| | In today’s edition: What to expect from Saudi Crown Prince Mohammed bin Salman’s visit to Washington͏ ͏ ͏ ͏ ͏ ͏ |

| |   Washington, DC Washington, DC |   Riyadh Riyadh |   Doha Doha |

| Gulf |  |

| |

|

- Will MBS give Trump $1T?

- PIF trims US stock holdings

- Emirates ups Boeing order

- Gulf carriers rollout Starlink

- UAE builds military drones…

- …launches digital dirham

Doha is building a free zone for fine arts. |

|

Saudi Arabia’s crown prince will do more than tend to a historic alliance during his meeting with US President Donald Trump this week: He is looking to position the kingdom he is likely to rule for decades to come as an indispensable ally. Billions for the US defense industry? Check. Billions more to back US artificial intelligence champions investing at home and abroad? Check. And don’t forget money for US gas exports and nuclear technology. But this is no longer just a commitment to recycle Saudi petrodollars, freely flowing around the globe under the protection of an American-led global order, into US assets. Crown Prince Mohammed bin Salman wants to redefine the US-Saudi alliance as a partnership that will shape the future. From Riyadh’s perspective, doubling down on Washington will help its most important strategic partner beat China on everything from AI to security, energy, and critical minerals. The kingdom hopes to use reserves of uranium and rare earth metals to tie itself into US supply chains eager to keep China out. And in a show of diplomatic usefulness, Saudi Arabia played a role hosting US-led talks to try to end the Russia-Ukraine war, offered help in resolving the Sudan conflict, and served as a temporary home for US military equipment in the lead up to Iran’s strike on Qatar’s Al-Udeid base. Saudi Arabia, through its oil sales, is also the swing vote in any efforts to shift global trade away from a reliance on the US dollar — a key concern of the Trump administration. All of that improves the Saudi pitch to the US at a time when its crude reserves are no longer big enough to fulfil MBS’ ambitions. In Trump’s first term, Saudi Arabia was so flush it needed to find other places to invest surpluses. Now it spends so much at home, it needs other nations to back MBS’ domestic vision. While closer — or the threat of closer — ties to Beijing are sometimes seen as a bargaining chip for Riyadh, all sides know that Chinese investment is not going to “Make Saudi Arabia Great Again.” For that, MBS needs the US. In that sense, the future of the two countries may be more entwined than ever. Once the pomp and ceremony of this week’s visit has passed, though, the longer term challenge for the crown prince will be ensuring that all the goodwill he has built up in the Trump era survives into future administrations. |

|

US and Saudi line up deals |

Brian Snyder/File Photo/Reuters Brian Snyder/File Photo/ReutersAny meeting between US President Donald Trump and another world leader, especially one who sits atop a $1 trillion sovereign wealth fund, wouldn’t be complete without hundreds of billions of dollars of commercial deals signed. A lavish US-Saudi investment summit at the Kennedy Center on Wednesday will likely clarify if Saudi Crown Prince Mohammed bin Salman, and his 1,000-person entourage, will reach that total. The contours have largely been set. In defense, the sale of F-35 fighter jets to the kingdom would be the first for the region. Artificial intelligence will also feature: Saudi tech companies HUMAIN and DataVolt are keen to get their hands on the latest chips to build out data centers, if the president’s and the prince’s teams can reach an agreement on security parameters. A potential nuclear deal could also boost revenue for US firms, and provide Washington access to Saudi’s uranium deposits. Another energy stream is Aramco’s plan to buy into US liquefied natural gas projects. Finally, the summit will also be an opportunity to get the merger of Saudi-backed LIV Golf and the PGA back on track. Saudi wealth fund boss Yasir Al Rumayyan has previously looked to use his relationship with Trump to try to get the deal done. — Matthew Martin |

|

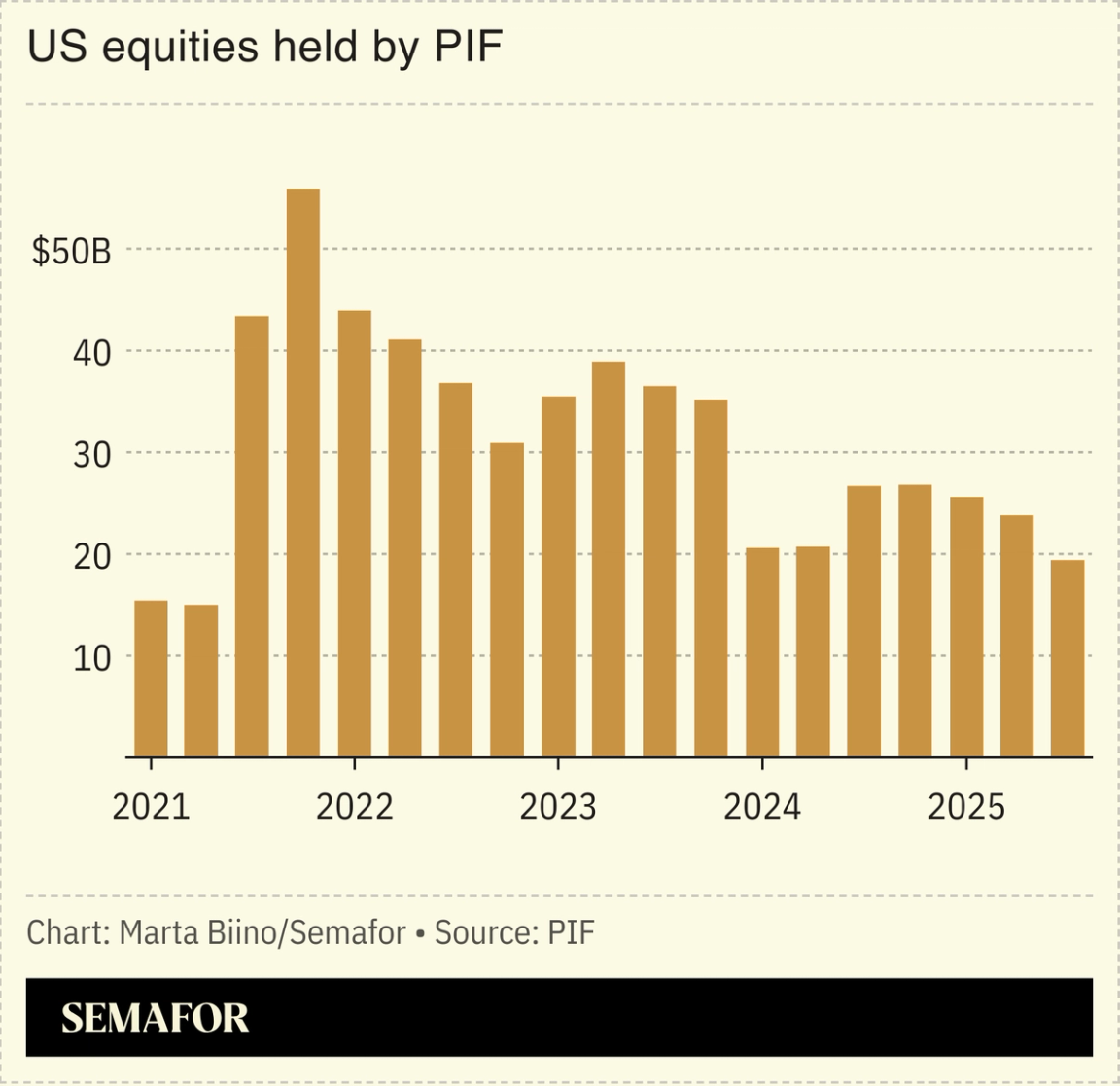

PIF cuts back US stock holdings |

Saudi Arabia’s sovereign wealth fund cut its holdings of US equities to the lowest level in four years, just weeks before a White House meeting between the kingdom’s de facto ruler and President Donald Trump. Public Investment Fund reduced its US stock exposure to $19.4 billion at the end of September, from $23.8 billion three months earlier, according to an SEC filing. The fund sold down stakes in firms including Pinterest and Air Products along with call options on companies including Amazon and Apple. The sales leave the PIF holding just US six stocks, including Uber, Lucid, and Electronic Arts, the videogame publisher that is set to be taken over by a Saudi-led consortium. PIF loaded up on US equities during the pandemic slump. It has since reduced holdings from a peak of $56 billion in 2021 as lower oil prices and vast spending commitments at home have led the fund to step up borrowing and recycle existing cash to use elsewhere. Since then it has leaned more into commercial deals, spending billions on everything from Boeing planes to hiring US firms like Parsons and Bechtel to work on Saudi projects. — Matthew Martin |

|

Emirates places $38B Boeing order |

Courtesy of Emirates Courtesy of EmiratesThe world’s biggest long-haul carrier just made a jumbo order. Emirates said it would buy $38 billion worth of Boeing 777-9 aircraft, and 130 GE Aerospace GE9X engines that power the jets. The deal, announced at the biennial Dubai Airshow, will boost Emirates’ order book to 367 Airbus and Boeing planes. “This is a massive long-term commitment to US aerospace manufacturing, generating support for hundreds of thousands of high-value manufacturing jobs in the US,” Sheikh Ahmed bin Saeed, chairman and CEO of Emirates, said on Monday. The company expects to receive Boeing aircraft up to 2038. Emirates had a record pre-tax profit of $3.3 billion for the first half of its fiscal year as more passengers paid for premium cabins. The Dubai carrier expects revenue to grow as more Airbus A350 jets join its fleet this year. |

|

Gulf carriers make Starlink standard |

A Qatar Airways ad featuring Elon Musk. Courtesy of Qatar Airways. A Qatar Airways ad featuring Elon Musk. Courtesy of Qatar Airways.Qatar Airways may have the early lead with Starlink on more than 100 aircraft, but Emirates doesn’t intend to fall behind. The Dubai carrier said it will provide the service this month and equip its entire 232-plane fleet over the next two years. The high-speed Wi-Fi will be free across all cabins, letting passengers make calls, work, and stream on seatback screens or personal devices. Inflight connectivity has become the latest front in the Gulf carriers’ amenities race. As aviation plays a growing role in their economies, airlines are using comfort and tech to keep transit passengers loyal — and to attract more tourists to the concerts, hotels, and malls in Abu Dhabi, Doha, and Dubai. |

|

UAE makes first digital dirham deal |

The UAE’s ministry of finance. Courtesy of Emirates News Agency-WAM. The UAE’s ministry of finance. Courtesy of Emirates News Agency-WAM.The UAE government has carried out the first deal using the digital dirham, an online version of its currency. The transaction between the federal Ministry of Finance and the Dubai Department of Finance was done using the mBridge platform, a settlement system for digital currencies used by central banks from China, Hong Kong, Saudi Arabia, Thailand, and the UAE. The country has been working on its digital dirham initiative for several years and is among the early movers globally in this space. Advocates of such central bank digital currencies say they can help to reduce costs, particularly for cross-border transactions. It comes as some of the global cryptocurrency elite are due in Dubai in early December for a two-day blockchain event hosted by crypto exchange Binance. |

|

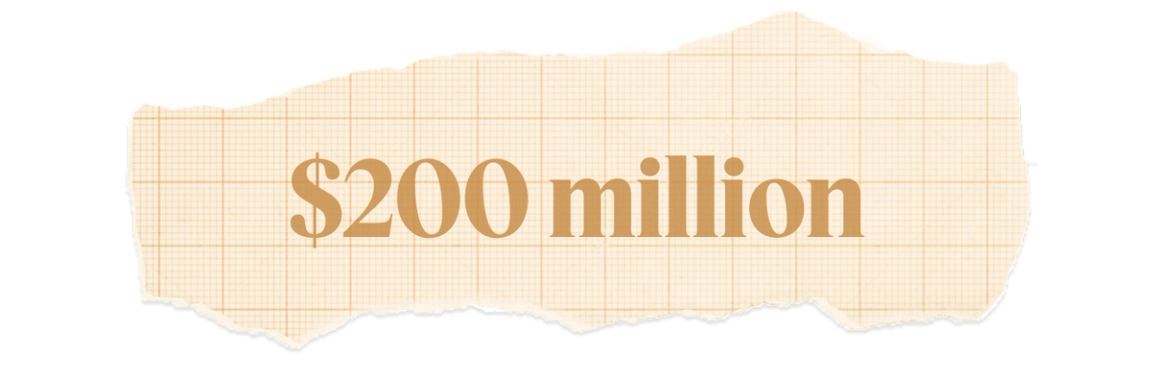

UAE to build drones with US partner |

The amount that UAE defense conglomerate EDGE Group is investing in a new drone manufacturing facility in Abu Dhabi, in a joint venture with US-based Anduril. Their first product will be a hover-to-cruise drone called Omen, which should be in production by the end of 2028. Omen will be aimed at both military and commercial customers, with potential uses including surveillance, logistics deliveries, and communications relay. The partners say they plan to codevelop other systems for customers in the Gulf and beyond, with US orders fulfilled from Anduril’s Arsenal-1 facility in Ohio. EDGE has previously signed partnerships with companies from Brazil, Italy, and Türkiye. This is its biggest deal to date with a US company. |

|

Boats- Qatar’s Al Masdar Investment is venturing into zero-emission yachts. The firm acquired a majority stake in Germany’s TYDE, a maker of yachts that use hydrofoils to lift vessels out of the water, which helps reduce drag and improve efficiency.

Deals- Abu Dhabi Investment Authority is reportedly considering selling up to half its $1.26 billion stake in Qatari telecom provider Ooredoo, whose stock saw an annual increase of 22%. — Bloomberg

- RedBird IMI’s two-year effort to offload The Telegraph continues. The Abu Dhabi-backed media investment fund’s May deal to sell the majority of its stake to its partner, US private equity firm RedBird Capital Partners, fell through, leaving the UK newspaper’s fate unclear. — CNN

- Arada Developments, the real estate company co-owned by the son of Saudi billionaire Prince Alwaleed bin Talal, bought a majority stake worth about $300 million in the Thameside West project in London that aims to build at least 5,000 homes. — Bloomberg

Energy- Middle East crude output is projected to rise nearly 50% to 44 million barrels per day by 2050, lifting the region’s share of global supply to almost 40% by mid-century, up from about one-third today.

- QatarEnergy secured a production-sharing agreement for a 35% stake in a shallow-water field off Guyana’s coast. The block is operated by TotalEnergies, with Malaysia’s Petronas a partner. QatarEnergy has been expanding its international upstream footprint, with oil and gas investments in Africa and the US.

Sports- Saudi Arabia’s bullish sports push is starting to show returns as bottom-tier Al-Kholood becomes the first Saudi Pro League soccer team bought by a foreigner. American investor and co-owner of Spain’s Cadiz, Ben Harburg, is betting analytics will help write a Cinderella story for his club. — Reuters

|

|

|