|

|

Constellation Software could be the best quality business I’ve ever seen.

Does it still make sense to buy the company after it increased +19.000%?!

Let’s take a look at this wonderful business.

Constellation Software Week

This is part III of Constellation Software week. Did you skip parts 1 and 2?

Constellation Software

👔 Company name: Constellation Software

✍️ ISIN: CA21037X1006

🔎 Ticker: $CSU

📚 Type: Owner-Operator/Serial Acquirer

📈 Stock Price: CAD 3,385

💵 Market cap: CAD 71.8 billion

📊 Average daily volume: CAD 183 million

During this investment thesis, we will often use CSI. To avoid confusion, this refers to Constellation Software Inc. (CSI).

8. Is the company a great capital allocator?

Let’s split this segment up into two: capital allocation and reinvestment rate.

Capital allocation

Mark Leonard understands the importance of capital allocation like no other CEO:

“Over the long term, stock returns will be determined largely by which capital allocation decisions the CEO makes. Two companies with identical operating results and different approaches to allocating capital will derive two very different long-term outcomes for shareholders.” - Mark Leonard

This is the essential piece of this investment thesis: What are the returns that Constellation makes on its investments?

We cannot just look at ROIC.

The typical ROIC formula (NOPAT/Invested Capital) is based on profits.

Under the “profitability section” of the investment case, you’ll read why NOPAT and other profit metrics don’t reflect the true value creation for CSI.

To better reflect reality, we use EBITA instead of NOPAT in the nominator of the formula.

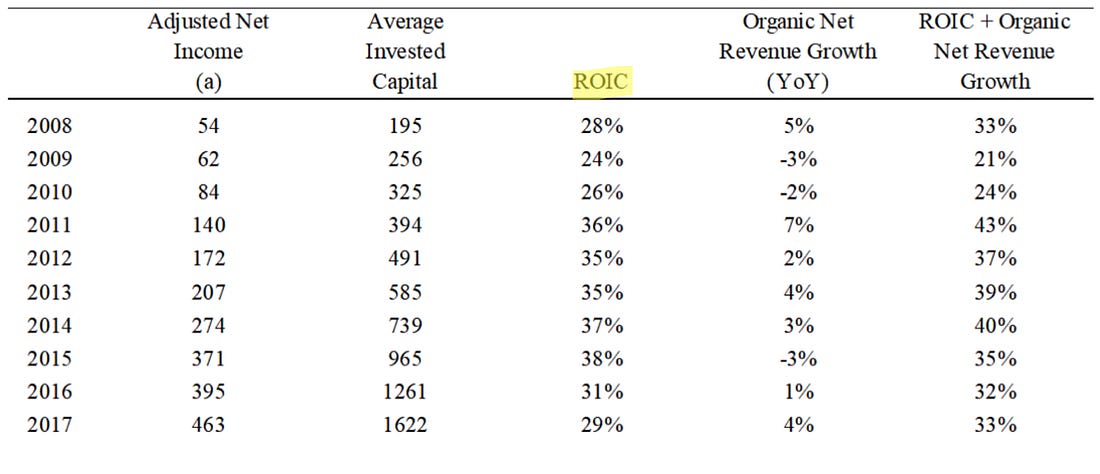

When using the adjusted ROIC, we arrive at the following number:

Adjusted ROIC: 32.5% (Adjusted ROIC 15%? ✅)

This is a very attractive number. It’s similar to the Adjusted ROIC that Leonard shared in his earlier shareholder letters.

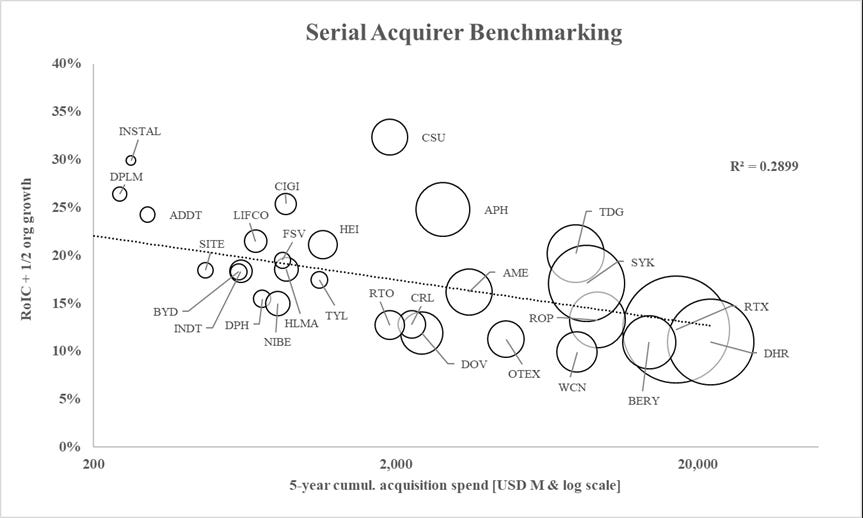

The visual below summarizes the entire investment case. It shows once again that CSI is the golden standard of serial acquirers.

|

The larger a serial acquirer becomes, the lower the ROIC tends to go.

When doing the research for this investment case, I found something else that was extremely interesting. In 2002, Constellation’s ROIC was still negative. This is 7 years after the company was founded.

The lesson I took away from this is that you should never be too fixated on the absolute ROIC. Instead, focus more on the direction and evolution of ROIC.

Reinvestment Rate

The million-dollar question for Constellation Software is this: How long can they maintain their high reinvestment rate?

Personally, I think a lot longer than most investors believe. Berkshire is roughly 15x times as big as Constellation and still finds creative ways to keep deploying capital instead of paying dividends.

Constellation Software has a massive database of VMS companies that it tracks. Although it’s not publicly known how many companies are in the d