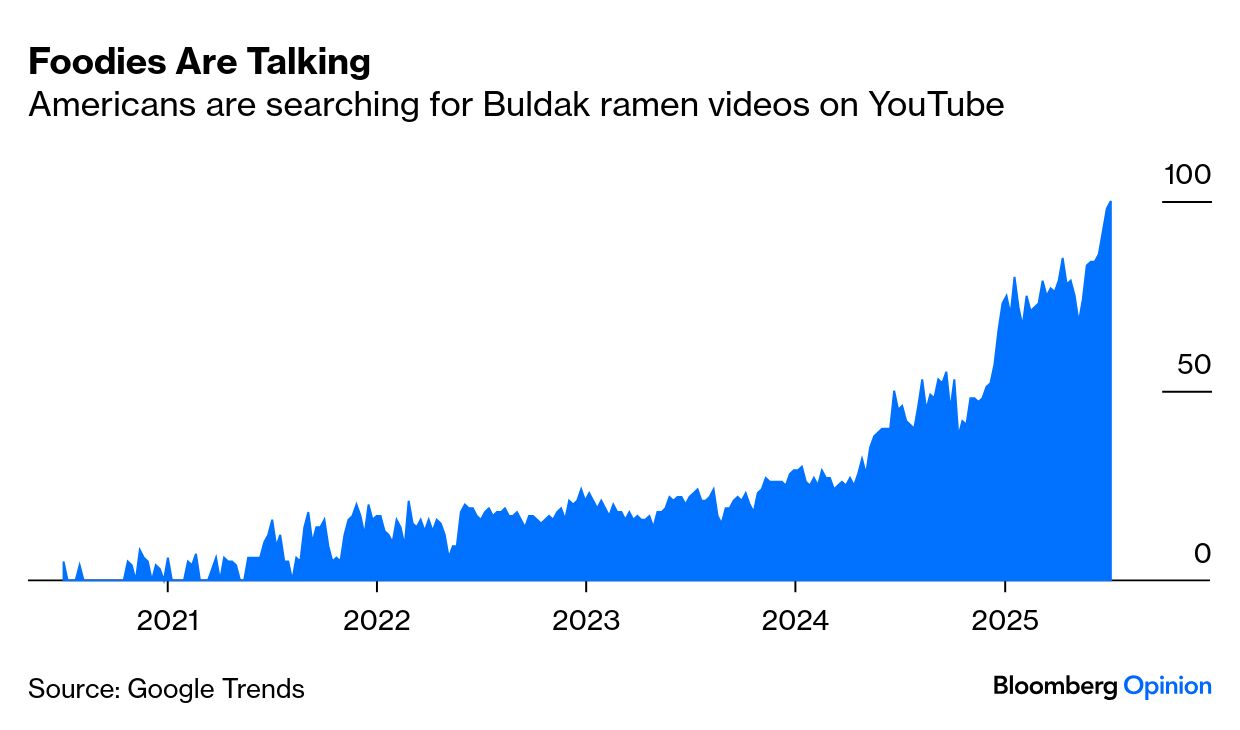

| This is Bloomberg Opinion Today, a concentrated concatenation of Bloomberg Opinion’s opinions. Sign up here. You Thought the Price of Computing Was Going Down? | I’ve always accepted Moore’s Law as a comfortable truth, very much worth holding. Formulated in 1965 by George Moore, the co-founder of Intel Corp., it posited that because the number of components on a single chip doubles every two years as a result of advances in miniaturization, the same amount of money will get you greater computing power. The price of cybernetic advancement will therefore go down. That’s been true of semiconductors for decades. It does not, however, apply to the humans who devise all the technological process — as demonstrated by the revelations of what Mark Zuckerberg is willing to pay AI pioneers to abandon their employers and come over to Meta Platforms Inc, the home of Facebook, Instagram and WhatsApp. Take Ruoming Pang, who was in charge of Apple Inc.’s AI models team. Zuckerberg snagged him with an apparent pay package of more than $200 million. It all seems part of the Facebook founder’s attempt to win a potentially profitable prestige war. As Parmy Olson says, “he’s now created momentum among other leading scientists who see his team as having a statistically higher chance of building ‘super-intelligent’ AI systems before anyone else.” Meta’s the place to be if you want to make history. Catherine Thorbecke points out that many of the AI scientists Zuckerberg has poached — including Pang — are Chinese nationals working in the US: “Eight out of the 12 new recruits to the Meta Superintelligence Labs team graduated from universities on the mainland before pursuing careers abroad. It means that a key driver of the global AI race is an intense scramble for the people building it: Chinese talent.” She says Beijing is well aware of this trend and, even though Xi Jinping intends to win the global AI race, the People’s Republic isn’t panicked. Citing a Stanford researcher, she says, “China looks at international experience less as a brain drain and more as a way for researchers to acquire knowledge before returning home, the Stanford paper said. The US ‘may be mistakenly assuming it has a permanent talent lead.’” DeepSeek’s dramatic (and cost-effective) breakthrough earlier this year was made with homegrown talent. One of Meta’s major recruits is Alexandr Wang (yes, he spells his first name that way). The company he started — Scale AI — was worth billions even before Meta paid $14.8 billion for a 49% stake in it and made Wang the Superintelligence co-lead along with Nate Friedman, former head of GitHub. Wang is the son of Chinese physicists who moved to Arizona, where he was born in 1997 (yes, he’s only 28). That means he’s a true blue American citizen, until someone tinkers with the definition. No Tsunami, But This Happened... | A week ago, even skeptics wouldn’t go 100% against the cataclysm that a manga artist made back in 2021 — that a huge earthquake would devastate Japan on July 5, 2025. A series of minor tremors were roiling one part of the archipelago, so people were nervous. The country is always expecting the “big one.” Ryo Tatsuki was also credited — if that’s the word — with accurately prophesying the March 2011 earthquake-and-tsunami that did lay waste to the east coast of the country. Expecting nothing to happen (with fingers crossed), Gearoid Reidy wrote on July 1 that people would “will just shrug and move on, perhaps a little embarrassed for having believed it, or a little better prepared than they otherwise would have been.” Of course, there was no natural catastrophe on July 5. However, two days later, Japan’s leaders received a stunning message. The US was imposing tariffs on Japan. Prime Minister Shigeru Ishiba, said Gearoid, is “entitled to be furious.” He explains: “Japan was among the first countries to begin talks after April’s ‘Liberation Day’ tariff announcement. It has spent months in negotiations, with Ishiba’s envoy making seven trips to the US for talks with Trump and other officials. The nation has been the largest investor in the US for the past five years and is a crucial security ally. All that only to end up with a tariff rate 1 percentage point higher than first proposed three months ago.” With 25% duties, I worry about my fellow foodies in the US having to pay up for the fish flown in exclusively from Japan. But Tokyo has been humiliated. “To add insult to injury,” says Gearoid, “Japan was lumped in with countries that are far less vital partners, including Kazakhstan and Myanmar.” So much for that special relationship. “Samyang Foods Co., the manufacturer of ‘Buldak’ ramen, has gained 93% this year. Trading at 26 times forward earnings, it boasts $8.1 billion market cap … Buldak, which translates to “fire chicken” in Korean, is not for the fainthearted. With its debut in 2012, Samyang introduced a level of spice previously unseen in the instant ramen market. It has roughly the same heat level as jalapeño peppers. Last year, Denmark briefly recalled the fiery ramen for being too spicy. ... Buldak has become an object of fascination for social media influencers who might enjoy truth-or-dare antics. The carbonara version, in particular, resembles the boxed macaroni and cheese Americans grew up with — with a kick.” — Shuli Ren in “Why Buldak Ramen Is an $8 Billion Brand.”  “More than three years after a bubble in psychedelic drug stocks burst there are signs that the bad trip for investors is over. Confidence and capital are tentatively returning to this pioneering sector amid encouraging trial data and as senior Trump administration officials signal openness to utilizing these mind-altering drugs to tackle mental health conditions such as depression. But to regain past stock market highs, psychedelics companies must also demonstrate commercial viability; not easy when patients consuming hallucinogens such as psilocybin (the active ingredient in magic mushrooms) and LSD might require supervision for between six and 12 hours.” — Chris Bryant in “Quicker Psychedelics Offer Investors a Better Trip.” Brazil’s big gift from the White House. — Juan Pablo Spinetto Ukraine needs a rescue, not recovery. — Marc Champion Core Scientific plus CoreWeave gets a dumb answer. — Chris Hughes Why chairing BP is a thankless task. — Javier Blas Private school tax breaks aren’t a human right. — Matthew Brooker Should companies borrow to buy crypto? — Lionel Laurent Central Banks are flying blind on hedge funds. — Paul J. Davies Walk of the Town: Bristol When It Sizzles | The train from Paddington Station in London to Bristol takes less than two hours, but I’ve always struggled with the online services of the Great Western Railway. It may be the historic descendant of the pioneering line that linked the capital and the port city, but it’s inefficient and unfriendly. So I wasn’t in a good mood on the way to Bristol — and it was a very hot Friday, and there were many hills to climb in the city.  A hilltop view of Bristol. Photograph by Howard Chua-Eoan/Bloomberg But I like Bristol, and an additional draw was a new Korean restaurant. Why get on a train for nearly two hours when there are perfectly fine Korean restaurants in London? That’s because the cooking at Dongnae and its older sibling Bokman is wonderfully done and seductively good, produced with delicious craft. The thought of kongguksu (chilled soy noodle soup) at the end of my journey was enough to make the heat tolerable.  The kongguksu at Dongnae in Bristol. Photograph by Howard Chua-Eoan/Bloomberg Back in New York, Korean food was perhaps my favorite cuisine. London’s comes close, though it’s not quite the equal of Gotham’s. Bristol’s is. Now, if only there were a different train to take. Out of the frying pan, into the water.  “You were expecting tariffs?” Illustration by Howard Chua-Eoan/Bloomberg Notes: Please send precautionary tales and feedback to Howard Chua-Eoan at hchuaeoan@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |