| | In this edition, why hard assets are harder to grab, and glimpses of the economy after the governmen͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- The cost of the shutdown

- Sports betting’s black eye

- ‘Reverse Robin Hood’ rewards threatened

- Private jets and pitchforks

- YouTube’s clout tests Disney

|

|

In the 1970s, if you wanted to understand a company’s worth, you could literally kick the tires. More than 80% of S&P 500 companies’ assets were, in accountant-speak, “tangible” — buildings, inventory, land, and securities with measurable value. Today, it’s about 10%. The rest is a corporate ectoplasm of code, data, and brand power. Marriott is a hotel company that doesn’t own hotels. Delta Airlines’ credit card partnership is more profitable than its airplanes. This shift from hard assets to soft ones isn’t necessarily bad. It mirrors the broader pivot in the US economy from manufacturing to services, which are more profitable and less vulnerable to outsourcing. The US economy has been literally getting lighter for decades, as Alan Greenspan noted a quarter-century ago. (The Trump administration is now keen to reverse this.) But the wealth being created today is a haze of licensing agreements and magic beans. I recently wrote about the dangers as fuzzy collateral replaces hard assets. Lenders are more easily bamboozled by fake spreadsheets than by fake factories. Bets on whether a sub-95-mile-per-hour fastball will hit the dirt can, it turns out, be rigged. When I got my copy of The Land Trap, a new book about the world’s oldest and most tangible asset, my first question was: wait, why? Watching crypto bros get rich on hype is hardly a call to revisit the value beneath our feet, and I wondered whether author Mike Bird was shouting into the wind the same thing that social psychologists are: Go out, touch grass. But The Land Trap will be a told-you-so corrective if and when those intangibles crumble to dust. Land is a unique asset, at the center of booms and busts since Babylon, and will be here long after Meta or Microsoft or Google try to wriggle out of their data-center leases, should the AI buildout prove to be overdone. “The fact that the new economy is so difficult to value raises the importance of land,” Bird told me last week. “It seems to come up again and again and again, even as the economy has become much more incorporeal.” Go out, touch grass. |

|

Does the economy need a functioning government? |

Evelyn Hockstein/Reuters Evelyn Hockstein/ReutersThe toll of the 41-day government shutdown (and counting) on the US economy will take a while to determine. Much of the estimated $15 billion a week in lost activity will be recouped as federal workers start collecting paychecks, welfare payments are restored, and travelers can confidently book holiday tickets. “We kind of need a functioning government to have a functioning economy,” economist Paul Krugman told Bloomberg. “This was [long] enough to show us.” Government shutdowns tend to be nonevents, economically: The longest on record, in 2018, shaved $3 billion off a then-$21 trillion economy, according to the Congressional Budget Office. Its latest estimate here is up to $14 billion in lost growth. But this standoff took a toll on consumer sentiment, which is at its lowest level since June 2022. And the political disagreement that ignited it — steep rises in health insurance premiums that will kick in next year — will squeeze Americans already pulling back. While spending that was delayed will likely show up in the first quarter of 2026, the Federal Reserve will have to take that on faith when it decides next month whether to keep cutting interest rates. |

|

Sports, scandals, and the need for ‘sanity’ |

Cleveland Guardians starting pitcher Luis L. Ortiz. Joe Nicholson-Imagn Images/Reuters. Cleveland Guardians starting pitcher Luis L. Ortiz. Joe Nicholson-Imagn Images/Reuters.The sports-betting scandals keep piling up, imperiling a money grab that has seen Trump and the New York Stock Exchange rush to get in. The indictment of two Cleveland Guardians pitchers for rigging ever more esoteric online bets in exchange for cash follows revelations about NBA players allegedly throwing games, and is likely to spark more calls to regulate what is a shadow stock market now being policed by federal prosecutors. “You cost me my parlay, I hope your family dies,” is how one New York Mets player characterized daily threats from gamblers. In the two years since Disney rolled out ESPN BET, the market has exploded — thanks in part to Kalshi and Polymarket, which are now locked in a fierce battle for users. NYSE President Lynn Martin told Semafor last month that a “regulatory framework” borrowed from the securities markets could “put sanity around” betting; the stock exchange recently invested $2 billion in Polymarket. (Here’s your regular reminder that insider trading — er, pitching — is not technically a crime, and the Cleveland players are charged instead with conspiring to defraud their teams, the league, and predictors of their “honest” services.) |

|

Rewards cards are getting a rewrite |

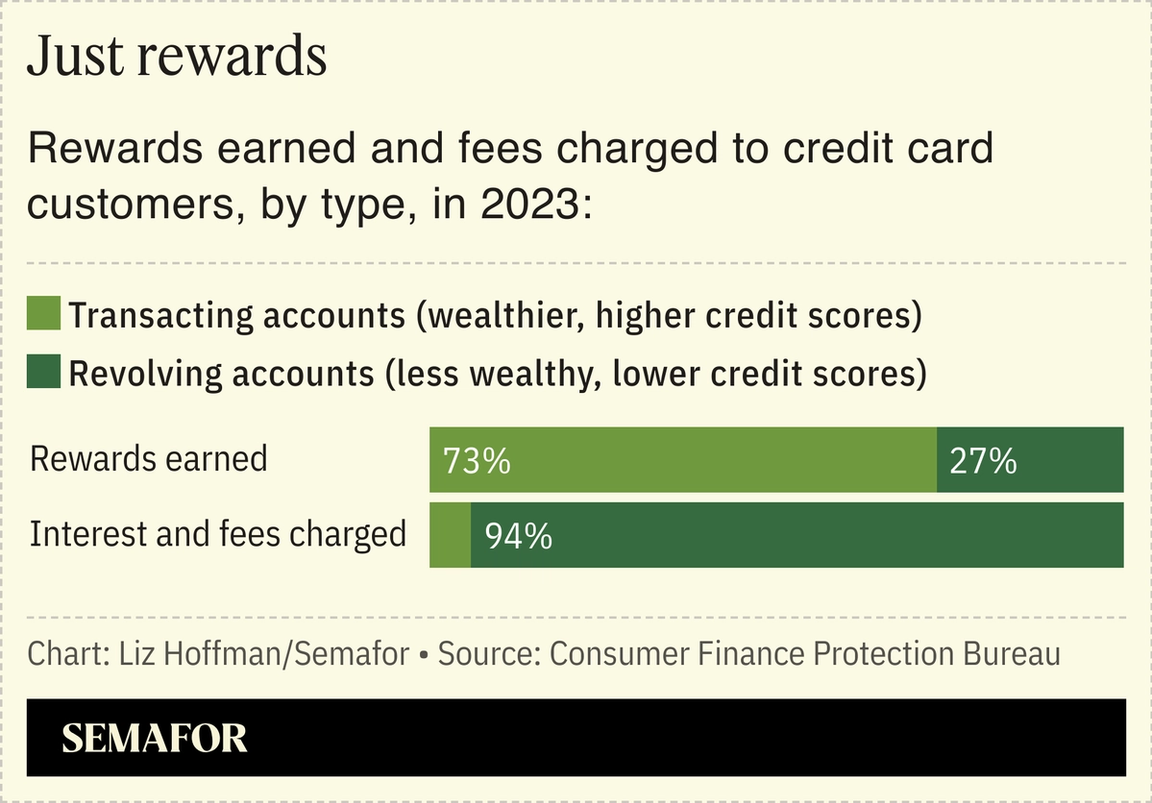

One of the greatest wealth transfers of the modern economy is being upended. We are speaking, of course, about rewards credit cards, where a settlement in a 20-year-old court case this week threatens huge businesses at JPMorgan Chase, American Express, and Capital One. Merchants can now reject cards that charge them higher fees, a freedom that Visa and Mastercard had long fought.  Rewards cards are a “reverse Robin Hood” system in which cash back, travel perks, and access to ever swankier airport lounges are underwritten by poorer customers who carry balances from month to month and pay interest rates averaging more than 24%. Federal Reserve economists in 2023 found that $15 billion a year is redistributed to “sophisticated individuals… at the expense of naive consumers.” |

|

Join more than 2 million readers who trust The Hustle for their daily 5-minute read on business and tech stories that actually matter. Become part of this informed community that starts each day with essential insights delivered with a fun, engaging twist. Sign up today. |

|

Shutdown comes for the FBOs |

Mike Segar/Reuters Mike Segar/ReutersThe shutdown is (nearly) over but air travel delays are likely to continue, and heat is building around private jets heading into the holiday season. The Federal Aviation Administration instituted a private-jet ban at 12 of the country’s busiest airports on Monday, days after it cut commercial flights to deal with a shortage of air-traffic controllers, who have been working without pay. The FAA’s crackdown on billionaire perks is largely symbolic — the list of airports doesn’t include New York’s Teterboro or Palm Beach. But it taps into the defining political narrative of the shutdown, when SNAP benefits were cut as Mar-a-Lago hosted a Gatsby-themed party and President Donald Trump broke ground on a White House ballroom. Backlash against private-jet travel is growing globally, even as it becomes a ubiquitous perk for chief executives who got used to flying private during the pandemic and remain rattled by security threats: More than half of the biggest US companies now pay for PJ use, according to Equilar. |

|

YouTube throws its weight around |

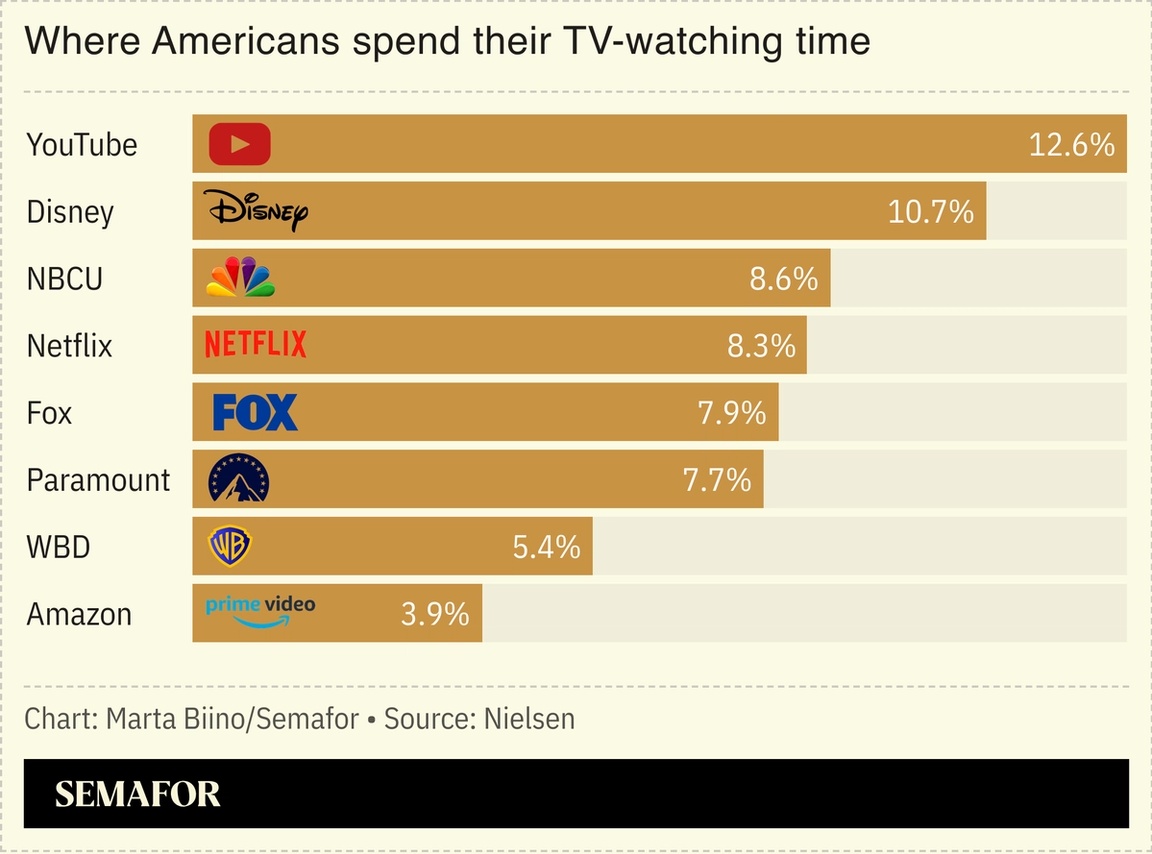

YouTube TV subscribers have now gone more than a week without ESPN and the rest of Disney’s programming. The dispute, which Morgan Stanley analysts say is costing Disney $30 million a week in lost revenue, follows standoffs with Comcast’s NBCUniversal and Paramount that were resolved before blackouts.  Carriage fights have been around as long as cable: Studios and distributors bicker about fees, screens go dark, and deals tend to be struck just before a must-watch event. But the rise of streamers, and the merging of content and distribution (Disney owns Hulu and Fubo, YouTube competitors) has complicated these disputes. And Hollywood is wary of the growing clout of YouTube, which now accounts for one of every eight minutes spent watching television, and far more in the under-30 set. Federal Communications Commission Chief Brendan Carr, whose agency doesn’t regulate streaming (yet), has weighed in, anyway: “Get it done!” |

|

The global financial system is entering a new era. The innovations that once reshaped markets, from index funds to ETFs, have become commoditized. In their place, a new wave of financial engineering is emerging. Semafor’s Liz Hoffman will convene leading figures in global finance at Semafor Business: The Ledger. On stage, they’ll explore which innovations will shape the future of the financial system — and which are poised to collapse under their own weight. On-the-record conversations with Michael Patterson, senior managing director at BlackRock, Gregg Lemkau, Co-CEO of BDT & MSD Partners, and others will dive into the new risks and new power brokers behind untested innovations. Dec. 2 | New York City | Request Invitation |

|

➚ BUY: TBS. Warner Bros. Discovery CEO David Zaslav met with Comcast’s Brian Roberts last week, Semafor scooped, as the media conglomerate weighs a bid for HBO Max that would help it compete with Netflix. ➘ SELL: TNT. The war in Ukraine has sent the price of high explosives soaring, threatening the supply of … smartphones. |

|

Companies & Deals- Lifting the cushions: Japan’s SoftBank sold its stake in chipmaker Nvidia for $5.8 billion in cash to fund its own huge AI investments, which — like nearly every player in the AI ecosystem — far exceed its financial capacity.

- Shuffle: Intel’s top AI executive is leaving for OpenAI just six months into the job, while Meta’s chief AI scientist is striking out on his own, the FT reports.

- Local flavor: Burger King is partnering with the Chinese investment firm behind Labubu dolls to double its restaurants in the country, just days after Starbucks announced it would sell a stake to a local PE firm. “After years of laying low, private equity firms are coming out of hibernation in China,” Bloomberg’s Will Davies writes.

- Pacific theater: Hedge fund Elliott is opposing the $30 billion sale of Toyota Industries in a test of whether Western-style activism can finally work in Japan’s modernizing but still cloistered corporate sector.

Watchdogs- Blowing the whistle: Trump’s nominee to run the FDIC told senators that offices tasked with fixing its culture after a scathing internal 2024 report on sexual harassment are deeply understaffed, Semafor’s Eleanor Mueller reports. DOGE cut 30% of its employees.

- London fog: The UK culture secretary is set to address Parliament over a leadership crisis at the BBC over the broadcaster’s handling of a Jan. 6 documentary.

Markets |

|

|