| Bloomberg Morning Briefing Europe |

| |

| Good morning. Elon Musk’s xAI is raising $20 billion. Spot gold prices climb above $4,000 for the first time. And it’s getting a lot harder for Brits to get richer. Listen to the day’s top stories. — Lily Nonomiya | |

| Elon Musk’s startup xAI is raising more financing than initially planned, tapping backers including Nvidia to lift its ongoing funding round to $20 billion, according to people with knowledge of the matter. It’s part of a flurry of announcements in the industry recently, with OpenAI having announced a deal to use AMD chips over multiple years while Meta has inked several multibillion-dollar deals in the past few months, including a $29 billion financing package for data centers. | |

| Spot gold prices climbed above $4,000 an ounce for the first time, as concerns over the US economy and a government shutdown added fresh momentum to a scorching rally. Check out our Markets Today live blog for all the latest news and analysis relevant to UK assets.

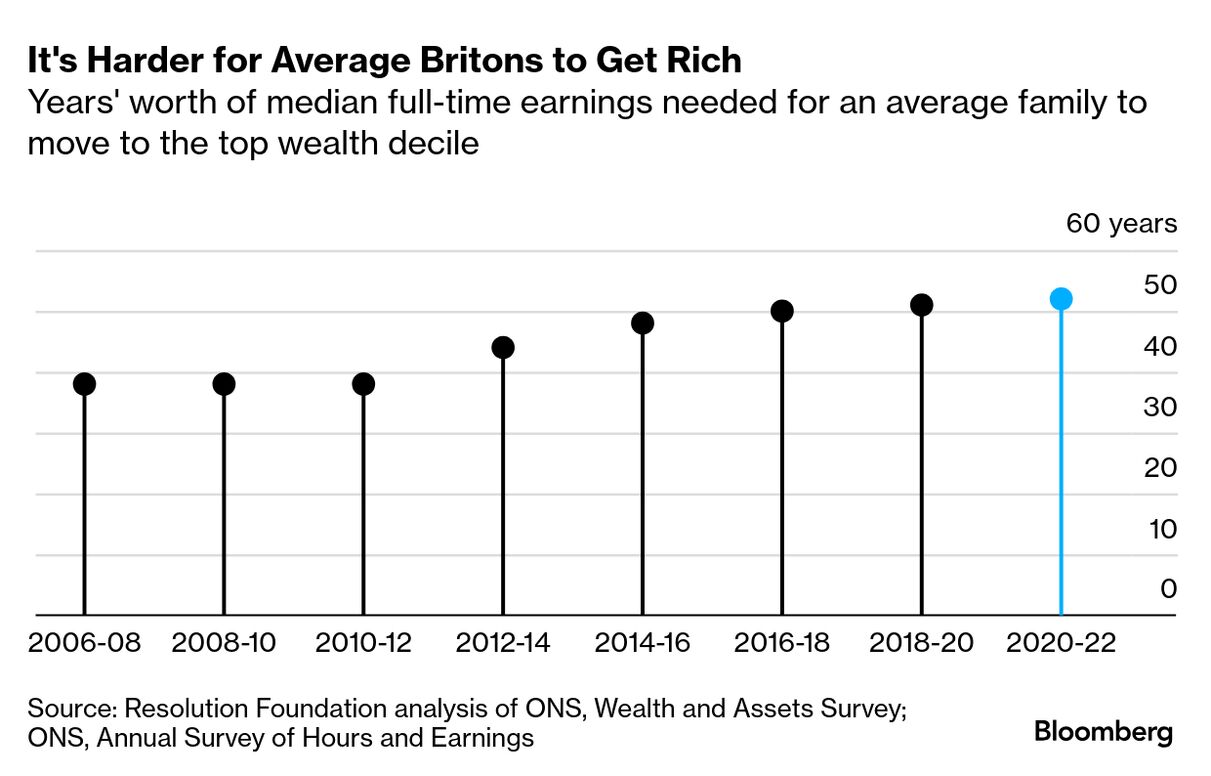

It’s a lot harder to get rich. Saving a lifetime’s worth of earnings still wouldn’t be enough for the average British worker to reach the ranks of the wealthy, according to a report revealing that economic inequality in the country has dramatically worsened over the last 15 years. A typical full-time employee would need to set aside around 52 years’ worth of pay to reach the top of the wealth distribution in 2020-22—14 more years than in 2006-2008.  Keir Starmer is leading a delegation of more than 100 British business, academic and cultural leaders to India, as he seeks to deepen commercial ties after signing a long-awaited free-trade agreement. But the UK prime minister has said he would resist demands from business to open up more visa spots for highly skilled workers from India.

Boxed in. Emmanuel Macron’s rivals are turning up the pressure on the French president, demanding their choice of prime minister, snap elections and even his resignation. His options to tackle the crisis appear limited as political maneuvering amid the turmoil grips even his own ranks. | |

| More Top Stories |  | |  | | | |

Deep Dive: AI Cost Savings | |

| Jamie Dimon said JPMorgan spends $2 billion a year on developing artificial intelligence technology, and saves about the same amount annually from the investment. - “We know that it’s got to billions of cost savings and I think it’s the tip of the iceberg,” the bank’s chief executive officer said in a Bloomberg TV interview.

- Dimon has consistently touted the opportunities offered by AI, even if it eliminates some jobs. He has said his bank already has hundreds of use cases for the technology, which will likely grow, and has touted its ability to help humans cure cancer and move to shorter work weeks.

| |

| Watch the Video |  | | | |

| |

| |

| |

| Just as Trump’s MAGA movement carried out a hostile takeover of the Republican Party a decade ago, British Conservatives can only watch as Reform UK pitches policies to voters that are shinier and claim to cost half as much, Rosa Prince writes. | |

| More Opinions |  | |  | | | |

| Our daily word puzzle with a plot twist. Play now! | |

| |

Nik Storonsky. Photographer: Adrian Dennis/AFP Revolut’s co-founder Nik Storonsky has moved his residence from the UK to the UAE. He becomes London’s latest high-profile departure as questions have swirled about the impact of tax reforms on the country’s wealthiest residents. | |

| One More |  | | | |

| Enjoying Morning Briefing? Check out these newsletters: - Markets Daily for what’s moving in stocks, bonds, FX and commodities

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Balance of Power for the latest political news and analysis from around the globe

- The Readout for essential UK insights on the stories that matter

- The London Rush for getting briefed ahead of your morning calls with the latest UK business headlines, key data and market reaction

Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. | | |