| At the start of last year, Bitcoin traded just above $43,000. Twenty months later, the world’s largest cryptocurrency has surged nearly 190% to surpass $125,000 and broken its record high for the 10th time this year. It’s outpaced even the mighty Bloomberg Magnificent Seven index, up a little over 100% in the same period. It’s not hard to see why. Trump’s pro-crypto regime has rolled back oversight and is advancing a friendlier regulatory framework. That has helped further institutionalization of the asset, thanks to the SEC’s approval of Bitcoin exchange-traded funds last year. Bloomberg News reports that investors put $3.2 billion into 12 US Bitcoin ETFs last week, the second-biggest week since they launched. The London Stock Exchange’s recent green light for crypto-linked exchange-traded notes follows a similar playbook. Those listings, set to go live on Wednesday, have added fuel to the interest in Bitcoin, which shows up both in Google searches and in its price: Another driver is the “debasement trade” — waning faith in fiat currencies in the face of persistent government deficits and inflation. Monday’s Points of Return reiterated the growing fiscal problem. The hangover from the post-pandemic inflation surge remains, and has coincided with a a dose of dollar weakness. The latest political developments helped this trade, with the yen weakening 1.6% against the dollar after Takaichi’s victory and thereby offering yet more easy money to the rest of the world through the carry trade. France’s political crisis helped the euro slip as much as 0.6% against the greenback. One common thread from these two shocks is that they make higher fiscal deficits more likely. The US government shutdown has prompted more to join the flight into gold and crypto. Bitcoin’s rally, in that sense, may still have room to run. Analysts at JPMorgan Chase expect it could climb to $165,000 by year-end, aligning with gold’s volatility-adjusted valuation. Gold’s status as the ultimate refuge remains unshaken. The S&P 500’s rebound from the lows of the Liberation Day tariffs initiated in April has been exciting, and it closed Monday at another all-time high in dollars — but its performance in gold terms tells a bleaker story. Under Trump, bullion’s dominance has been almost a one-way trade, and the S&P has dropped 20%: Gold, which broke through $3,000 an ounce in March, is on the verge of $4,000. In addition to its haven attributes, Longview Economics notes that “near-vertical” price actions (not just with the metal but primarily with other asset classes) reflect exuberance and fear-of-missing-out (FOMO) buying: In other words, broad-based signs of euphoria in markets have continued to build. That’s increasingly reflected in the message of our medium-term models, which are warning of a pullback.

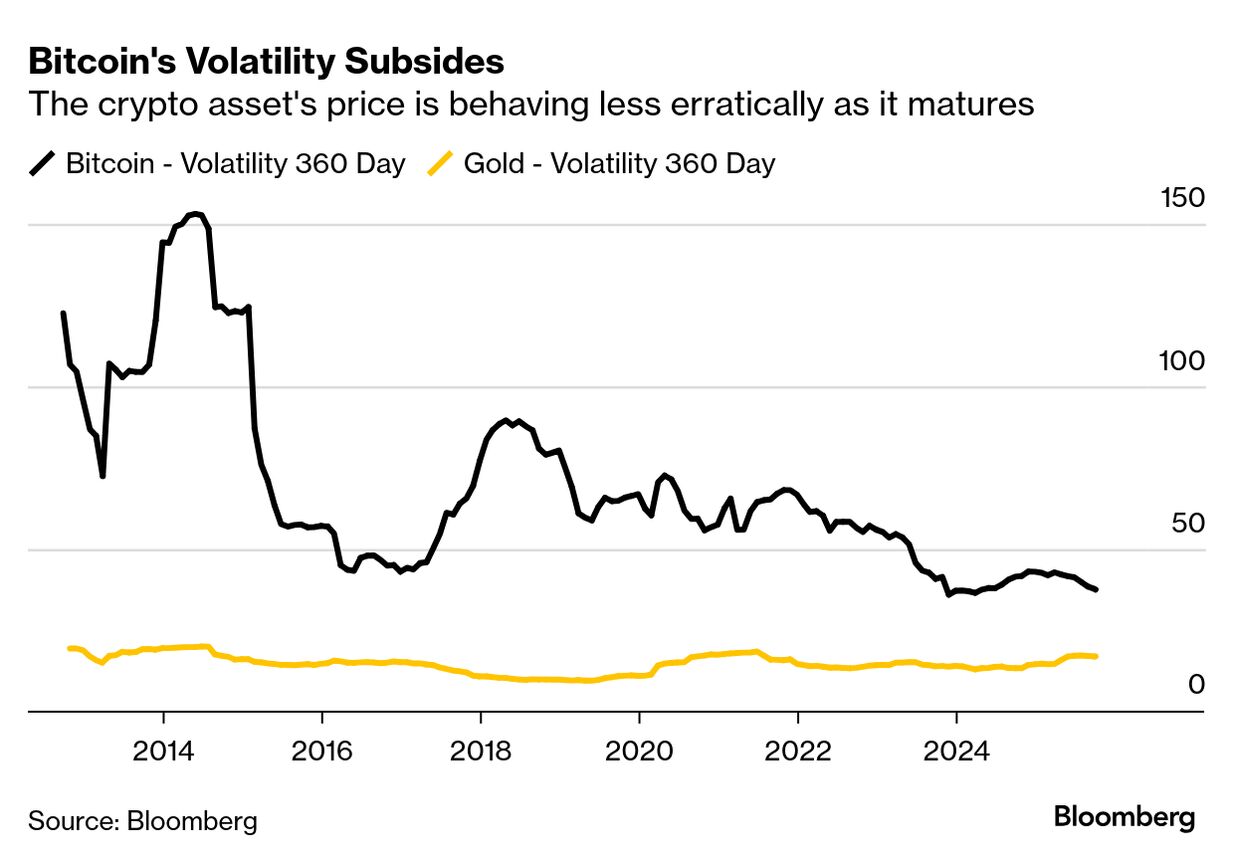

It generates such a signal when markets have become persistently and excessively “greedy.” Meanwhile, crypto enthusiasts are used to volatility, and regard warnings of a pullback as “normal.” What is important for them is its magnitude. Measures of Bitcoin’s volatility, as a crude proxy of the scale of potential pullbacks, indicate that it is coming of age and starting to mimic gold — although it still has some way to go:  Institutional adoption driven by pro-crypto regulations may well be hastening this maturity. Charlie Morris of ByteTree Group notes that with institutional investors’ allocations still less than 1%, there is potential for this to go much further. Beyond that, Stéphane Ouellette of Frnt Financial points to a rise in Bitcoin’s hash rate, the pace at which it's mined. The effort is increasingly spread across “politically unaligned nations with miners taking highly diverse forms.” This makes the asset accessible globally, hard to censor, and less affected by disruptions in any one location. Bitcoin’s run will end at some point. But its steadily reducing volatility suggests that the next pullback won’t be as painful as its predecessors. And now the crypto faithful who only know to remain perpetually long Bitcoin (or in other words, HODL) have been joined by those who are losing their faith in governments to avoid debasement. —Richard Abbey

|