|

Today is Dividend Day.

The series where I teach you 5 things about dividend investing in less than 5 minutes.

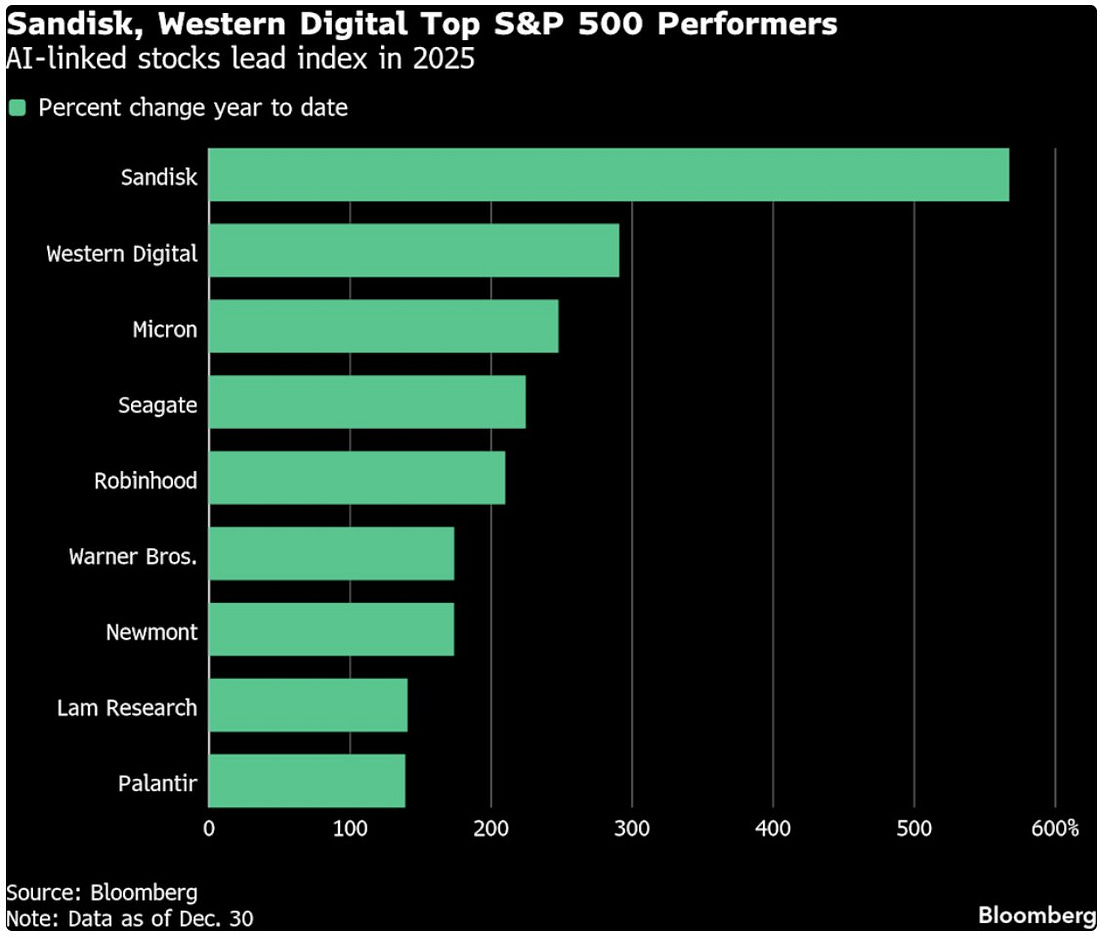

1️⃣ Royal Shareholder Returns

Consistency a sign of quality.

We love a company that can raise its dividend year after year, regardless of what the economy is doing.

This image is a very creative idea: a family tree of dividend royalty, raking companies based on their reign of consecutive increases:

|

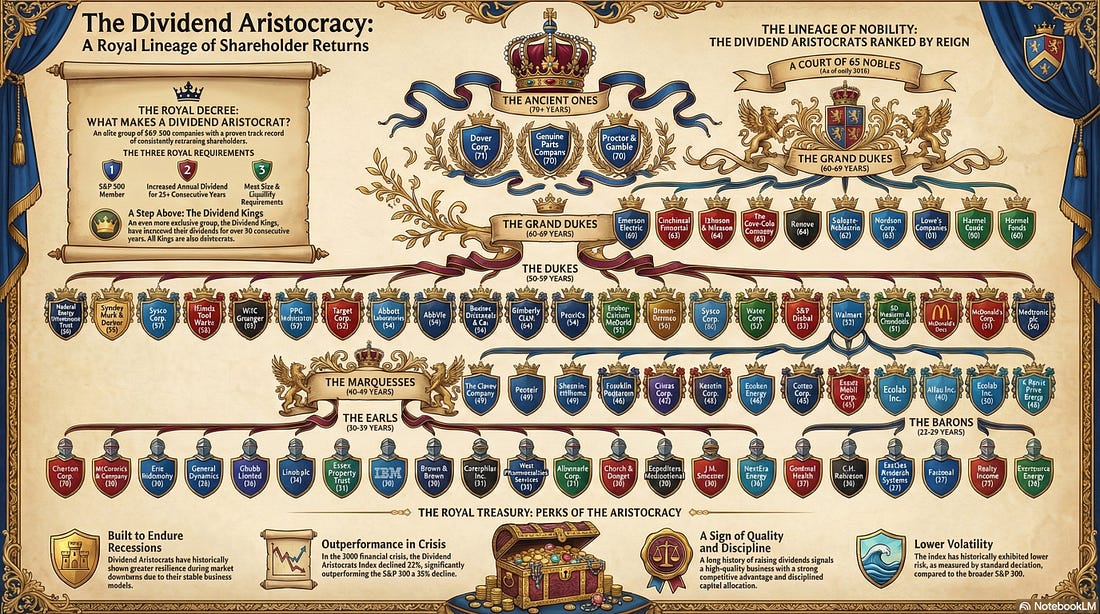

2️⃣ 2025’s Top S&P 500 Stocks

2025’s top performing stocks were all about the physical hardware that powers AI.

Data storage giants like Western Digital and Seagate are shot up as AI models demand massive amounts of memory.

Companies providing essential infrastructure often capture the most significant gains during a technological shift.

Before you can build the future, you need the physical infrastructure to support it.

3️⃣ An Investing Quote

It is easy to look at a the charts of massive gainers and wish you had owned them from the start.

But the reality is rarely a straight line up.

Even the world-class winners we just highlighted often experience gut-wrenching drawdowns on their way to the top.

Warren Buffett reminds us that to capture those 200% or 500% returns, you have to be willing to sit through the periods where the market moves against you.

“Unless you can watch your stock holding decline by 50% without becoming panic-stricken, you should not be in the stock market.”

— Warren Buffett

4️⃣ The Power of Cloning

You don’t need to be a genius to be a great investor, you just need to be a great cloner.

Warren Buffett once admitted that he has very few original ideas, he simply applies the best of what he sees from others.

Here’s a thread all about why cloning successful strategies is one of the most underutilized tools in investing.

From Mohnish Pabrai to Charlie Munger, the greats have always stood on the shoulders of giants.