| Read in browser | |||||||

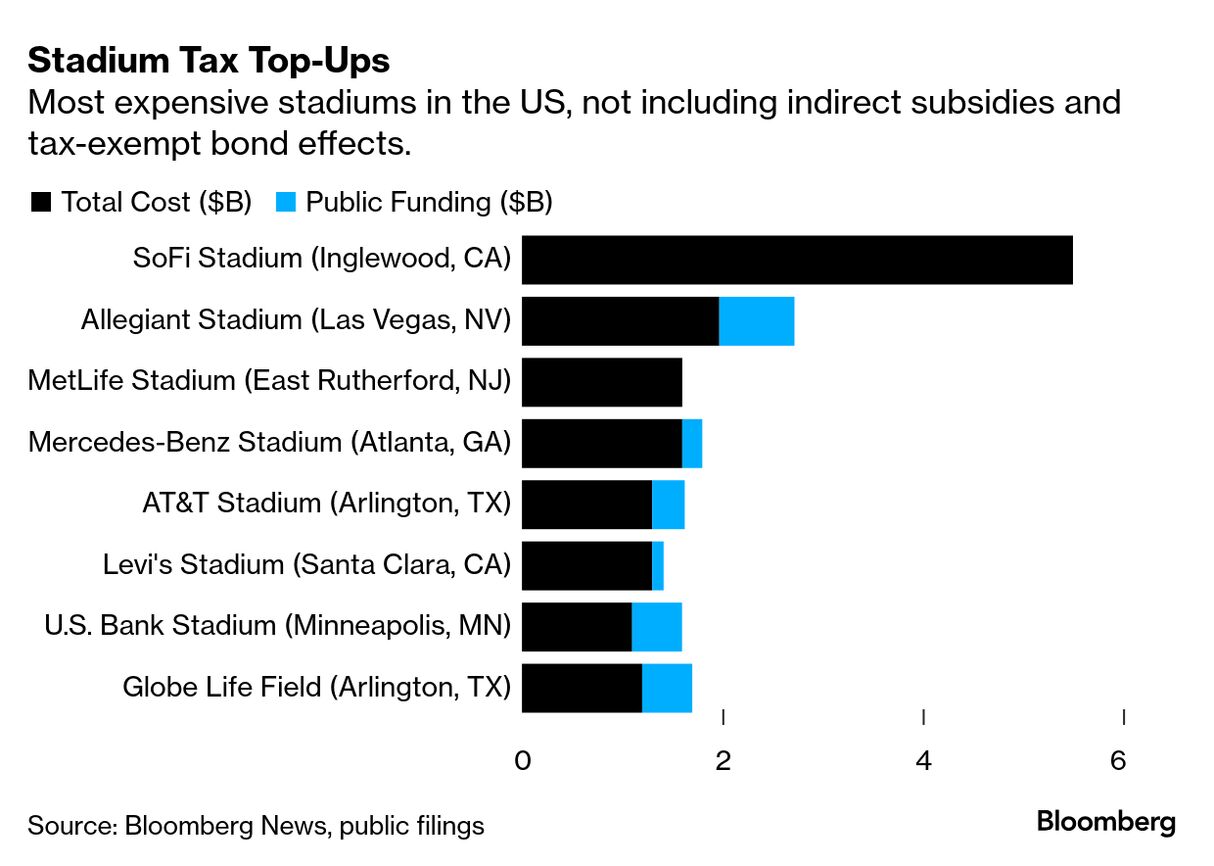

Welcome back to the Business of Sports. This week we ask what happened to a Saudi sports conference that was cancelled on its opening day, how much some new NFL stadiums could cost and the latest mess rocking the business behind college football. Also, check out how Golden State became the most valuable franchise in the WNBA. As always, send us any feedback, tips or ideas here. If you aren’t yet signed up to receive this newsletter, you can do so here. Read My Lips: “No New Taxes”What’s up folks. It’s Randall here to tell you that if you live in either Denver or Arlington Heights, Illinois, you’ll have a brand new multibillion dollar stadium in your town in the next five years. Congrats are in order to you all. Luckily for you Chicagoans and Denverites, the stadiums for the Bears and Broncos will come at no (new) cost to you. (Shocking, right?) “In the spirit of a true civic partnership, the Walton-Penner Family Ownership Group will privately fund this investment and work with the community, city and state to reconnect historic neighborhoods with no new taxes.” the ownership, Denver’s mayor and Colorado’s governor said in a letter announcing the deal.  Empower Field At Mile High in Denver. Its replacement is slated to open in 2031. Photographer: Jamie Schwaberow/Getty Images The key words there are “no new taxes,” so in other words, whatever you’ve been paying, you’ll continue paying it. The Chicago Bears are relocating from downtown Chicago to Arlington Heights. The team’s president and chief executive officer confirmed in a letter that their new stadium in Arlington Heights will be built without state funding for construction. They aim to finalize plans this year to submit a bid to host a Super Bowl as early as 2031.  Both letters address the desire for a dome and to host a Super Bowl. If you’re wondering why, it’d be difficult to have one without the other. Chicago in February is brutal, and Denver is colder than the Windy City, so Super Bowls without roofs in either city would be more frigid than Helheim. Now let’s talk money. The most expensive stadium ever built is SoFi Stadium in Inglewood, California, at $5 billion. Second is new Yankee Stadium at $2.3 billion, followed by the Las Vegas Raiders’ Allegiant Stadium at $1.9 billion. Josh Harris’ new building for the Washington Commanders will jump to second with an estimated cost of $3.8 billion. In Cleveland, the Browns are planning for a $2.4 billion home. The question now is where will the homes of the Bears and Broncos land? The Bears original plan would’ve seen a $3.2 billion stadium and $4.6 billion for the total surrounding amenities. I’d expect their new home to be closer to the Commanders price rather than the Browns based on their previous plan. I’ll say $4 billion total. I’m fascinated to see what the Walton-Penner group does. The last time a Walmart family built a stadium, they set records with SoFi. What does this side of the family tree do? I’ll bet the under and guesstimate $3.3 billion. As someone who spent 12 years in Aurora, Illinois, just typing Super Bowl week in Chicago or Denver is bringing me chills. Godspeed to us all when that time comes. ICYMI

Thanks for Visiting RiyadhPreparing the infrastructure for a football World Cup is a gigantic challenge, even more so now that FIFA has expanded the competition to 48 teams from 32 for next year’s event onwards. Plans for the Saudi version in 2034 are already underway and, as ever, there are a number of foreign firms involved in the mad scramble for work on the construction of stadiums. So it was something of a surprise that a recent conference on the subject of World Stadiums, featuring segments focusing on Saudi Arabia’s road to 2034 was cancelled at the very last minute earlier this month.  A stall displaying a welcome message for the Saudi 2034 FIFA World Cup football tournament at the Ministry of Media in Riyadh, Saudi Arabia. Photographer: Giuseppe Cacace/AFP/Getty Images The World Stadiums and Arenas Development Summit was due to kick off Sept. 1 in the old downtown of Riyadh, near landmarks including the Murabba Historical Palace. Dozens of people gathered at the Radisson Blu Hotel that morning, only to be greeted by signage saying: “Due to unforeseen circumstances beyond our control, the event has been postponed until further notice.” Some attendees said they hadn’t received any notification of the cancellation. Worldlink Conferences — the event’s organizers — said they received urgent orders from the government the night before the summit to pause the event. The reason for the postponement was due to event permit issues with the company’s local partner, which was only communicated to Worldlink by the government the night before the event, according to Conference Director Sidharth Sharma. The Saudi government didn’t respond to a request for comment. The speaker list included representatives from firms likely to be involved in the planning for Saudi 2034. Those included Populous, which is working on a number of sites in the list of potential venues for the event, CBRE Saudi Arabia and the Spanish seating firm Figueras. While the event’s abrupt cancellation isn’t related to any known hiccups or issues with the World Cup, the optics aren’t great as the kingdom looks to draw in the top players in stadium building and event planning to ensure that the biggest global event in its history goes off without a hitch. — Christine Burke and David Hellier NIL PointsHey, it’s Ira. It’s been more than two months since colleges began paying athletes directly. And it’s been more than three months that players have been asked to disclose any third-party name, image and likeness deals of more than $600 to the NIL Go clearinghouse run by Deloitte. All of this is under the terms of the landmark settlement agreement between former players and the NCAA finalized in June. The basic swap in the deal is money for control. Players get paid. Schools get a cap on costs and new rules to tamp down on outside spending. Athletic departments can pay their players up to $20.5 million this academic year. Players have to submit their third-party NIL deals to the clearinghouse to establish that they aren’t pay-to-play arrangements.  College football’s attempt to formalize how players get paid still has a long way to go. (Above quarterback Arch Manning scores for Texas.) Photographer: Tim Warner/Getty Images So far, the money is flowing. UCLA athletic director Martin Jarmond said last week at Bloomberg Power Players New York that his school had already paid out nearly $5 million to its players. “A lot of checks are being signed,” said Jarmond, “And more to come.” Whether schools can control the outside spending is still to be determined. The settlement set up a new College Sports Commission to monitor athletes and schools and to oversee the NIL clearinghouse. In early September, the group released its first NIL deal flow report and then revised it the following day with dramatically different numbers. In the initial report, the CSC said it had cleared more than 8,000 deals since the clearinghouse opened on June 11, for a combined total of $79.8 million. In the revision, it lowered those numbers to about 6,000 deals and $35.42 million. So what happened to the roughly 2,000 deals totaling more than $44 million? They were in the NIL Go system, according to the commission, but were either pending or had been sent back to athletes for clarification or revision. These deals had been mislabeled, the CSC said in a statement, due to a “clerical reporting error” by Deloitte. According to the revised report, the CSC has yet to make an up-or-down ruling on more than 2,000 deals totaling nearly $36 million. (332 deals totaling about $10 million failed to get clearance on first pass.) “We take full responsibility for this reporting error,” Deloitte said in the statement provided by the CSC. “We have taken additional measures to avoid any future recurrence and are fully confident in the NIL Go platform.” This isn’t a good start for an organization that is supposed to be a linchpin in the new college sports economy. Part of the problem seems to be that the CSC is understaffed, with just four employees. But the confusion and delay also points to a thornier question for the commission: Is it willing to enforce its own rules? Many of the deals that the CSC is sitting on are with so-called “associated entities,” which is legalese for the collectives and boosters whose spending the settlement is intended to curtail. These are people who are willing to write checks for millions of dollars to entice top talent to the schools they support. The settlement doesn’t let them do that anymore unless they can show that deals are for a legitimate business purpose and within a range of compensation that fits the going market rate for endorsements. Some of those boosters may not take kindly to being told no. Some might file a lawsuit if they were. And they might have a strong case. Boosters never signed on for any settlement. If they want to pay a linebacker $500,000 so their alma mater can win on Saturdays, who are Deloitte and the CSC to say that they can’t? Collectives are submitting deals to NIL Go to find out what they can get away with. In many cases, they have yet to get an answer. But things can’t go on like this forever. At some point, either the CSC will start rejecting deals and face the blowback or collectives will decide that the new rules are toothless, and they don’t need to bother with NIL Go. More From BloombergFor more on the intersection of money and sports, subscribe to the Bloomberg Business of Sports podcast. Find it on Apple, Spotify or anywhere you listen. Get Bloomberg newsletters in your inbox:

Explore all newsletters at Bloomberg.com. We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Business of Sports newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|