| | In today’s edition: A rough guide to Abu Dhabi Finance Week, CoinMENA acquired by Turkish crypto exc͏ ͏ ͏ ͏ ͏ ͏ |

| |   Abu Dhabi Abu Dhabi |   Washington, DC Washington, DC |   Istanbul Istanbul |

| Gulf |  |

| |

|

- Guggenheim eyes Abu Dhabi

- Aldar-Mubadala fund

- Paribu snaps up CoinMENA

- UAE at White House AI talks

- Oman’s African power play

China’s ‘dual-pillar’ approach to the Gulf, and other weekend reads. |

|

From a rather humble beginning as a fintech gathering, Abu Dhabi Finance Week (ADFW) — and the ballooning events happening around it — is becoming the can’t-miss finale in the global calendar of convenings: A celebration of finance, sports, entertainment, and culture in the self-proclaimed “capital of capital.” At its core, it’s a pitch to the world’s financial elite, but has evolved into a marker of the city’s ascendancy. Ahmed Jasim Al Zaabi, chairman of ADGM and Abu Dhabi’s economic development department, is leading the effort, with support from top sovereign wealth executives such as Mubadala’s Khaldoon Al Mubarak and ADQ’s Mohamed Alsuwaidi (who also serves as the UAE’s minister of investment). Power players to spot at ADFW: Binance’s Richard Teng, Emaar’s Mohammed Alabbar, hedge funders Alan Howard and Ray Dalio, and Carlyle’s David Rubenstein. Bill Gates will speak and take part in a polio pledge. There will be a dramatic showdown in the world of Formula 1, with the season finale delivering a rare three-way title race on Sunday. Along with the action on the track, music acts including Benson Boone, Post Malone, Idris Elba — actor, DJ, and Semafor friend — Calvin Harris, Metallica, Katy Perry, and top DJs well beyond my knowledge. Also: museums. And beaches. Abu Dhabi is launching the first Bridge Summit as well, a media-and-tech forum with an impressive global lineup. Bitcoin MENA tackles the crypto angle, with Strategy’s Michael Saylor, Binance founder CZ, and somehow, Trump’s 2016 campaign manager Paul Manafort. This list is in no way comprehensive. Many of my Semafor colleagues and I will be in Abu Dhabi, and will do our best to get you all the highlights. Let us know if you’ll be around by replying to this email. Also, join us for our own event on Dec. 11, the ADFW edition of our Next 3 Billion On Tour, in partnership with the Gates Foundation! You can request an invitation here. |

|

Abu Dhabi next up for Guggenheim |

| |  | Kelsey Warner |

| |

Guggenheim Partners Investment Management CIO Anne Walsh. Courtesy of the Milken Institute. Guggenheim Partners Investment Management CIO Anne Walsh. Courtesy of the Milken Institute.Guggenheim Partners is eyeing an office in Abu Dhabi, as the contemporary art museum that bears its name prepares to open its doors in the UAE capital next year. The investment management firm, which has had an outpost in Dubai since 2007, is working on obtaining a license in Abu Dhabi’s finance hub, ADGM, Chief Investment Officer Anne Walsh of Guggenheim Partners Investment Management said in an interview, without giving a timeline. The firm’s investment management is still run out of offices in the US and Europe, and building up a money management team in the Gulf is a “next step,” she said. Gulf outposts have traditionally housed client-relations specialists, with active money management run from other hubs. But regulators have put teeth into staffing requirements: To be licensed as an investment manager in Abu Dhabi’s financial free zone, Guggenheim will need a team on the ground managing money, not just relationships. Walsh is bullish on demand for private credit, calling it “bubbly, but not a bubble.” Guggenheim is preparing to close its fourth private credit fund, of about $4.5 billion, early next year, she said. The $2 trillion asset class has stirred fears in recent months, following some high-profile defaults. |

|

Aldar to launch Gulf real estate fund |

The value of the real estate investment fund Abu Dhabi developer Aldar will launch next year, targeting global institutional investors. The Aldar Capital initiative is a joint venture with fund manager Mubadala Capital — an arm of the Abu Dhabi sovereign wealth fund — and aims to sign up sovereign wealth funds, pensions, funds of funds, insurance companies, and family offices as customers. It will be based in the Abu Dhabi Global Market financial zone and will target real estate and infrastructure deals in the UAE and across the wider Gulf. The region’s property markets are awash with foreign owners, but the market for overseas institutional buyers is relatively underdeveloped. |

|

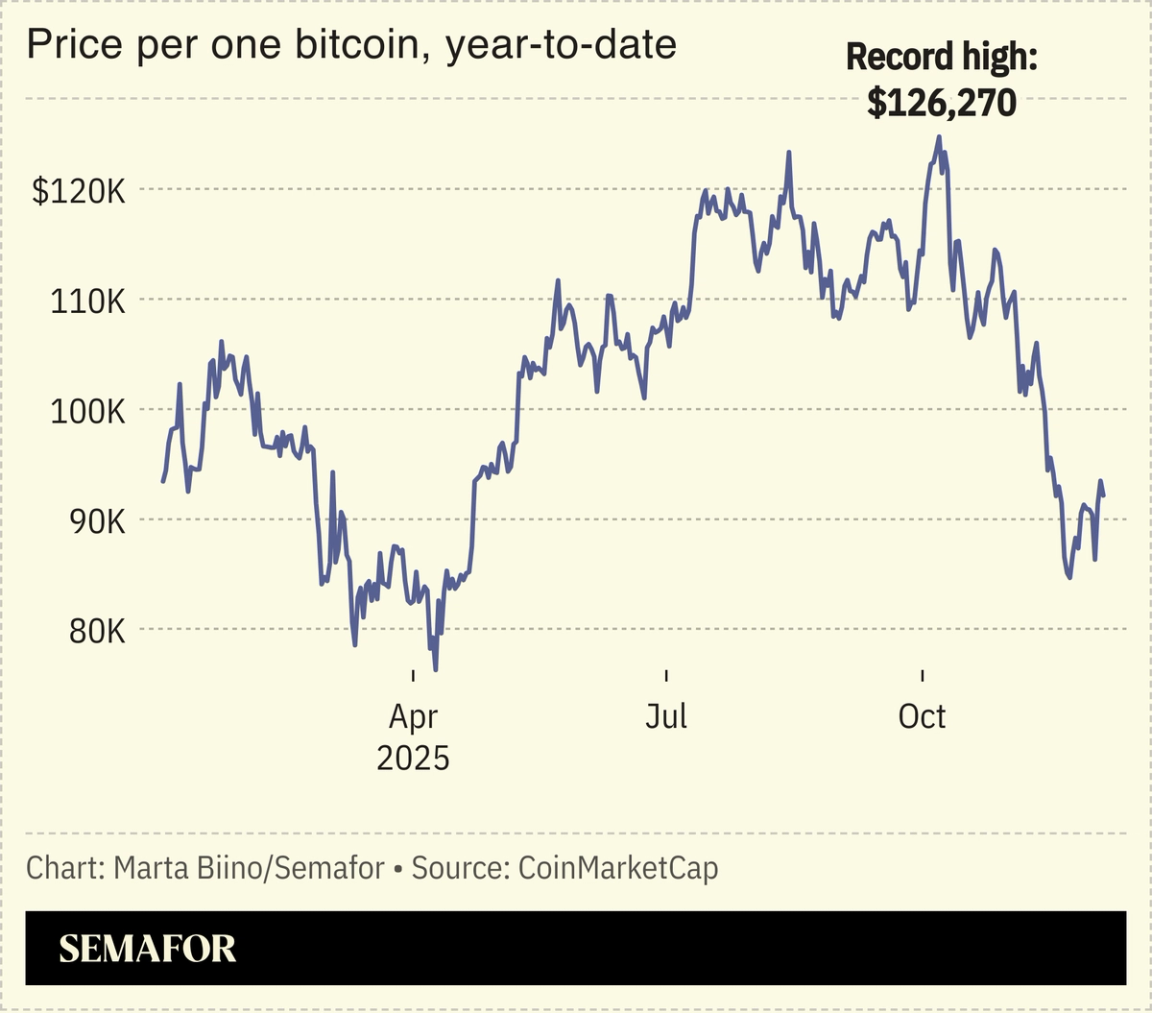

Türkiye’s Paribu buys Bahrain crypto exchange |

One of Türkiye’s biggest digital asset platforms bought the Gulf’s top homegrown crypto exchange. Paribu acquired CoinMENA, the Bahrain-based and Dubai-licensed exchange, in a deal valued at $240 million. CoinMENA, founded in 2020, has raised almost $20 million from investors including BECO, Arab Bank Switzerland, Circle, and Bunat Ventures. It has more than 1.5 million users in 45 countries. The Middle East accounts for roughly 7% of global virtual asset transaction value. Although Bitcoin has slumped in recent months, the industry remains bullish: Driven by a crypto-friendly Trump administration, the stablecoin market has grown to nearly $300 billion so far in 2025, up 42% year-to-date, according to JPMorgan. — Mohammed Sergie |

|

Global powers target Gulf AI collaborations |

Stephen Nellis/Reuters Stephen Nellis/ReutersGulf countries are being courted by the US and Japan, as the global artificial intelligence race heats up. The UAE is one of eight countries invited to the Pax Silica summit in the White House on Dec. 12. The meeting, which will also feature Israel, South Korea, and the UK, is an effort by the US to bolster its AI supply chain and reduce China’s influence in critical minerals and chips. Saudi Arabia is not on the guest list, although last month it agreed with the US to set up a rare earth refinery in the kingdom. Tokyo is also looking for Gulf help to reduce its dependence on Chinese critical minerals: Japan’s Prime Minister Sanae Takaichi told the Future Investment Initiative’s Tokyo gathering this week that it would “accelerate efforts” to promote supply chain collaboration with countries including Saudi Arabia. |

|

Oman joins African renewables race |

A solar park in South Sudan. Thomas Mukoya/Reuters. A solar park in South Sudan. Thomas Mukoya/Reuters.Omani renewable energy specialist O-Green said it would develop up to three gigawatts of solar and wind power projects in Botswana, joining a growing wave of Gulf power developers in Africa. The deal was announced during a visit by an Omani business delegation to Gaborone in late November, alongside others covering energy infrastructure and trading, and gold and diamond exploration. Gulf developers have built up large portfolios across Africa, with Saudi Arabia’s ACWA Power and the UAE’s Amea Power and Masdar at the forefront. Muscat has not been as active, but it is picking up the pace across several industries, particularly in the south of the continent. An Omani investment roadshow landed in South Africa in early December; last year, Oman’s Maaden International Group (not to be confused with the Saudi mining giant also called Maaden), acquired a 41% stake in Angolan diamond miner Catoca. |

|

As one of the world’s foremost financial hubs, Abu Dhabi is emerging at the crossroads of innovation, investment, and inclusion — linking markets across the Middle East, Africa, and Asia. At an event held during Abu Dhabi Finance Week, Semafor will showcase insights from the upcoming Global Findex 2025 report and the Global Digital Connectivity Tracker, translating global research into practical, locally grounded conversations. With Abu Dhabi prioritizing sustainable finance, digital transformation, and cross-border collaboration, the city provides an ideal stage to explore how technology and capital can work together to expand access, inclusion, and economic opportunity. Dec. 11 | Abu Dhabi | Request Invitation |

|

Deals- Public Investment Fund subsidiary the Saudi Bahraini Investment Company is setting up a joint investment program with Bahraini sovereign wealth fund Mumtalakat, with target sectors including financial services, manufacturing, and infrastructure.

- Abu Dhabi-listed private equity firm Investcorp Capital acquired a portfolio of US industrial assets valued at about $400 million, spanning 35 buildings across six states.

- Sovereign wealth fund Abu Dhabi Investment Council launched legal action to stop Houston-based Energy & Minerals Group selling shares in Ascent Resources to a sister fund. ADIC claims the deal shortchanges investors. — Financial Times

Diplomacy- Qatari mediation has yielded two major breakthroughs: a peace deal between the Democratic Republic of Congo and Rwanda signed in Washington, and an expected agreement in Doha between Colombia and the paramilitary group AGC (expected after this digest hits your inbox).

- Mexican architect Frida Escobedo has won an international competition to design Qatar’s new Ministry of Foreign Affairs headquarters, a building along the corniche that will become a monument reflecting Doha’s diplomatic ambitions.

Crime- Kuwait has set out tough new anti-drugs laws, with punishments ranging from fines to life imprisonment. For cross-border drug trafficking: the death penalty. — Kuwait Times

|

|

- China’s “dual-pillar” approach to the Gulf — with its mix of strong political ties with Iran and expansive economic engagement with the GCC countries — has inherent tensions, writes Yuan Zhang for Gulf Research Center.

- The Gulf has become “one of the central stabilizing regions of the international system,” using its role in energy, finance, trade, and increasingly diplomacy to play a role that was unthinkable a generation ago, writes Kuwait-based analyst Layan Mandani.

- The sprawl and influence of International Holding Company, Abu Dhabi’s largest listed firm, ove

|

|

|