| Bloomberg Evening Briefing Asia |

| |

| Gold bulls rejoice! The spot price of the precious metal smashed through $4,000 an ounce for the first time, fueled by concerns over the US economy and a government shutdown. From the beginning of this century, gold has now yielded better returns than equities. The milestone comes against the backdrop of a laundry list of uncertainties, from global trade, the Federal Reserve’s independence, US fiscal stability and heightened geopolitical tensions. Combined, these factors have boosted demand for haven assets all while central banks continue to buy the precious metal at an elevated pace. Bullion is on track for its best annual performance since the 1970s, a decade when rapid inflation and the end of the gold standard sparked a 15-fold rally of the precious metal. Billionaire Ray Dalio said Tuesday that gold is “certainly” more of a safe haven than the dollar and the record-setting rally echoes the 1970s. The remarks from the Bridgewater Associates founder mirror those of Citadel founder Ken Griffin, who said that bullion’s rise reflected anxiety about the US currency. One of the key drivers of gold’s dramatic rise is the ongoing US government shutdown. There was little sign the impasse would end soon after President Donald Trump raised the stakes in the confrontation with Democrats by hinting at the possibility of blocking back pay for certain federal workers when the government reopens. —Samson Ellis | |

What You Need to Know Today | |

| Elon Musk’s AI startup is tapping backers including Nvidia to raise $20 billion, more than initially planned. The financing includes equity and debt in a special purpose vehicle that will buy Nvidia processors and rent them to xAI for use in its Colossus 2 project, according to people familiar with the matter. The massive fundraising round is just the latest for the AI industry, which has seen tens of billions invested at a frenetic pace in order to build the necessary infrastructure.  xAI founder Elon Musk. Photographer: Shawn Thew/EPA | |

|

| Anthropic PBC aims to be the latest US artificial intelligence company to tap India in the race for engineering talent. The company known for its Claude AI models plans to open an office in Bangalore in early 2026, it said in a blog post. Top AI model builders from Google to OpenAI are expanding in the country of 1.4 billion people for its technical expertise as well as to target it as a market. | |

|

| SoftBank has agreed to buy ABB’s industrial robots unit in a deal worth almost $5.4 billion. The Swiss industrial conglomerate said it has abandoned an earlier plan to spin off the business into a separately listed entity. It expects the deal with Softbank to close in the second half of next year. The size of the deal reflects the Japanese investment firm’s interest in the burgeoning field. | |

|

| Russian-speaking hackers have claimed responsibility for a ransomware attack that hobbled Japan’s biggest beermaker’s operations for more than a week. The group, known as Qilin, admitted to stealing roughly 27 gigabytes of data from Asahi Group, including financial documents, contracts and employees’ information. The outage was the latest in a global wave of cyber-incidents that have hit carmakers, financial firms and hospitals.  Cans of beer at an Asahi Breweries plant. Photographer: Toru Hanai/Bloomberg | |

|

| New Zealand’s central bank cut interest rates more than expected, underscoring mounting concerns about a slowing economy. The RBNZ lowered its benchmark rate by 50 basis points to 2.5%. Most economists had forecast a 25-point reduction. The authority cited weak economic activity as a reason for the more aggressive cut and said it remains open to further reductions. | |

|

| Foundation Healthcare, backed by Singapore investment firm Temasek, is considering an IPO that could value the medical group at more than $1 billion, according to people with knowledge of the matter. The company is reaching out to prospective financial advisers about working on an offering that might take place next year. The company could raise as much as $300 million from the IPO, one of the people said. | |

|

| British Prime Minister Keir Starmer has rebuffed calls to allow more highly skilled workers from India to come to the UK. He made the comments en route to Mumbai, where he is due to tout a free trade agreement between the two countries signed in July. He’s joined on the trip by 125 business and cultural leaders, several of whom have warned efforts to restrict overseas workers coming to the UK risk creating a labor shortage.  UK prime minister Keir Starmer. Photographer: Chris Ratcliffe/Bloomberg | |

What You’ll Need to Know Tomorrow | |

| |

| |

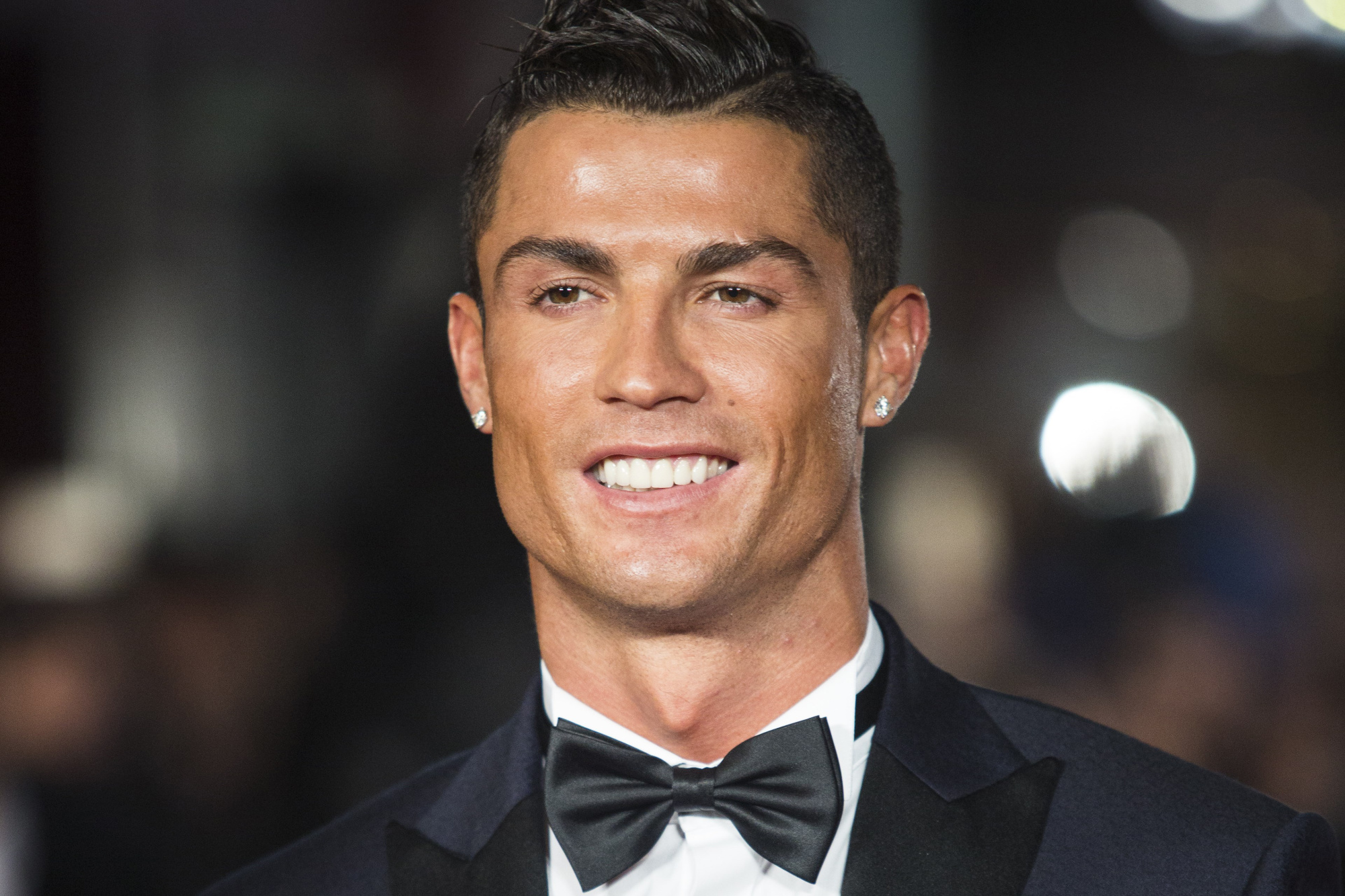

| Cristiano Ronaldo’s football career has been a series of glittering firsts, from a record transfer to Real Madrid to scoring more competition goals than any man in history. He’s now notched up another huge win off the pitch: becoming the first billionaire player. During more than two decades at some of Europe’s biggest clubs, including Manchester United and Juventus, the 40-year old Portuguese national hasn’t been shy about cashing in on his stardom with lucrative side gigs for the likes of Armani and Nike. But it’s now, in the twilight of his playing career, that he’s been catapulted into the top ranks of the richest sportspeople, inking a fresh contract extension in June with Saudi Arabian team Al-Nassr that’s reportedly worth more than $400 million. Ronaldo’s net worth has now climbed to $1.4 billion, according to the Bloomberg Billionaires Index, which is valuing his wealth for the first time, making him the first footballer identified by the index to achieve that status.  Cristiano Ronaldo. Photographer: JACK TAYLOR/AFP | |

| Enjoying Evening Briefing? Check out these newsletters: - Markets Daily for what’s moving in stocks, bonds, FX and commodities

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Balance of Power for the latest political news and analysis from around the globe

- India Edition for an insider’s guide to the emerging economic powerhouse

- Hong Kong Edition for what you need to know from the Asian finance hub

Explore all newsletters at Bloomberg.com. | |

|