| | In this edition, AWS’ outage reveals widespread web connections, a look behind the scenes at CSX, an͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- A Hollywood free-for-all

- Is Amazon TBTF?

- The ‘Japan First’ trade

- Cockroaches and canaries

- Sitting out the AI boom

- Rail M&A ousted CEO

Anthropic CEO subtweets David Sacks ...

|

|

In 2022, we made a bet that sophisticated readers were drowning in noise but starved for signal. The community we’ve built around our journalism, many of whom have joined us on stage or in the audience of our live events, literally can’t afford to be manipulated for clicks. You’re too busy. We’ve brought you big scoops on CEO comings and goings, on the deals reshaping Wall Street (and those that aren’t, but should), and the AI megabet that started it all. But we also know that not all scoops are created equal. We’ve spent our time chasing stories that matter — stories that, in the persuasive recruiting pitch Semafor Editor-in-Chief Ben Smith gave me back in 2022, touch one live wire to another live wire. Dealmaking as national security. Corporate governance culture wars. Private capital’s seam-busting growth. We solved a CEO catfishing mystery that explained the meme-stock phenomenon better than any market chart I’ve seen. Our scoop on mudslinging in the Treasury Secretary auditions has aged well in a combative Washington. A Hollywood mogul’s curious investment captured the geopolitical tug of the Middle East. These are the stories of a new world economy that’s emerging. Our World Economy Summit has become a destination for global leaders, and it’s been great to meet and interview many of you there. We launched in the Gulf last year — the most interesting place in the financial world right now — and will be expanding our China coverage soon. So thank you for reading, sharing tips, and yelling at me when you think I’ve gotten something wrong. My notebook is always open. (And check your phones — you’ve probably missed a call from Rohan.) |

|

Warner Bros. puts up a for-sale sign |

Mike Blake/Reuters Mike Blake/ReutersWarner Brothers set off a media free-for-all Tuesday. The company is dual-tracking its plan to separate cable from its Hollywood properties with a come-and-get-it pitch to rival programmers, studios, and tech companies. Comcast has expressed interest in acquiring all or part of Warner, Semafor can confirm, complicating life for both David Zaslav and Paramount, which has lost its head start in the bidding. Who might want what, and why? Comcast would get little use out of Warner’s cable assets, unless it were to glom them onto its own planned channels spinoff. (That’s the Dow-DuPont two-step.) But adding Warner Bros. to Universal Pictures would create a movies juggernaut; Game of Thrones and Lord of the Rings would be fodder for Comcast’s theme parks; and a combined HBO-Peacock would instantly be the second-largest streamer by subscribers. Does Netflix, which became a content player without a legacy Hollywood studio, want one now? Co-CEO Greg Peters threw cold water on speculation recently, casting Netflix as “builders rather than buyers.” Apple has also been M&A-shy, and is likely to direct any appetite it has to take the lead in the AI race. But it spends heavily on programming — it just shelled out $140 million for F1 rights and re-rebranded AppleTV. Paramount is aided by Larry Ellison’s deep pockets and close ties to the White House, which has criticized Comcast’s Brian Roberts but is also friendly with Discovery’s éminence grise, John Malone. A combined Paramount-Skydance-Warner Bros.-Discovery-TikTok-Free Press is an ambitious mix of old and new media. “Social issues” (whither Zaslav?) could complicate negotiations, but the regulatory path is cleaner, in the US if not Europe. |

|

AWS outage raises ‘too-big-to-fail’ questions |

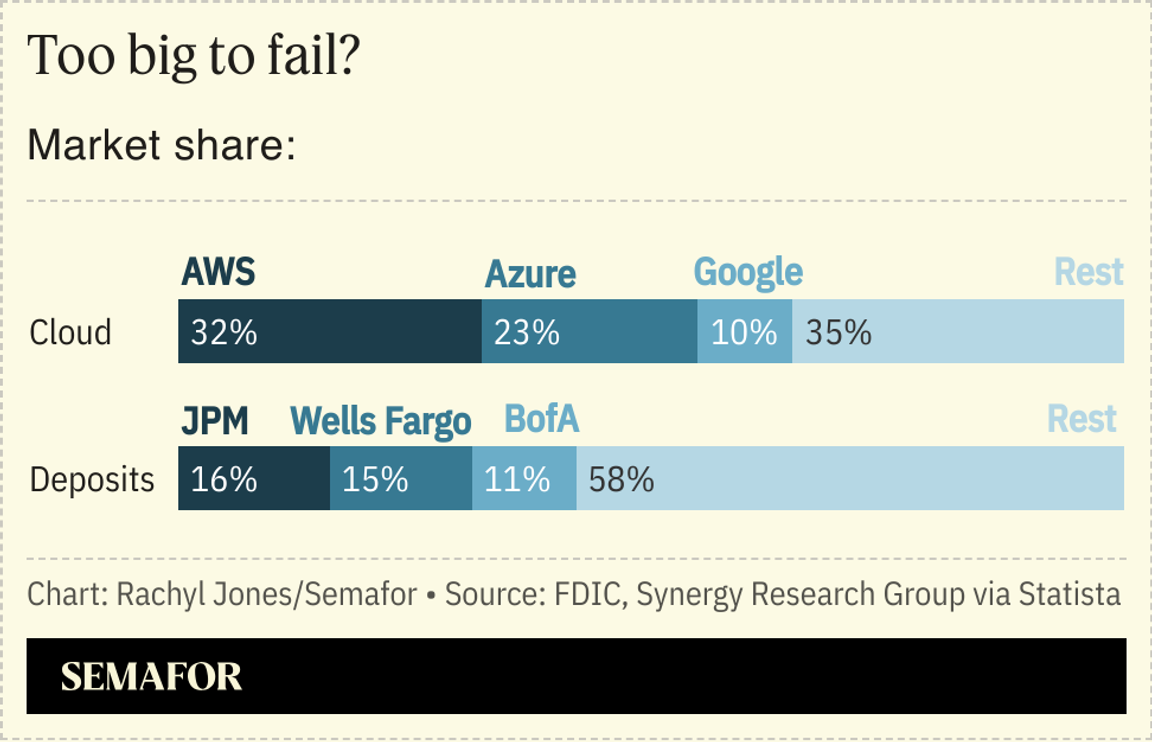

An outage at Amazon Web Services, the world’s largest cloud provider, brought down much of the internet on Monday — including, as observant Semafor Flagship and DC readers will have noticed, the company that sends our emails. Airlines, social media sites, banks, and even a smart mattress popular among tech billionaires were affected.  The collapse raises questions about so much of the economy relying on one vendor for critical services. Sen. Elizabeth Warren, D-Mass., was quick on X to make “Too Big to Fail” comparisons; blue checks rallied in defense of free markets. (Cloud computing is more concentrated than retail banking, where the biggest banks’ share of deposits is capped.) Regulators in the US and UK have previously sounded the alarm on whether the handful of companies that dominate cloud storage and services might pose systemic risks (the Federal Reserve sent examiners inside an AWS facility in Virginia) and that was before the AI spending boom that has entrenched these providers. |

|

Japan’s new PM sends stocks surging |

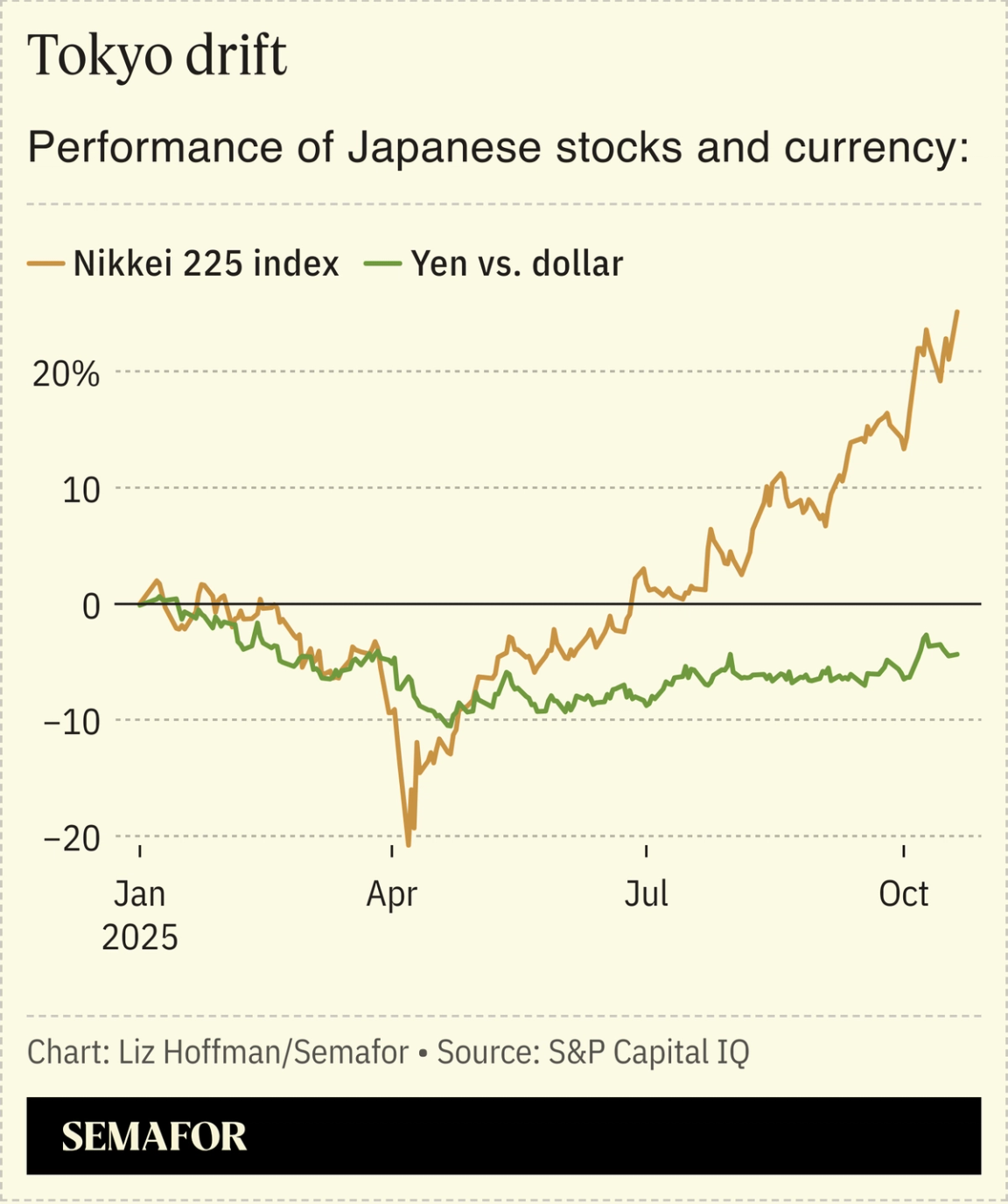

Japanese stocks hit record highs on Tuesday but the yen continued its slide, as investors expect the country’s new prime minister to unleash a flood of cheap money to try to jolt the country’s sluggish economy.  Newly elected Sanae Takaichi faces steep challenges, Semafor’s Jeronimo Gonzalez writes: stubborn inflation, slower growth, and trade tensions with the US that the country’s first female PM will address at a meeting with President Donald Trump next week in Tokyo. (High on the agenda is a dispute over rice imports.) Japan’s deeper problems include an aging population, soaring social-security costs, and a debt-to-GDP ratio that is by far the world’s highest. Germany surpassed Japan as the world’s third-biggest economy in 2023, and India isn’t far behind. AEI economists make the case for a looming yen crisis; a weak currency risks Trump’s ire, but Tokyo, which has held interest rates low, has few tools to boost it. |

|

Corporate debt woes: A ripple or one-off? |

Goldman Sachs President John Waldron. Paul Morigi/Getty Images for Semafor. Goldman Sachs President John Waldron. Paul Morigi/Getty Images for Semafor.Fears are mounting about trouble in the corporate lending market, with banks and their lightly regulated cousins in the investment world pointing fingers. The blame game is overly simplistic, several executives said. “I don’t really understand why we’re talking about private credit as one thing and lending in the banking system as another thing,” Goldman Sachs President John Waldron said at Semafor’s World Economy Summit last week. The three places low-rated companies can go for cash — banks, private credit funds, and the junk-bond market — are approaching equal sizes, Waldron said: “There’s one system …We may, and probably will, have some defaults, and it’s not going to be pretty when it happens. Everybody in that system will feel that to an extent.” Private-credit executives including Blackstone’s Jon Gray and Blue Owl’s Marc Lipschultz were quick to point out that much of the lending to First Brands and Tricolor — two deeply indebted companies whose recent bankruptcies set nerves on edge — was originated by banks. (Allegations of fraud are swirling around both companies.) “We’re deep into a credit cycle and people get sloppy,” PNC President Mark Wiedman said. “It’s about whether or not you’re certain that your security interest is actually secure. There are established protocols for how to do this. It’s not complicated.” Per Franzen, CEO of EQT, cited “pockets of, maybe, complacency” by lenders. But he told Semafor’s Andrew Edgecliffe-Johnson that “we don’t see any systemic risk at this point.” |

|

Top investor ‘declines’ data center boom |

Kris Tripplaar/Semafor Kris Tripplaar/SemaforOne of the world’s biggest infrastructure investors has sat out the AI data center boom — and thinks those diving in may end up regretting it. I Squared Capital isn’t squeamish: It has backed Indian toll roads, Malaysian solar farms, and refrigerated warehouses in the Philippines. But the current rush into AI infrastructure — on the promise that there will be enough paying customers to generate the revenue needed to justify all this spending — is too rich for CEO Sadek Wahba’s blood. “The usage is still unproven. Are these AI models going to be profitable? I don’t know,” Wahba, whose firm manages $50 billion, said in an interview. “When you start unpeeling the onion, it’s much more volatile and uncertain.” Data centers’ huge needs for power, water, and industrial components that are in short supply — anyone needing one of GE Vernova’s gas turbines must wait until 2028 — add to the risk, Wahba said: “I politely decline.” |

|

The tensions behind CSX’s CEO ouster |

Benoit Tessier/File Photo/Reuters Benoit Tessier/File Photo/ReutersThe CEO of one of America’s largest railroads was fired last month after his board felt he mishandled a takeover approach from a rival, people familiar with the matter said. Joe Hinrichs’ abrupt ouster from CSX followed informal outreach earlier this year from his counterpart at Union Pacific about potentially merging the two railroads, which Hinrichs failed to pursue, the people said. The tepid response sent Union Pacific CEO Jim Vena looking elsewhere, and striking a deal with Norfolk Southern soon after. Simmering disagreements over Hinrichs’ pay added to boardroom tensions, the people said. |

|

Chicago is either a war zone quickly spiraling out of control or a peaceful city under siege by an overreaching federal government. It all depends on who you ask — and which channel you watch. In this episode, Ben and Max bring on Illinois Gov. JB Pritzker to talk about how he’s fighting a messaging battle against the Trump White House. They also talk about how conservative media is shaping the situation on the ground, what he thinks of California Gov. Gavin Newsom’s trolling approach to Trump, and whether we should bet on the Chicago Bears. |

|

➚ BUY: Cleaner decks. OpenAI is paying former investment bankers $150 an hour to write AI prompts that could be packaged into a drudgery-slashing solution for Wall Street. ➘ SELL: Empty floors. Vacant Chinese office towers are forcing fire sales by Western investors and banks. Wuhan’s skyscrapers are emptier than San Francisco’s. |

|

|