| Read in browser | ||||||||||||||

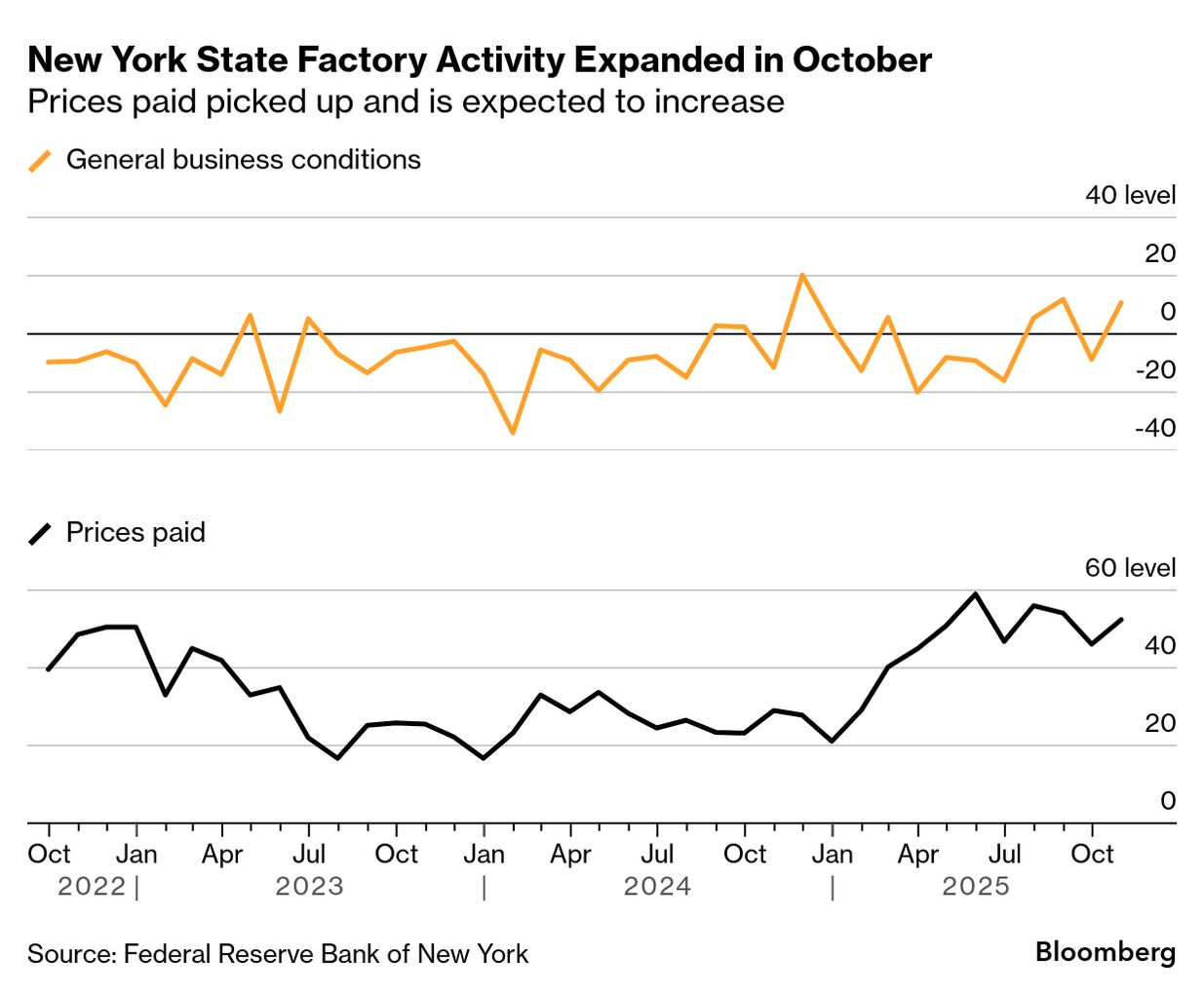

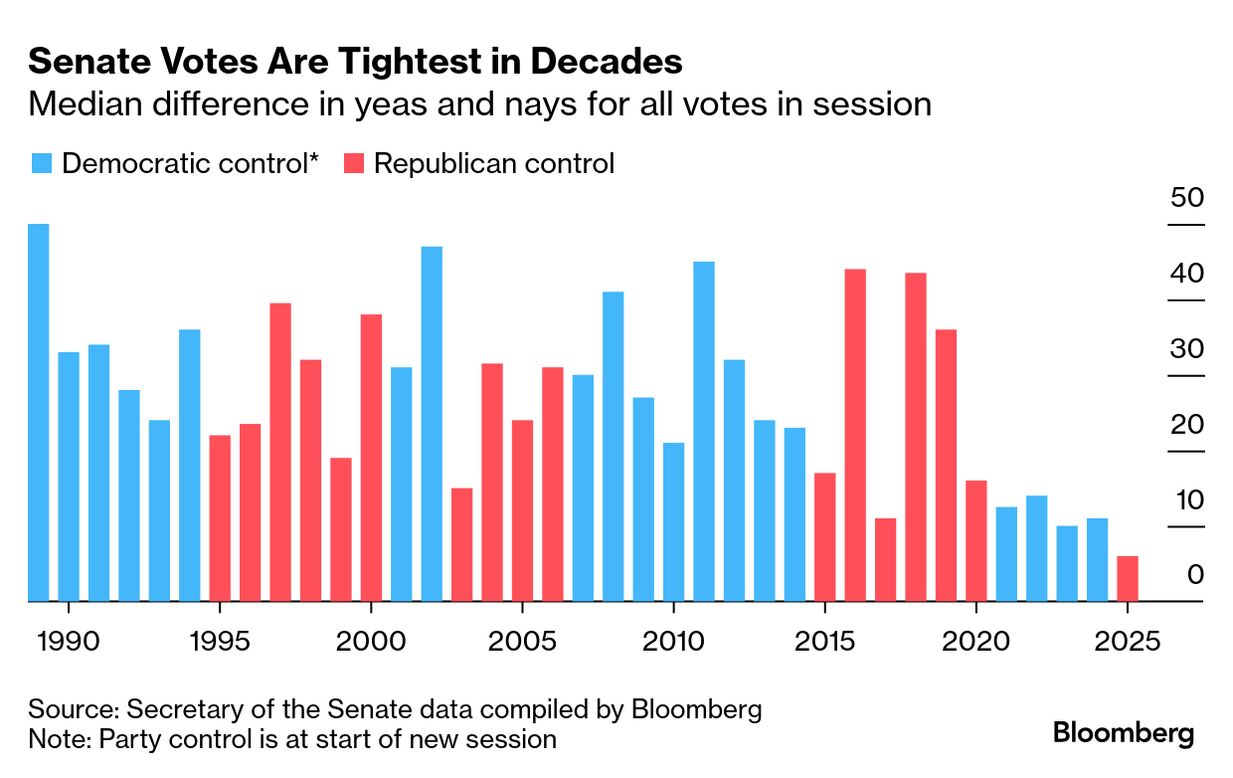

This is Washington Edition, the newsletter about money, power and politics in the nation’s capital. Today, US Treasury reporter Daniel Flatley looks at the latest trade moves between the US and China. Sign up here. Email our editors here. Making an OfferIf you’ve ever watched a police procedural show on TV, you’re no doubt familiar with the good cop-bad cop routine. Typically, the bad cop — usually a grizzled veteran — roughs up and threatens the suspect. Then the good cop comes in and offers a sweetheart deal: Admit what you did was wrong, sign a plea agreement and you can walk away. Treasury Secretary Scott Bessent played both roles this morning during a news conference in Washington where he said China “could not be trusted” with the global supply chain and singled out Chinese official Li Chenggang for what he called “unhinged” comments.  By the end of his remarks, however, he was offering China a way out of the latest trade standoff with the US: An extension of the trade truce between the two nations in exchange for a delay in China implementing its recently announced export controls on rare earth elements. “Right now, we are currently in a 90-day roll on the tariffs,” he said. “So, is it possible that we could go to a longer roll in return for a delay? Perhaps.” Perhaps indeed. It may be an attractive offer to Beijing as the two nations approach a potential meeting between Presidents Donald Trump and Xi Jinping, tentatively planned for the end of the month in South Korea. Or it may lead China to believe it has a stronger hand in the negotiations as a Nov. 1 deadline looms. The rare earths issue has been a thorn in the US’s side for many months. China dominates in processing the metallic elements, and the resultant products are used in everything from iPhones to MRI machines. A tentative truce on the matter was reached during trade talks between the two nations in London in June, but that appears to have broken down. The squeeze on rare earths supplies doesn’t just affect American companies, and Bessent may be banking on more countries joining the US in pressuring Beijing. See more here: G-7 Set to Discuss Joint Response to China Curbs on Rare Earths If he’s able to bring in reinforcements, that may strengthen his hand. Otherwise, he may have to hope that the threat of higher tariffs have made his offer of an extension attractive enough to bring China back to the table. — Daniel Flatley Don’t MissA federal judge ordered the Trump administration to pause plans to fire thousands of federal workers during the government shutdown, just moments after White House Budget Director Russell Vought said he expects layoffs to exceed more than 10,000 people. The Supreme Court’s conservatives suggested they will restrict the creation of majority-Black and majority-Hispanic voting districts in a case that could further undercut a landmark civil rights law and bolster Republican electoral prospects. The Trump administration expects Europe, not the US, to lead the North Atlantic Treaty Organization, Defense Secretary Pete Hegseth said, marking an apparent shift in Washington’s stance toward the alliance. Brown University declined the White House’s invitation to sign an agreement that would grant preferential funding in exchange for a slew of policy changes, like DEI bans and limits on international students. Trump said his administration would look at San Francisco as the next target of his federal crime crackdown, which has been mostly directed at Democrat-run cities. Bessent said he would present Trump with a list of “three or four candidates” for him to select from to serve as the next chair of the Federal Reserve in December. Argentina’s sovereign bonds spiked after media outlets reported that Bessent outlined a financial aid package that would total $40 billion to Javier Milei’s government, double the previous pledge. The US submarine industry is struggling to get out of drydock after years of delays, rising costs and a weakened industrial base, while China has been making big investments in its fleet. New York state factory activity unexpectedly expanded and the outlook climbed to the highest since the start of the year despite lingering price pressures.  Cybersecurity company F5 said nation-state hackers breached its networks, prompting alerts from cybersecurity agencies in the US and UK, with a senior US official warning of potentially “catastrophic” compromises. Federal banking regulators are set to release a plan to ease a set of capital requirements for small banks, which trade groups say would free up more lending. A former White House National Security Council staffer and current State Department adviser has been arrested and charged with illegally keeping more than 1,000 pages of classified documents at his northern Virginia home. Watch & ListenToday on Bloomberg Television’s Balance of Power early edition at 1 p.m., host Joe Mathieu interviewed Representative Sam Liccardo, a California Democrat, about what it would take to start negotiations to end the shutdown and Trump’s threats of more layoff and cuts to programs.  On the program at 5 p.m., Joe and Julie Fine talk with Democratic Representative Pete Aguilar of California and Republican Representative Michael McCaul of Texas about the president’s unilateral actions during the shutdown and how long the standoff could go on. On the Big Take Asia podcast, Bloomberg’s Hyonhee Shin and host K. Oanh Ha explore whether the cash incentives being offered by South Korean companies for workers to have children will be enough to address the country’s record-low fertility rate. Listen on iHeart, Apple Podcasts and Spotify. Chart of the Day For the ninth time, the Senate voted to advance a stopgap spending bill to end the government shutdown. And for the ninth time, it failed narrowly under a rule that requires 60 votes to end debate. The predictability of the Groundhog Day-like voting sequence is part of a larger pattern: Votes in the Senate this year are narrower than they’ve been in decades, a sign of growing gridlock and polarization in a legislative chamber that once operated by consensus and lopsided votes. — Gregory Korte What’s NextThe National Association of Home Builders housing market index will be published tomorrow. Trump is scheduled to meet with Ukrainian President Volodymyr Zelenskiy Friday at the White House. Existing home sales for September will be reported by the National Association of Realtors on Oct. 23. The University of Michigan’s final read of consumer sentiment for the month will be released Oct. 24. The summit of the Association of Southeast Asian Nations opens Oct. 26 in Malaysia. The Federal Reserve’s rate-setting committee meets Oct. 28-29. The Asia-Pacific Economic Cooperation leaders summit opens Oct. 31. Seen Elsewhere

More From BloombergLike Washington Edition? Check out these newsletters:

Explore all newsletters at Bloomberg.com. Follow us You received this message because you are subscribed to Bloomberg’s Washington Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|