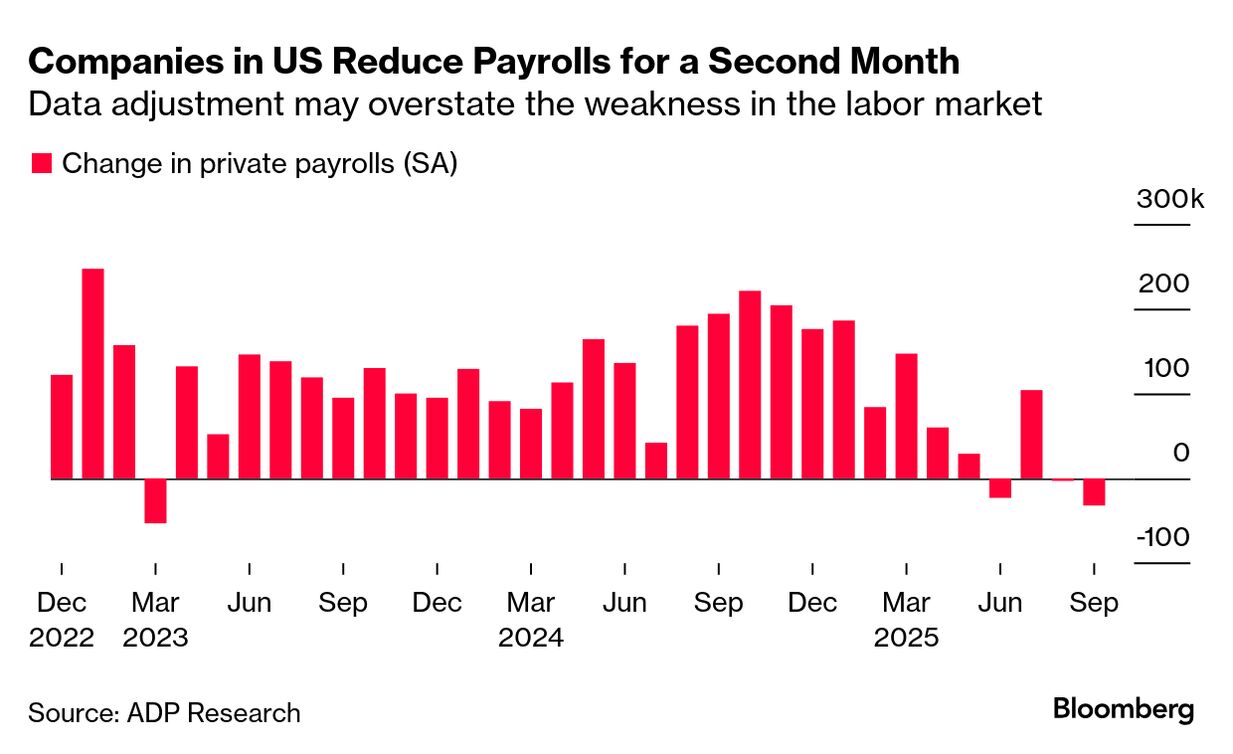

| Payrolls at US companies unexpectedly dropped in September, according to ADP Research data released Wednesday. While part of that was due to an adjustment related to government numbers it relies on, the company said the data continues to support an underlying softening trend. Other recent sources generally point to anemic job growth, less appetite for hiring, few firings and modest wage gains. “This month’s release further validates what we’ve been seeing in the labor market, that US employers have been cautious with hiring,” said Nela Richardson, chief economist at ADP. The report, published in collaboration with the Stanford Digital Economy Lab, showed wage growth continued to gradually soften. Workers who changed jobs saw a 6.6% increase in pay, the lowest in a year. Those who stayed put saw a 4.5% gain, little changed from the prior month.  The ADP data stand to be the highest profile report on the labor market this week as the Trump administration said it would delay its September employment numbers, scheduled for Friday, because of the government shutdown. Some on Wall Street have cast doubt on ADP’s data, favoring instead that of the US Bureau of Labor Statistics. But President Donald Trump’s August firing of BLS commissioner Erika McEntarfer after a grim jobs report has planted seeds of doubt as to the reliability of BLS numbers and whether they will be insulated from politics. Trump’s first choice to replace McEntarfer may not have assuaged such doubts. EJ Antoni is chief economist of the conservative Heritage Foundation and a contributor to its far-right Project 2025 manifesto. A Trump loyalist, his selection was controversial from the start, given his lack of government experience and extreme statements on everything from whether the BLS should issue job reports to Social Security being a “Ponzi scheme.” A recent CNN report may have made matters even worse for the nominee. It also was recently reported that Antoni was present at the Jan. 6, 2021, attack on the US Capitol. Late Tuesday, he withdrew his nomination. —David E. Rovella |