| | In this edition: US-South Africa talks, Côte d’Ivoire elections, and fighting Russian disinformation͏ ͏ ͏ ͏ ͏ ͏ |

| |   Johannesburg Johannesburg |   Abidjan Abidjan |   Bangui Bangui |

| Africa |  |

| |

|

- Black empowerment future

- Free trade area push

- Côte d’Ivoire readies for vote

- Weakened financial markets

- Russian disinformation grows

- S. Africa’s coal targets

Why Tutankhamun’s tomb is at risk. |

|

South Africa’s International Relations Minister Ronald Lamola. Phill Magakoe/AFP via Getty Images. South Africa’s International Relations Minister Ronald Lamola. Phill Magakoe/AFP via Getty Images.Trade talks between South Africa and the US have been hit by “sticking points” over “domestic issues,” Pretoria’s International Relations Minister Ronald Lamola said. Specifically, Washington — South Africa’s second-biggest trading partner — has put pressure on Pretoria to end Black Economic Empowerment laws aimed at redressing wealth imbalances caused by apartheid, slapping a 30% tariff on imports over laws which the Trump administration says unjustly discriminate against white South Africans. Lamola said BEE, land redistribution laws, and the “false narrative” of a genocide had been raised in the latest trade talks. “We’ve insisted that this should be separated from the trade engagements,” he said on Tuesday at the FT Africa Summit in London. Talks could get more, rather than less, complicated: On Monday, the second-biggest party in South Africa’s government — the pro-business Democratic Alliance — proposed a bill to replace BEE laws, which it says have become an excuse for state-sponsored corruption, a move that threatens to upend the shaky coalition. — Alexis Akwagyiram |

|

Call to boost intra-Africa trade |

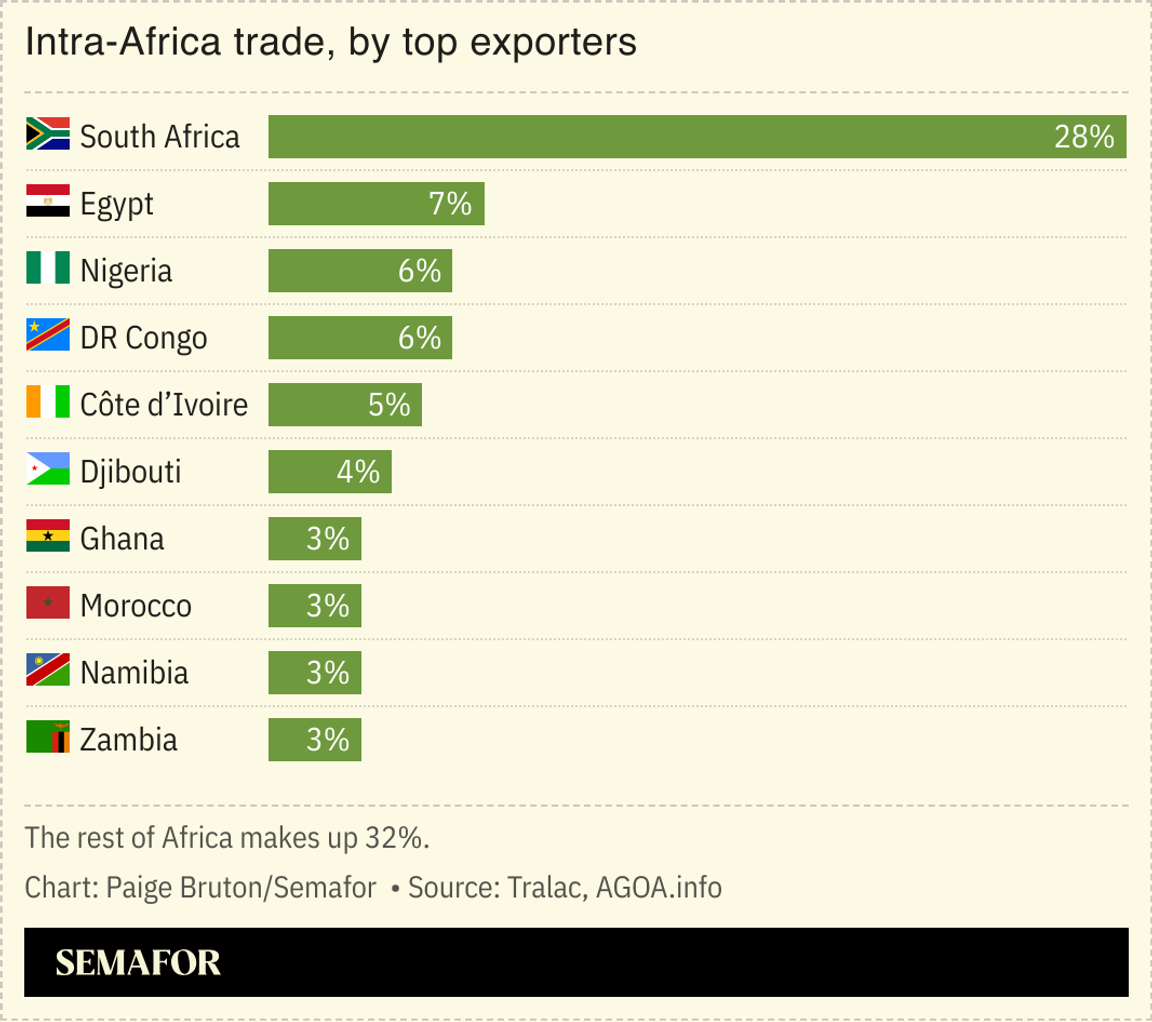

Policymakers should focus on accelerating implementation of Africa’s free trade area to make the continent more resilient to global shocks, the secretary general of the African Continental Free Trade Area Secretariat said. Wamkele Mene, speaking at the FT Africa Summit in London, conceded that trade was not happening “at the pace that we would like to see” within the AfCFTA, which in 2018 became the world’s largest free trade area by territory. Mene said Washington’s “disregard for trade rules” and the expiration of the AGOA preferential trade agreement with the US highlighted the need for Africa to “build a domestic market,” by establishing reliable supply chain networks and using transport logistics to improve trade. Boosting trade between nations on the continent is widely seen as a crucial step towards strengthening economic development. Intra-African trade reportedly made up just 14% of total African trade in 2024, compared to around 60% intra-regional trade for both Asia and Europe. — Alexis |

|

Côte d’Ivoire braces for election |

| |  | Alexander Onukwue |

| |

Luc Gnago/Reuters Luc Gnago/ReutersIvorians are preparing to vote in presidential elections on Saturday amid rising tensions over the exclusion of opposition candidates and a government crackdown on dissent that has led to the arrest of more than 200 protesters this month. President Alassane Ouattara, 83, is the favorite to win a fourth term, but will have to fend off challenges from four other candidates including Simone Ggbagbo, the ex-wife of former President Laurent Ggbagbo who was barred from running in the polls. The vote comes months after leading opposition figure Tidjane Thiam, the former CEO of Credit Suisse, was disqualified over his dual citizenship with France. Côte d’Ivoire, Francophone West Africa’s biggest economy and the world’s top cocoa producer, saw economic growth of 6% in 2024: It is one of the world’s fastest-growing economies, according to the IMF, and is projected to grow more than 6% this year and next. |

|

Financial markets weaken in 2025 |

Emmanuel Croset/AFP via Getty Images Emmanuel Croset/AFP via Getty ImagesTightening global financial conditions have negatively impacted more than a dozen African markets this year, a survey by South African bank Absa found. Market depth — defined as “the size and liquidity of domestic equity and bond markets, along with the diversity of listed assets” — weakened in more than half of the 29 countries surveyed in the bank’s annual Africa Financial Markets Index. Africa’s largest markets, including Egypt, Morocco, Nigeria, and South Africa, all weakened from 2024. Increased geopolitical tensions, trade policy uncertainties, infrastructure gaps, and poor legal frameworks have all played a role, the report said. On the flip side, Benin, Malawi, and Namibia recorded strong improvements in their capital markets thanks to initiatives that increased deal activity, the index found. — Alexander |

|

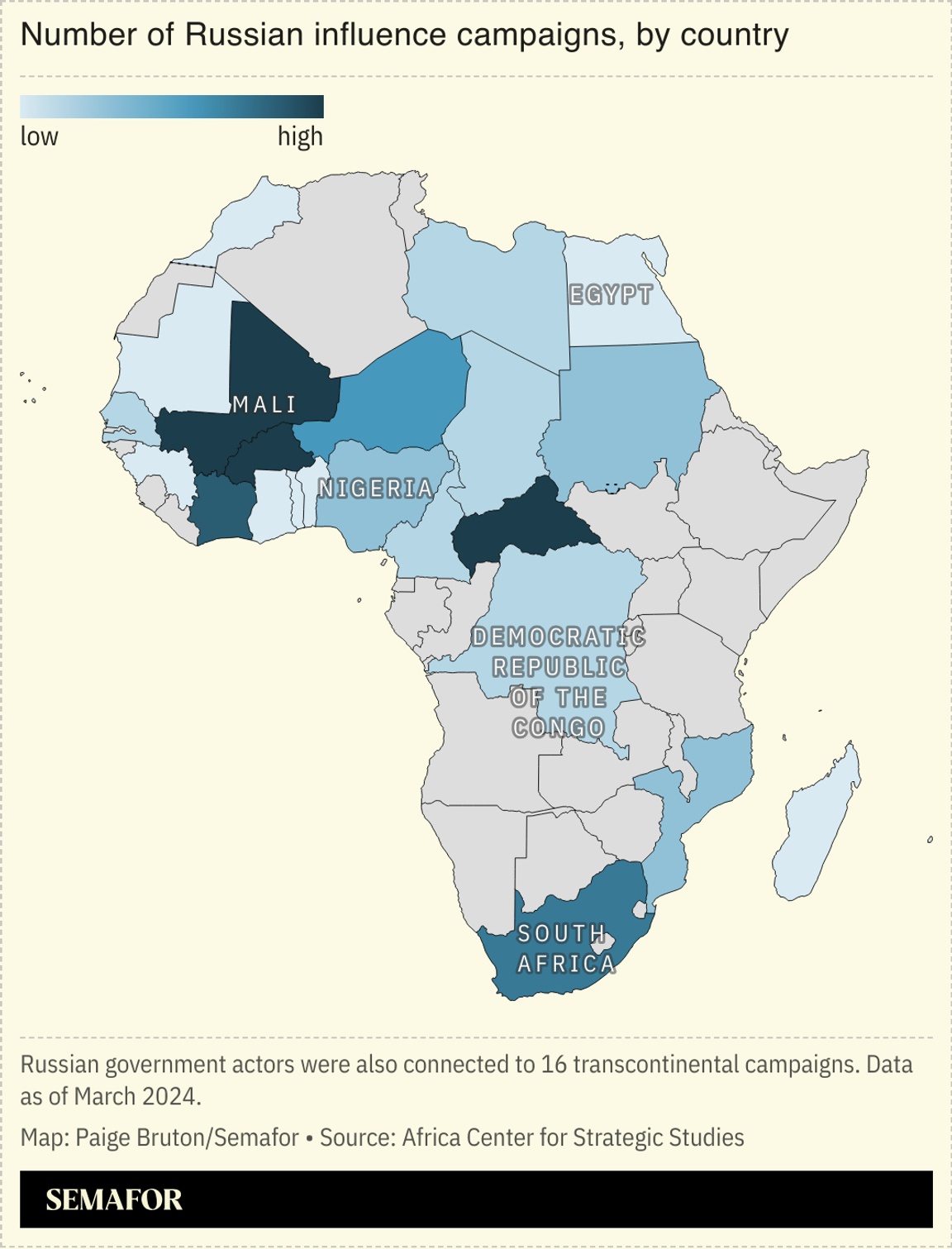

Action urged on disinformation |

European governments should partner with like-minded African nations to launch campaigns to counter Russian disinformation on the continent, a new report argued. Russia has built a vast propaganda and media network across dozens of African countries, according to a policy brief about Russian “information warfare” in Africa for the European Council on Foreign Relations think tank. Moscow operates thousands of online channels, paying African influencers to promote its narratives, the report stated. Governments on both continents have been “far too complacent” about the threats they face “from authoritarian and predatory actors like Russia,” the author said, adding that they must learn from Russia’s offensive methods to spark their own pushback, including “cultivating informal channels of communication that speak to people in their own language” and boosting funding for independent media. — Preeti Jha |

|

Coal dependency goal in South Africa |

South Africa’s target for coal dependency by 2039, down from 58% today. The figure was announced by the country’s energy minister as part of broader plans to invest 2.23 trillion rand ($128 billion) in energy infrastructure by 2042. Africa’s most industrialized economy also plans to spend more heavily on nuclear and gas — in line with a global trend toward more nuclear power. Pretoria wants the two energy sources to account for 16% of total generation capacity in the next 14 years compared to 3% at present. South Africa was the world’s seventh-largest coal producer in 2023, according to the most recent International Energy Agency data, and relies heavily on the fuel for its electricity supply. |

|

Business & Macro

|

|

|