| | The state’s biggest-ever test of ‘virtual power plants’ was a success.͏ ͏ ͏ ͏ ͏ ͏ |

| |   San Francisco San Francisco |   Kyiv Kyiv |   Kigali Kigali |

| Net Zero |  |

| |

|

- Battery breakthrough

- Africa’s nuclear ambitions

- Energy war resumes

- Wildfires burn insurance

- Wall Street dumps fossil fuels

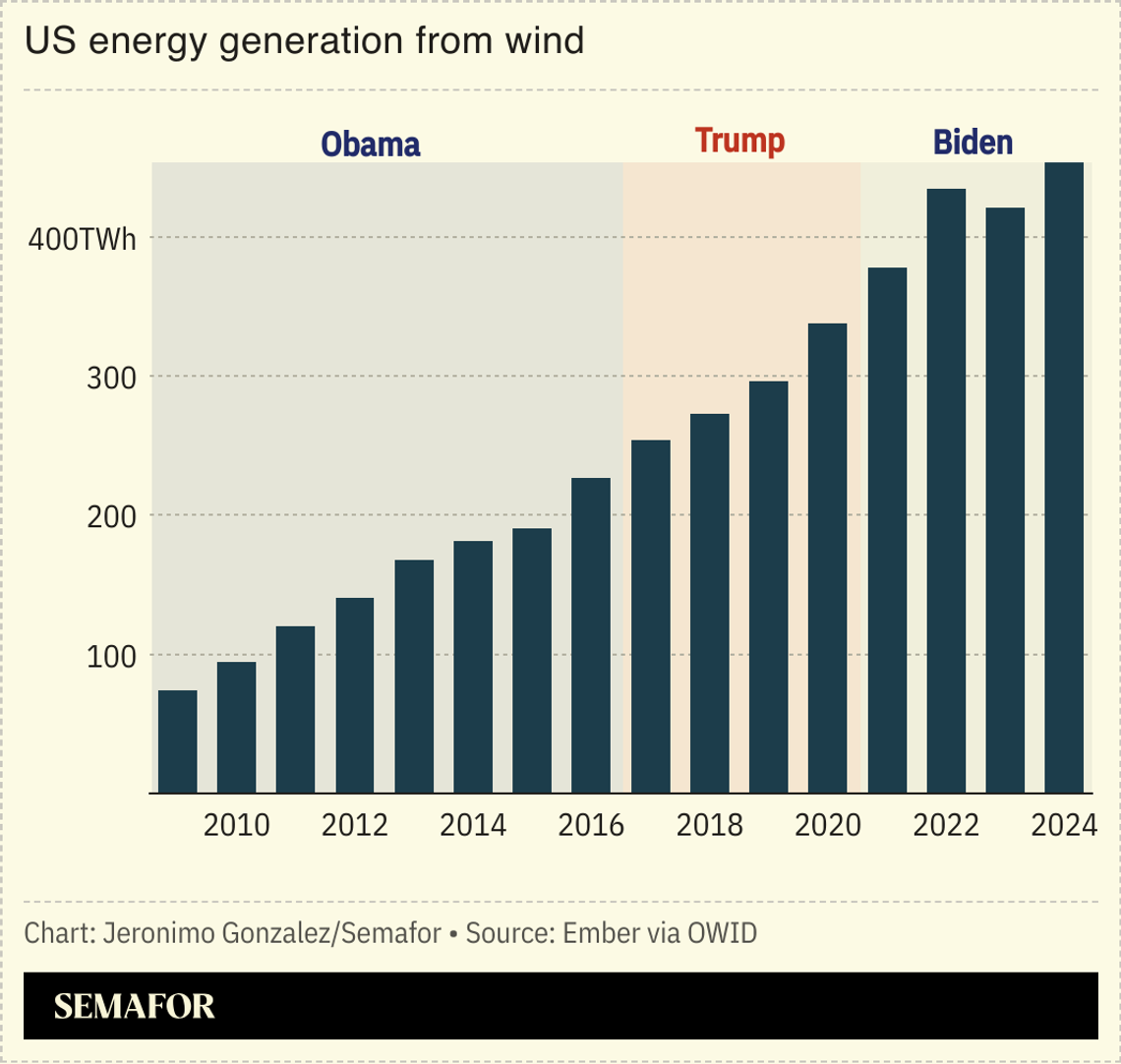

Trump throws up new roadblocks to wind energy and to a global plastics treaty. |

|

The Trump administration has a new beef with renewable energy: It takes up too much space. One of the Interior Department’s latest rules for evaluating whether to approve energy projects on federal land will focus on “energy density,” a metric that supposedly captures how much power a project can produce per acre of land it occupies. Secretary Doug Burgum, in describing his agency’s attitude toward renewables, has complained they are “gargantuan;” an agency spokesperson told The New York Times that “evaluating land use efficiency and environmental impact isn’t partisan, it’s responsible governance.” It strikes me as a strange complaint. Clearly, a wind or solar farm could indeed be larger, per megawatt, than a typical coal or gas-fired power plant. But it’s not clear that the US is running out of acres for power projects, all else being equal. And if it is, looking at just the footprint of the power station is myopic: Renewables currently occupy no more than 2 million acres of federal land. Onshore oil and gas drilling leases occupy 24 million acres; coal mining occupies a further 405,000. Fossil fuels also need a lot of big pipelines, trains, roads, and ports to move them around. Not all acres are equal, of course, but there are myriad existing laws to protect areas that are sensitive for ecological, cultural, or other good reasons. And it’s not clear why size, per se, should be a decisive factor: Proximity to natural resources and to demand centers, transmission networks, cost, and speed to construction, not to mention climate impact, all seem like much more important considerations for what kind of power station to build in a given place. A broader issue with Interior’s crackdown on renewables is that it exacerbates what has always been the most widely held bipartisan complaint about US energy project development: There’s too much red tape. Now, there’s more than ever. It also, as Sen. Lisa Murkowski (R-Alaska) noted recently, smacks of “picking winners and losers,” which was supposed to be Democrats’ recurring transgression. Time will tell if other actions by the Trump administration can succeed in speeding up the construction of power capacity, regardless of flavor; for now, the main effect seems to be slowing it down. |

|

California’s virtual power plant success |

| |  | Tim McDonnell |

| |

Patrick T. Fallon/Reuters Patrick T. Fallon/ReutersCalifornia’s biggest electric utility pulled off a record-breaking test of cutting-edge grid technology that should make powering the data center boom and avoiding heatwave blackouts cheaper, easier, and greener. The groundbreaking test, carried out with Tesla and the top US rooftop solar installer, will help keep the state’s clean energy momentum going despite the Trump administration’s crackdown on renewables. On a hot Tuesday last week, during the 7pm-9pm window that is typically its time of peak demand as people come home from work and turn on appliances, Pacific Gas & Electric switched on residential batteries in more than 100,000 homes and drew power from them into the broader statewide grid. The purpose of the test — the largest ever in the state, which has by far the most home battery capacity in the US — was to see just how much power is really there for the utility to tap, and to ensure it could be switched on, effectively running the grid in reverse, without causing a crash. The result, which the research firm Brattle published this week, was 535 megawatts, equal to adding a big hydro dam or a half-sized nuclear reactor at a fraction of the cost. “Four years ago this capacity didn’t even exist,” Kendrick Li, PG&E’s director of clean energy programs, told Semafor. “Now it’s a really attractive option for us. It would be silly not to harness what our customers have installed.” So-called “virtual power plants” — networks of customer-owned assets that utilities can control as an alternative to building new traditional power plants — are the solution to a lot of the biggest problems facing the US power system. |

|

Africa’s nuclear ambitions |

| |  | Prashant Rao |

| |

Ghana and Rwanda are leading the race to deploy Africa’s first small modular nuclear reactors, the head of the industry’s main global trade group said in an interview. South Africa is the only African country with its own nuclear power plants, and Egypt is building its own, but both are large-scale, traditional facilities. And while several nations on the continent have expressed interest in deploying SMRs — newer technology that is more easily built and scaled — Accra and Kigali have taken the most aggressive steps to build such sites on their territory, Sama Bilbao y León, the director general of the World Nuclear Association, told Semafor. “We are going to need money, we are going to need supply chains, we are going to need work force, we are going to need many things to develop nuclear” in Africa, the career nuclear physicist said. “But the number one thing that we need is visionary leadership that knows, that has a plan, and moves forward.” |

|

Sofiia Gatilova/Reuters Sofiia Gatilova/ReutersUkraine and Russia ramped up attacks on each other’s energy infrastructure as a deadline approaches for Moscow to agree to a ceasefire deal or face new US sanctions. Energy attacks have slowed considerably from their peak last year, after a loosely followed energy truce was struck between the two countries in March. But early on Wednesday morning, Russian drones damaged a gas compressor station linking Ukrainian pipelines to an LNG import terminal in Greece, which had been used to receive gas from the US, according to Ukraine’s state-owned company Naftogaz. Other recent attacks have targeted gas production fields and oil refineries, and the UN’s nuclear power watchdog warned of explosions near the occupied Zaporizhzhia nuclear plant. Ukraine, for its part, has stepped up long-range drone attacks on Russian oil depots and refineries, which could drive up the cost of fuel for Russians. Ukrainian special forces may also have played a role in a string of recent mine attacks on Russian “shadow fleet” oil tankers. In a statement on Tuesday, Ukrainian President Volodymyr Zelenskyy urged Trump to follow through with sanctions on buyers of Russian crude oil: “For Russia to move toward peace, it must run out of money for the war.” And Trump seems prepared to oblige, saying on Wednesday that he will double tariffs on India as a punishment for buying Russian oil. Whether all these physical and economic attacks will lend momentum toward a ceasefire remains to be seen: Trump is expected to meet with Putin next week, and could have a follow-up meeting shortly thereafter with both leaders together, The New York Times reported. |

|

Fires burn insurance plans |

Abdul Saboor/Reuters Abdul Saboor/ReutersWildfires across parts of Canada and the US, as well as blazes in southern France, caused significant damage and sparked warnings of the impact of extreme weather events. More than 500 wildfires were burning out of control in Canada, authorities there said, and around 81 million people in the US were under air quality alerts. In France, meanwhile, the prime minister described a “catastrophe on an unprecedented scale.” Changing weather patterns, driven in large part by climate change, are having serious financial consequences: The first six months of 2025 saw about $80 billion in insured catastrophe losses worldwide, the reinsurer Swiss Re said. “Wildfire risk is evolving… with changing climates compounding the loss threat that fires present,” it said. This item first appeared in Flagship, Semafor’s daily global affairs briefing. Subscribe here. → |

|

|

Wall Street dumps fossil fuels |

Eli Hartman/File Photo/Reuters Eli Hartman/File Photo/ReutersWall Street is falling out of love with fossil fuels, and showing more affection for renewables. Financing for oil, gas, and coal projects from the top six US banks fell to $73 billion in the first seven months of the year, down 25% from the same period last year, according to a Bloomberg analysis. The data, analysts say, show that banks have an “it’s complicated” relationship with the energy transition: While all these same banks have dropped out of net zero groups in the past year, they are clearly souring on the prospective returns from fossil fuel projects. Private equity investors, meanwhile, are increasingly piling into renewables. Dedicated infrastructure funds raised $134 billion in the first six months of the year, more than they raised in all of 2024. More than one-third of that was for renewable-focused funds, according to an analysis by the investment firm Generate Capital. “The fundamentals of the [renewable energy] market are just incredibly strong,” Logan Goldie-Scot, Generate’s vice president of research, told Semafor, because few other technologies are ready and able to meet the country’s surging power needs. But the economics of renewables will become more challenging as tax credits phase out, he said, so infrastructure investors feel they are under a ticking clock to get the best returns. |

|

New Energy Fossil FuelsTechPolitics & Policy- The US sent letters to various countries urging them to reject limits on plastic production and chemical additives in plastic, Reuters reported.

COP30 |

|

|