| | In this edition, why corporate America is shifting away from the MAGA movement, and prediction marke͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- AI goes to war, messily

- Prediction-market politics

- Wall Street’s grind on trial

- A $3B bet on trade

- Senate Dems push Paramount

JPMorgan employees can’t get a table in their own bar … Michael Lynton blames the Sony hack on his need to fit in … |

|

The big business story of 2025 was watching CEOs scramble to reorient their companies to fit President Donald Trump’s agenda. They committed trillions of dollars to American investments, stacked their boards with MAGA friends, abandoned progressive causes, watched what they put on their air, brought gilded gifts to the White House, and wrapped themselves — metaphorically and sometimes physically — in the flag. With Trump looking unstoppable and conservative culture looking ascendant, companies, law firms, universities, and other institutions decided that acquiescence was both the safest option and good business. But political pendulums swing both ways. With the White House on its heels on a number of fronts, and polls suggesting the Democrats will win the House and possibly the Senate, those decisions may age badly. “Big business has to understand there are consequences when they team up with corrupt government,” Sen. Ruben Gallego, D-Ariz., wrote yesterday, threatening to investigate corporate mergers approved by the Trump administration. Senate Democrats are hinting at hearings on the Justice Department’s antitrust drama and, as Semafor’s Rohan Goswami scooped this morning, warning David Ellison not to misplace any communications between Paramount and the president. There’s no predictable way to win in this form of capitalism, which is why it generally hasn’t led to broad prosperity around the world. The apolitical company went extinct sometime around 2020 — if it ever existed at all; part of this is just closed-door influence-peddling coming out into the open. There’s no easy way back. Just this morning, the new head of New York’s biggest CEO council said proudly that the group was moving “into a place more overtly political.” Last year was a bumper job market for MAGA insiders. Democratic legislative staffers may be the most sought-after corporate hires in 2026. |

|

Anthropic, Pentagon spat goes deeper |

Joshua Roberts/File Photo/Reuters Joshua Roberts/File Photo/ReutersAI is becoming a weapon of war, and not everybody is thrilled about it. The Pentagon’s increasing use of AI tools has opened fissures in Silicon Valley, Semafor’s Reed Albergotti reports. On one side is Palantir, the unapologetically militaristic company that serves as a portal for its own and others’ AI tools for the US military. On the other is Anthropic, whose Claude chatbot was used, seemingly without its knowledge and via Palantir’s software, in the US’ capture of Nicolás Maduro. Soon after the raid, during one of its regular calls with Palantir, an Anthropic employee inquired about the operation with a counterpart at Palantir, who gathered that Anthropic disapproved of Claude’s use — and promptly informed the Pentagon about the conversation, according to a senior Defense Department official. (An Anthropic spokesman called this account of the exchange “false”). What is superficially a spat about subcontracted app plug-ins reveals a deeper rift over whether AI is a tool, like any other technology, to be wielded against America’s enemies or whether it needs its own moral code. Read on for more on the deepening rift between Anthropic and the Pentagon. → |

|

|

Betting markets’ fight isn’t over |

Jonathan Ernst/Reuters Jonathan Ernst/ReutersPrediction markets won over Trump, but the rest of Washington will be harder. Kalshi, Polymarket, and their cohorts won big this week when Commodity Futures Trading Commission Chair Mike Selig asserted that he, not the states, can police them — and suggested that he expects to do so lightly. By endorsing prediction markets’ argument that regulators should treat them more like derivatives exchanges than casinos, however, Selig also laid bare some messy political dynamics. Republicans split on the CFTC announcement, Semafor’s Eleanor Mueller reports. And the states aren’t going quietly: Utah Gov. Spencer Cox’s pushback was particularly sharp, blaming prediction markets for cultural rot, and a sign of things to come. Plenty of business models have succeeded by ignoring state and local regulators and leaning into their popularity until rules caught up. See: Airbnb, Uber, and to some degree, robotaxis. AI giants find themselves in a similar position now, fighting state pushback by appealing to a White House that’s firmly on their side. |

|

Wall Street 120-hour work weeks go on trial |

Carlo Allegri/Reuters Carlo Allegri/ReutersA legal test of Wall Street’s grinding culture goes to trial next week. A banker fired by Centerview in 2020 two months into her employment says the firm wouldn’t accommodate her medical need for eight hours of sleep a night and is seeking millions of dollars in compensation. The case helped fuel a revolt across Wall Street, mostly since quelled, by junior talent tired of 120-hour weeks. That it hasn’t settled — Centerview can easily afford to make the matter go away — suggests the firm doesn’t want to set a precedent and sees value in the grind. And it has the tacit support of a cohort of executives who see a decline in generational hustle. “You can’t get around the effort part of” investment banking, Lazard’s Peter Orszag said last year. “There is not a goddamn person you can get a hold of” on work-from-home Fridays, Jamie Dimon vented. Both sides, though, are fighting the last war. Few industries are set to be as upended by AI as the spreadsheet-wrangling, PowerPoint presentation-polishing work done by Wall Street’s youngest bankers. The question is whether the time that AI tools save will go toward more sleep, or simply more deals. Centerview declined to comment. |

|

Long live imports, ports chief says |

Mike Blake/Reuters Mike Blake/ReutersThe CEO of one of the biggest US ports is making a $3 billion bet that Trump is wrong. Noel Hacegaba, who last month took the helm of the Port of Long Beach, has greenlit the largest capital-spending plan of any port in North America: $3.2 billion over 10 years to expand a complex that was just barely edged out last year by Los Angeles a few miles up the coast. The spending is based on forecasts that imports will continue to grow faster than the economy as a whole, and that Trump’s push to make America more self-reliant won’t change that. Long Beach expects to double its import volume by 2050. “We are bullish on the future, no matter the short-term volatility or uncertainty,” he said in an interview with Semafor. “Demand for products will outstrip the US’ ability to manufacture them here for the foreseeable future.” And even Trump’s push to revive American manufacturing isn’t “about clothes and shoes,” he said. “We’re talking about expensive components. We will still need ports to import the machinery, parts, and supplies those US factories need.” But Trump’s trade wars and a broader fracturing of long-standing partnerships has impacted Long Beach. The share of its imports coming from China fell from 70% in 2019 to 60% today, with Vietnam and other Southeast Asian countries picking up the slack. That adds several days of transit time, bringing pressure from retailers to make up that time at the docks. Long Beach is spending $2 billion to build ship-to-rail capabilities that keep goods off trucks and get them on shelves faster. |

|

Senate Democrats target Warner Bros. |

David Ellison. Brendan McDermid/Reuters. David Ellison. Brendan McDermid/Reuters.Democratic senators unhappy with Paramount CEO David Ellison’s refusal to testify about his efforts to buy Warner Bros. Discovery are ratcheting up the pressure. Senate Minority Leader Chuck Schumer and five other senators accused Ellison Thursday of a “pattern of evasion” and asked the billionaire to preserve all communications with Trump, his family members, lobbyists, and Justice Department staff, according to a letter viewed by Semafor. The senators suggested they would investigate any deal that Paramount struck for Warner, which, even if agreed to, likely wouldn’t close until well after the midterm elections later this year. |

|

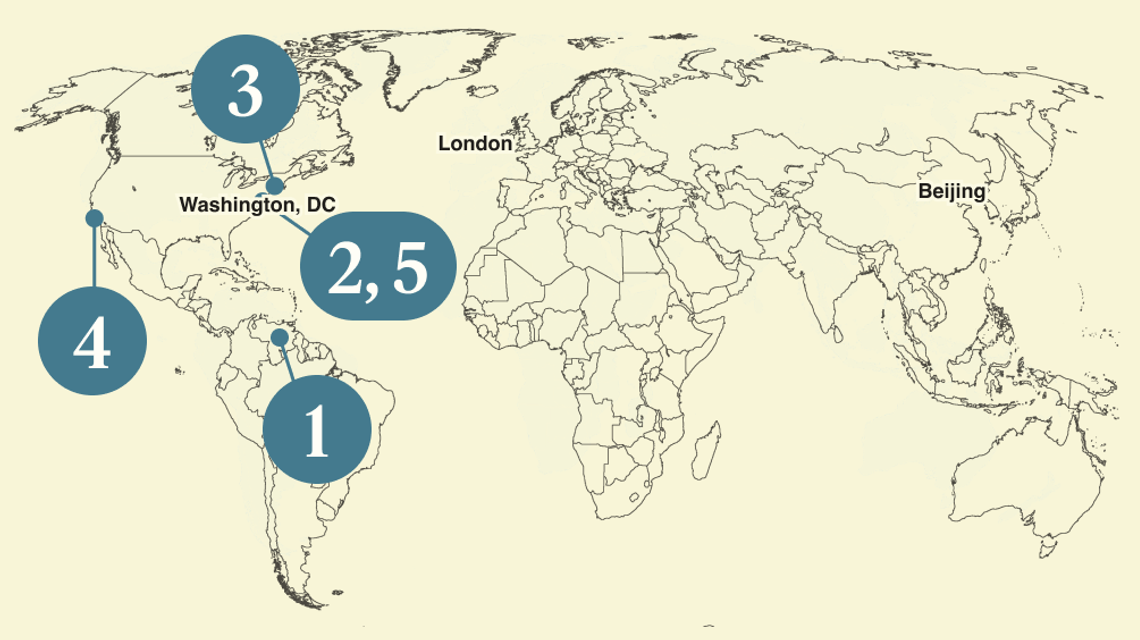

This April, Joanne Crevoiserat, CEO of Tapestry, will join global leaders at Semafor World Economy — the premier convening for the world’s top executives — to sit down with Semafor editors for conversations on the forces shaping global markets, emerging technologies, and geopolitics. See the first lineup of speakers here. |

|

➚ BUY: Bono. U2 unexpectedly dropped its first new album in nine years, a politically charged collection touching on ICE raids, Ukraine, Gaza, and Iran. ➘ SELL: Prince. Andrew Mountbatten-Windsor was arrested Thursday on allegations he sent Jeffrey Epstein confidential documents when he was working as a trade envoy for the UK. |

|

Companies & Deals- Peace offering: JPMorgan wants to be the banker for Trump’s “Board of Peace,” the FT reports, a mandate that’s unlikely to make much money but could be a conciliatory move after Trump sued the bank last month for allegedly “debanking” him for political reasons.

- Flying high: Did Palantir CEO Alex Karp really spend 28% of 2025 on a private jet? Jefferies analysts break down the disclosure math.

- Bottomless pit: OpenAI is in the opening stages of another funding round, this time for the record-breaking sum of $100 billion, as the AI giant and other major tech companies prepare to pour billions into developing the infrastructure needed to power the AI boom.

- Dinosaurs demoted: One of the world’s biggest consulting firms will weigh employees’ use of AI tools when deciding on promotions.

|

|

|