|

|

Brookfield is one of the best compounders you’ll ever see.

But is it still an interesting investment?

Let’s take a look at this high-quality business.

Brookfield Week

This is part III of our Deep Dive in Brookfield Corporation.

Did you miss the first two articles?

Brookfield

👔 Company name: Brookfield Corporation

✍ ISIN: CA11271J1075

🔎 Ticker: BN

📚 Type: Owner-Operator

📈 Stock Price: CAD 61

💵 Market cap: CAD 137 billion

📊 Average daily volume: CAD 135 million

1. Is the company a great capital allocator?

Capital allocation is the most important task of management. We want companies that put the money of shareholders to work at an attractive rate of return.

To understand this better, it helps to break capital allocation into its main parts:

Investments in the core business

Acquisitions

Dividends

Share buybacks

Investments in the core business

Normally, we approach this by looking at ROE and ROIC.

ROE (Return on Equity) tells you how much profit a company makes for every dollar of shareholder money.

Formula: Profits / Equity

ROIC (Return on Invested Capital) tells you how much profit a company earns for every dollar it has put to work.

Formula: Profits / Invested Capital.

For a ‘normal’ business these metrics show how efficiently the company uses its money to make even more money.

But Brookfield isn’t a normal business. It’s more like a collection of hundreds of companies.

As a result, ROE and ROIC aren’t the right metrics to assess the efficiency of Brookfield’s business.

In fact, they can be very misleading.

Here is why:

Brookfield’s profits aren’t ‘normal.’ A big part of Brookfield’s earnings comes from changes in the value of its assets (buildings, infrastructure, …) not from selling products or services. These are accounting gains, not cash profits. So, in one year, the profit might look huge, and the next year tiny, even if the business itself didn’t really change. The numerator is unreliable.

Their balance sheet is very complex. Brookfield owns some assets directly, and others together with investors. Because of that, it’s hard to know exactly how much capital truly belongs to Brookfield itself. The ROE-denominator is unreliable.

They buy and sell assets all the time. Brookfield constantly recycles capital: it sells mature assets and reinvests in new projects. This means the amount of invested capital changes every few months. The ROIC-denominator is unreliable.

In other words: Brookfield is an investment engine, always buying, selling, and reinvesting to compound value over decades. To judge how well they allocate capital, we should ask:

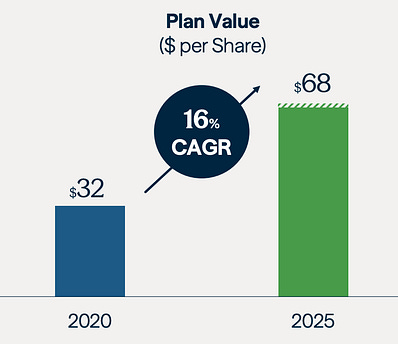

Are they growing value per share?

Brookfield aims for a 15%+ IRR (Internal Rate of Return) on new capital. Are they delivering on that goal?