| | US lawmakers prepare to vote to reopen the government, South Korean traders are fueling US meme stoc͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - US shutdown end in sight

- Trump’s ties to Epstein emails

- AMD stock booms

- It’s about power, not chips

- US disengages with Africa

- SK embraces meme stocks

- GLP-1s vs. food delivery

- UK targets animal testing

- Lagos luxury boom

- AI-generated CS papers

Pickle lovers descend on a London pub. |

|

US shutdown on track to end |

Nathan Howard/Reuters Nathan Howard/ReutersUS lawmakers are set to vote on a funding package to reopen the government Wednesday evening, ending the country’s longest-ever shutdown. It could take days for agencies to fully resume operations, officials warned: Flight disruptions in particular could linger, but services should be back to normal by the Thanksgiving travel period. The shutdown’s conclusion, however, won’t lift a fog that’s settled over the country’s economists and policymakers, a Reuters columnist argued. Without government data, experts have resorted to metrics like Broadway show attendance to gauge economic health. October inflation and jobs data might never be released, the White House said Wednesday, further complicating the decision of an already-torn Federal Reserve on whether to cut interest rates in December. |

|

Epstein emails reference Trump |

Kevin Lamarque/Reuters Kevin Lamarque/ReutersUS lawmakers on Wednesday released a trove of emails from Jeffrey Epstein that reference Donald Trump, heightening scrutiny over the president’s ties to the disgraced financier and sex offender. Some of the communications suggest Trump was more aware of Epstein’s conduct than he has acknowledged; the White House said the emails are cherry-picked. Still, their release — hours before a vote to end the government shutdown — is sure to reignite a debate in Washington, and among Trump’s own supporters, over his handling of the Epstein files. The scandal has pitted Trump against many members of his conservative base, including those who spent years promoting Epstein conspiracy theories, and Democrats will be eager to capitalize on Trump’s alleged links. |

|

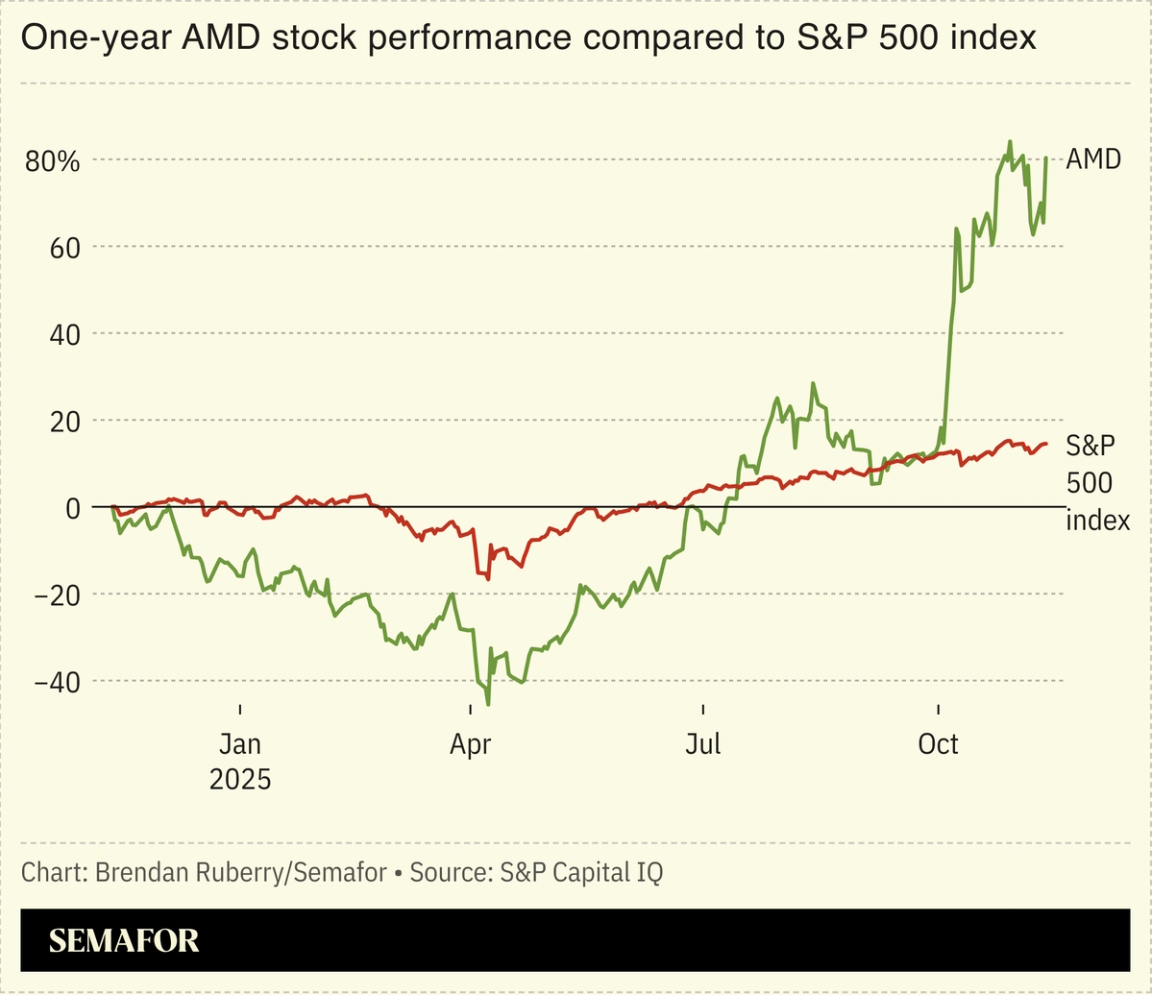

AMD revives AI trade enthusiasm |

US chipmaker AMD’s stock surged Wednesday as its CEO predicted the market for AI processors is “insatiable.” The company’s forecast that its AI data center business will grow 80% annually boosted US markets and revived enthusiasm in the AI trade following days of investor trepidation. Concerns of an AI bubble persist as Big Tech spending surges — startup Anthropic just announced a $50 billion data center investment. AMD CEO Lisa Su shut down those concerns, saying “I think it’s the right gamble.” Other tech executives are similarly bullish because they are “selling a product that customers can’t get enough of,” Semafor’s tech editor argued. “We’re in a moment of opportunity and uncertainty. The risks are everywhere. The upside is endless.” |

|

AI race comes down to energy |

Tingshu Wang/Reuters Tingshu Wang/ReutersThe US-China AI race will come down to electricity, rather than a contest over chips or models, experts argued. Both superpowers are building advanced AI systems, which require enormous amounts of power to run. “Here, China has a head start,” the Financial Times’ June Yoon wrote: Beijing is adding renewable energy capacity at an unprecedented scale. Thanks to China’s “commodification strategy for AI,” some Silicon Valley startups are using cheaper Chinese AI, Bloomberg’s Tracy Alloway noted, showing how the AI race is “about power availability rather than model or data sophistication.” The US’ chip export controls to curtail China’s tech advances seem to be working, but ultimately, “power will belong to those who can keep the AI models running,” Yoon wrote. |

|

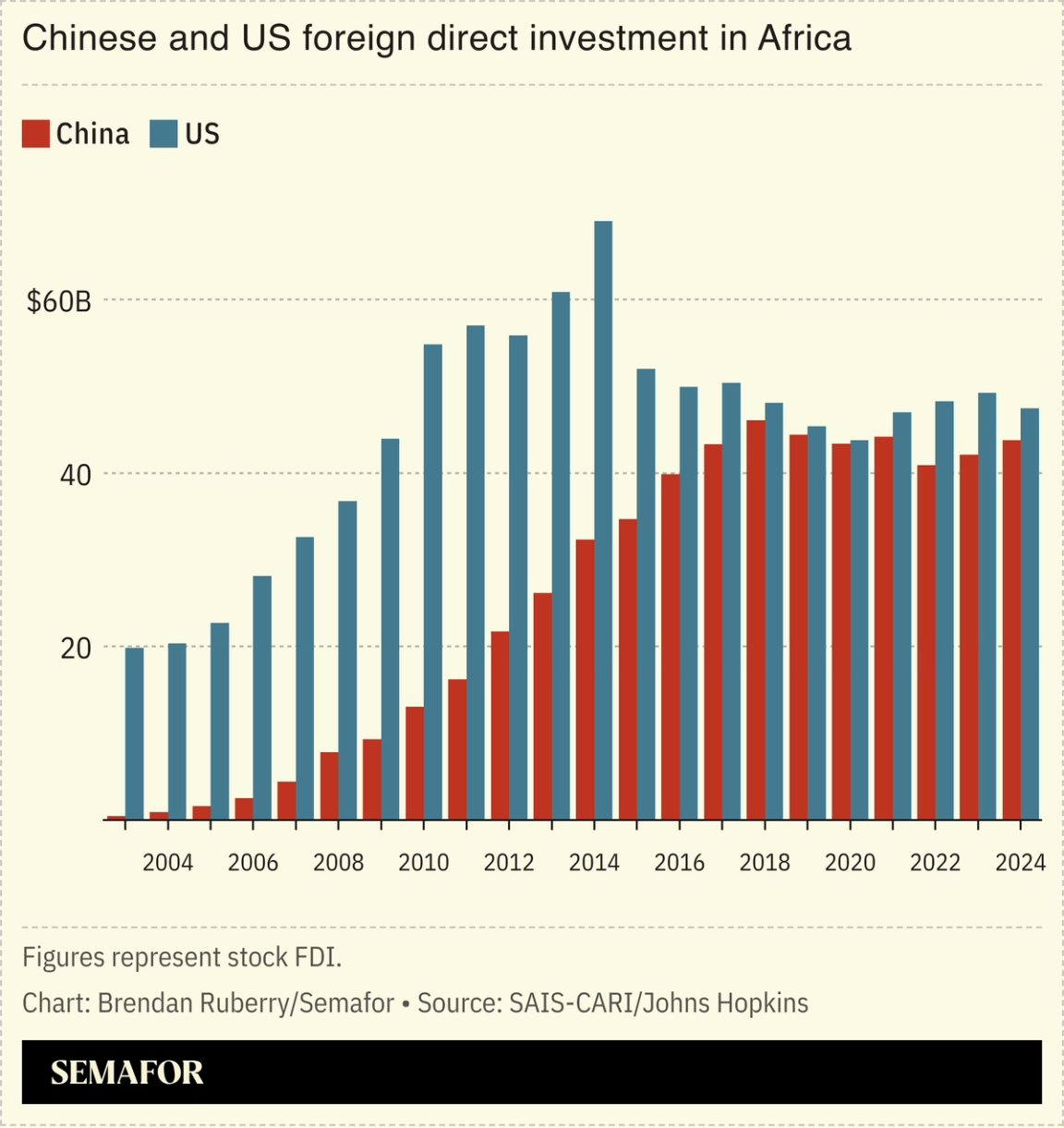

Trump’s G20 snub helps China |

US President Donald Trump’s boycott of this month’s G20 summit in South Africa risks undermining 15 years of Washington’s efforts to counter China’s growing influence on the continent, analysts said. Trump cited unsubstantiated claims of a “white genocide” in South Africa as the reason for the snub, but experts also pointed to Pretoria’s trade deficit, its support for Palestine, and its ties to countries that oppose US hegemony, Semafor’s Africa editor wrote. The US has previously aimed to curb Beijing’s influence through multibillion-dollar infrastructure projects, but China, along with rising middle powers like Turkey and the UAE, are expanding their reach. Washington has slashed Africa humanitarian initiatives, instead focusing on “narrow… almost cynical” economic engagements, journalist Howard French noted. |

|

S. Koreans hunt for gains on Wall St. |

Han Jae-Ho/Reuters Han Jae-Ho/ReutersSouth Korea’s retail investors are descending on Wall Street and enthusiastically fueling meme stocks. Korean traders’ holding of US equities nearly doubled in 2025 — their presence could change the makeup of American markets by distorting valuations through speculative investments, an expert told the Financial Times. The practice, characterized by dramatic rises and falls in companies that sometimes don’t even make money, is already commonplace in Korea. “Korean retailers are just crazy. They are not like average retail investors in other parts of the world. They are very aggressive,” a strategist said. Many Koreans were driven to the US following years of underperformance in their domestic market, coupled with high property prices and wealth inequality. |

|

GLP-1s threaten India food delivery boom |

Francis Mascarenhas/Reuters Francis Mascarenhas/ReutersThe rising popularity of GLP-1 weight loss drugs in India risks clipping the growth of another burgeoning industry: food delivery. Quick-commerce platforms have boomed in the world’s most populous country, becoming major revenue-drivers thanks to wealthier urban and online customers. But anti-obesity drugs, which curb users’ appetites, are now taking off — appealing to the same customer base that uses the delivery apps. The patent for the active ingredient in Ozempic will expire in March, triggering a generic manufacturing boom in the country. “Cheap weight-loss drugs won’t destroy” India’s delivery model, the India Dispatch newsletter wrote, but it “will thin it at the margins that matter most for valuations.” |

|

News, but only the good stuff. Introducing Nice News, an easy-to-read daily digest that delivers uplifting, interesting, and intelligent stories. Join over 1.1 million other readers who wake up with a more optimistic mindset — subscribe to Nice News for free. |

|

UK takes aim at animal testing |

Vuk Valcic/SOPA Images/LightRocket via Getty Images Vuk Valcic/SOPA Images/LightRocket via Getty ImagesThe UK unveiled plans to reduce animal testing in research. Science Minister Patrick Vallance said the government hopes to end some test types this year, and reduce the use of dogs and monkeys in testing by 35% by 2030, replacing animal experimentation with computer modeling and in-vitro testing. The number of animals used in UK research is already down 30% from its 2015 peak of 4.14 million. The US this year dropped some animal testing requirements, and the EU revealed a “roadmap” toward ending the practice. But scientists foresee difficulties: Vallance himself said we can’t “eliminate animal use in the foreseeable future,” and another scientist told the BBC that alternatives will “never replace the complexity” of animal testing. |

|

Luxury homes take off in Lagos |

Sodiq Adelakun/Reuters Sodiq Adelakun/ReutersLagos is seeing a luxury housing boom. There are about 135 homes priced over $1 million in the former Nigerian capital, with a further 1,400 expected by 2029, in a country where a third of people earn less than $2.15 a day. Nigerian émigrés are taking advantage of a weak naira, Bloomberg reported, and anti-corruption rules in the US and Europe have made it hard for wealthy Nigerians to park cash overseas, so they invest in real estate. The boom contrasts with a fall in Nigeria’s millionaire population, which has dropped by 47% in the last decade. The deals are often done in cash, and the government is concerned that many are a means of money laundering. |

|

|