| Prediction markets have been around for decades. In the 16th century, they successfully forecast the outcome of papal conclaves. Economists have long established that they do a brilliant job of aggregating information and opinion. Now, they’ve reached the financial big time. Intercontinental Exchange Inc. (ICE), the owner of the New York Stock Exchange, is putting $2 billion into Polymarket, the betting venue of the moment, valuing it at more than $8 billion. Either the political betting that has made Polymarket’s reputation will make money on a scale never before seen, or ICE has made a big mistake. Total daily volume on Polymarket has only ever once exceeded $1 billion (on election day last year). Total trading in Nvidia stock alone on Monday was $49 billion. Many thousands of other stocks and derivatives all generated more turnover for ICE. ICE is currently worth $92 billion. Spending $2 billion on Polymarket is a big deal for them. Its executives have built a huge company and know what they’re doing — but how can this valuation possibly make sense? There are several possible explanations:

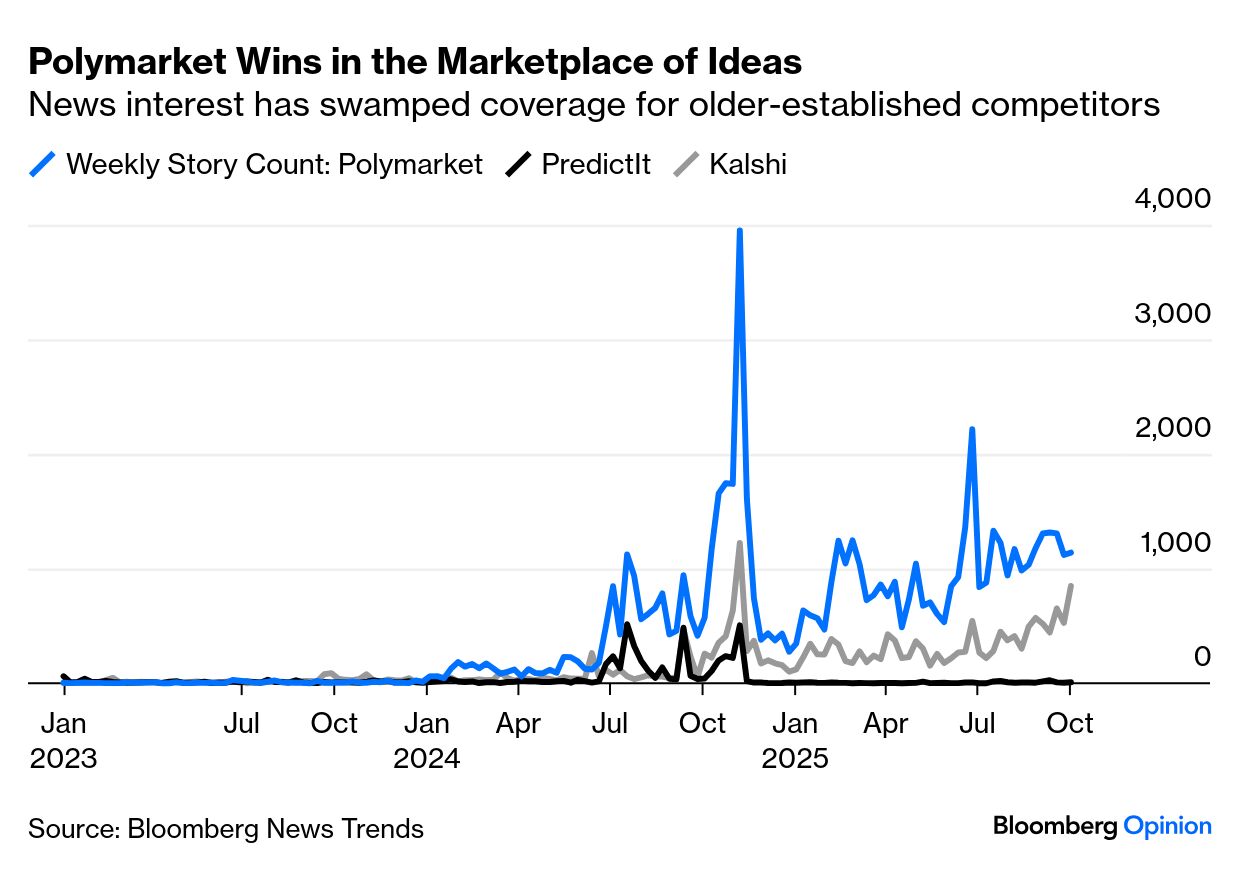

ICE Is Backing the Winner of the Prediction Market Battle No prediction market has caught the imagination quite like Polymarket. That includes the non-profit PredictIt, which limits the size of wagers in a way that makes the market harder to distort but also harder to make real money on, and Kalshi, which won various lawsuits last year in a bid to become a for-profit regulated US exchange. Polymarket, with early backing from Peter Thiel, enthusiastic support from Elon Musk, Donald Trump Jr. as an adviser, and a lot of good press, has swamped all of them, garnering far more coverage than the competition:  It’s not the first time a prediction market has created such excitement. Ireland-based Intrade.com became hugely influential as its contracts called the winner of 49 states in the 2008 presidential election, and all 50 four years later. This is better than Polymarket’s record last year: It gave Kamala Harris a 40% chance of winning the election, and a 75% shot at winning the popular vote. But Polymarket basked in positive coverage, while Intrade fell foul of regulators, closed to US investors soon after the 2012 election, and shut down altogether the following year. Polymarket’s link with ICE appears to be the final step in ensuring it doesn’t suffer that fate. Founder Shayne Coplan posted on X that this was “a major step in bringing prediction markets into the financial mainstream” and also “a monumental step forward for DeFi” (decentralized finance). Polymarket will now work with the NYSE to “usher in a new financial era of tokenization.” ICE Is Desperate to Get Into Sports Betting As anyone who has tried to watch sport recently will know, it’s suddenly saturated with betting. Whether at the stadium, at your computer, or watching TV, you are bombarded with proffers to bet. It’s made a lot of money for the bookmakers who led the charge into the newly legalized field of sports gambling led by DraftKings and Flutter Entertainment’s FanDuel. Polymarket is famous for politics, but its site reveals plenty of wagers on sport. To support the notion that this deal is all about sports, look only at the performance of DraftKings and Flutter. They were flying high in a way ICE must envy, until the market treated the Polymarket deal as very bad news for them: Dennis Kelleher, head of Better Markets, attacked the deal, saying that it was merely an attempt by unregulated gambling markets to create a loophole in the Commodities Exchange Act and avoid the robust state regulations on gambling. He said: It’s no different than buying into a bookie or casino, which would be viewed as outlandishly inappropriate a mere 10 months ago. While legalization may happen, that will not get rid of the risks from bookmaking and casino activities, particularly if they have little or no regulation, which will migrate from the gambling markets to the core of the financial system.

Fellow Bloomberg Opinion daily newsletter writer Matt Levine has a similar take. Some successful sports bettors are wonderful people, but it’s still alarming that there is so much money to be made in gambling. What does it say about us as a people if there is more money to be made from betting on sports than on allocating capital to companies where it is most needed in the economy? Fear Of Missing Out Financial exchanges have enjoyed a fantastic run since the pandemic, but ICE has slipped in the last few months. A big punt on the sexiest market of the moment makes sense. In sporting parlance, it’s like a Hail Mary pass, or betting on a rank outsider: This looks a lot like the Next Big Thing. It really would be horrible to miss out. Take Risk Management to the Next Level There is a non-cynical interpretation. Market discipline is great for harnessing the “wisdom of crowds” and producing the best prediction possible with the available evidence. Merely as an analytical tool on traders’ and bankers’ screens, this is useful — which is why the Bloomberg terminal already carries a lot of prediction market data, and why Points of Return often cites them. Polymarket contracts are futures — instruments that originated to help producers manage their risks. When Polymarket offers contracts on who will run the Fed, or on elections around the world, it’s offering the chance not just to gauge risks, but to manage them. Someone planning an investment in wind energy last year might have bought Trump futures as a hedge, for example. The problem, as Koleman Strumpf, an economist and expert in prediction markets at Wake Forest University, puts it, is that prediction markets aren’t nearly big enough to provide a hedge for any corporate investor. “If the markets were to get 10 times bigger between now and election day in 2028, maybe it could be a little more useful.” The chances of scaling up are much greater now that Polymarket is under ICE’s wing. Maybe, just maybe, this deal will harness the wisdom of crowds to help us all manage risk. And if not, there’s money in sports betting. |