|

|

2026 is just around the corner.

How will quality companies perform? Are we in an AI bubble?

Let’s take a look.

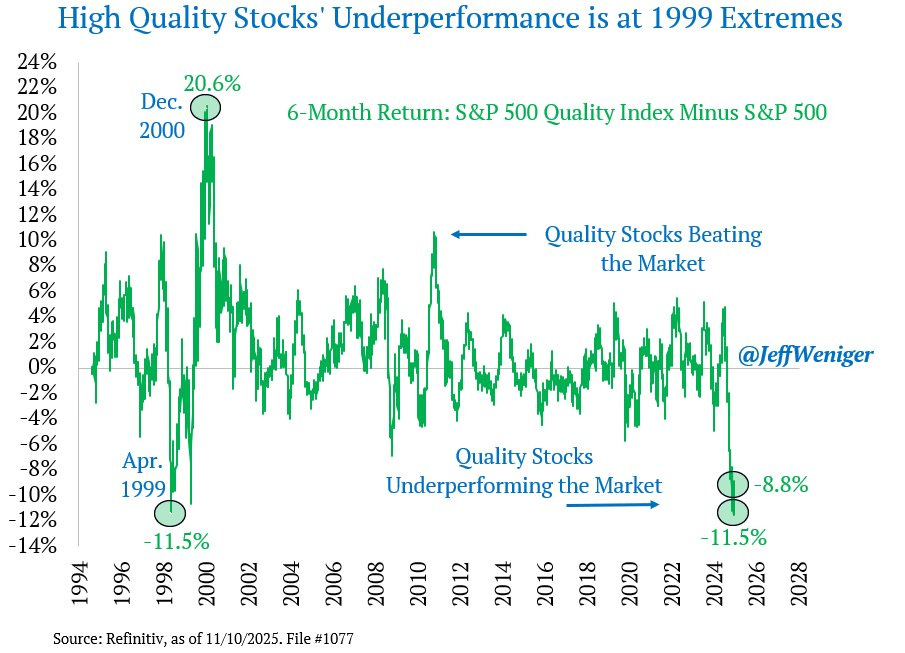

In 2025, technology and growth companies as a group benefited greatly from the enthusiasm surrounding artificial intelligence (AI), while investors paid less attention to many quality companies, holding companies, and serial acquirers. With the end of the year in sight, attention is turning to 2026. Will AI once again demand attention, or will the focus shift to quality companies?

We put these questions to a panel of experts consisting of Kris Heyndrikx (founder of Potential Multibaggers and Best Anchor Stocks), Michael Gielkens (partner/owner of Tresor Capital), and Pieter Slegers (founder of Compounding Quality, De Kwaliteitsbelegger, and Tiny Titans).

You can find Kristof and Michael’s newsletters here:

Tresor Capital newsletter (written by Michael Gielkens and Tresor Capital)

Potential Multibaggers (written by Kris)

1. As an investor, how do you deal with the AI hype?

Michael Gielkens: Few would deny that AI is the future. Yet it seems that investors are getting ahead of themselves. The tech giants have transformed from a ‘capital light’ to a capital-intensive business model due to large investments in chips and data centers, while the returns on those investments are still uncertain.

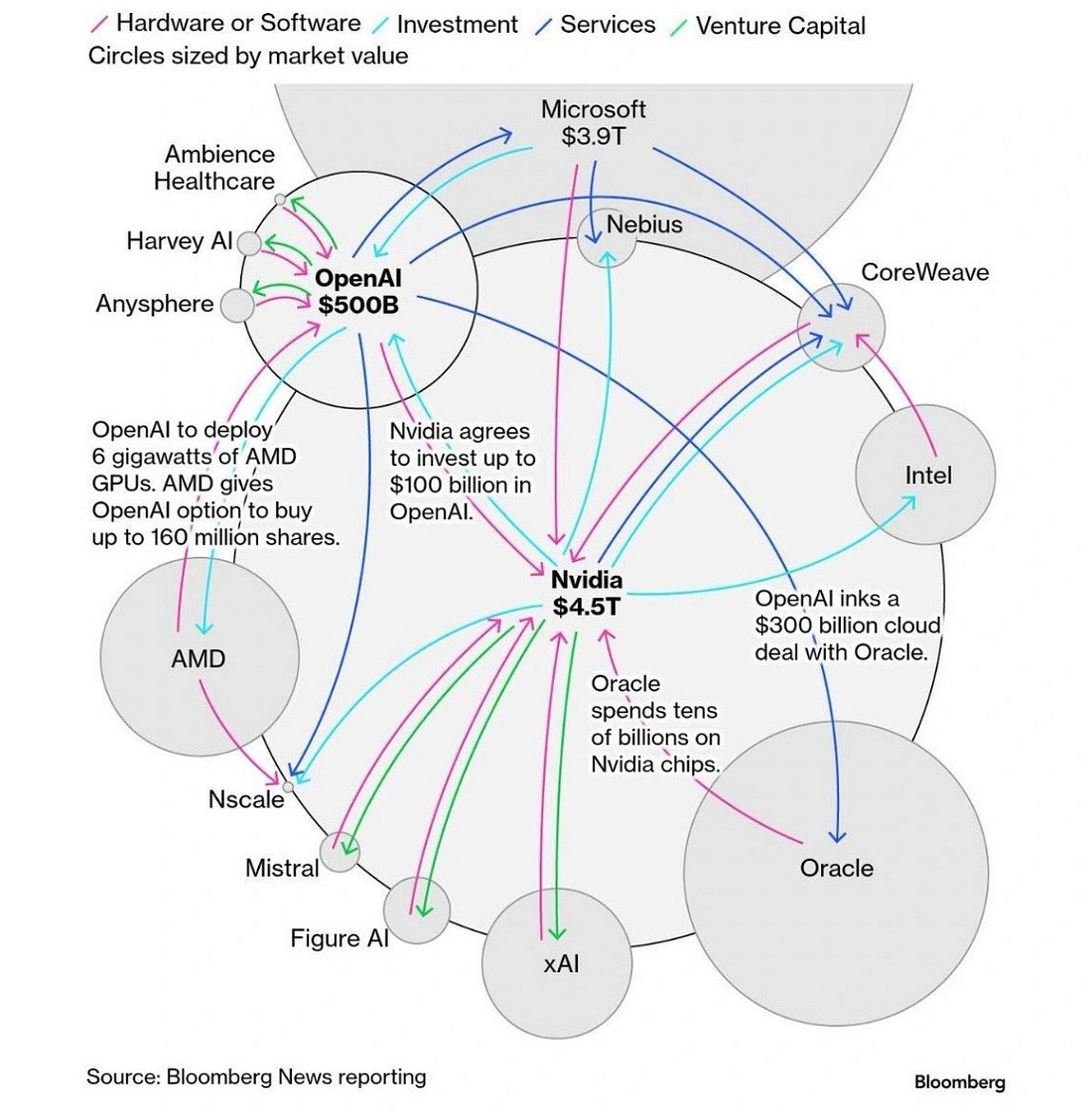

The capital merry-go-round between players such as OpenAI, Oracle, and Nvidia is reminiscent of the tech bubble in the 1990s. No one doubted that the internet was a tremendous innovation, but investors learned a hard lesson when the Nasdaq corrected by nearly 80%.

We are currently seeing a lot of ‘hopium’ in the share prices. The difference with the dot-com bubble is that tech giants are now generating solid cash flows, although they are also taking on more and more debt in the AI battle. This is reflected in credit default swaps, the insurance against bankruptcy, which have risen sharply recently.

In times when markets focus on a single theme, investors pour their capital into one area, causing prices to move vertically. When sentiment reverses, these prices can plummet. Warren Buffett once said, “It’s only when the tide goes out that you discover who’s been swimming naked.”

At Tresor Capital, we choose a different route. We focus on companies that do benefit from AI, but are not existentially dependent on it. These players were already strongly positioned within the technology sector before the hype. Crucially, they generate significant cash flows, enabling them to finance their AI investments from their own resources without incurring additional debt. This means they are not at the mercy of the kindness of strangers. We play this field through holding companies with stable cash cows or with a broad portfolio of various tech and AI companies. In this way, we create indirect exposure through a mix of public and private companies.

Kristof Heyndrikx: As a growth investor, I have already benefited greatly from AI. Nvidia, AMD, Broadcom, TSMC, Google, Cloudflare, CrowdStrike... I have them all in my portfolio. You certainly won’t hear me complaining. But even I am getting a little nervous about the big money carousels that are now being set up. The weakest link in the whole system is OpenAI, which has committed no less than a trillion dollars for the coming years. The company is currently loss-making and generates only $13 billion in sales. That certainly makes everything more risky now than in recent years.

Still, I think there is upside potential. Currently, there is a bit of an AI selling wave, which is very healthy.

I see a division in AI. On the one hand, there are AI software platforms, which are incredibly expensive. Companies such as Palantir, Cloudflare, and CrowdStrike are stocks I would not buy at the moment. Put them on your list for when there is a sharp dip, because they are top companies, but currently too expensive.

At the same time, you can see that infrastructure expansion will accelerate even further in 2026. This also means that stocks such as Nvidia and AMD are not expensive at all. Next year, Nvidia’s earnings per share are expected to grow by no less than 60%. That implies a price-earnings ratio for 2026 of 22.8. If you divide that PE by the growth, you get a 2026 PEG ratio of just 0.38x. Anything below 1 is cheap, so this is very cheap. For AMD, you see a 2026 PEG ratio of 0.49, which is also cheap. Of course, the slightest suspicion that expectations will not be met will cause the price to plu