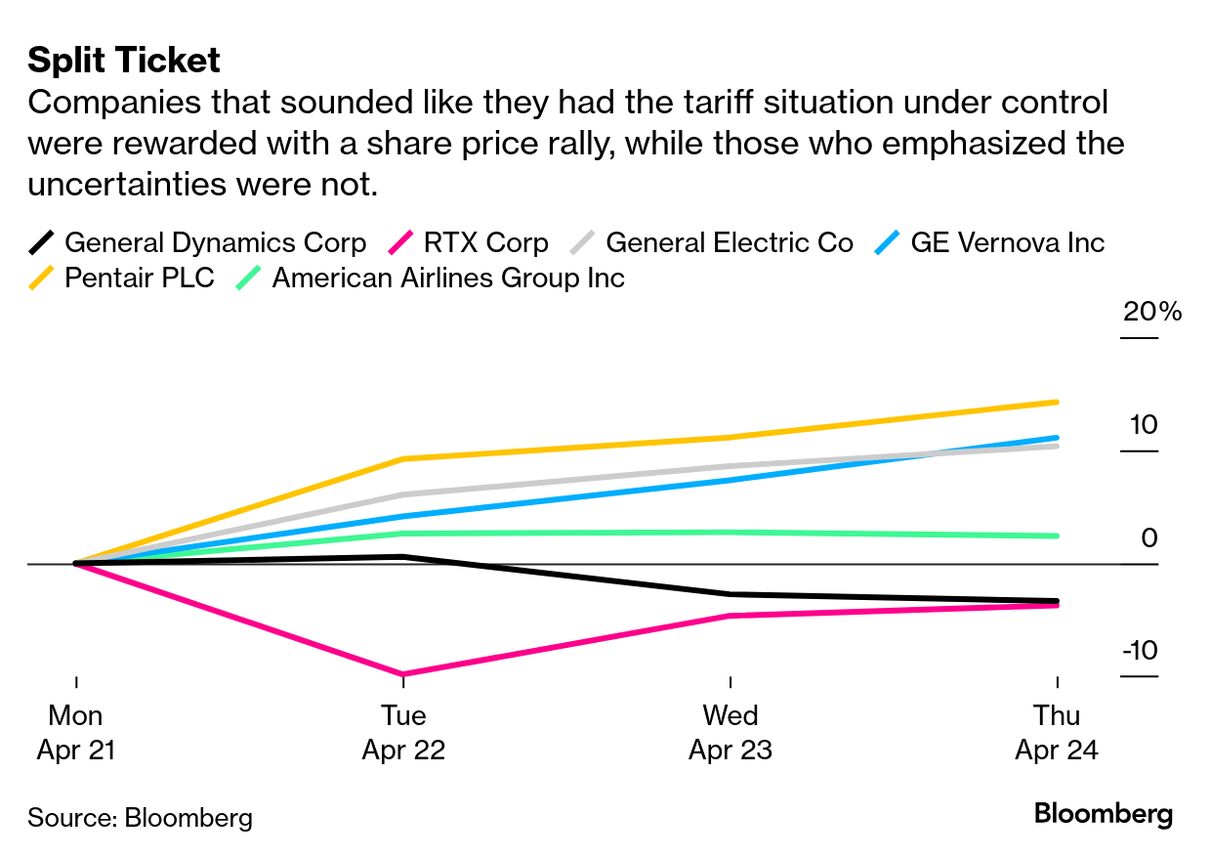

| “We do not know the scope and breadth of the tariffs issue at the moment and will not for a while” so to pretend otherwise is “sheer speculation,” Phebe Novakovic, chief executive officer of General Dynamics Corp., the company behind Gulfstream private jets and military tanks, said this week. “Anything I say on that subject, given our lack of firm knowledge, will almost certainly be wrong.” It was one of the more accurate comments anyone has made about tariffs so far this earnings season, if not the most helpful for investors.

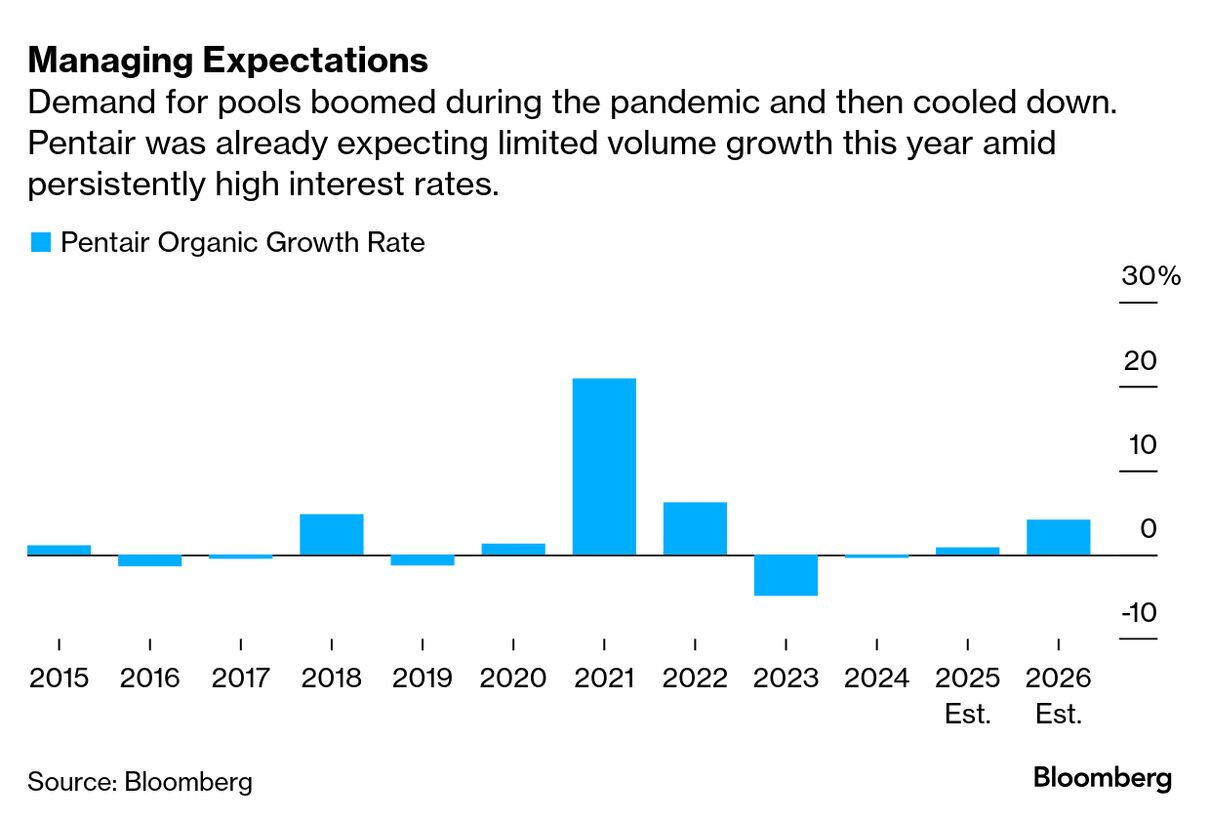

The tariff elephant in the room has made vibes more important than numbers — past, present and future. Companies are handling President Donald Trump’s amorphous and ever-changing plans to blow up the global economic order in different ways. Some, including Delta Air Lines Inc. and American Airlines Group Inc., have decided it’s not worth trying to guess where levies will end up and what the economic cost of a global trade war might be so they’ve scrapped their financial guidance altogether. Others, such as Post-it maker 3M Co. and missile and jet engine manufacturer RTX Corp., have offered two versions of their outlooks: one with tariffs and one without. A few select companies — including Pentair Plc, General Electric Co. and GE Vernova Inc. — have already come up with specific plans to fully counteract the added cost of Trump’s import taxes and keep doing business mostly as usual.  GE CEO Larry Culp has appealed directly to Trump to spare the aerospace industry from tariffs, emphasizing the benefits of a 45-year-old trade agreement that had largely allowed airplane parts to cross borders without penalty and fostered a booming export market in the US. Absent a rollback, GE will use duty drawbacks — refunds of import taxes on products that are eventually exported — and foreign trade zones — designated areas subject to special US customs procedures — to whittle down the hit from tariffs to about $500 million. After that, the company is planning to increase prices, cut costs in back-office functions and make tweaks to its supply chain to make up the difference and keep its outlook intact. “We didn't really have to think too much about the way product flows” before these tariffs, Culp said in an interview. “We've been turning over every stone in order to smartly, legally, compliantly offset the tariffs.” (GE is now doing business as GE Aerospace after last year’s spinoff of its GE Vernova energy assets.) Some companies will navigate this storm better than others. But the problem remains that no one really has any idea what kind of storm is coming or just how damaging it might be. Country-specific reciprocal tariffs that go beyond the blanket 10% rate implemented earlier this month were paused for 90 days, while goods that are compliant with the US-Mexico-Canada trade agreement are also exempt for now. It’s anyone’s guess how long those reprieves last or if they become permanent. Trump this week indicated a willingness to substantially pare back his 145% tariffs on China and said there was no need to “play hardball.” But Treasury Secretary Scott Bessent also said the US won’t unilaterally cut the levies and is seeking a deal with China. The Trump administration is considering reducing certain tariffs that target the automotive industry after executives warned knee-jerk efforts to unravel a highly integrated global supply chain would lead to higher prices, production cuts and job losses, Bloomberg News reported, citing people familiar with the matter. Read More: Trump U-Turns on Powell, China Follow Dire Economic Warnings “Chaos is its own cost,” Senator Elizabeth Warren, a Democrat from Massachusetts, said of the tariff turmoil in an interview at Bloomberg’s New York headquarters this month. “Can tariffs be a useful tool in the toolbox? You bet they can — when used with a specific goal in mind, a timeline that makes sense” and careful attention to the knock-on effects for both necessary imports and export markets, she said. But “a tariff that applies to virtually every country and virtually every product they sell to the United States with not even an attempt to articulate what the goal is” can create extreme economic ripple effects. The more pool-pump maker Pentair raises prices, the more it expects consumers to defer purchases and rethink projects. Still, it’s planning to pass on the higher costs of tariffs anyway rather than take the hit to its profits. The company currently expects the two dynamics to largely cancel each other out — fewer pool products sold but at higher price points. But “right now, we're guessing at what that impact would be” on the pool market, Pentair CEO John Stauch said on an earnings call this week.  Airlines, meanwhile, are dialing back their growth plans for this year and speeding up retirements of older jets as demand from leisure and business travelers rapidly deteriorates. GE Aerospace trimmed its outlook for aircraft departures to reflect that pullback in North America; fewer flights mean less maintenance work. However, the company, along with other aerospace manufacturers, says it hasn’t seen anything to indicate demand is drying up for spare parts or new planes. Conditions can change quickly, though: Southwest Airlines Co. CEO Bob Jordan said the recent drop in domestic leisure bookings is the worst he’s seen besides the dramatic plunge during the pandemic. Revenue slipped three percentage points in the first quarter and Southwest is forecasting a six-point slide in the second quarter because of economic weakness. Read More: Economic Warning Signs Get Harder to Ignore “In this industry, that’s a recession. Those are huge drops,” Jordan said in an interview with Bloomberg News’ Mary Schlangenstein. It also remains unclear the extent to which a standoff over who foots the bill for tariffs will bring the already fragile aerospace supply chain to a halt. American Airlines this week said it won’t pay the cost of tariffs for jet deliveries from Airbus SE, echoing a similar stance from Delta. “The thing I'm really trying to make sure we're focused on is making sure that an argument over a 10% tariff — who is going to pay — doesn't turn into a continuity of supply issue,” Boeing Co. CEO Kelly Ortberg said on the company’s earnings call this week. “We really need to make sure that people are buying and bringing in the parts that we're going to need and then we'll work through the financial implications.” Read More: Plane Supply Chain Veers Toward Paralysis RTX is bracing for an $850 million hit to its operating profit if the current tariffs stay in place through the end of the year but that forecast doesn’t include secondary effects, such as weaker demand or supply-chain and operational disruptions, CEO Chris Calio said. “The industry has been used to a duty-free environment. And so all of us have had to come up with different sort of processes and protocols to avail ourselves of these mitigations that we've talked about,” he said. “We've seen in the past what happens when you kind of are herky-jerky with your supply chain.” Factory announcements are still trickling in despite the tariff turmoil, including a $23 billion investment in US infrastructure by Swiss pharmaceutical firm Novartis AG and $50 billion of spending on research, manufacturing and distribution facilities by Roche Holding AG. GE Vernova in January announced plans to invest $600 million in its existing US factories to expand production of heavy-duty gas turbines and support work on onshore windmills, while GE Aerospace in March said it will spend almost $1 billion to increase output of jet engines and bolster its supply chain. Those investments are still happening. Read More: Manufacturers Are Spending, Not Reshoring But other businesses — particularly smaller and medium-sized companies — are pausing or even canceling US investments. Kai Seim, founder of Seim & Partner, a German engineering firm that focuses on broadband projects, told the New York Times he had recently evaluated opening an office in the US but decided against it, citing “lost trust in the legal, the political and the financial system.” Trivium Packaging, a manufacturer of steel and aluminum containers for everything from canned foods to aerosol sunscreens, and olive-oil company Fresh Press Farms are also among those pausing US expansions, Bloomberg News has reported. Growth in overall US private construction spending on manufacturing has flatlined from the boom seen under the Biden administration. “The simple reality is that if this trade war does not settle quickly, customers will respond by delaying and canceling projects,” Melius Research analyst Scott Davis wrote in a note. “In historical times of distress, even high-return projects get shelved.” If companies respond to tariffs by raising prices, that “may just end up making projects uneconomical, at the same time that confidence in that project is falling,” he added. “Are we being dramatic? Maybe yes, but this trade war has risk of spiraling into a capex recession.” “If there are reciprocal or retaliatory tariffs somewhere else in the world that might make the provision of a product or service price prohibitive, we might need to rethink how we deliver for that non-US customer.” — GE Aerospace CEO Larry Culp Culp made the comments in an interview when asked whether tariffs change the calculus on exporting goods from the US. One of the bigger longer term risks of Trump’s trade policy is that broad tariffs and reciprocal levies from irritated allies force global manufacturers to isolate the US market in the same way that they have China. In other words, American plants for American-bound goods and factories elsewhere in the world to serve everyone else. To help mitigate the cost of Trump’s import taxes, GE Aerospace is already combing through its supply chain to “make sure we're not bringing a product into the US for a non-US customer only to ship it back out,” Culp said. This would, of course, be detrimental to the ultimate value proposition of any domestic factory revival and risks further inflating the trade deficits with other countries that Trump says he wants to close. So it’s also possible that trading partners seek to buy more goods from US factories to help make their case to Trump for tariff relief, Scott Strazik, the CEO of GE Vernova, said in an interview. The company has invested in US onshore wind turbine manufacturing capabilities, including at facilities in Pensacola, Florida, and Schenectady, New York. Orders for its onshore wind business have been soft in North America amid permitting delays, high interest rates and uncertainty over tax incentives included in the Inflation Reduction Act. “Maybe we'll do more exports from those facilities here in the near term, depending on where the order book goes,” Strazik said. Read More: Ties to China Weren’t a Problem. Now They Are

GE Vernova maintained its 2025 guidance, despite the expectation that tariffs will add as much as $400 million in costs. The company plans to lean on inflation-protection provisions and change-of-law clauses in contracts to pass on some of the cost of tariffs to customers, while also cutting expenses and reorganizing its supply chain to lessen its dependence on China. GE Vernova has alternative suppliers in place for about two-thirds of the parts and materials it currently sources from China. It can’t make the shift immediately because there are contracts in place but the company can redirect its next round of orders to non-Chinese suppliers. Still, GE Vernova won’t be looking to cut China out of its supply chain completely, Strazik said. “With the size of China, I would always want to have that as optionality for us for certain markets and certain opportunities,” he said. There are also some things that companies can only buy from China. In the case of Pentair, with US tariffs on Chinese goods at 145%, “we're going to have to make a determination if customers still want that product,” Stauch, the CEO, said. “We just might not be able to carry that product line going forward because we can't be competitive. It's the only place it could be sourced.” Deals, Activists and Corporate Governance | Boeing agreed to sell its Jeppesen flight navigation unit and other digital assets to private equity firm Thoma Bravo for $10.6 billion in cash that the planemaker can use to help chip away at its bloated debt load. Airlines and amateur pilots use Jeppesen software to create interactive flight plans. The business, which is profitable, had also attracted interest from other aerospace manufacturers including TransDigm Group Inc., GE Aerospace, RTX and Honeywell International Inc. Boeing acquired the Jeppesen operations for $1.5 billion in 2000. The divestiture “provides an insurance policy on liquidity” for Boeing until the company gets aircraft production back on track and cash flow turns positive again, Bloomberg Intelligence analysts George Ferguson and Melissa Balzano wrote in a note. United Parcel Service Inc. agreed to acquire Andlauer Healthcare Group Inc. — which provides specialized cold-storage transport and supply-chain management services for drugs and vaccines — for $1.6 billion. UPS generated about $10 billion in revenue from health-care shipments in 2023 and has said it’s looking to double that figure through acquisitions and new business ventures. Health-care deliveries typically carry higher margins than consumer retail orders. |