| | In today’s edition, Trump strikes first big trade deal with the UK, and the few top execs voicing po͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- UK trade deal

- Powell’s FOOL’s errand

- Google gets buggy-whipped

- PE’s minnows on the hook

- Airwaves auction

- Bill Gates’ big giveaway

|

|

I went to the Milken conference, finance’s annual mecca in Beverly Hills, this week looking for signs that the industry’s luminaries might land on some unified talking points to nudge the White House off the trade ledge. They did not. Executives’ public comments were muted. Beyond Citadel’s Ken Griffin, who doubled down on his criticisms of President Donald Trump, the edgiest I heard was Apollo CEO Marc Rowan saying that the US had gone from “hyper-exceptionalism to merely exceptional.” Even in private, the mood was better than I expected, as executives seemed to buy the promise of deregulation and tax cuts that the White House has been selling hard lately. And remember, this is a finance conference, not a business one: Wall Street can make money in good times and bad, unlike airlines, retailers, and other consumer-facing companies that have been sounding the alarm lately. “They want to do deals,” Tim Sloan, the former Wells Fargo CEO now running a lending business for Fortress Investment Group, told Bloomberg. “Volatility creates opportunity.” |

|

Alberto Pezzali/Pool via Reuters Alberto Pezzali/Pool via ReutersTrump has his first key trade deal, announcing the outlines of an agreement with the UK to drop some tariffs and increase exports. Britain agreed to buy more US goods and fast-track American agricultural and industrial goods through customs inspections. Commerce Secretary Howard Lutnick said a UK airline will buy $10 billion worth of planes from Boeing, whose stock rose 4% on the news. British steel, aluminum, and Rolls-Royce engines will be able to enter the US tariff-free, and 100,000 cars a year can do so under 10% tariffs. (UK Prime Minister Keir Starmer held his own press conference at a Jaguar Land Rover factory.) Treasury Secretary Scott Bessent and trade czar Jamieson Greer are on their way to Switzerland for their first talks with Chinese officials. “You better go out and buy stock now,” Trump said this morning. The last time he doled out financial advice, just before pausing his “Liberation Day” tariffs, he was right. |

|

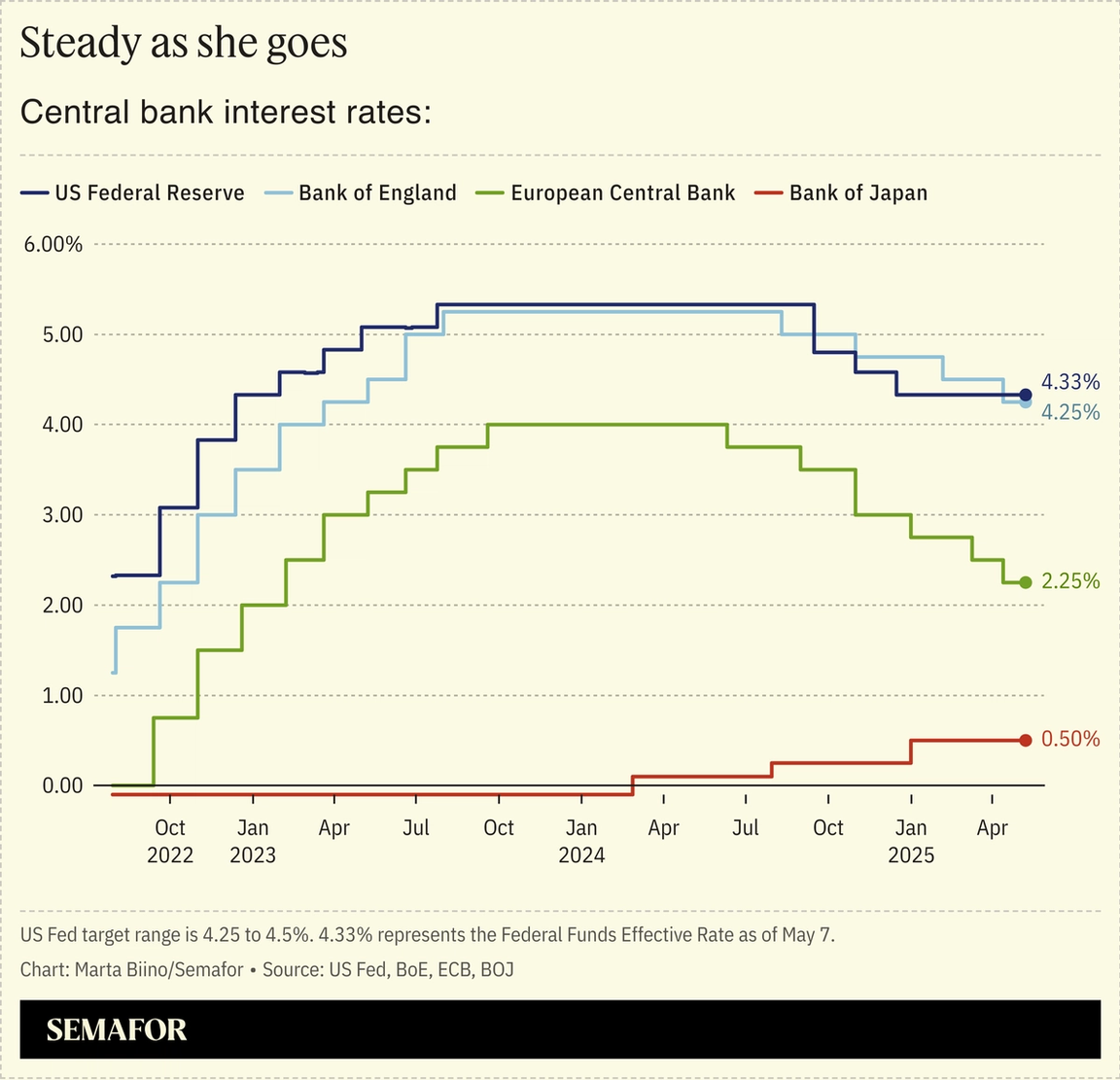

Fed in ‘wait and see’ mode — literally |

Trump returned to his market-rattling criticism of the Federal Reserve this morning, calling Chair Jay Powell a “a FOOL, who doesn’t have a clue.” The Fed’s decision to hold interest rates steady Wednesday — rather than cut, the president’s loudly voiced preference — was a “thinly veiled critique” of the White House’s economic policies, said Pantheon US chief economist Samuel Tombs.  Powell said “wait and see” 12 times at the press conference. The decision to hold borrowing costs steady was expected, but puts the US further away from other countries. (The Bank of England again cut rates this morning, its fourth such move in its past seven meetings.) Central banks have two main jobs — keeping inflation steady and unemployment low — and the likelihood that Trump’s tariffs will increase prices has put the Fed in a bind not faced by other countries. |

|

Is Google search the AI era’s buggy whip? |

Annegret Hilse/File Photo/Reuters Annegret Hilse/File Photo/ReutersGoogle’s dominance over online search — which fueled the first two decades of the internet and got the company declared an illegal monopoly — may be over. A top Apple executive said Wednesday that the company was “actively looking at” revamping how searches on iPhones are done, and potentially replacing Google with AI models. “There are new entrants attacking the problem in a different way,” Apple senior vice president Eddy Cue said. Cue was testifying at the US government’s monopoly trial of Google parent Alphabet. The last time he was on the stand in this case, in 2023, he was defending Apple’s exclusive arrangement with Google, which was renegotiated a few years earlier. “There wasn’t a valid alternative to Google,” Cue said at the time. Now there is: For the first time in 22 years, Google search usage on iPhones declined in favor of AI assistants like ChatGPT and Anthropic, Cue said. That was essentially Google’s defense all along — that new technologies would keep online search competitive and that the Justice Department was taking a hopelessly outdated view. But a federal judge ruled last year that the company illegally monopolized the market, in part through agreements like the Apple deal. Alphabet stock fell more than 9% yesterday as investors see the risk to its cash cow: Google search accounts for more than half of Alphabet’s revenue. The question now for Google is whether its own AI assistant, Gemini, is good enough to replace its legacy search engine. The risk for Sundar Pichai is that AI’s revolutionary punch came too slow to sway antitrust officials and too fast for Google’s engineers. |

|

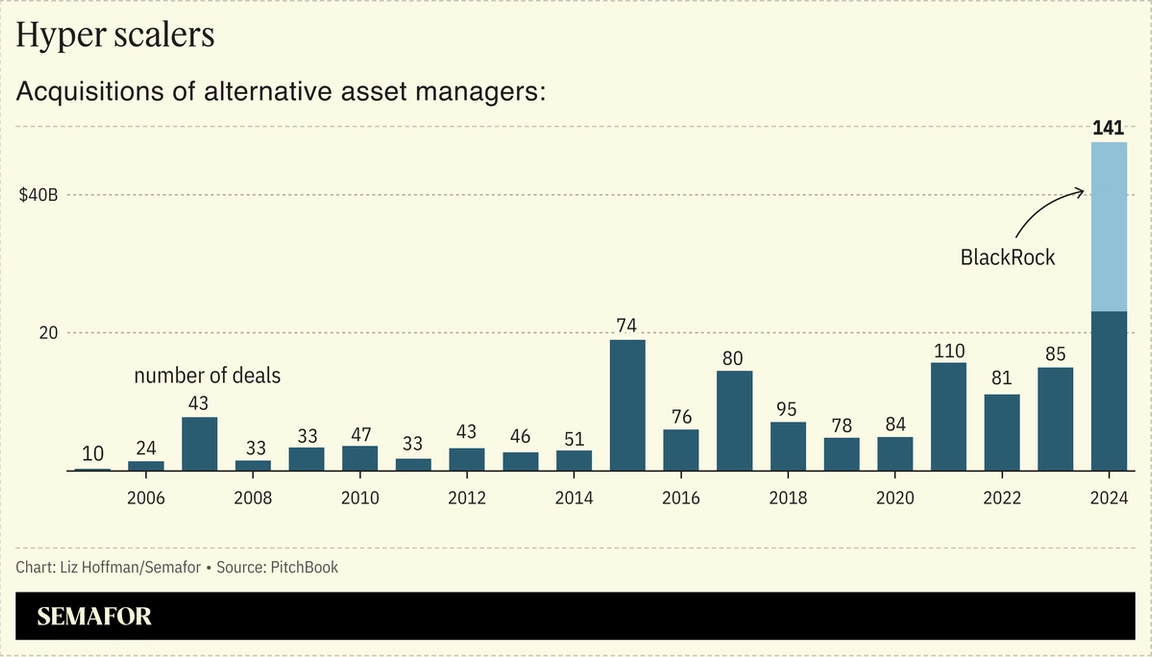

PE’s small players are getting squeezed |

Investment firm MidOcean Partners has been sounding out potential acquirers, people familiar with the matter said, the latest sign of just how tough the going is for subscale Wall Street shops.  MidOcean manages about $11 billion, making it a relative minnow in the world of private investments, where Blackstone’s $1 trillion leads the pack and even $50 billion can be seen as too small. HPS’s $100 billion-plus wasn’t enough to convince IPO investors it could make it alone, resulting in its (fully priced, to say the least) sale to BlackRock last year. MidOcean declined to comment. “You’re seeing this concentration of where the dollars are going to the big players,” Advent managing partner John Maldonado told me recently, noting that more than half of private-equity fundraising dollars over the previous year had gone to the 20 largest firms. Smaller shops have two choices: Be really good, ideally at a niche strategy that’s tough for others to replicate, or find a buyer. Recent deals include Clearlake’s acquisition of MV Credit ($5 billion in assets) and Blue Owl-Atalaya ($10 billion). Mathieu Chabran, co-founder of Tikehau, a €50 billion French investment firm, told me this week at the Milken conference that he had 85 companies on his own list of potential takeovers. |

|

Airwaves auction gains backers, but who’s bidding? |

A major part of the Trump administration’s plan to sell national assets is moving forward, with consequences for big telecom companies. Republicans are working to authorize an auction of wireless spectrum as part of the “big, beautiful bill” that would enact the president’s domestic agenda. Renewing the Federal Communications Commission’s ability to license out airwaves is the first step towards opening up tens of billions of dollars worth of spectrum, currently reserved for the Defense Department, for commercial use. Proponents including Sen. Ted Cruz say it could raise $100 billion that could be used for border security. It’s part of a broad push from the White House to privatize huge swaths of the economy — what Treasury Secretary Scott Bessent has called “monetizing the US balance sheet.” The idea is to sell off, borrow against, or otherwise slap a price tag on everything from gold reserves to government buildings to national art collections and grazing lands, while pushing thousands of federal workers into “higher productivity jobs in the private sector.” The idea is gaining purchase with financiers, even those not ideologically aligned with much of the White House’s agenda. “You think about the Grand Canyon or the White House, things like that that are out there that are part of our nation,” Ariel Investments co-CEO John Rogers told Semafor last month. “The value of those assets have grown and compounded over the years.” The questions now around a potential spectrum auction: Who’s bidding? And will the taxpayer actually benefit? AT&T, Verizon, and T-Mobile spent a combined $81 billion at the FCC’s last auction, in 2021, and have borrowed heavily in recent years to pay for a broader spectrum buildout, begging patience from their shareholders. Now that stock buybacks and dividend growth have restarted, there’s little appetite among investors for a fresh round of capital spending.  The Congressional Budget Office has estimated that an auction could bring in $80 billion, according to several industry lobbyists familiar with the numbers. But that doesn’t account for the cost to the Defense Department to move its systems to a new wavelength, which a DoD official testified in 2023 could be more than $120 billion and take 20 years to pull off. — Rohan Goswami |

|

Al Lucca/Semafor Al Lucca/SemaforBill Gates said he’s “horrified” by the cuts to US foreign aid and that even his plans to give away most of his $200 billion fortune, which he discussed in an interview with Semafor, won’t be enough to compensate. “I’m still quite optimistic about what we can do in the next 20 years, even though I’m horrified about where we find ourselves with these aid reductions,” Gates said, referring to both the dismantling of USAID and belt-tightening by wealthy European nations that are now turning inward. Gates, who along with his ex-wife, Melinda French Gates, has championed global health aid, is nearly alone among the billionaire class in criticizing Trump’s cuts and putting his own cash into the gap. — Yinka Adegoke |

|

Join Anthropic Co-Founder Jack Clark, World Labs CEO Dr. Fei-Fei Li, Booking Holdings CEO Glenn Fogel, and Singapore Economic Development Board Executive Vice President Ih-Ming Chan for a discussion on the breakthroughs driving AI and why building the policy frameworks governing them is more important than ever. May 21, 2025 | San Francisco, CA | Request Invitation |

|

➚ BUY: TikTok. Comedian Hasan Minhaj headlined ByteDance’s version of upfronts, telling advertisers that TikTok continued to be an unrivaled cultural juggernaut. Even as executives contend with the possibility of a US ban, they still have to compete for advertiser dollars. ➘ SELL: Tick tock. Omega-owner Swatch is facing an unusual shareholder mutiny: a small investor is jousting for a board seat at the company’s upcoming AGM, accusing the controlling family of running the business solely for their own benefit. |

|

Companies & Deals- Butts in seats: BlackRock will require its more senior employees to be in the office five days a week, as more companies scrap their flexible working policies, the Financial Times reported.

- Gulf course: Disney will open a theme park in Abu Dhabi, its first in the Middle East. The park will be financed and built by an Emirati company, according to CEO Bob Iger, who dialed into the company’s earnings call from Abu Dhabi. The Gulf has become a magnet for Western companies, especially as high hopes for China as a top international market have faded.

- K Street: Band-Aid maker Kenvue has a new finance chief with M&A chops. Amit Banati helped shepherd the biggest deal of 2024 — Kellanova’s $36 billion sale to Mars — and his appointment comes as Kenvue, which spun off from J&J in 2023, contends with at least three separate activist investors and is widely seen as a likely participant in the consolidation reshaping the food industry.

|

|

|