|

We all want the same thing: an investment that goes up every single year, and never drops in value.

But as Howard Marks has spent decades telling his clients that this goal is impossible.

As an investor, you have to accept a hard truth: You cannot maximize your gains and minimize your losses at the same time.

Who is Howard Marks?

Howard Marks is the co-founder of Oaktree Capital Management, a massive investment firm that manages billions of dollars.

He is most famous for his memos.

These are regular letters to clients that are so insightful that even Warren Buffett says they are the first things he opens and reads when they land on his desk.

Marks often focuses on the psychology of risk and surviving the worst times in the markets, instead of chasing the best ones.

The Two Risks We Face

Most people think of “risk” as the chance that you might lose money.

But Howard Marks says that investing is about balancing two very different types of risk:

The Risk of Losing Money: The stock price might crash or a company could go bankrupt

The Risk of Missing Opportunities: You could be too cautious and not earn enough money to meet your long-term goals.

If you try to completely eliminate the first risk by putting all your money in a savings account, you’re guaranteed to fall victim to the second.

You won’t lose your principal, but you won’t have the growth you need to retire comfortably.

We Have to Take Some Risk

Good investing isn’t about avoiding risk entirely, it’s about finding the right spot on the risk spectrum.

You need to take enough risk to meet your long-term return goals, but not so much that a single bad streak destroys your account.

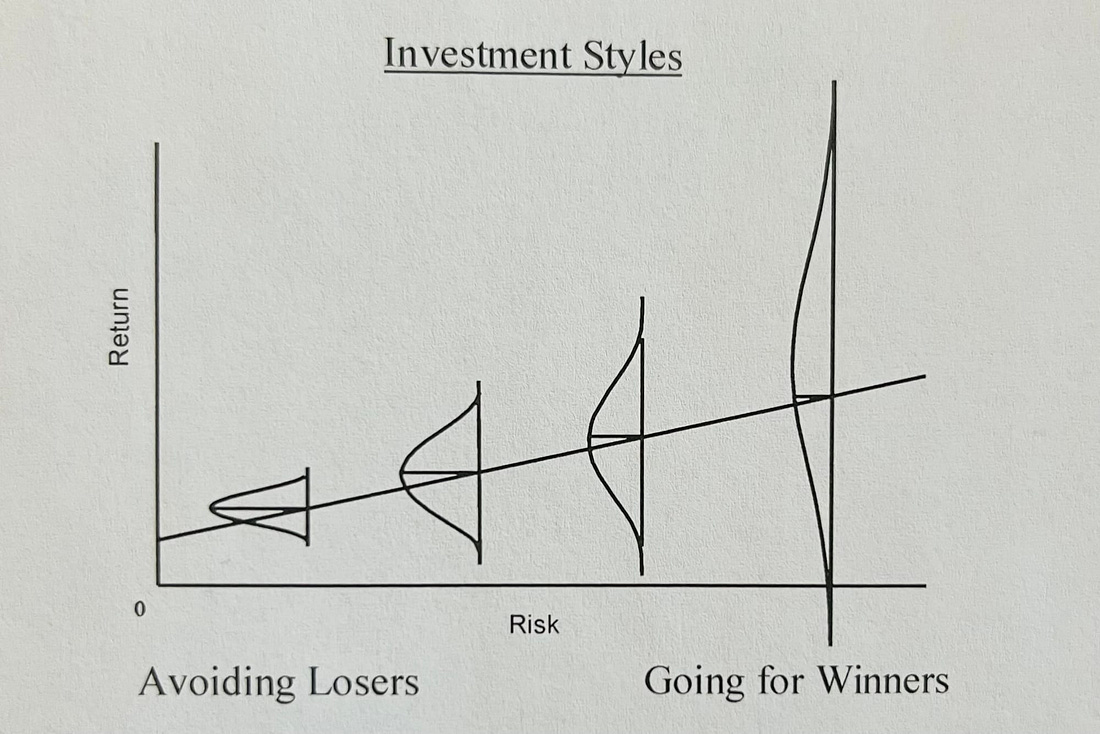

If you focus on minimizing losses, labeled ‘avoiding losers’ in the image, then your returns will likely fall in a relatively small range - not too bad, but not as high as they could be either.

If you focus on maximizing gains, or ‘going for winners’ the range of outcomes gets a lot wider. You could end up with very high returns, but you could end up with big losses too.

This brings us to an important idea: Risk Avoidance vs. Risk Control.

Risk Avoidance is when you avoid doing anything where the outcome is uncertain. In the end, avoiding all risk usually leads to return avoidance.

Risk Control is the “intelligent bearing of risk for profit”. It means not taking risks that are more than you can live with or risks that you’re not being well-rewarded to take.

Risk Control

At Compounding Dividends, we practice risk control by buying great companies.

We look for businesses with strong moats that share their profits with us as owners.

This creates an asymmetry - we get access to the upside potential of the equity markets without taking on 100% of the downside risk.

Dividends Create a Floor: Stock prices