| Stablecoin bill set for final passage |

| |

| This is Washington Edition, the newsletter about money, power and politics in the nation’s capital. Every Monday, Bloomberg Intelligence senior analyst Nathan Dean gives his insights into what’s been happening and what’s coming up in the nooks and crannies of government and markets. Sign up here and follow us at @bpolitics. Email our editors here. | |

| |

| For the last two weeks, my family and I have been running around Finland – saunas, midnight-sun hiking, eating too much of the lovely cinnamon bread called Korvapuusti – but at the same time, I’ve been preparing for what comes next now that the “One Big Beautiful Bill” has passed. Let’s first talk crypto. Years of lobbying and legislative efforts will likely pay off as Congress kicks off “crypto week.” Most significant to us is the GENIUS Act, a bill that would allow stablecoin issuers like Circle to operate under a regulatory framework. Here’s Bloomberg News’ Yash Roy with more on the expected House vote. Since it already passed the Senate, this bill should reach President Donald Trump’s desk this week. Yet I can’t say the same for a broader crypto market structure bill called the CLARITY Act. This bill, important for platforms like Robinhood and Coinbase, would also bring regulatory clarity. But while there was bipartisan agreement on stablecoins, as I write here on the Bloomberg terminal, this bill needs more time to cook. It’ll pass the House, but the Senate may need more time. It looks to me that passage is feasible in the first half of 2026. We should also talk about deregulation. Like I’ve said before, there’s no magic wand here. There’s a process. And that process will largely kick off in the second half of 2025 now that leaders like Fed Vice Chair for Supervision Michelle Bowman are confirmed. So whether it’s the leverage ratio for banks or relaxing of broadcaster caps, deregulation is coming. Here’s our most recent “Votes & Verdicts” podcast where my colleagues and I discuss what rules and regulations you should have on your radar for the rest of the year. Tidbits | |

| |

| Trump threatened to impose stiff financial penalties on Russia if it does not end hostilities with Ukraine, while pledging fresh weapons supplies for Kyiv. The president will announce $70 billion in artificial intelligence and energy investments tomorrow in Pennsylvania, the latest White House push to speed up development of the emerging technology. Trump indicated he is open to more trade negotiations, including with the European Union, even as he insisted that his letters threatening new tariff rates are “the deals” for US trading partners. Economists have long been warning of a tariff-driven boost to US inflation. The next report on consumer prices, which comes out tomorrow, will put their conviction to the test. Federal Reserve Chair Jerome Powell has requested that the central bank’s inspector general review its $2.5 billion building renovation, which has come under attack from Trump and his allies. A divided Supreme Court let Trump resume dismantling the Department of Education, lifting a lower court order that required the reinstatement of as many as 1,400 workers. Harvard University warned that the combined cost of federal actions against the school, including a recently passed tax increase on its endowment, could approach $1 billion annually. Attorney General Pam Bondi has fired the Justice Department's top official responsible for counseling senior political appointees on ethics matters, including financial disclosures and conflicts of interest. The ink is barely dry on Trump’s $3.4 trillion tax and spending package and House Republicans are already at work on a follow-up budget bill coming this autumn. Trump’s head of the Federal Trade Commission, Andrew Ferguson, had echoed the tough-cop message of his controversial predecessor Lina Khan, but his approach in office is more nuanced. Cuba’s crucial and struggling tourism industry was hit with more US sanctions, as the Trump administration ratchets up pressure on the communist-run island and its top officials. | |

| |

| Today on Bloomberg Television’s Balance of Power early edition at 1 p.m., hosts Joe Mathieu and Kailey Leinz interviewed retired Rear Admiral Mark Montgomery about US plans to ramp up arms sales to Ukraine and Russia's continued attacks on the country. On the program at 5 p.m., they talk with Democratic Senator Jeanne Shaheen of New Hampshire about the president's decision to send more weapons to Ukraine and what's ahead in Congress. On the Big Take podcast, host Sarah Holder and Bloomberg’s Kara Carlson examine what the disaster in Kerr County, Texas, reveals about the growing risk of flooding across the country as the climate changes — and the difficult economic choices facing communities grappling with these new risks. Listen on iHeart, Apple Podcasts and Spotify. | |

| |

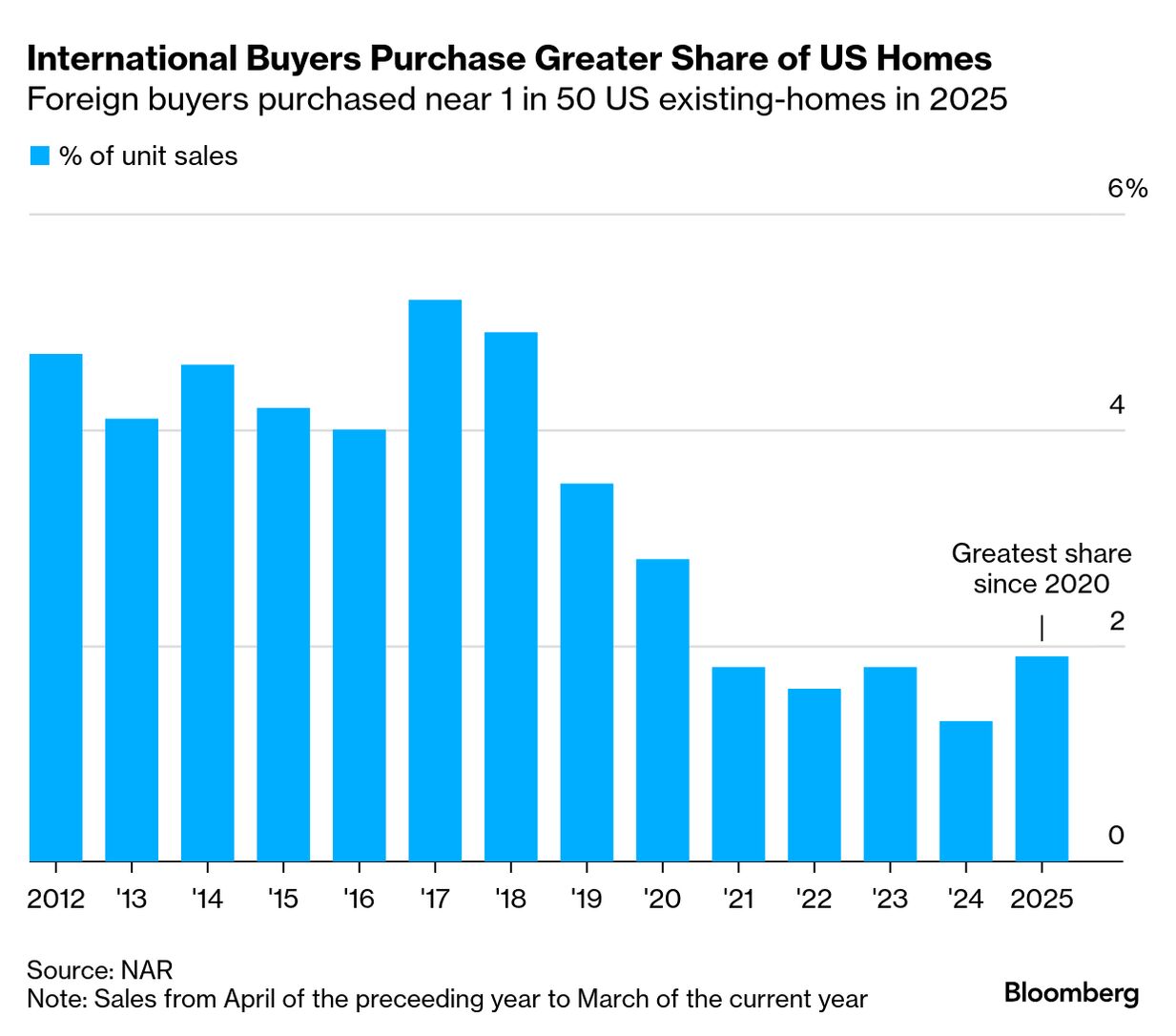

While many Americans may feel despondent about the US housing market, it continues to entice a large number of foreign buyers. In the 12 months ending in March, 78,100 properties were purchased by buyers beyond US borders. While down substantially from pre-pandemic years, the figure is up 44% from April 2023 to March 2024. Foreign buyers accounted for 1.9% of existing home sales, and they’re purchasing more expensive homes. The median price was $494,400, compared to $408,500 overall — and near half of foreign buyers made an all-cash purchase. Compared to prices in the central business districts in many other countries, prices in most US metro areas are significantly less expensive. Asian buyers, particularly from China, remained the largest group of buyers, according to the National Association of Realtors report. The share of Asian buyers was 38% (15% of the overall total were from China), Latin American buyers purchased 28%, Canadian buyers accounted for 14%, and European buyers 11%. — Alex Tanzi | |

| |

| The consumer price index data for June will be released tomorrow. The producer price index for June will be reported Wednesday. Retail sales in June will be reported on Thursday. June’s import price index also is set for release Thursday. Housing starts and building permits for June are out on Friday. The University of Michigan’s preliminary reading of consumer sentiment in July will be released Friday. Sales of existing homes during June will be reported July 23. New home sales in June will be reported July 24. Durable goods orders for June will be released July 25. | |

| |

- The Department of Veterans Affairs used dubious methods to meet cost-cutting goals like claiming credit for canceling contracts that already had been canceled or had expired, according to the New York Times.

- Newly unearthed documents show the CIA hid its involvement with a group of Cuban dissidents who had interacted with Lee Harvey Oswald in the months before President John F. Kennedy's assassination, the Washington Post reports.

- FEMA repeatedly granted exemptions to Camp Mystic in Texas to remove buildings from areas deemed vulnerable to extreme flooding in the years before the deadly flash flood that swept away children and counselors, the Associated Press reports.

| |

| Like Washington Edition? Check out these newsletters: - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- California Edition for a weekly newsletter on one of the world’s biggest economies and its global influence

- FOIA Files for Jason Leopold’s weekly newsletter uncovering government documents never seen before

- Morning Briefing Americas for catching up on everything you need to know

- Balance of Power for the latest political news and analysis from around the globe

Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Washington Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |