| Read in browser | ||||||||||||

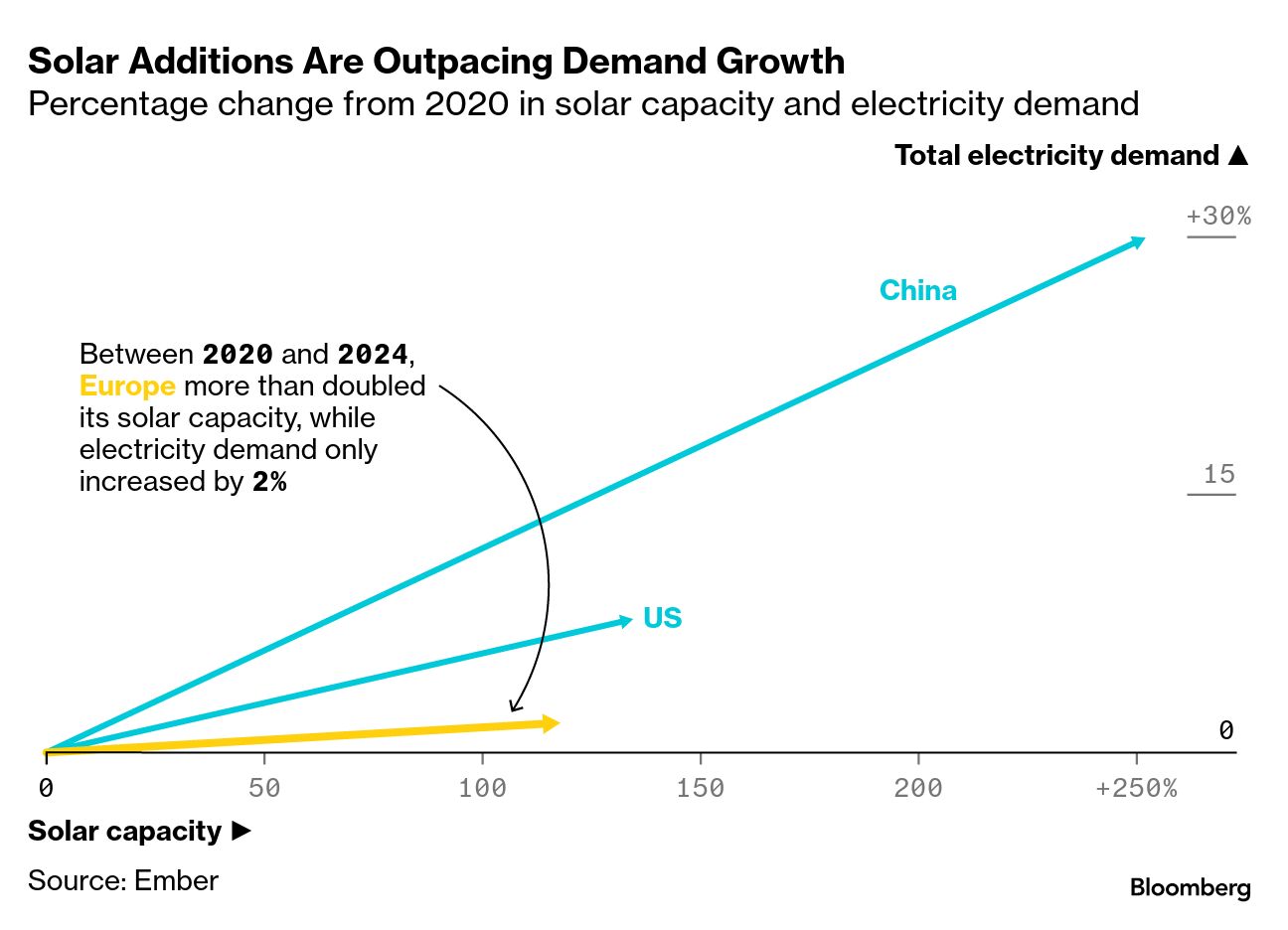

Welcome to the Brussels Edition. I’m Suzanne Lynch, Bloomberg’s Brussels bureau chief, bringing you the latest from the EU each weekday. Make sure you’re signed up. Given the intensity of the pushback against the green transition in some corners of Europe, climate discussions passed relatively smoothly at last week’s EU summit. But the real showdown is still to come. It starts in Brussels a week from now, when environment ministers meet to agree the bloc’s 2040 emissions-cutting goal. That will come just days before UN climate talks in Brazil. Former US Energy Secretary Jennifer Granholm offered an assessment of the differing perceptions on both sides of the Atlantic, sharing her thoughts about President Donald Trump rowing back on climate policies. “It’s not as bad as you might think,” she told the Brussels Sustainability Club this morning. Trump’s so-called Big Beautiful Bill is “still the largest investment in clean energy in US history. In fact, it’s the largest investment in clean energy in the world except for China.”  Jennifer Granholm. Photographer: Aaron M. Sprecher/Bloomberg While acknowledging the sidelining of solar, wind and electric vehicles by the US administration, she said there’s still bipartisan support for geothermal, nuclear and long-duration energy storage. While there may be a dip in electric vehicle purchases, the transition is “still moving forward,” albeit at a slower pace, Granholm said. She poured cold water on the pledge by the EU to buy $750 billion worth of energy from the US — agreed under the EU-US trade deal this summer — questioning if the US had the capability to deliver these amounts. As the EU scrambles to agree to its own targets ahead of the COP gathering, a big question looming over the event will be the size and scope of any US delegation — and whether it should be present at all given its exit from the Paris climate agreement. As our Bloomberg colleagues write, the Trump administration hasn’t withdrawn from the climate arena, it’s just fighting for the other side by encouraging other countries to jettison their renewable energy commitments. The pressure campaign was in evidence at the International Maritime Organization conference in London this month. The world was on the brink of adopting a global carbon tax for the shipping industry which had been years in the making. Then, the Trump administration undertook a successful monthslong campaign to defeat the initiative.  Meanwhile, Europe is experiencing its own challenges in advancing the green transition, even apart from ongoing political disagreements over climate targets. Solar farms are being built at a phenomenal rate in Europe, but the rapid expansion is bumping up against the shortcomings of a grid system built before renewables were a key part of power generation, our energy team reports. The EU will need to rely on wind and solar if it is to reach its emissions targets, and ensuring the infrastructure is up to scratch is a huge challenge. The Latest

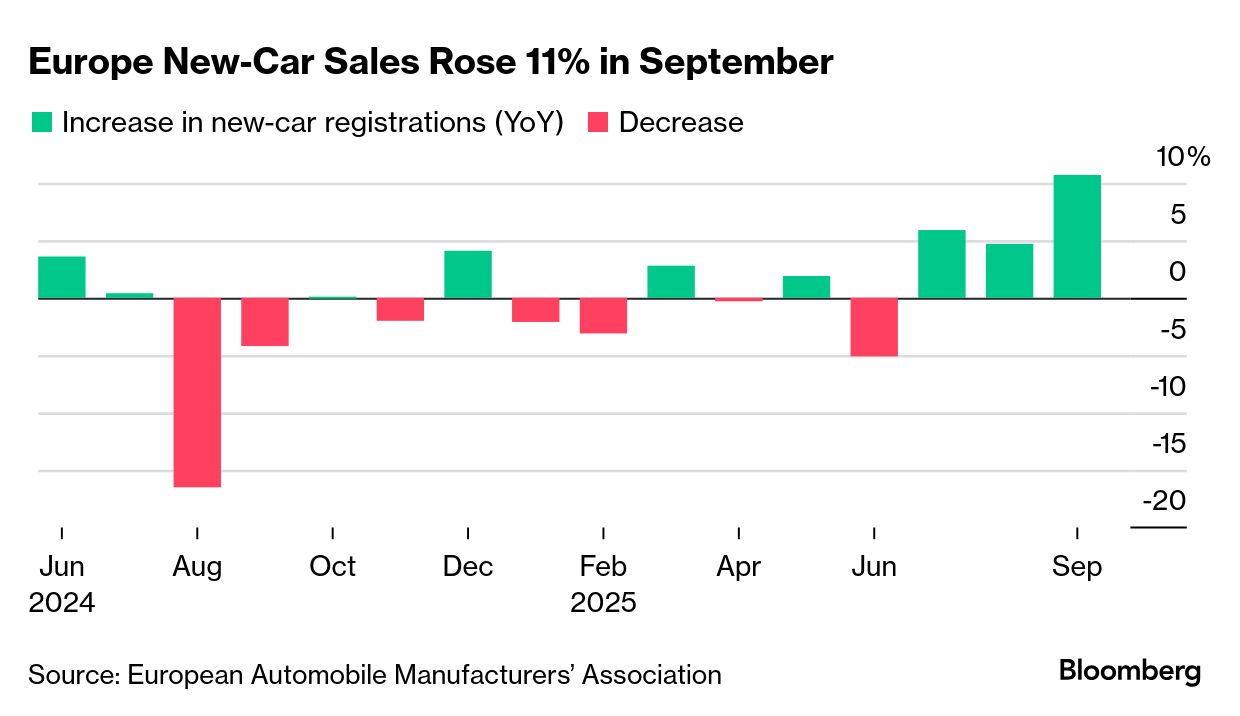

Seen and Heard on Bloomberg New Rolex land-dweller model watches.Photo by Fabrice Coffrini/AFP via Getty Images US President Trump’s shock 39% tariff on Swiss-made imports is pushing up prices for luxury watches. Prices for pre-owned timepieces rose 1.5% in the three months to Sept. 30, compared with the previous quarter. Read our Bloomberg Opinion columnist Andrea Felsted on how second-hand values are inflating again as some consumers seek to beat the levies by opting for used watches. Chart of the DayEuropean car sales rose for a third consecutive month in September, with new-vehicle registrations increasing 11% to 1.24 million units, as consumers were able to choose from a greater number of affordable electrified models. The overall sales increase may prove short-lived due to worsening trade tensions with China.  Coming Up

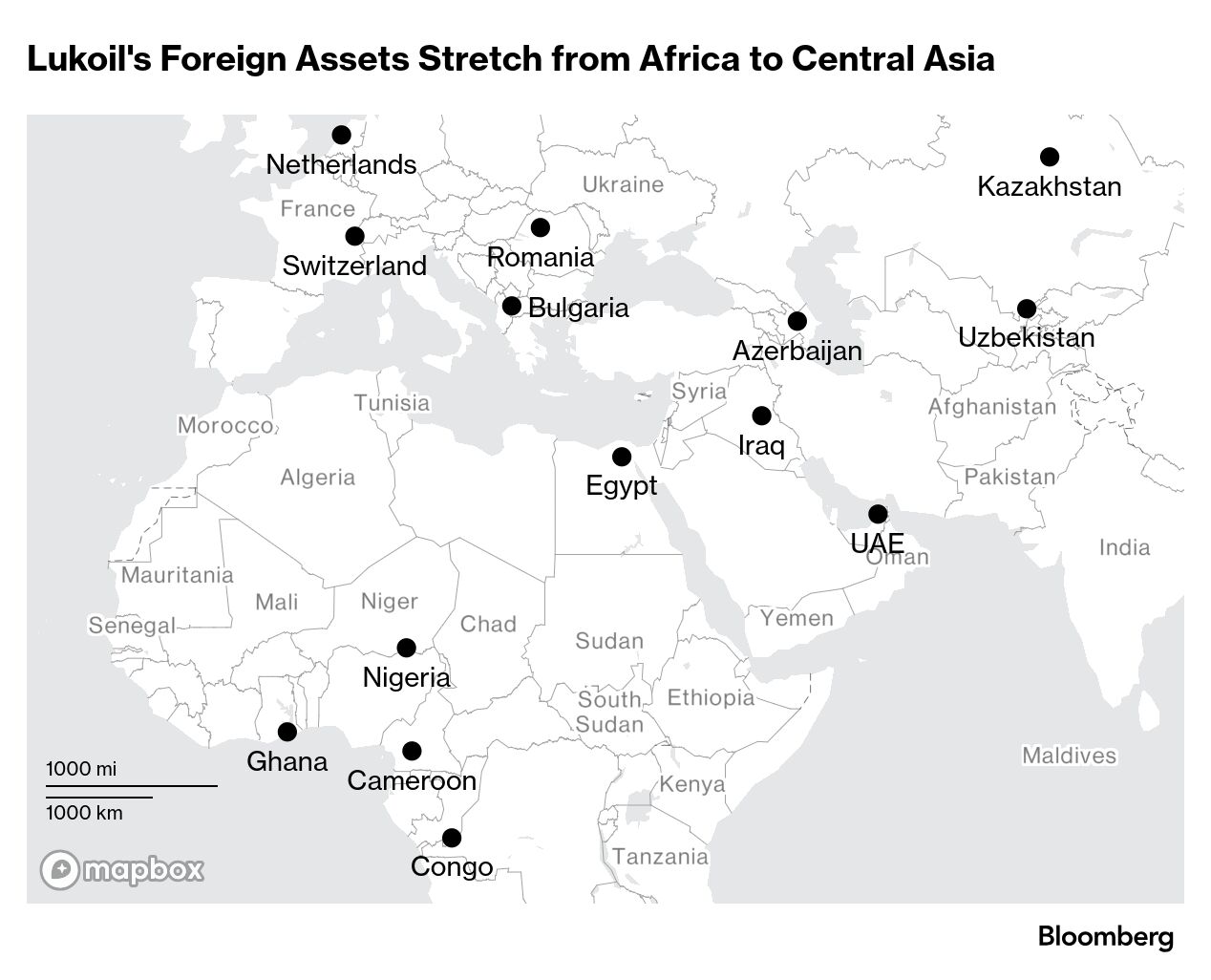

Final Thought Lukoil announced plans to sell international assets after being hit by US sanctions last week. Russia’s second-largest oil producer has started considering bids from potential buyers. Lukoil is the most internationally diverse of Russia’s oil giants, with upstream businesses in former Soviet countries, UAE and Africa. The Russian producer also has a network of more than 5,300 retail fuel stations in 20 countries around the world as well as refineries in Europe. Like the Brussels Edition?Don’t keep it to yourself. Colleagues and friends can sign up here. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|