| | In this edition, will Davos finally get it right on where the world is heading? And a global warning͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Dalio on debt

- Trump summons CEOs

- Lululemon founder’s blacklist

- Porat on sovereign AI

- ‘Just listen,’ Moynihan says

- How China beats the West

|

|

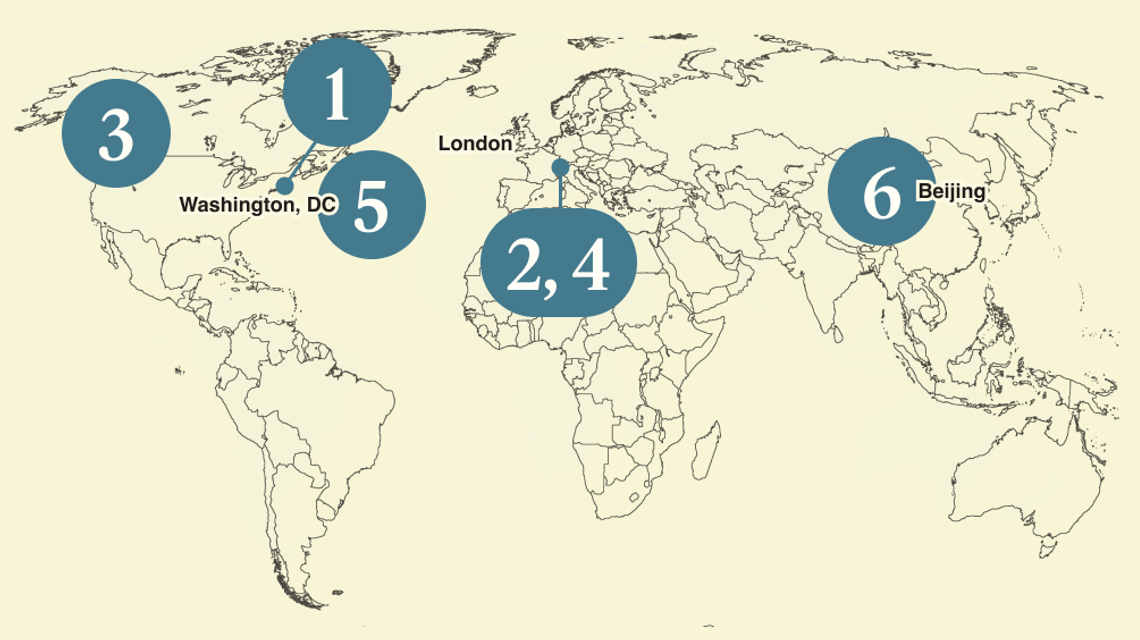

Hi from Davos, where we’re a mile up but a bit more grounded than usual with geopolitics and commercialism. We won’t overload you this week with whatever the opposite of schadenfreude is — nobody likes reading about parties they weren’t at — though if you’re a parasocial white badger, you can sign up for our daily Davos dispatches here. Besides, Davos has been wrong, consistently, about where the world is heading. Its global risk survey is often a battle plan for fighting the last war — seemingly filled out, as one Shell executive noted this week, while glancing at the cover of an old Economist issue tucked into the seatback of a private jet on the trip in. “It is inconceivable — repeat, inconceivable — to get a world recession,” one economist attendee said in 2008. The mid-2010s crowd whiffed on Brexit, MAGA, and the populist wave that followed. In 2020, delegates dipped into communal fondue fountains as COVID-19 circulated in plain view not far away. Davos was briefly all-in on the metaverse. I’ve mused before about creating an Inverse Davos Index to bet against the consensus that emerges by Friday. Call me an optimist, but I have higher hopes for this year. Attendees are clear-eyed about the two big known unknowns on the horizon: AI and President Donald Trump. A quick walk down the Promenade shows plenty of boosterism for both (the USA House, newly operating with the State Department’s blessing and money from the MAGA-fied Freedom 250 semiquincentennial committee, had a decent red-meat menu last night) but the conversations have a sober edge. Leaders of six of the world’s seven biggest economies are here. Technically, seven of the biggest eight, as Gavin Newsom sits down with Semafor’s Ben Smith on Thursday to tout the California governor’s own brand of combative economic populism. And the do-gooderism of past Davoses has been replaced by earthier assessments: less virtue-signaling, more value-hunting. (Spoof away, Besties!) The way you know the climate here has changed is that nobody is talking about climate change. Is this the year the Davos consensus is finally right? Dare to dream. It’s the magic mountain, after all. |

|

Bridgewater’s Dalio takes shot at US’ finances |

Ray Dalio speaking to Semafor’s Liz Hoffman. Firebird Films/Semafor. Ray Dalio speaking to Semafor’s Liz Hoffman. Firebird Films/Semafor.Countries in Trump’s crosshairs have found few ways to fight back against a president who appears dug in on owning Greenland, patrolling the Western Hemisphere, and bullying Europe. One thing they do have, Bridgewater’s Ray Dalio told Liz: A lot of America’s bonds. The $9 trillion of US debt owned by foreign countries is an “enormous vulnerability,” Dalio said at Semafor Haus in Davos. His warning came as global investors finally appeared spooked by Trump’s actions, and stocks and bonds tumbled. An executive at Denmark’s largest pension plan said it was selling off its $100 million in US Treasury bonds — a move he insisted wasn’t political — after Trump doubled down on his Greenland demands. “You could easily imagine it could simply become unpopular to buy or hold US debt,” Dalio said. (The hedge-fund founder promptly urged the audience to buy gold.)  This isn’t the first time the US’ reliance on global bondholders has become a weakness: In 2007, Russia suggested to Chinese officials that they simultaneously dump their holdings of Fannie Mae bonds, then-Treasury Secretary Hank Paulson wrote in his memoir. A PIMCO executive told the Financial Times that the bond giant was pivoting away from US assets because of Trump’s “unpredictable” policies, and General Atlantic’s co-president told Bloomberg TV that “for the first time in our 45-year history, we have more assets outside the US than inside.” Room for disagreement: Michael Froman, head of the Council on Foreign Relations and a former US Treasury and trade official, told Liz that the US’ growing debt load is “the most under-discussed risk that we face” but that he’s “less apocalyptic” about it being wielded by foreign countries as a cudgel. “You’ve got to put [your money] somewhere,” and there are few alternatives that have the depth, liquidity, and (relative) stability of the US dollar. |

|

CEOs brace for Trump in Davos |

Denis Balibouse/Reuters Denis Balibouse/ReutersSome chief executives making annual treks to Davos got a surprise note Monday: Trump wanted to meet. The US president plans to convene a group of corporate executives tomorrow evening after his speech at the World Economic Forum. The agenda is unclear, but the invites sent corporate staffers scrambling to rework schedules that have been months in the making. Tim Walsh, Chair and CEO of KPMG US, told Semafor he hoped to be at the meeting: “Being in the room enables me to get that feedback,” on what clients can expect on issues like tariffs, he said, but “I’m not sure we’re getting new information.” The boosterism of 2025, when corporate executives cheered Trump’s promises of tax cuts and deregulation, has hardened into a wary deference. |

|

Lululemon’s founder seeks Advent’s ouster |

Hollie Adams/Reuters Hollie Adams/ReutersLululemon is losing its zen. Its founder-turned-activist Chip Wilson is trying to boot two directors appointed by private equity firm Advent from the company’s board, Semafor’s Rohan Goswami reports. While Wilson has said he doesn’t want a board seat for himself, he has made clear that he won’t consider any settlement with the company unless two legacy directors linked to Advent, which has been involved in the company since 2005, step down. Advent helped Lululemon go public and made Wilson one of Canada’s wealthiest businessmen. But the company’s founder has soured on Advent in recent years, and now views the private equity firm’s influence and lingering presence as a personification of Lululemon’s ailments. |

|

Google’s Ruth Porat warns of AI power vacuum |

Ruth Porat speaking to Semafor’s Ben Smith. Firebird Films/Semafor. Ruth Porat speaking to Semafor’s Ben Smith. Firebird Films/Semafor.Google’s Ruth Porat told Semafor’s Ben Smith that an AI power vacuum could emerge if the US and its companies don’t move fast enough to compete globally — and that China would step in to fill it. “When I am with any head of state, they say ‘We will not miss this digital transformation,’” Porat said at a Semafor Haus event in Davos. “They also say, ‘We would like to work with the US. If the US is not here — we will work with China.’” Major economies are racing to develop their own sovereign AI — with some adopting novel tactics — but the most popular models remain those developed in the US and China. If China goes into countries where the US is absent, Beijing will be able to execute a playbook it perfected with infrastructure decades ago, through the Belt and Road Initiative: when the US pulled out of countries, or refused to fund airports or bridges, Chinese expertise, and money, stood ready to fill the vacuum. It’s a concern that remains top of mind for AI executives broadly, even if there is a bit of political expediency at work: OpenAI’s Sam Altman has been sounding the alarm bell on China for months. |

|

BofA’s Moynihan sees little US economic slowdown |

Andrew Edgecliffe-Johnson and BofA’s Brian Moynihan. Firebird Films/Semafor. Andrew Edgecliffe-Johnson and BofA’s Brian Moynihan. Firebird Films/Semafor.With markets whipsawing and Trump trading jabs with just about every European leader, it can be easy to forget we’ve been here many times before. If the turmoil from Trump’s “Liberation Day” tariffs taught us anything, it’s that CEOs and other business leaders eventually just get down to business. Exactly one year into the Trump administration, a lot of the confusion is “actually settled in that people can predict a business plan and then go on,” Bank of America CEO Brian Moynihan told Andrew Edgecliffe-Johnson at Semafor Haus in Davos. The leader of the second-largest US bank is one of the most bullish prognosticators on the US economy, which he predicts will continue to chug along this year thanks, in part, to the tax refunds coming Americans’ way. On the corporate side, it took a few months for companies to work through tariff shocks, but the end of the year saw deal activity “unleashed,” he said. “As we look at next year, our investment banking teams would look around the world and say, the pipelines are full.” As for what Trump is going to do next? “People always ask, ‘What does he mean?’ Just listen. He’ll say it,” Moynihan said. |

|

China’s unbeatable economies of scale |

Caroline Brehman/AFP via Getty Images Caroline Brehman/AFP via Getty ImagesIconic cars have been powerful symbols of a country’s industrial coming-of-age — Ford’s Model T, Germany’s VW. For China today, that may be an ultra-luxury EV made by, of all companies, a vacuum manufacturer. The Kosmera Nebula 1, made by Dreame Technology, stole the show in Las Vegas at CES with 1,900 horsepower and zero-to-60 time of 1.8 seconds, writes Semafor’s Andy Browne. The company’s best-known product is, essentially, China’s Roomba. (America’s Roomba is also now China’s Roomba, after the company went bankrupt and was bought by a Shenzen-based supplier.) The Nebula heralds not just China’s engineering prowess but also the shape-shifting nature of its industrial and tech titans. Dreame is funded by Xiaomi, which leapt from smartphones and other consumer electronics to EVs. Apple, by comparison, tried for a decade to build a car before giving up. China’s biggest advantage is its crossover: upstream, high-tech manufacturers rely on the same specialist supply chains for parts that fit into different products; downstream, they utilize the same distribution networks to reach customers. “The system produces unbeatable economies of scale — and drastically lowers costs,” Andy writes. |

|

Hironori Kamezawa, President & Group CEO, Mitsubishi UFJ Financial Group, is joining the Semafor World Economy Global Advisory Board — a forum of visionary business leaders guiding the largest gathering of global CEOs in the US. The expanded board represents nearly every sector across the US and G20. Joining the Advisory Board at this year’s convening will be our inaugural cohort of Semafor World Economy Principals — an editorially curated community of innovators, policymakers, and changemakers shaping the new world economy with front-row access to Semafor’s world-class journalism, meaningful opportunities for dialogue, and touchpoints designed for connection-building. Applications are now open here. |

|

➚ BUY: Da Bears. Indiana is pitching for the Chicago Bears to move to the city of Gary — centering the argument on “tax certainty.” Sky-high property taxes in Illinois would see a property tax bill on |

|

|