| | In this edition, why Mamdani’s mayoral win won’t scare off New York’s financiers, and pharma’s hot-m͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- SCOTUS skeptical on tariffs

- Wall St.’s advice to Mamdani

- M&A hot-mic mess

- Ben & Jerry’s saga continues

- AI’s human overlords

US job cuts hit 22-year monthly high … Little mystery in Musk pay vote ... Google to integrate prediction markets in search ... |

|

Good news for Zohran Mamdani: Wall Street isn’t going anywhere. Andrew Cuomo, the vessel for Wall Street’s dashed mayoral hopes, is fond of invoking scripture: deeds over words, he’s told many a church congregation over his now-punctuated political career. As the city’s financiers complain loudly about Zohran Mamdani’s win, watch what they do, not what they say. The local media and thirsty suburban real estate agents have stoked fears that New York’s billionaires (i.e. its tax base, cultural patrons, and scientific benefactors) will leave for places where it is cheaper to be rich. I doubt it. “There are two things driving the US economy right now: compute power and people power,” said Scott Rechler, CEO of RXR Realty, one of the city’s biggest commercial property firms. “The compute is in data centers in the middle of nowhere. The people are in New York City.” Indeed, “Midtown in particular is celebrating an incredibly hot real estate market,” the former real estate executive now running the MTA, Janno Lieber, remarked last week. “Commercial leasing is out of sight.” The same college-educated, white-collar workers who backed Mamdani’s affordability campaign are pinched by costs precisely because their cohort wants to live here. And finance companies aren’t even pretending to leave anymore. Goldman Sachs nine years ago splashily moved investment bankers to Dallas, Atlanta, and other heartland cities — and has scarcely mentioned the initiative since. “Equities in Dallas” (shudder) remains as relevant a shorthand for New York City’s primacy as it was when Michael Lewis wrote Liar’s Poker in 1989. Bosses who demanded their employees return to the office five days a week will have a hard time moving to Florida. The city’s biggest hook on the billionaire set is a personal income tax that is, practically speaking, optional. The physical embodiment of a finance industry doubling down on the city is the $3 billion, gleaming, hypersustainable monument to capitalism JPMorgan just opened on 47th Street. RXR plans to break ground early next year a few blocks away, at 175 Park Ave., which will be the tallest building in the Western hemisphere; “We’re not changing any of our plans,” Rechler said. Salesforce — whose CEO, Marc Benioff, isn’t shy about criticizing urban mismanagement as he sees it — renewed and expanded its Times Square office tower in September. Sales of pricey condos hit a three-year high as Mamdani’s win was all but assured. That’s the evidence of the markets, and of long-term investors putting their money where their mouths are. On the other side of the ledger, we have … a few Florida real estate agents on TikTok getting reprinted in the New York Post. It’s a fun story, evergreen and buzzy, but don’t mistake it for reality. Just ask John Paulson when you see him at the Princeton Club. |

|

SCOTUS gets tough on tariffs |

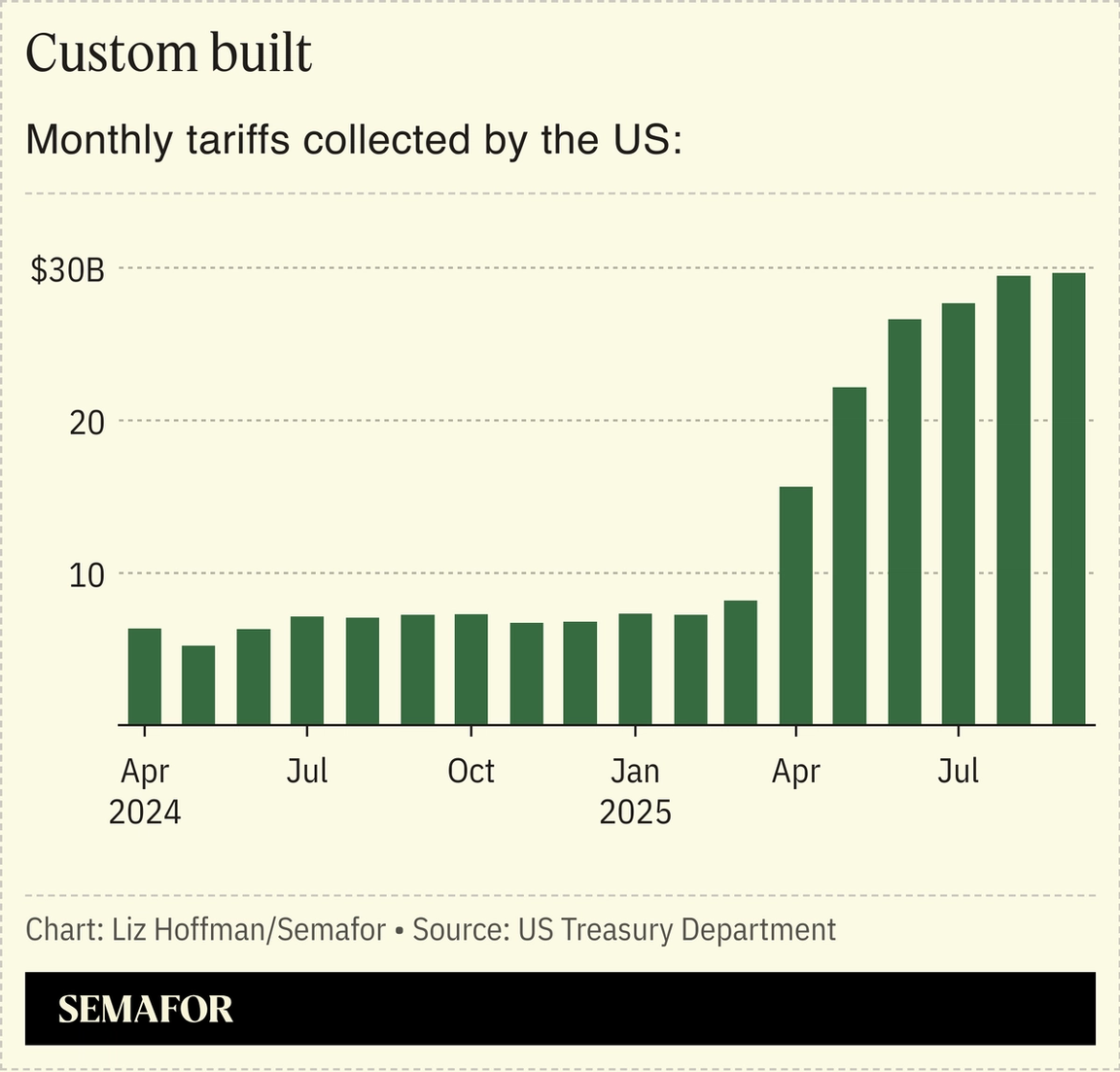

The White House faces the very real possibility of a Supreme Court reversal of Trump’s tariff regime, after justices in the conservative majority appeared skeptical of his legal basis during oral arguments Wednesday. Chief Justice John Roberts called the tariffs “taxes on Americans,” noting that power belongs to Congress, while Justice Neil Gorsuch worried aloud that a Democratic president could declare climate change an emergency to put a steep tax on gas cars.  The private businesses and blue states challenging the tariffs “had a good day,” said Scott Lincicome, a trade lawyer at the Cato Institute, which filed an amicus brief and put the odds of a ruling against the White House at 70%. (The betting markets are even less favorable.) The “slippery-slope” argument of “if this is on the table, what is off the table?” got significant airtime, Lincicome said. An adverse ruling would force the Treasury to refund more than $90 billion in tariffs. Yields on US Treasury bonds spiked on concerns about lost revenue, though experts said most of the levies could be reintroduced on more solid legal ground. |

|

Wall Street’s advice for Mamdani |

Angelina Katsanis/Reuters Angelina Katsanis/ReutersWary Wall Streeters have some advice for Mamdani. - Mamdani “would be better off taking a page from the start — the start — of Eric Adams’ tenure, than from any part of Bill de Blasio’s administration. Adams realized where he lacked experience and was open to the input of the business community, which cares deeply about this city. De Blasio never sought that input.” (Careful personnel selection, Adams’ downfall, Scherr noted, will be key.) — Stephen Scherr, co-president of real estate firm Pretium

- “Mayors are judged not on the speeches they give but: Is the city safe? Is it welcoming to job providers? Does it provide an excellent education? Does it deal with basic costs of living? He’s run on the fourth, but once he sits in the seat, he’ll be judged by the first three, too.” — Ralph Schlosstein, chairman emeritus of Evercore

- “Free rent will only reduce the supply of housing. We need to build. I hope he reaches out to the people in this city who’ve done that before.” — Scott Rechler, CEO of RXR Realty

- “Business leaders don’t have to embrace him, but they have to work with him and be invested in his success, and vice versa.” — Robert Wolf, CEO of 32 Advisors and former CEO of UBS Americas

- “I’m hopeful, and the next step would be to appoint a team of experienced city managers. He’ll need the broadest possible support as he contends with the onslaught that’s coming from the [Trump] administration.” — Antonio Weiss, investor and former Obama adviser

- “Make sure the snow gets picked up. If he doesn’t, we won’t have a socialist mayor for another 20 years.” — Lloyd Blankfein, former Goldman Sachs CEO

- JPMorgan CEO Jamie Dimon’s advice? Call the mayor of Detroit.

Elsewhere: Mamdani adding Lina Khan to his mayoral transition team will do little to calm Wall Street, or quiet persistent rumors that Khan is toying with a congressional run next year (which a spokesperson denied to Semafor this summer). While local politics is an odd soapbox for trustbusting, Khan at the FTC found novel uses for dusty laws in pursuit of a progressive agenda. Quick read: Jefferies today has a tidy explainer laying out what Mamdani can and can’t do. |

|

Hot mic raises temp in M&A fight |

Mike Blake/Reuters Mike Blake/ReutersWhite-shoe lawyers in the middle of the year’s testiest M&A fight are denying they insulted the Delaware judge overseeing their case on a hot mic. Pfizer’s bid to stop obesity drugmaker Metsera from selling itself to Novo Nordisk were foiled by that judge, who ruled that Metsera’s board was within its rights to find Novo Nordisk’s higher but regulatorily dicey offer superior to Pfizer’s $7.3 billion initial bid. (Both companies have submitted fresh offers in the past 24 hours, according to people familiar with the matter.) Adding more drama to the takeover battle: at the end of a telephone hearing Tuesday, a participant could be heard insulting Vice Chancellor Morgan Zurn’s grasp of the law and criticizing her handling of the case. Zurn was skeptical of Pfizer’s need for urgency, saying that she was reluctant to step into the middle of a live bidding war. One participant — unaware they were broadcasting to anyone still on the line, which was open to muted investors, analysts, and reporters — said Zurn was “misunderstanding” the nature of M&A contests. |

|

Ben & Jerry’s board chair in hot seat with parent |

Ronen Zvulun/Reuters Ronen Zvulun/ReutersBen & Jerry’s owner is trying to oust the head of the ice cream maker’s board after investigating its charitable donations to pro-Palestinian causes. Unilever executives said in a securities filing Anuradha Mittal “no longer meets the criteria” to sit on the committee, which was created in 2000 to protect Ben & Jerry’s progressive mission when it was sold to the Dutch conglomerate. Semafor previously reported that Unilever was auditing the Ben & Jerry’s Foundation’s grants to progressive groups, including two with ties to foundation leaders, and had cut off funding for the charity after its trustees refused to cooperate. What began as a niche tussle between opinionated founders and straight-laced corporate owners has turned into a major headache for Unilever, which will spin off its ice-cream businesses next month. Mittal did not respond to a request for comment, but Ben & Jerry’s co-founder Ben Cohen called the findings “a power grab to stifle the social mission, which will in turn destroy the long-term value of the brand.” |

|

Microsoft’s AI chief still wants humans in charge |

Denis Balibouse/Reuters Denis Balibouse/ReutersMicrosoft will prioritize human control over superintelligent AI, even if that makes it dumber, the tech giant’s AI CEO Mustafa Suleyman told Semafor’s Reed Albergotti. Giving up some capabilities to keep humans in control is “a very tough tradeoff,” but the alternative is “a crazy suicide mission,” said Suleyman, a self-described AI “accelerationist” whose caution would prompt snickers from the AI absolutists. AI critics will be skeptical of Microsoft’s or any of its competitors’ ability to keep that promise, but Reed writes they have a commercial reason to do so: “Microsoft’s customers aren’t actually asking for superintelligence. They would be happy with average intelligence with superhuman reliability.” Humanists and capitalists of the world, unite. Watch Reed’s full interview with Suleyman on YouTube. |

|

The industries, egos, and institutions that shaped modern capitalism — long before the billionaires wore hoodies. From how whisky and hot pants made Southwest Airlines a success to the surprising origin of the VW Beetle, Business History — a new podcast from Planet Money alums Jacob Goldstein and Robert Smith — shares the surprising stories of businesses big and small. Required listening for anyone who wants to understand the business beneath the business. Listen to Business History. |

|

➚ BUY: Pennsylvania. Keystone State businesses have some of the highest five-year “survival” rates, federal data shows, as AI buildouts and a natural gas renaissance continue to boost the state’s economy. ➘ SELL: Penn. ESPN switched its gambling partnership from Penn Gaming to DraftKings barely three years into a 10-year, $2 billion pact. |

|

“You cannot be re-elected anymore with a basic pro-business agenda.”

— Economist Thomas Piketty speaking to the Financial Times |

|

< < |

|

|