| | Beleaguered Ukrainian energy officials in Davos are running short of money and fear being overlooked͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

- Ukraine’s LNG goals

- Big Tech’s real estate pullback

- Boost for Chinese EVs

- Data centers get bigger

- Illegal logging operation

Davos CEOs want to stay mum on climate. |

|

US President Donald Trump is due to arrive at the World Economic Forum in Davos tomorrow with a defiant message about American power projection, but one that could backfire for his domestic policy agenda. Trump’s text-message threat to Norway’s prime minister that, after being snubbed for the Nobel Peace Prize, he “no longer feel[s] an obligation to think purely of Peace” set an ominous tone for the fate of multilateralism here. Climate was already almost absent from the agenda, reportedly as an inducement to Trump; all I saw were a few mini-EVs parked outside a sadly depopulated-looking “climate hub” along the main strip, a far cry from when BlackRock’s Larry Fink donned a global warming-themed scarf in 2020. But even for the fossil fuel trade, Trump’s belligerence toward Greenland, Venezuela, and elsewhere signals that the global energy market is an increasingly treacherous place. China, Europe, and other top fossil fuel importers are looking at that situation and realizing the trade patterns of the past decade are no longer reliable, Jeff Currie, chief strategy officer of energy pathways at the private equity giant Carlyle, told me: “The immediate fundamental impact of Venezuela on oil markets is relatively limited, but the geopolitical impact is much more significant, because it creates exactly the kind of anxiety that leads to hoarding.” Even as the US seeks to extend its grasp over more natural resources, in other words, its increasing unpredictability as a political and trade partner is driving key customers for those resources to find new suppliers and accelerate their non-fossil energy transitions. An underappreciated ripple effect, Currie said, is that even though the oil market appears to be oversupplied relative to total global demand, preemptive hoarding could actually drive prices higher — undermining Trump’s interest in domestic “affordability.” The takeaway for Davos participants is clear: While the conference is ostensibly meant to promote a “spirit of dialogue,” for energy there’s now much more a spirit of competition, one that will ultimately be reflected in prices. |

|

| |  | Tim McDonnell |

| |

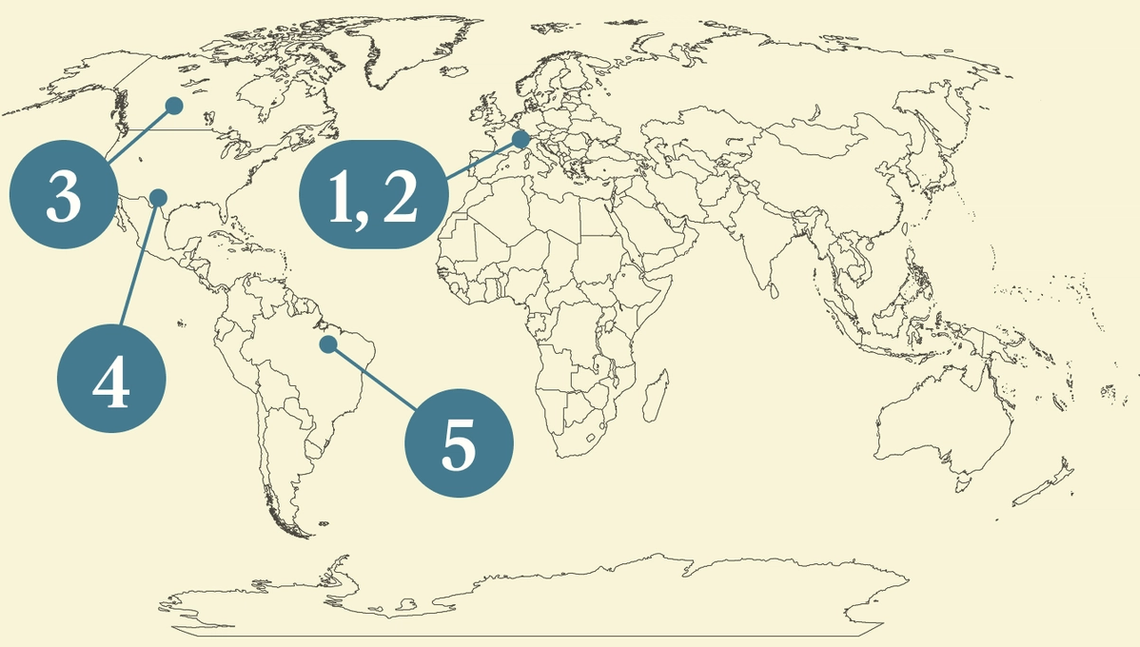

Pavlo Palamarchuk/Reuters Pavlo Palamarchuk/ReutersUkrainian energy companies are running short of funds to recover from attacks, and are concerned that crises over Venezuela and Greenland are drawing political oxygen away from their country as they try to hammer out big new energy deals with the US. Several of the country’s top political and private-sector energy leaders met for breakfast this morning in Davos, while the latest massive attack by Russia against energy infrastructure in Kyiv and elsewhere was still ongoing. If relentless power and heating cuts are meant to break Ukrainians’ resolve, they aren’t working, Sergii Koretskyi, CEO of the state-owned gas company Naftogaz, told Semafor: “We are staying strong, and will not give up.” But Ukraine still needs far more Western financial support to rebuild and to buy more imported gas, especially from the US, he said. And although US President Donald Trump and his Ukrainian counterpart Volodymyr Zelenskyy are due to meet here this week and possibly sign a new deal for Ukraine’s recovery, the mood behind closed doors among energy industry leaders isn’t optimistic, Koretskyi said. In a Monday night dinner of global oil and gas executives — which, according to a participant list seen by Semafor, included most of the European and Gulf majors but none from the US — “I saw that now Ukraine is not number one, or even number five, on the agenda,” he said. Talks between Kyiv and the White House have continued to move slowly forward on what could be a more practical and lucrative opportunity for US exporters: Selling more LNG to Ukraine. That effort faces some major unresolved headwinds. But on the Davos sidelines, Ukraine’s top private equity fund is forging ahead with a new onshore wind farm, and “not waiting for the war to end.” |

|

Big Tech’s real estate pullback |

Noah Berger for AWS/Reuters Noah Berger for AWS/ReutersThe business of selling power-equipped real estate to data center developers is getting more challenging, one of the top global real estate investment firms told Semafor. David Steinbach, chief investment officer of Hines, said in an interview in Davos that historically the company never gave a second thought to the grid access potential of a plot of land. That changed in the past few years as hyperscalers became some of the company’s most important clients, and Hines found it could earn tens of millions of dollars preparing “powered land” to sell to them. Now that strategy is facing headwinds, Steinbach said. Utilities are increasingly reluctant to arrange grid connection deals with middlemen like real estate firms, preferring to deal directly with the tech companies. And the tech companies themselves, after a panic-driven spending spree on data center real estate, are becoming much more conservative about how much they’re willing to spend on it: “Eighteen months ago it felt like the foot was really on the gas, but now it’s come off the gas quite a bit.” |

|

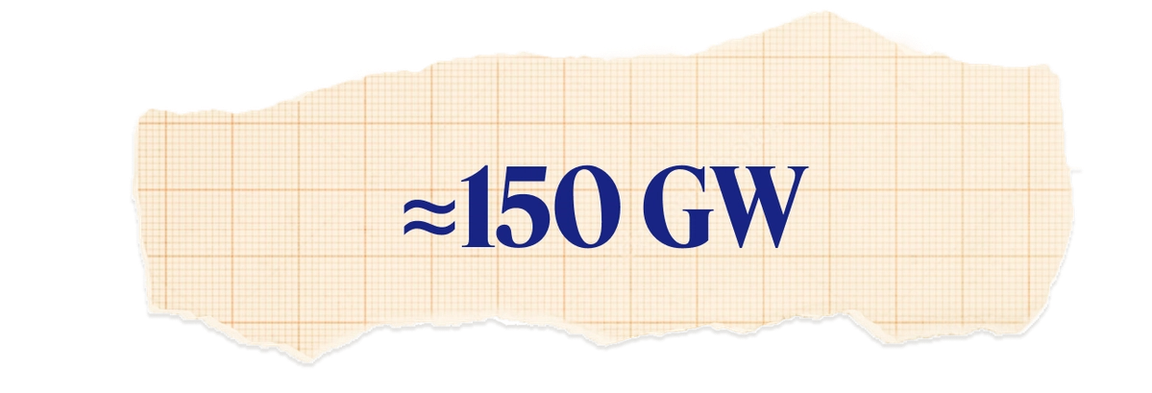

The total US data center load by 2028, up from 80 GW in 2025 — a jump that won’t spread evenly across the country, a new report found. As grid capacity tightens, developers are chasing power availability and infrastructure, turning states like Texas into leading data center markets. By 2028, Texas alone is projected to exceed 40 GW of capacity, nearly 30% of the US total, according to the report from Bloom Energy. Meanwhile, states like California and Iowa stand to lose ground because of tighter power supplies, permitting complexity, and longer interconnection timelines. The data centers themselves are also getting bigger, with many projected to surpass 1GW, roughly 20% of New York City’s entire electricity load. This boom is forcing a reckoning in the power sector: Data centers demand electricity at an astonishing speed and scale, but the grid infrastructure needed to power them moves at a pace measured in years, sometimes pushing developers to turn to onsite-powered campuses instead. —Natasha Bracken |

|

Mukesh D. Ambani, Managing Director & Chairman, Reliance Industries, is joining the Semafor World Economy Global Advisory Board — a forum of visionary business leaders guiding the largest gathering of global CEOs in the US. The expanded board represents nearly every sector across the US and G20. Joining the Advisory Board at this year’s convening will be our inaugural cohort of Semafor World Economy Principals — an editorially curated community of innovators, policymakers, and changemakers shaping the new world economy with front-row access to Semafor’s world-class journalism, meaningful opportunities for dialogue, and touchpoints designed for connection-building. Applications are now open here. |

|

Illegal logging operation |

Ueslei Marcelino/Reuters Ueslei Marcelino/ReutersA massive illegal logging operation spanning 5,000 hectares of pristine forest in Indigenous Territory in Brazil’s Pará state, the capital of COP30 host Belém, was uncovered, a new investigation found. The report, released by the Environmental Investigation Agency, used satellite imagery and official records to track 25,000 cubic meters of timber, about 830 containers, from three Brazilian sites, often then exported to major US and European buyers, including suppliers for Marriott hotels, Hyatt resorts, and Formula One VIP stands. In total, more than 78,000 cubic meters of illegal timber, equivalent to 31 Olympic swimming pools of logs, were identified in recent years. Domestically, illegal logging decimates forests, destroys ecosystems, tramples Indigenous rights, and fuels organized crime. Abroad, the EU and US — Brazil’s largest timber export markets — have laws designed to block illegal wood: the European Union Timber Regulation, soon to be replaced by the stricter EU Deforestation Regulation, and the US Lacey Act. The EIA’s findings, however, come amid recent efforts in the EU to weaken the EUTR and delay the tougher regulation, and significant reductions in resources for enforcing the Lacey Act by the Trump administration. —Natasha Bracken |

|

New Energy- A US federal judge allowed construction to continue on a Virginia offshore wind project, marking the third such project this week to win a legal challenge against the Trump administration.

- China’s thermal power generation, which is mostly coal-based, fell last year for the first time in a decade, as renewables increasingly meet electricity demand.

Jason Lee/Reuters Jason Lee/ReutersFinance- Norway’s oil fund said companies should be given more leeway to target net zero by 2050, arguing the 1.5C threshold for global warming should be moved to 2C to avoid unrealistic expectations.

- China’s Belt and Road Initiative increased by three-quarters to $213.5 billion in 2025, signaling Beijing’s willingness to position itself as a new, reliable option in the face of diminishing US influence.

- The European Central Bank published a paper showing that banks with the greatest so-called transition risks now “face significantly higher borrowing costs” in funding markets.

Tech- Google signed a deal in October to buy power from a planned Illinois natural gas facility equipped with carbon capture and storage technology.

Minerals & Mining- Demand for lithium is accelerating, ending a glut that saw prices decrease, according to one of the world’s biggest lithium traders.

|

|

|