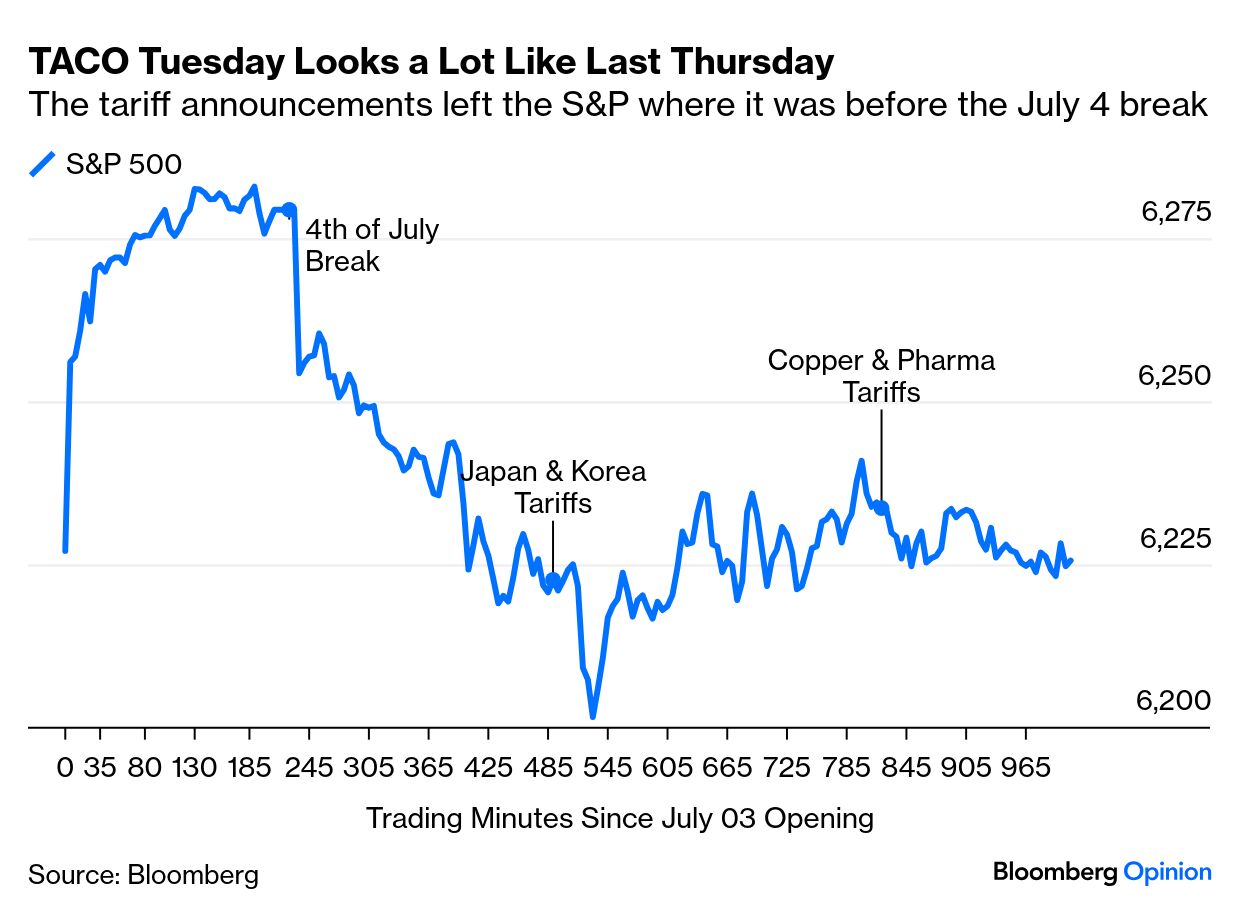

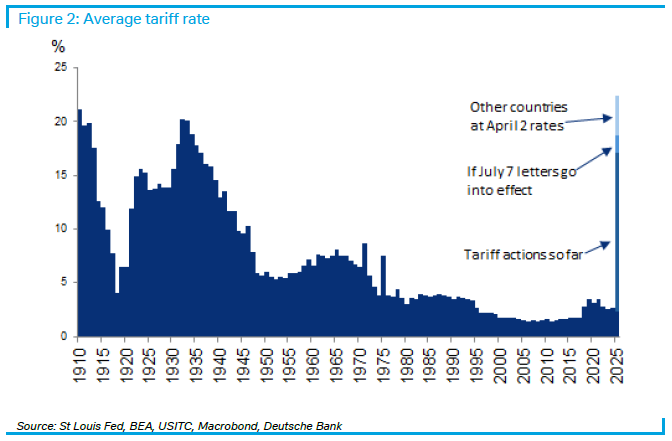

| More drama on trade policy has been met by a continuing absence of drama in the markets. The 90-day pause on the Liberation Day tariffs concluded with President Donald Trump telling reporters at a cabinet meeting that he would levy tariffs of 50% on copper and 200% (!) on pharmaceuticals. In response, US stocks carried on with one of their dullest trading days this year. The S&P 500 closed down 0.07% on TACO Tuesday, exactly where it started the last day before the Fourth of July weekend:  Even a presidential assertion that there would be no further extensions after the new Aug. 1 deadline had minimal impact. That ought to be a big deal. If the tariffs indeed go ahead exactly as announced, then the average rate on all US imports will be its highest in a century, back to levels last seen during the Depression-era Smoot-Hawley Act. If the countries whose tariffs haven’t been announced yet also see rates in line with what was unveiled on April 2, then overall levies will be the greatest since the era of Trump’s favorite president, the arch-protectionist William McKinley (in office from 1897 to 1901).  An effective rate of close to 20% would be far worse than what was expected at the turn of the year, exceeding anything Trump explicitly promised during his campaign. Equity traders, however, seem to be coalescing around lower rates than this, implying confidence in significant climbdowns, presumably in return for substantial concessions from other countries. A poll of traders by Barclays Equity Strategies’ Alexander Altmann found virtual unanimity that the effective rate will settle above 10% (and therefore its highest since the Second World War): And yet, investors made little of this, while journalists couldn’t decide what exactly had happened as the president talked tough without committing to anything. These headlines (from the Financial Times, New York Times, and Bloomberg) are all accurate, and show how muddy the waters are: Trump Renews Threat to Hit Trading Partners With Steep Tariffs Trump’s New Trade Threats Set Off Global Scramble to Avoid Tariffs Latest Tariff Pause Shows Limits of Trump’s Frenzied Dealmaking Trump’s words did massively effect the sectors most directly specified. This is how the prices of the S&P 500 pharmaceuticals sector and copper moved Tuesday. You can see when Trump spoke: The move in copper verged on the historic. Futures rose more than 10%, the first time they’d done so since the Global Financial Crisis in October 2008: Copper is an important commodity, vital in many industries, and is now at an all-time high. Whether or not 50% levies are eventually imposed, Trump’s threat profoundly affected anyone who wants to buy or sell copper now. There’s a broader question over the potential economic impact that tariff uncertainty could have. Worries have quietened somewhat due to the lack of any serious economic downturn in the three months since the Liberation Day levies were announced. But it would be unwise to bank on this — particularly when investors have left no room for error by bidding the S&P 500 up to a record. “Maybe these tariff headlines are fake news,” says Peter Tchir of Academy Securities, “but at the all-time highs, that is a mighty big assumption.” That said, it is a sensible base case: The messaging from both the president, but particularly from Bessent, seem to be guiding to “more negotiations” into a “newish” August “sort of” deadline. Given prior pauses, extensions and pullbacks, it is reasonable for the market to assume that the latest round of tariffs (via letters) won’t amount to much (it was incredibly difficult not to include a joke about the post office losing the letters in the mail).

And while investors, able to move money within seconds, stay relaxed, corporate managers don’t have that luxury. They need to grow accustomed to a world in which trade policy is not set by agreed rules or accepted institutions. The World Trade Organization oversees just these issues. It is still in business, but the US has no interest in using its services.  The Codelco El Teniente copper processing facility in Machali, Chile. Photographer: Cristobal Olivares/Bloomberg Dan Wales, director of economic research at Fulcrum Asset Management in London, argues that a regime that can change trade policy from day to day can have a chilling economic effect. “A flexible tariff world doesn’t help anyone. People need to be able to plan for the prices or goods,” he says. “If you have a flexible tariff, it isn’t the same as a change in the exchange rate.” That problem is compounded by communication strategy, or lack of it, and the fact that decision-making resides completely with the president himself, whose opinions are almost impossible to second-guess. To quote Sir Ivan Rogers, a former UK trade representative and now of Fordham Global Foresight: US trade policy bottom lines remain largely opaque to partners because they depend on the president himself, and he is surrounded at court by different factions with different objectives. Who spoke to him most recently can be decisive. All partners are struggling to work out what most counts to President Trump personally.

The problem for the rest of the world, although not for the US administration, is Trump’s political strength after a string of victories. In this video, Ale Lampietti outlines just how much political capital he now has:  Trump was prompted into the 90-day pause by the “yippy” bond market. The swift rise in yields in the week after Liberation Day threatened to make it far harder for the US to fund its deficit, forcing a rethink. That strengthened the notion of a “Trump Put” — a level for the market at which the president would back down on unpopular policies. That subsequently morphed into TACO (Trump Always Chickens Out).

Now, with stocks strong, and bond yields and the dollar at levels that the White House finds comfortable, there’s room for the president to incur some unpopularity before a “put” is reached. Indeed, consumer worries that tariffs would cause more inflation also appear to be dissipating and removing another source of political pressure. The latest survey of consumer inflation expectations by the Federal Reserve Bank of New York, released Tuesday, showed forecasts right back to 3%, the top of the Fed’s target range:  At this point, it’s the economy, and not financial markets, that will need to shift to change trade policy. The Trump Put is now a number for inflation, rather than bond yields or share prices. Bob Elliott, CEO of Unlimited Funds, argues in his Nonconsensus newsletter: This creates a bit of a policymaking and markets paradox. Without clear macroeconomic impact, markets have pushed to new highs on the post-Liberation Day TACO trade. But without market or economic pain feedback, the admin is getting more aggressive.

The tariffs in force to date have not, yet, inflicted any serious negative consequences. And the events of the last two days have been performative more than anything else. Viktor Shvets of Macquarie even draws a comparison with professional wrestling (of which the president is famously a devotee): World Wrestling [Entertainment, or WWE] features what appear to be vicious fights that are purely performative with ultimate outcomes often predetermined... entertainment, not competitive sports or wars. These are as good examples as any for the ongoing havoc: not conventional negotiations (legally binding long-term agreements around which businesses can plan), but what can be described as vague temporary ceasefires. The chaos is likely to endure until there is evidence of damage done to the US economy.

A vicious but performative model. Photographer: Rich Freeda/WWE/Getty Performative anger like this should chill economic activity. Just look at Tuesday’s move in copper, with a big real-world change in conditions following an off-the-cuff threat. But for now, the market thinks it can ignore the tariff drama as easily as WrestleMania. Every so often, wrestlers get seriously hurt, even though the sport is scripted. It’s impossible to remove all risk when big men throw each other across a ring. Similar arguments apply to tariffs. Much rides on the notion that the US can take trade policy backward a century without breaking anything. |