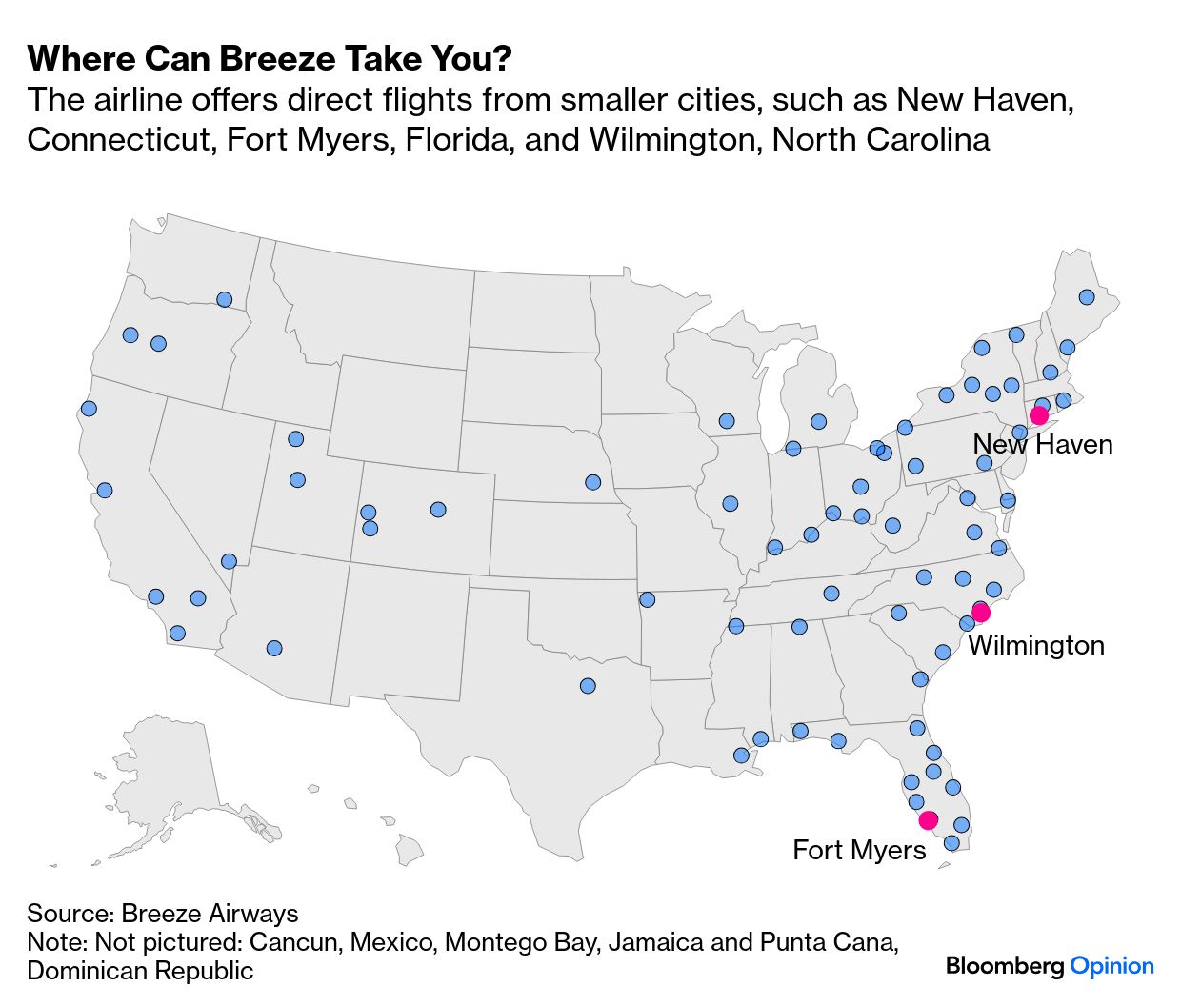

The Government Girl-bossed Too Close to the Sun | One of the loudest complaints about the lyrics of Taylor Swift’s new album, The Life of a Showgirl, is that they’re too internet-y. The amount of casual references she makes to memes — eldest daughter, ah-matized, girl-bossing, redwood tree, keep it 100 — feels overwhelming and outdated to some listeners, although maybe that’s the point. Not all of her songs need to be about suffering and torture! Regardless, Jason Bailey says it’s a major commercial success, despite mixed reviews about her artistry. Elsewhere in quibbles with the terminally online, you have US politicians who are taking Gen Z’s jargon to a cringey extreme. David M. Drucker says both sides of the aisle are far too preoccupied with internet virality and meme-making. “Republicans revel in ‘owning the libs.’ Prominent Democrats, intent on proving to their activist base that they’re fighting to stop Trump, have dialed up profanity in their rhetoric. And yet, none of this is how most voters, left or right, are living their lives day-to-day,” he writes. I don’t know what’s more fascinating about JetBlue founder David Neeleman: That he’s quietly launched a small airline called Breeze which experienced a 41% operating revenue boost in the first half of 2025, or that he’s the father-in-law of Hannah Neeleman, the insta-famous Mormon tradwife of “Ballerina Farm” fame. That’s a lot of lore for one man! Thomas Black says he has big dreams for his latest aviation project: “Breeze has 50 aircraft and Neeleman believes there are enough of these secondary markets to support a fleet of 400. He figures that 125 US cities have lost a quarter of their air service over the last decade as the large airlines drive passengers to their hubs,” Thomas writes. You can see the appeal of such a service — no one wants to have a five-hour layover at the Atlanta airport, but sometimes there’s no choice. Breeze is hoping to change that.  Eeek! Gold futures surpassed $4,000 for the first time today because it’s seen as a “safe haven” for investors during periods of instability. But what’s so safe about a chunk of metal? “A dollar can buy things. The stock market offers ownership in profitable companies. A bond promises a stream of payments,” writes Allison Schrager. But gold? Other than it being shiny and scarce, it doesn’t have much going for it, utility-wise (other than cat grills). Which is why Allison says you should resist the temptation to hoard it, even when trusted voices — looking at you, Ray Dalio! —are going bananas over the metal. “There is nothing safe about gold as an asset. Like any other commodity, its prices are extremely volatile. All it adds to a portfolio is risk,” she says. China is quietly joining Russia’s shadow war on Europe. — Hal Brands Greenhushing is — whisper it! — coming for carbon removal. — Lara Williams Europe’s capital rules rely more on fantasy than reality. — Paul J. Davies South Korea should use the public outcry against ICE to strike a trade deal. — Juliana Liu This just in: Christianity cool again! In the UK, at least. — Adrian Wooldridge France is the sick man of Europe who’s too big to fail. — John Authers Companies should stop being obsessed with hiring repeat CEOs. — Beth Kowitt Pam Bondi’s first oversight hearing. Two years since the Oct. 7 attack. Long live Saul Zabar, the smoked fish czar. Jacob Elordi wants that Bon Iver clout. Happy Supermoon to all those who celebrate. The crypto torture townhouse is a hot rental. |