|

A company that I’m sure you have products from is on sale.

It’s got massive scale, processing over 2 million orders a year for businesses ranging from small charities to Fortune 500 companies.

The company is a marketing machine in a very fragmented industry with a unique business model that requires almost no capital.

It’s also got a fortress balance sheet with over $100m in cash and no debt.

But it’s got some problems:

Fears of new tariffs on Chinese goods.

Demand from new customers has softened in a shaky economy.

The stock price has taken a hit, dropping 40% from its highs.

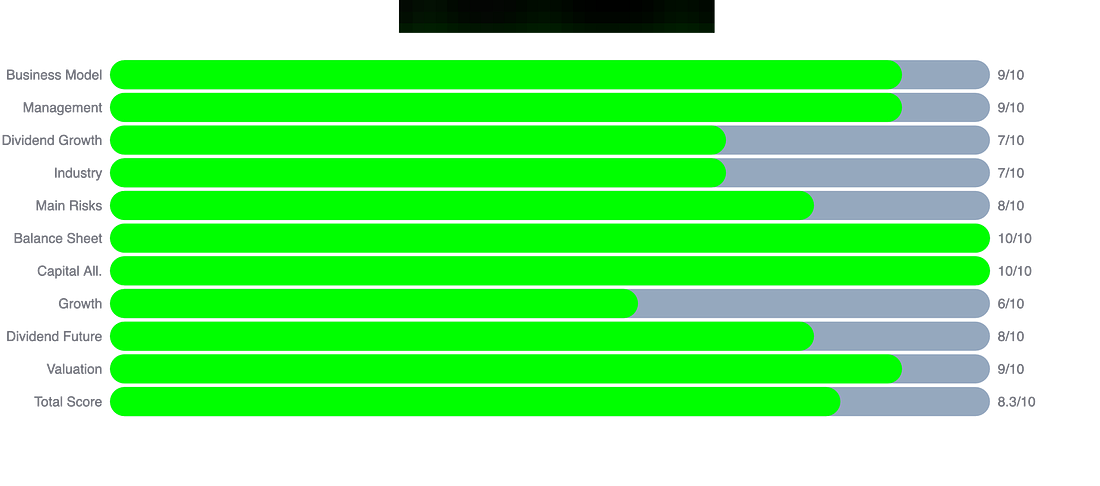

All of that means the stock is down, but the dividend yield is high, and it receives an interesting dividend score:

Let’s take a quick look.

This business barely needs capital.

It doesn’t hold inventory.

It simply markets, takes orders, and keeps customers happy.

That model gives it scale.

The kind competitors can’t easily copy.

The brand is strong too.

Customers stick around because this company promises something rare in its industry:

Certainty.

On-time delivery.

Fair prices.

No-risk guarantees.

Right now the stock is down.

But the dividend is up.

Way above normal.

The market is scared about tariffs and a softer economy.

Short-term stuff.

But this company has a history of getting stronger when others pull back.

Want the full breakdown?

The moat, the risks, the dividend math, the valuation…

and of course the name?

That’s all in the premium version.

Click the link below and join us today.

But maybe you’re not ready yet.

Maybe you want to wait for the next opening.

Maybe you just want to be notified when discounted spots appear.

Totally fine.

We will have a limited number of discounted memberships that will reopen later in 2026.

If you want your name on the list, so you get notified before anyone else,

you can do that here:

You’ll also get a copy of my 10 favorite cannibal stocks when you do.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.