the stops for the visit, with golden carriages, military splendor and an opulent banquet. Closer to home, India’s securities market regulator cleared the Adani Group and its billionaire founder Gautam Adani of some allegations of impropriety raised by the US short seller Hindenburg Research in early 2023. Indonesian President Prabowo Subianto decided to avoid using the military to quell unrest in Indonesia last month, but the episode reinforced his view that bolder action was necessary to address inequality and rein in tycoons.

Atlassian is set to buy engineering intelligence company DX for about $1 billion in cash and restricted stock, the companies said in a statement late yesterday. | | | | | | | | | When retired Australian nurse Joan handed over her pension savings of A$70,000 to a family member to build a small guest apartment in their backyard, she thought she was finally securing a permanent home. Instead, the arrangement collapsed within a year. As housing stress and cost-of-living pressures mount, adult children are asking parents to unlock their wealth early — or to stop spending it.  Even if prevalence rates remain unchanged, the number of victims of elder abuse is projected to reach 320 million by 2050. Photographer: Brent Lewin/Bloomberg | | | | | You received this message because you are subscribed to Bloomberg's Australia Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

|