|

|

Dear Partner,

Via this way, I warmly want to welcome you to this blog. This blog of Compounding Quality focuses – as you might suspect - on quality investing.

The beautiful thing about quality investing is that quality companies (or compounders) manage to grow their free cash flow exponentially thanks to a combination of favorable characteristics. Once you have done your homework and your view about the company was correct, you can let the company work and compound for you. In other words, quality investing is one of the only investment methods where you can use a buy-and-hold strategy. When you invest in a value stock, you buy a company that is undervalued. As a result, you should sell it when the company’s stock price evolves to their intrinsic value (calculated by you). Once that is done, the process restarts, and you should find another undervalued company. This is in stark contrast with quality investing because when you can buy a great company at a fair price, you should never sell the stock. Some examples of long-term great compounders since their IPO: IDEXX Laboratories (CAGR of 21.2% since 1991), Microsoft (CAGR of 25.9% since 1986) and Pool Corporation (CAGR of 26.3% since 1995).

For Terry Smith, Quality Investing is based on 3 metrics:

Buy good companies

Don’t overpay

Do nothing

Chuck Akre’s Three-Legged Stool is also a great framework for quality investors:

Obviously the million-dollar question is how you can find these quality companies. Quality companies often possess over the following characteristics. We will go through them all in this article:

A wide moat (competitive advantage)

High management integrity

Low capital intensity

Good capital allocation

High profitability

Attractive historical growth

A secular trend / optimistic outlook

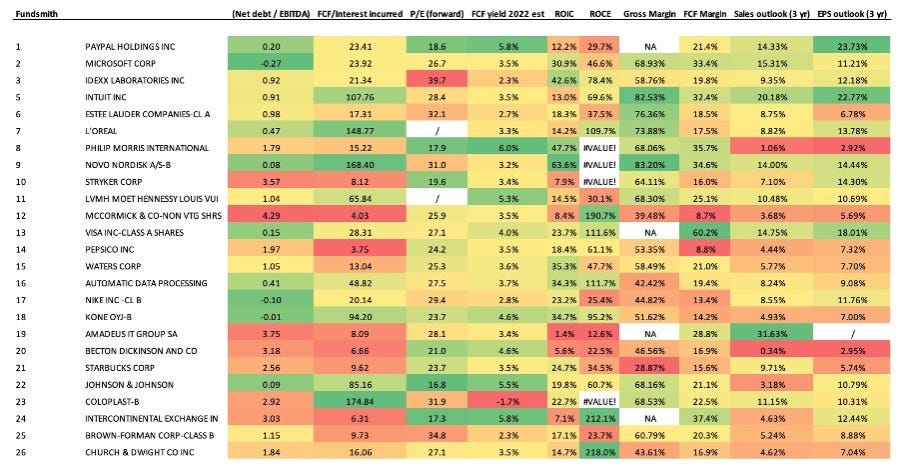

Some great examples of quality companies can be found in the portfolio of Terry Smith (Fundsmith):

Wide moat (competitive advantage)

“A good business is like a strong castle with a deep moat around it. I want sharks in the moat. I want it untouchable.“ – Warren Buffett

As a quality investor, you are not looking for The Next Big Thing. You want to invest in companies that have already won. In other words, you want to invest in companies that are clear market leaders with strong pricing power that managed to outperform the stock market for years and preferably even decades in the past.

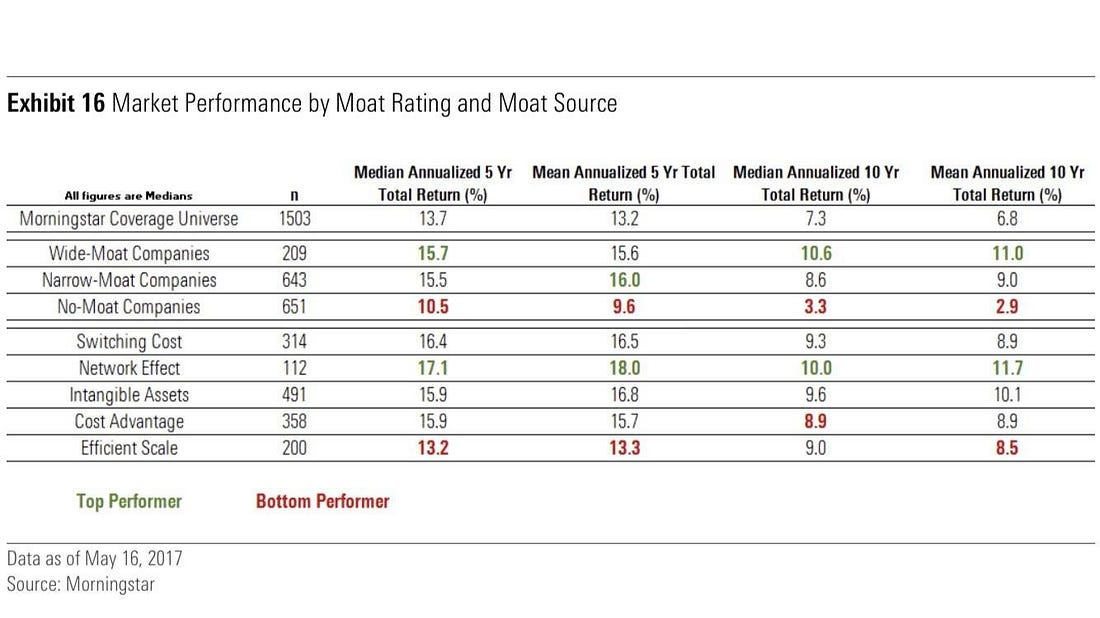

Wide moat stocks outperform the market in general:

Think for example about companies like S&P Global and Moody’s. Both companies are active in the credit rating business and are truly essential for the global debt market. Every US listed company that wants to issue debt, needs a credit rating from at least 2 of the 3 big rating agencies: S&P Global, Moody’s or Fitch. Debt issuers practically have no choice than asking for a credit from these companies and this gives S&P Global and Moody’s a lot of pricing power. S&P Global and Moody’s were industry leaders in the 1970s, are industry leaders today and probably will still be industry leaders in 40 years from now.

Some other great examples of wide moat stocks: Nike and Adidas, Visa and Mastercard, Assa Abloy, MSCI, and Equifax.

Wide moat stocks perform better than the market:

High management integrity (skin in the game)

“If management and the board have no meaningful stake in the company – at least 10 to 20% of the stock – throw away the proxy and look elsewhere.” – Martin Sosnoff

You want to invest in companies with high management integrity. Management’s interest should be aligned with the one of you as an investor. Having skin in the game is very powerful.

That’s also the reason why, in general, family-owned business often perform better than non-family business. Credit Suisse has written a great paper about this wherein they conclude that since 2006, family companies outperformed non-family companies with 3,6% per year. The paper can be found