| Bloomberg Evening Briefing Americas |

| |

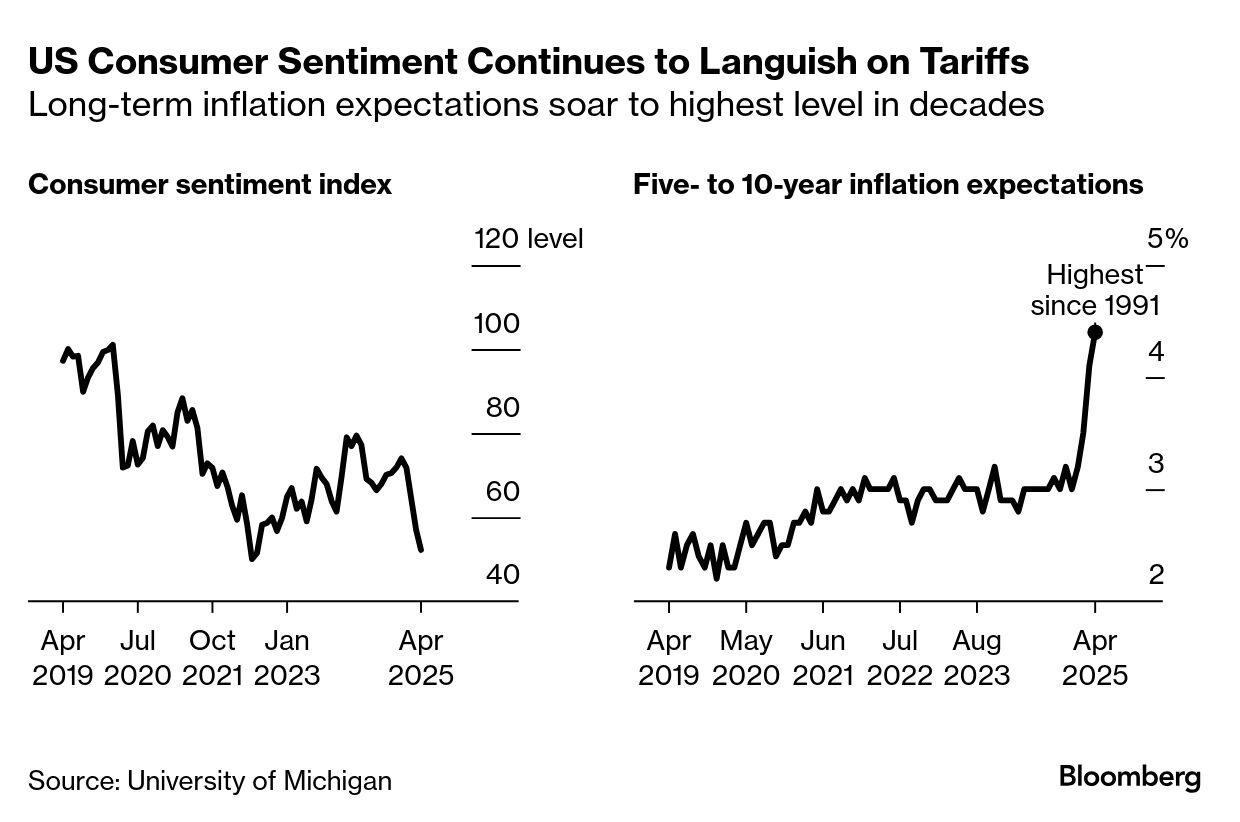

| As US President Donald Trump departed for Italy to attend the funeral of Pope Francis, the news at home for his administration was not good as the week came to an end. On the economic front, there is record fear among his constituents. US consumer sentiment fell to one of the lowest readings on record and long-term inflation expectations climbed to the highest since 1991 on worries over the domestic consequences from his tariffs. Economists see Trump’s policies, and in particular his global trade war, as making the chances of a self-induced recession a coin flip.  An ABC-Ipsos poll found that seven in ten Americans feel the Republican’s tariff campaign will drive up inflation—the main issue he campaigned on during last year’s presidential election. And a New York Times average of polls reported Trump’s overall approval rating has fallen steadily since he took office and is now at 45%. And finally, a majority of respondents to a New York Times/Siena poll expressed disapproval over Trump’s efforts to gather more power to the executive. In markets Friday, a dollar gauge was on track for its worst performance during the first 100 days of a US presidency in data going back to the Nixon era, when America abandoned the gold standard. But Treasuries rallied as investors pinned their hopes to signs that the US-China trade confrontation may be starting to cool. There was also some pleasant news in equities, too. —David E. Rovella | |

What You Need to Know Today | |

| Trump launched his trade war on China and then promptly warned Beijing not to retaliate. Chinese leader Xi Jinping ignored his plea and instead responded with retaliatory levies. Escalation ensued. Now, after weeks of Trump urging Xi to come to the table (replete with unrequited entreaties for a phone call), China has quietly removed a few tariffs of its own. Wu Xinbo, director at Fudan University’s Center for American Studies in Shanghai and an adviser to China’s Foreign Ministry, contends Trump misjudged the potency of US economic pressure, leaving him unprepared for the trade war he started. “The mainstream narrative within the Trump team is that because the Chinese economy is bad, if the US plays the tariff card, then China will have no choice but to surrender,” Wu said. “But surprisingly to them China didn’t collapse and surrender.” | |

| |

|

| Trump has been having a hard time with the courts. He’s triggered a constitutional crisis by failing to abide by some of the growing pile of rulings finding his effort to consolidate power illegal. This has particularly been the case in his attempts to deport non-US citizens without legally mandated due process. His agencies have been pressuring state and local officials to assist in their efforts. On Friday, the FBI arrested a state judge for allegedly obstructing immigration security agents from detaining a man inside a Wisconsin courthouse. Legal experts had already weighed in on what they reportedly said was a problematic government case, but that didn’t stop protests from erupting outside a federal courthouse in Milwaukee this afternoon. Wisconsin Governor Tony Evers, a Democrat, said in a statement after Judge Hannah Dugan’s arrest that the Trump administration is continuing a pattern of “dangerous rhetoric to attack and attempt to undermine our judiciary at every level.” | |

|

| |

|

| |

| |

|

| Toyota Chairman Akio Toyoda is said to have proposed a buyout of Toyota Industries, seeking to consolidate his grip on Japan’s biggest business empire as a wave of merger and acquisition activity roils the country. The proposal is said to value Toyota Industries, which makes looms for textile manufacturing as well as parts for Toyota’s cars, at ¥6 trillion ($42 billion), a roughly 40% premium over its market capitalization at the close Friday. Toyota Industries, the company founded by Toyoda’s great-grandfather Sakichi that ultimately birthed the world’s No. 1 carmaker, formed a special committee after receiving the proposal and hired advisers to review its viability. | |

|

| While America shudders at the prospect of a return to higher inflation, the European Central Bank’s task of restoring 2% inflation is almost complete, with April’s reading set to come in only a fraction north of that target. Consumer-price growth probably slowed to 2.1% this month, according to the median forecast of 32 economists surveyed by Bloomberg. An underlying measure that strips out volatile elements such as energy is predicted to tick up to 2.5% in readings due next Friday. “Business surveys for April suggest that US tariffs have not done much damage in the euro-zone so far,” said Capital Economics Chief Europe Economist Andrew Kenningham. “But we think there will be a noticeable impact in the coming months and have reduced our forecast for euro-zone GDP growth to almost zero for the second and third quarters.” | |

|

| |

What You’ll Need to Know Tomorrow | |

| |