| | Donald Trump convenes his Board of Peace, the US reports a record goods trade deficit, and Riyadh qu͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

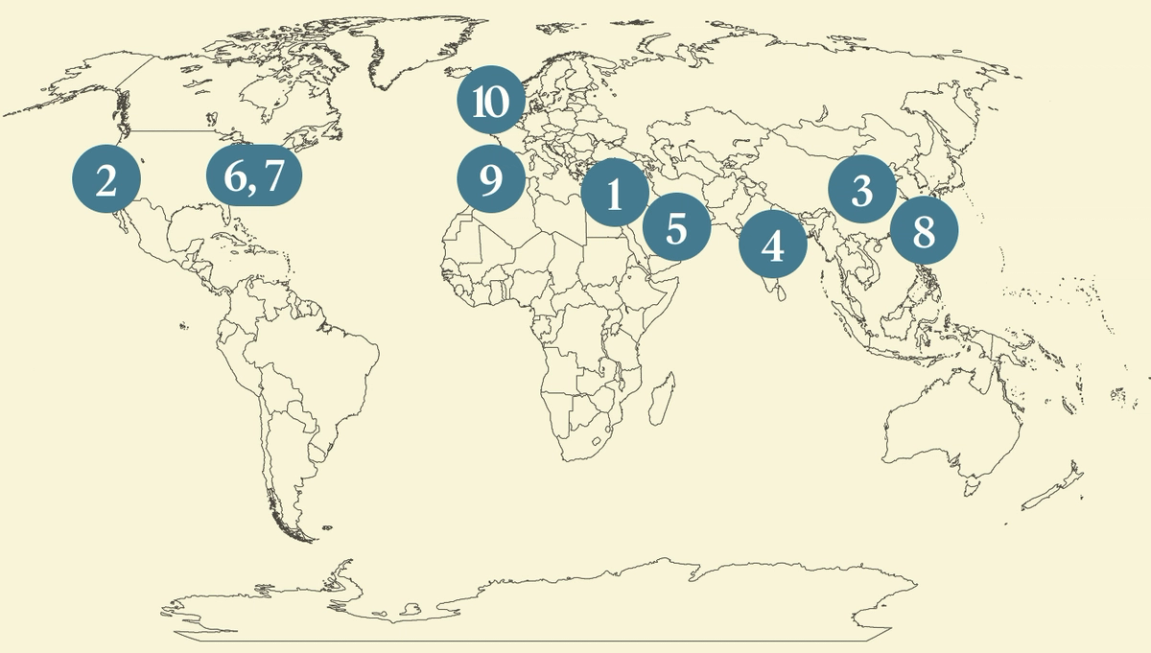

The World Today |  - The Board of Peace meets

- Record US goods trade deficit

- Chinese EV sales fall

- AI money, rivalry in India

- Changing the Taiwan narrative

- Wall St. work culture on trial

- Spate of CEO turnovers

- Riyadh loosens Ramadan rules

- 2,000-year-old elephant bone

- 2005 YouTube video

Why a 1982 book by a Jesuit priest is deeply relevant today, and Japan’s konbini fall out of vogue. |

|

Trump commits $10B to Board of Peace |

Kevin Lamarque/Reuters Kevin Lamarque/ReutersPresident Donald Trump said the US would commit $10 billion to his Board of Peace initiative, with other members contributing $7 billion to the mammoth task of rebuilding Gaza. More than two dozen countries joined the board’s first meeting in Washington on Thursday, offering a concrete look at the governments that will shape Gaza’s future, Axios noted. Troops from at least five nations, including Albania and Kazakhstan, are due to make up a multinational peacekeeping force in the territory, even as Hamas tightens its grip on Gaza and is reluctant to disarm. While Trump on Thursday vowed to settle global conflicts, he also said he could reach a decision on whether to strike Iran within 10 days. |

|

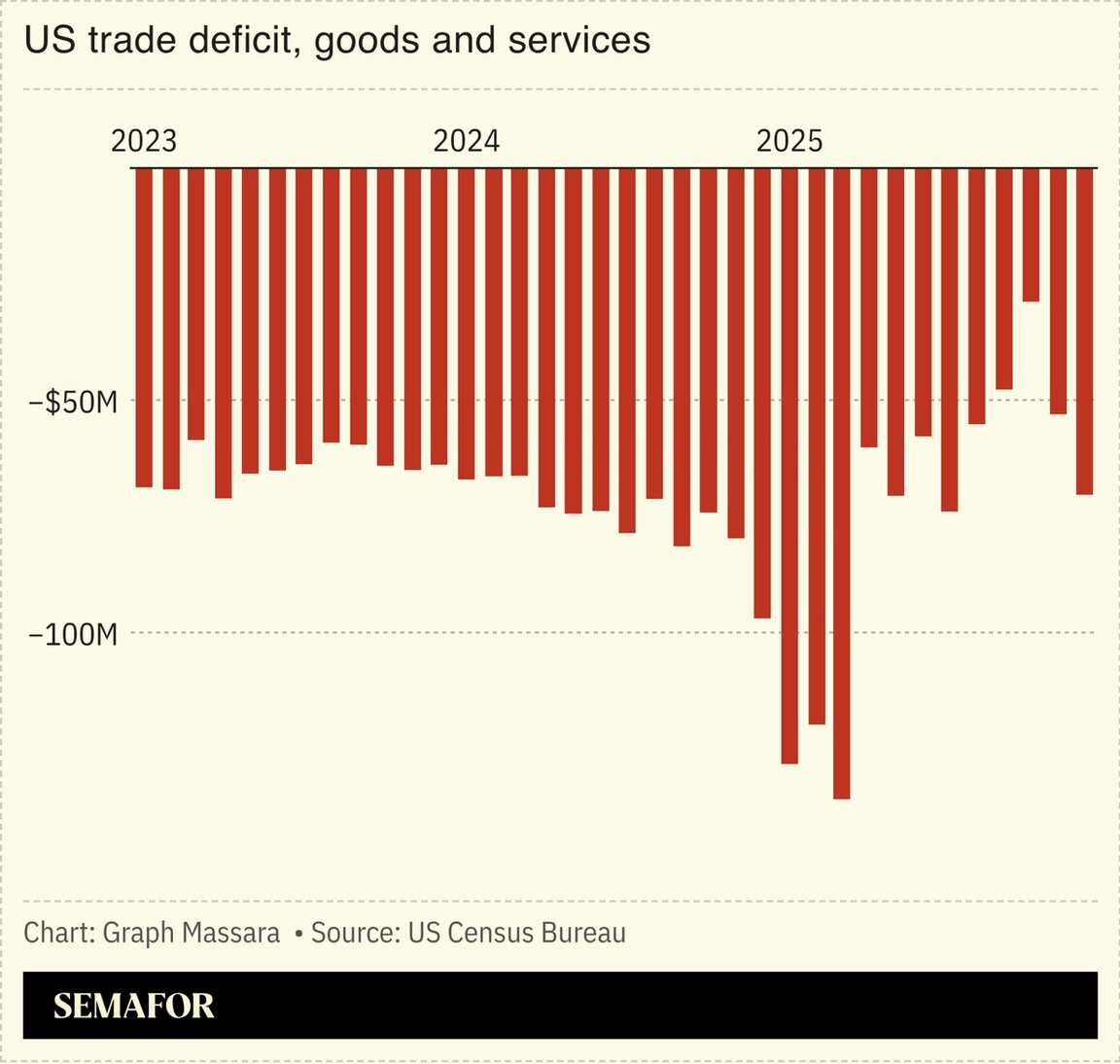

US goods trade deficit hits record high |

The US trade deficit in goods widened to a record high last year, as imports increased despite President Donald Trump’s tariffs. The data suggested the duties have not brought global manufacturing to the US en masse, but rather, companies rerouted orders and supply chains to skirt or get ahead of the import fees. And while global trade held up, it was scrambled. Shipments from China to the US fell nearly 30%, while Americans bought more from Vietnam and Mexico. Trump repeatedly said the tariffs would lower the trade deficit, but it’s too early to say how that will play out long-term. Many companies are still benefiting from the “‘inventory effect’ from massive stockpiling in early 2025,” an economist noted. |

|

Rafael Martins/Reuters Rafael Martins/ReutersInvestors are cooling on Chinese EV firms after they reported weak January sales, a downturn that could have ramifications for overseas markets. Industry leaders BYD and Geely were among the hardest-hit, and some analysts expect the country’s EV sales to keep falling this year as stimulus measures and consumer incentives are phased out. Beijing raised the quota for the number of EVs that can be sold this year as a way to boost auto sales, Caixin reported. The sluggish domestic market could lead vehicle exports from China to surge — “yet another reminder to the world’s carmakers that what happens in the country steers the industry everywhere,” The Economist wrote. |

|

India AI summit attracts money, rivals |

Ludovic Marin/AFP via Getty Images Ludovic Marin/AFP via Getty ImagesIndia’s AI summit this week put on bold display the forces driving the AI boom: money and rivalry. The event was a nexus for dealmaking and investment announcements. Anthropic is partnering with Indian giant Infosys; OpenAI is working on data centers with Mumbai-based Tata Group; and India’s Reliance Industries, led by Asia’s richest person, Mukesh Ambani, announced a $110 billion data center investment. The summit was India’s opportunity to “hype itself as an emerging AI power,” The Economist wrote, and parade its “abilities as a global convener.” In a telling moment, the Indian prime minister posed on stage with the biggest names — and competitors — in AI, including the CEOs of OpenAI and Anthropic, who refused to link hands for a photo op. |

|

Case for a new US-Taiwan narrative |

Yi-Chin Lee/Reuters Yi-Chin Lee/ReutersThe US needs to revamp its narrative around Taiwan, a leading China expert argued. Washington and Taipei recently struck a trade deal and strengthened military and tech ties. But some in US President Donald Trump’s orbit now posit that Taiwan’s chip dominance makes it a liability for the US, Brookings’ Ryan Haas wrote. Washington must “update its own story about why Taiwan matters” to recognize that military conflict over the island is not inevitable and that Taipei is central to the US’ AI ambitions. The issue has taken on greater urgency after Trump suggested he was discussing arms sales to Taiwan with Chinese leader Xi Jinping; the weapons package is reportedly in limbo following pressure from Beijing. |

|

Wall Street’s hustle culture on trial |

Brendan McDermid/Reuters Brendan McDermid/ReutersA test of Wall Street’s grinding culture goes to trial next week. A junior banker fired in 2020 two months into her employment is arguing the investment bank wouldn’t accommodate her medical need for eight hours of sleep a night; she’s seeking millions in compensation. The case helped fuel a revolt across Wall Street by young talent tired of 120-hour weeks. But the trial suggests the firm, which could have settled the case, doesn’t want to set a precedent and sees value in the grind. The bank has the tacit support of executives who see a decline in generational hustle. For junior bankers, though, the larger war will be waged against new AI tools that threaten to automate most of their tasks. |

|

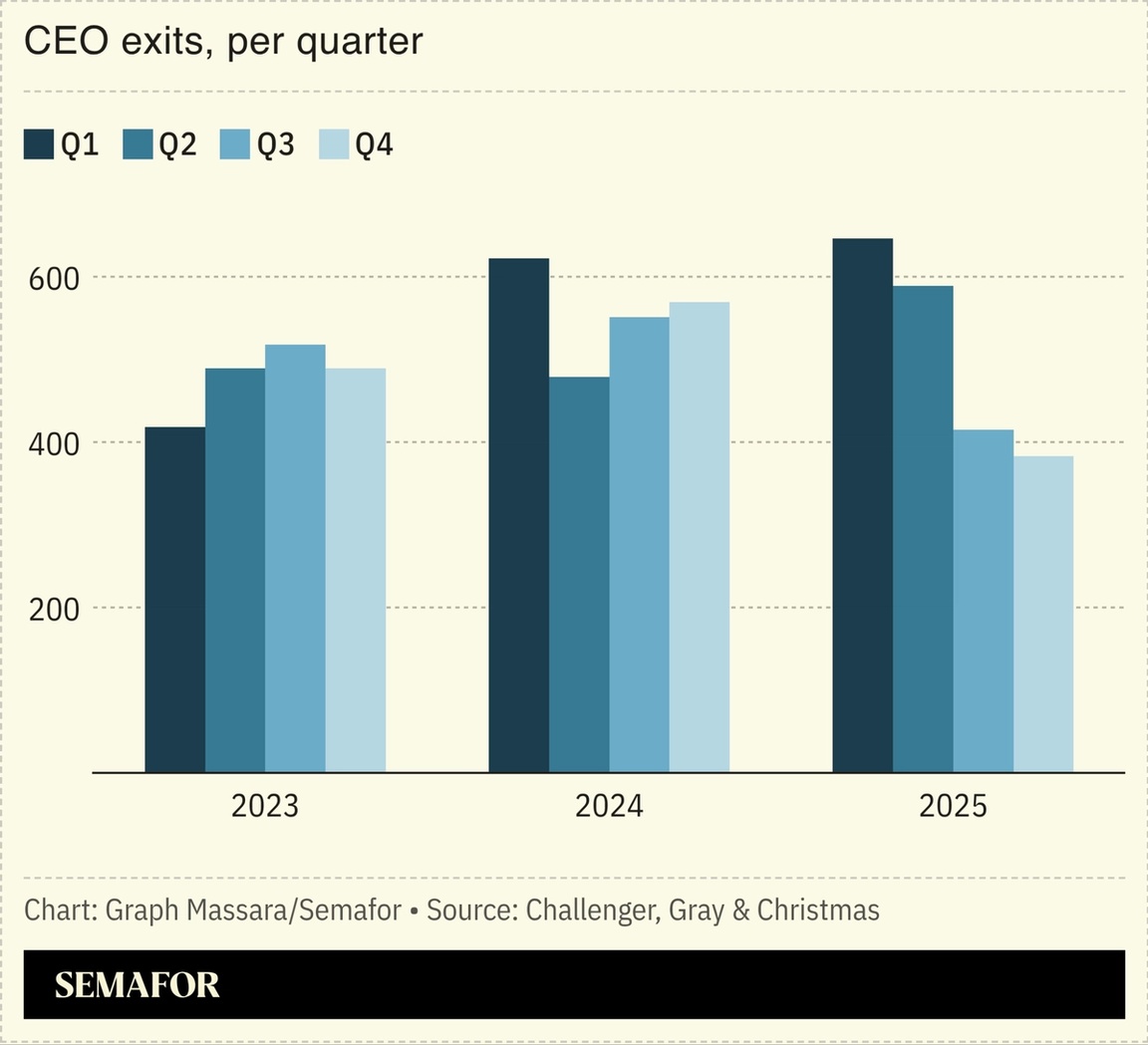

US sees record CEO turnover |

About 11% of CEOs at 1,500 of the biggest public US companies were replaced last year, a record. The trend seems to be continuing this year, with giants like Disney, HP, PayPal, and Walmart announcing new leaders. It is “more than the normal ebb and flow of executive reshuffling,” The Wall Street Journal noted, as companies grapple with the rise of AI and an unsettled economic and geopolitical climate. The incoming cohort of chief executives is also younger compared to last year’s appointees, with an average age of 54, compared to 56 before; more than 80% are first-time CEOs. Fewer women were picked as CEOs, accounting for just 9% of new appointments, down from 15% in 2024. |

|

Riyadh quietly eases Ramadan rules |

Manal Albarakati/Semafor Manal Albarakati/SemaforSaudi Arabia’s capital appears to be quietly easing rules about eating out in daylight hours during Ramadan. Some restaurants and cafes are staying open throughout the day and serving food during the Muslim month of fasting, Semafor’s Riyadh-based team reported, the latest sign of the city gradually loosening social restrictions to attract more foreign workers: Today’s Riyadh hosts concerts, desert raves, and a liquor store for wealthy non-Muslims. In past years, all restaurants were closed during daylight hours of Ramadan and religious police ensured no one was eating or drinking in public. But it’s still far from a wholesale opening, and remains a sharp contrast from neighboring UAE, where visitors barely notice any changes during Ramadan. |

|

There’s a money story in the Arabian Peninsula. Take one look at the news, and you’ll see headlines about Saudi Arabia’s rapidly changing economy, Qatar’s investment in mass infrastructure, and the UAE’s transformation into a global tech hub. The geopolitical tectonic plates are shifting. To stay up to date on the business happening in the Gulf that impacts the world around you, check out Semafor Gulf. Each issue uncovers the economic forces shaping the region — and the world. |

|

Proof of Hannibal’s war elephants |

“Hannibal Crossing the Alps on Elephants,” by Nicolas Poussin “Hannibal Crossing the Alps on Elephants,” by Nicolas PoussinA 2,000-year-old bone found in southern Spain may be the first archaeological evidence of Hannibal’s legendary war elephants crossing the Alps. The Carthaginian general fought the Second Punic War against Rome, battling for control of the Mediterranean for 14 years before his defeat. He was believed to have crossed the Alps, along with 37 elephants, to avoid Roman defenses concentrated to the south. While historians agree the crossing happened, thanks to extensive documentary evidence, including images on ancient coins, no physical remains had been discovered, until now. The unearthing of the four-inch cube of bone suggests this elephant died before reaching the Alps, but nonetheless may prove the existence of Hannibal’s troop of battle beasts. |

|

|