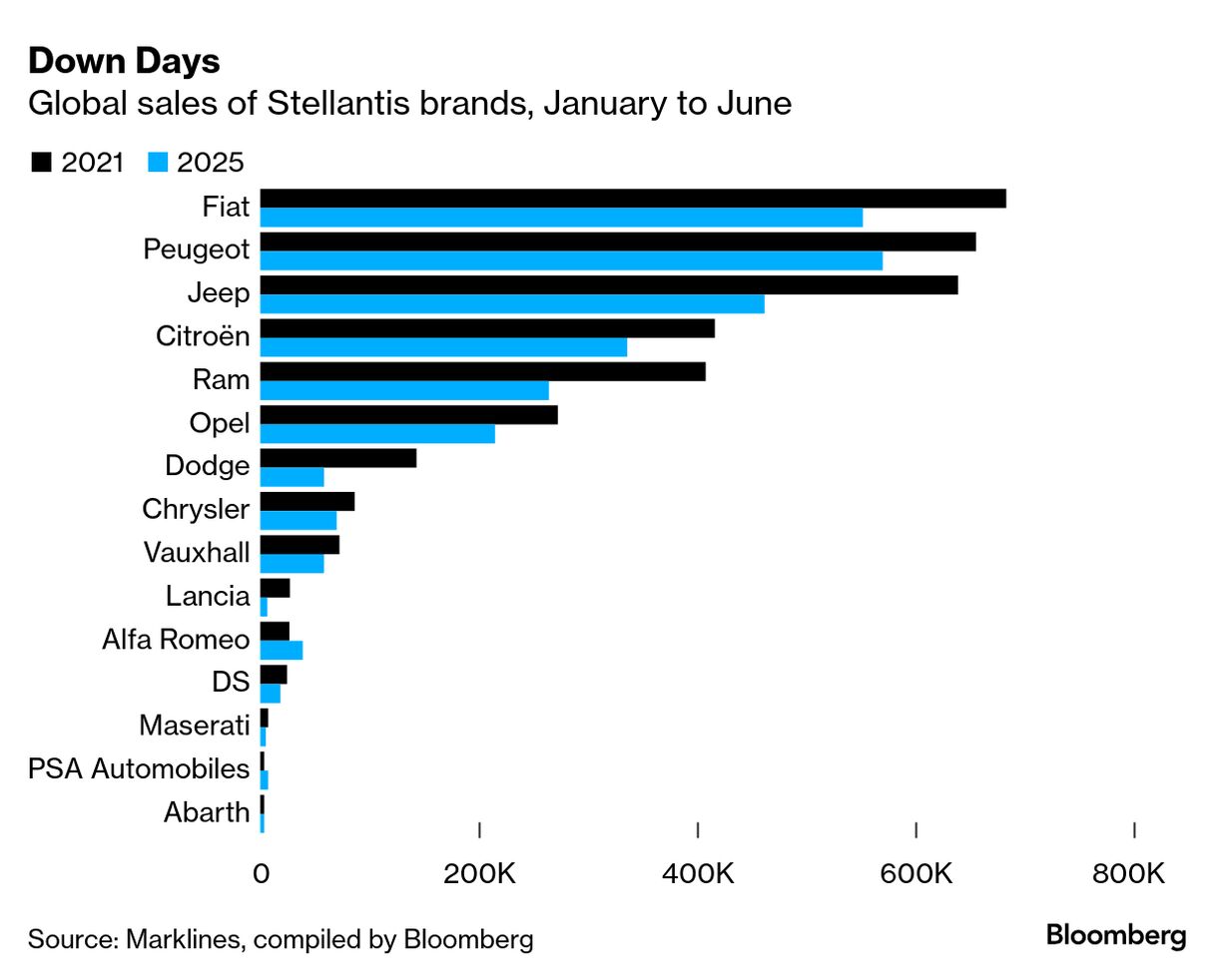

| Welcome to Bw Reads, our weekend newsletter featuring one great magazine story from Bloomberg Businessweek. Today Gabrielle Coppola and Albertina Torsoli write about an iconic brand that was mismanaged by a French-Italian-American auto conglomerate, a profit-obsessed CEO and a billionaire dynasty. And that was before Stellantis collided with Trump’s trade war. You can find the whole story online here. You can also listen to it here. If you like what you see, tell your friends! Sign up here. Early in the fourth quarter of this year’s Super Bowl between the Philadelphia Eagles and the Kansas City Chiefs, 100 million viewers found themselves being soothed by Harrison Ford. From a cozy mountain lodge, mug in hand, the actor riffed on life, heroes and freedom—namely, the freedom to choose a gas-guzzler versus an electric vehicle, both of which are sold by Jeep. “Freedom is the roar of one man’s engine, and the silence of another’s,” Ford said in the two-minute TV spot as footage of World War II-era Jeeps flickered on screen, followed by two modern-day models flying into the desert. “We won’t always agree on which way to go, but our differences can be our strength.” As Ford unplugged his hybrid Wrangler and drove off into the mountains, he flashed the two-finger Jeep wave to a fellow traveler gunning his own plug-in. The multimillion-dollar ad was a pricey way to remind Americans just how much they really do love freedom in the form of a rugged vehicle. But for Stellantis NV, the Dutch-headquartered Franco-American-Italian car company that owns Jeep—along with Dodge, Ram, Peugeot, Citroën, Alfa Romeo, Maserati and a hodgepodge of other makes—it was a bid to help resurrect a storied brand whose sales had collapsed. The commercial had been greenlit by John Elkann, the 49-year-old billionaire chairman of Stellantis, who for the time being was also the de facto chief executive officer. Having ousted the CEO, Carlos Tavares, two months earlier, Elkann had a massive cleanup job on his hands.  Of the many strategic blunders Tavares made during his four-year reign over what was once a $93 billion conglomerate, perhaps his most egregious was the mismanagement of Jeep, Stellantis’ crown jewel. He jacked up prices and increased production of Jeep’s most expensive trims, without adequately investing in new products, which left gaping holes in an aging lineup and swelling inventory on dealer lots. The extent of the damage became clear in July 2024, when Stellantis reported that its net income had been cut almost in half. By September, exasperated dealers sent an open letter to Tavares accusing him of destroying the company’s brands. Elkann is the leader of the Agnelli family, Italy’s version of the Kennedy clan. His great-great-grandfather Giovanni Agnelli, known as “the Henry Ford of Italy,” founded Fiat SpA in 1899; his grandfather, the flamboyant Gianni Agnelli, multiplied the family’s riches while partying with Jacqueline Onassis and jumping out of helicopters for kicks. The lanky, lower-profile Elkann runs a family-controlled holding company in the Netherlands, Exor NV, which had €38 billion ($45 billion) in net assets at the end of 2024, with the Agnelli family stake valued at about €10 billion. Not only is Elkann responsible for managing the fortunes of 100 or so relatives, he’s also trying to transform Italy’s legacy companies into international giants that can survive another century. That quest has become more difficult as incumbent automakers struggle to compete in the age of electrification and the rise of China. Over the years, Elkann, who counts Jeff Bezos, Sam Altman and LVMH’s Bernard Arnault in his network, has diversified away from the mass-market auto business, venturing into luxury, health care and technology. Doing so helped him boost Exor’s net asset value per share 14 times since March 2009, when the company was listed in Milan. He also became a smaller shareholder in a bigger auto company, one supposedly big enough to survive the industry’s upheaval. His most valuable asset is a controlling stake in a separate and much more profitable car company, Ferrari NV, which represented almost half of Exor’s entire value last year, while Stellantis accounted for just 13%. If Stellantis, formed from the 2021 merger of Fiat Chrysler and France’s PSA Group, is Elkann’s link to the past, it’s also his problem, and a drag on his portfolio. “John Elkann longs to trade pistons for pixels, yet the road from Mirafiori to Silicon Valley is treacherous and muddy,” says Carlo Alberto Carnevale Maffè, a professor of business strategy at Milan’s Bocconi University, referring to the site of Fiat’s headquarters. “He’s perhaps betting on sleek M&A to redefine the empire, but the rust in Europe’s car industry demands more than a visionary’s touch to shine.”  Elkann in 2023 at the Formula One Grand Prix in Spielberg, Austria. Photographer: Mark Thompson/Getty Images With Tavares out, Elkann and the board had begun scouring the globe for a unicorn CEO: someone who understood manufacturing and auto retail, but who also had a clear vision for a future increasingly defined by software and batteries instead of internal combustion; a turnaround whiz who knew the US market but could navigate the internal politics of the three-way culture war among the company’s American, French and Italian fiefdoms, not to mention a 248,000-person global workforce and restive unions; someone who could manage a newly assertive chairman and board filled with appointees safeguarding dynastic wealth and national interests. It’s as much a turnaround job as it is a sort of United Nations ambassadorship. And that was just the internal assignment. Then there was the global politics, which Elkann tried to stabilize as the CEO search got underway. He embarked on an international apology tour, mending fences with Italy’s right-leaning prime minister, Giorgia Meloni, who’d clashed with Tavares over job cuts brought on by lackluster sales at the Italian brands Alfa Romeo, Fiat and Maserati. He assured President Emmanuel Macron of Stellantis’ ongoing commitment to France, whose government indirectly owns a 6.7% stake via the state-owned investment bank Bpifrance, which has a seat on the board. But Donald Trump was Elkann’s biggest problem. The reelected president’s vow to scrap EV targets and bring manufacturing jobs back to the US ran counter to Tavares’ strategy for the conglomerate, which was to remake Stellantis as a nationless manufacturer primed for the EV transition. Elkann, like many of the corporate chieftains hoping to get on Trump’s good side, came to Washington bearing gifts. There was a $1 million donation from Stellantis to Trump’s inauguration fund, along with the promise of more than $5 billion in new investment, including a pledge to reopen an assembly plant in Illinois that had been controversially shuttered during the Biden presidency. Trump accepted the peace offering, then unleashed a barrage of tariff and policy announcements, further destabilizing the auto industry by upending supply chains, scrambling investment decisions and leaving carmakers on the hook for billions of dollars in new duties. On a February call with investors reviewing Stellantis’ annual results, Elkann dismissed a question from an analyst who asked whether he would consider breaking up the company, given the uneven pace of global EV adoption and rising geopolitical tensions. Toyota Motor Corp. and other companies were gaining share because of their global reach, not in spite of it, Elkann said. “I believe that in our case, where we have regional scale and global scale, we’re actually very well equipped for the world to come.” (Elkann and Tavares declined to speak to Bloomberg Businessweek for this article.) After trying to lure several external CEO candidates, the post sat open for almost six months, until late May, when Elkann and the board finally announced that they hadn’t poached an outsider to lead the company in its fight for survival but had promoted someone internally. Antonio Filosa, an Italian who’d successfully run Stellantis’ South American division and had been with the company for 26 years, would be the new CEO. Filosa’s profile had risen amid an exodus of senior management under Tavares; only seven months earlier he’d been promoted to run the North American operations. But in many ways, anointing him as CEO was a tacit admission of what no one was willing to say aloud: Outside talent wasn’t exactly clamoring for this job. Keep reading: The Corporate Saga Behind Jeep’s Downfall |