|

|

Novo Nordisk is a global market leader in diabetic and obesity care.

This market is growing at tremendous rates. But Novo Nordisk struggled last year.

Is it still an attractive company?

Novo Nordisk - General Information

🧬 Company name: Novo Nordisk

✍️ ISIN: DK0062498333

🔎 Ticker: $NVO.B

📚 Type: Duopoly

📈 Stock Price: DKK 378

💵 Market cap: DKK 1.3 trillion

📊 Average daily volume: DKK 1.98 billion

📅 Last update: July 29th, 2025

Steven Van Der Burg wrote a Deep Dive of 78 (!) pages on the company.

Let’s dive into the conclusion and share the full investment case.

Conclusion Investment Case

Novo Nordisk is a quality stock facing problems right now.

Today, Novo Nordisk is 3x as cheap as Eli Lilly.

I don’t believe this large valuation difference is justified.

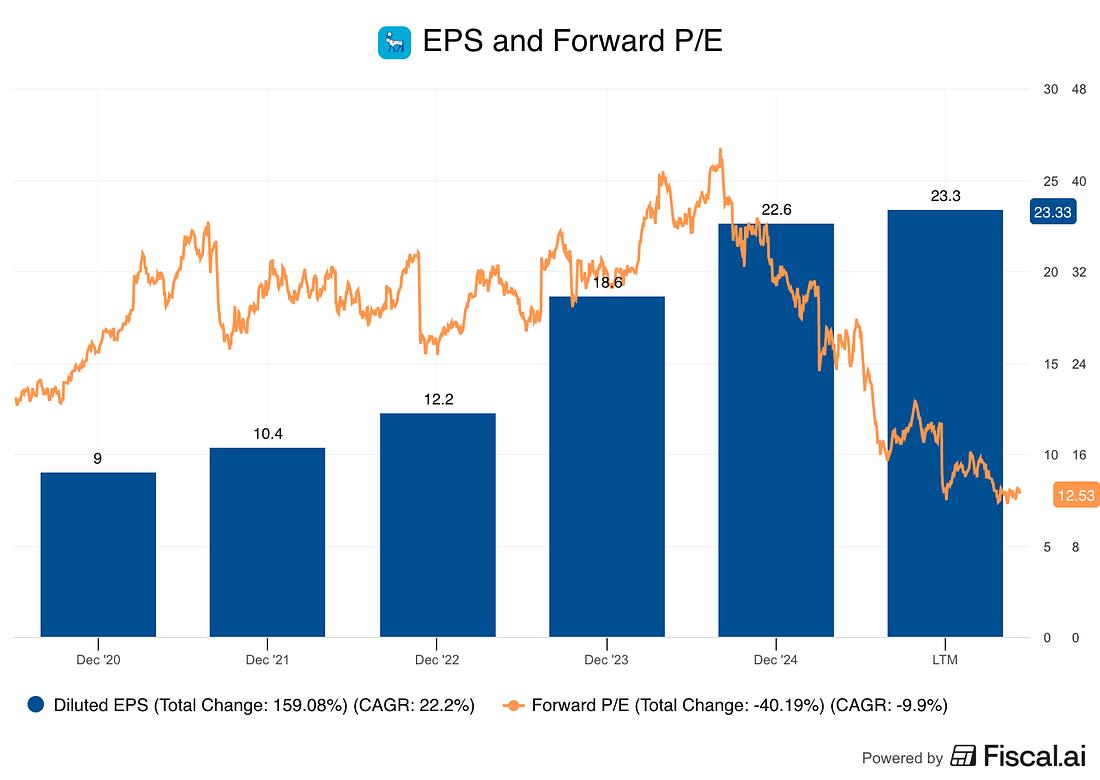

If you want to see the entire investment case in one image, look at this one.

It compares the forward PE (orange) with the EPS (blue):

|

Since 2020:

The Forward PE declined from 20.9x to 12.9x (-38%)

EPS rose from 9 DKK to 23.5 DKK (+161%)

Novo Nordisk is really cheap.

This gives (a lot of) room for multiple expansion in the future.

What is Novo Nordisk?

Novo Nordisk is a Danish healthcare giant focused on serious chronic diseases.

They are the world leader in diabetes care, producing over 50% of the world’s insulin supply.

But the real story today is GLP-1 drugs for obesity.

The Obesity Market

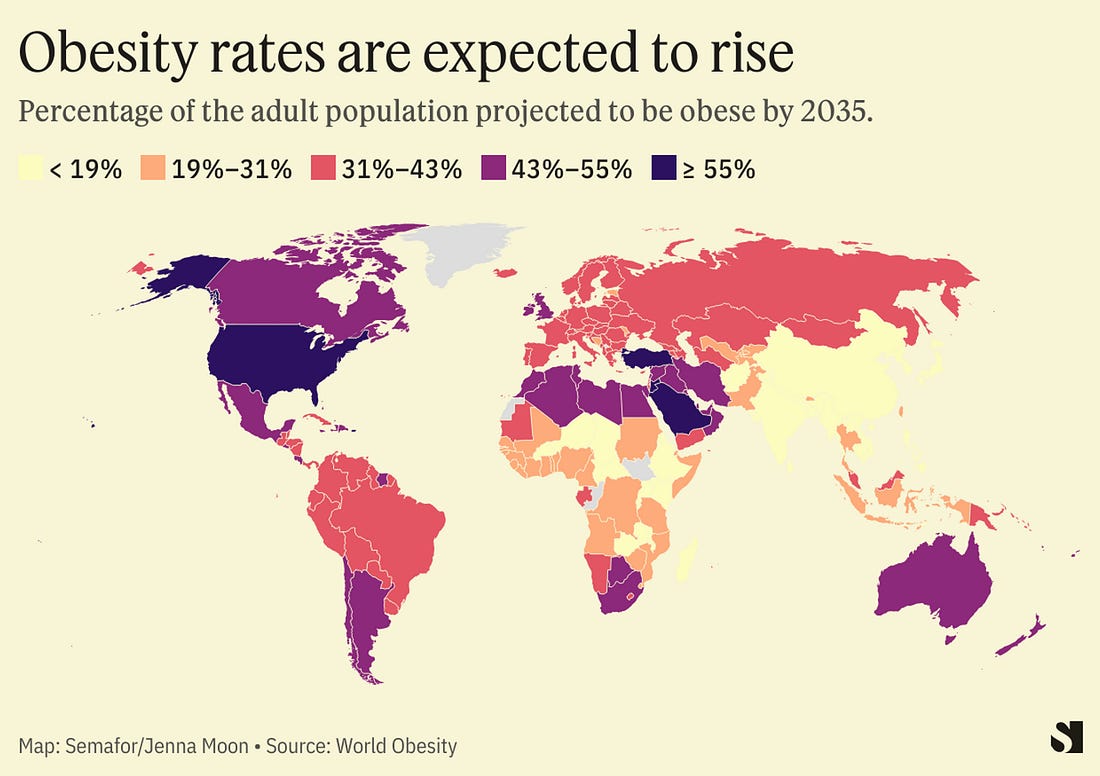

The market for obesity treatments is growing tremendously.

934 million people worldwide have obesity.

Only 2.2 million are currently treated with branded medication.

This means over 97% of the market is still untapped.

Demand for obesity drugs is growing at more than 100% (!) per year.