|

|

Looking for serious investors

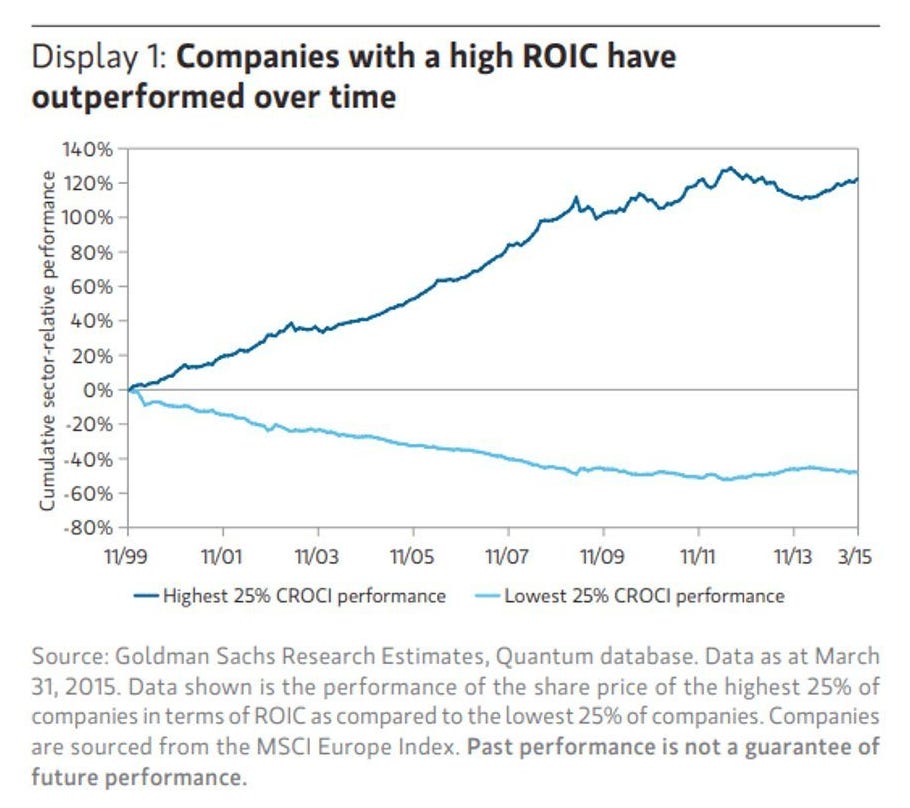

Do you want to become a better investor in 2026? We are looking for a few investors who want to step up their game. Sounds like something for you? Apply here.For quality investors, the Return On Invested Capital (ROIC) is one of the most important financial metrics.

A high ROIC is key for value creation and it’s a great way to look at a company’s competitive advantage.

In this article we’ll teach you everything you need to know about one of the most important metrics in the world of finance.

The power of compounding

Let’s start with an example. Suppose that there are 2 companies:

Company A: ROIC of 5% and reinvests all its profits for 25 years

Company B: ROIC of 20% and reinvests all its profits for 25 years

Can you guess how much company A and B would be worth if you invest $10.000 in both (assumption: valuation remains constant)?

In this example, an investment in company A would be worth $33.860 while an investment in company B would increase to $953.960!

This simple example beautifully shows the importance of ROIC and the power of compounding.

Now you’re convinced of the importance of ROIC, let’s explain this financial metric to you.

What is Return On Invested Capital (ROIC)?

Capital allocation is the most important task of management.

If you want to look at how efficient management allocates capital, you can take a look at the ROIC.

Return On Invested Capital (ROIC) = (NOPAT / Invested Capital)

NOPAT = Net Operating Profit After Tax

Invested Capital = Total assets - non-interest-bearing current liabilities

When a company has a ROIC of 15%, it means that for every $100 in capital the company has on its balance sheet, $15 in NOPAT is generated.

You want to invest in companies with a high ROIC as this means that the company is allocating capital efficiently.

As a rule of thumb, the ROIC should be higher than 10% and preferably higher than 15%.

Why ROIC matters

Did you like the first example in this article? Let’s use a second one.

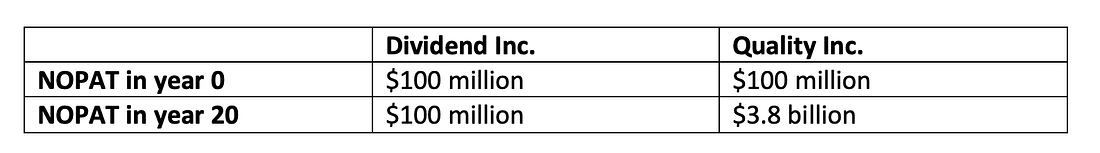

In this example, we have 2 companies: Quality Inc. and Dividend Inc.

Both companies generate a NOPAT (profit) of $100 million per year and need $500 million to operate (invested capital). Furthermore, both companies have a ROIC of 20%.

Dividend Inc. has no growth opportunities and distributes all earnings as a dividend to shareholders. As a result, Dividend Inc. will distribute $100 million to shareholders each year and will still make $100 million in profits 20 years from now.

On the other hand, Quality Inc. is active in a secular growth market and is able to reinvest all its earnings in organic growth. This means Quality Inc. pays no dividend to shareholders and reinvests everything in itself.

After 1 year, Quality Inc. has $600 million in capital (the starting capital of $500 million + $100 million in reinvestment). On this invested capital of $600 million, Quality Inc. generates a ROIC of 20%. As a result, Quality Inc.’s earnings grew to $120 million (20% * $600 million).

NOPAT = ROIC * Invested Capital

In year 2, Quality Inc. again reinvests it’s earnings of $120 million in organic growth. As a result, Quality Inc.’s invested capital grew to $720 million (the $600 million it already had + $120 million in reinvestment). The earnings of Quality Inc. grew to $144 million (20% * $720 million).

Can you guess how many profit Quality Inc. would make if they would be able to this for 20 consecutive years?

The correct answer is $3.8 billion!

As a result, a high ROIC in combination with plenty of growth opportunities is the golden egg for investors. It will result in exponentially increasing earnings for a company if management makes good capital allocation decisions.

“Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result.” - Charlie Munger

Growth only creates value when ROIC > WACC

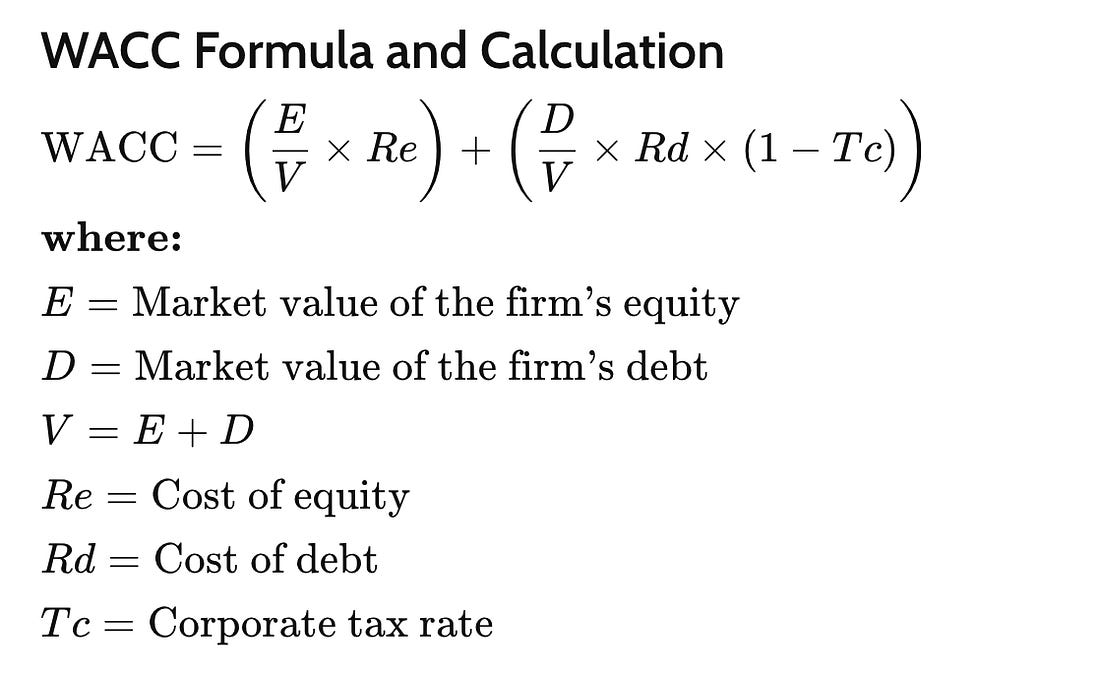

It is very important to understand that growth only creates value when the Return On Invested Capital (ROIC) of a company is higher than the Weighted Average Cost of Capital (WACC).

The formula to calculate the WACC of a company can be seen hereunder. Simply put, the Weighted Average Cost of Capital is equal to the firm’s average cost of capital (cost of equity + cost of debt).

Source: Investopedia