| | In this edition: Growth forecasts revised up, Madagascar’s new army general PM, and celebrating Nige͏ ͏ ͏ ͏ ͏ ͏ |

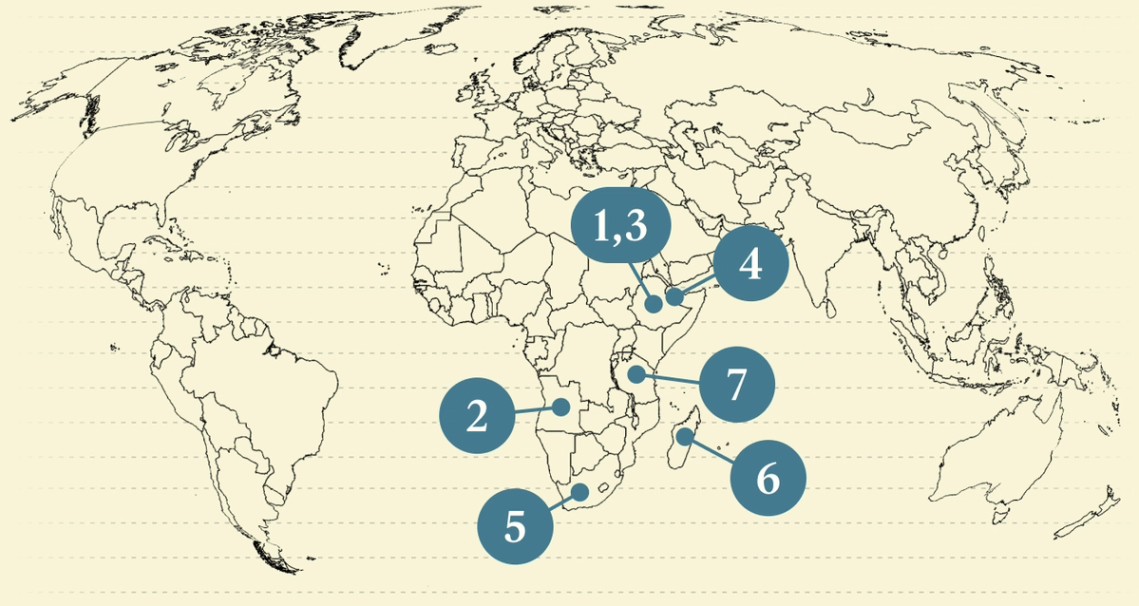

| |   Luanda Luanda |   Hargeisa Hargeisa |   Antananarivo Antananarivo |

| Africa |  |

| |

|

- Growth forecast raised

- Angola raises eurobonds

- Boosting domestic resources

- Somaliland recognition calls

- AI fintech eyes IPO

- Madagascar’s new PM

- Surging gold exports

Celebrating the legacy of Nigerian modernism. |

|

World Bank improves growth forecast |

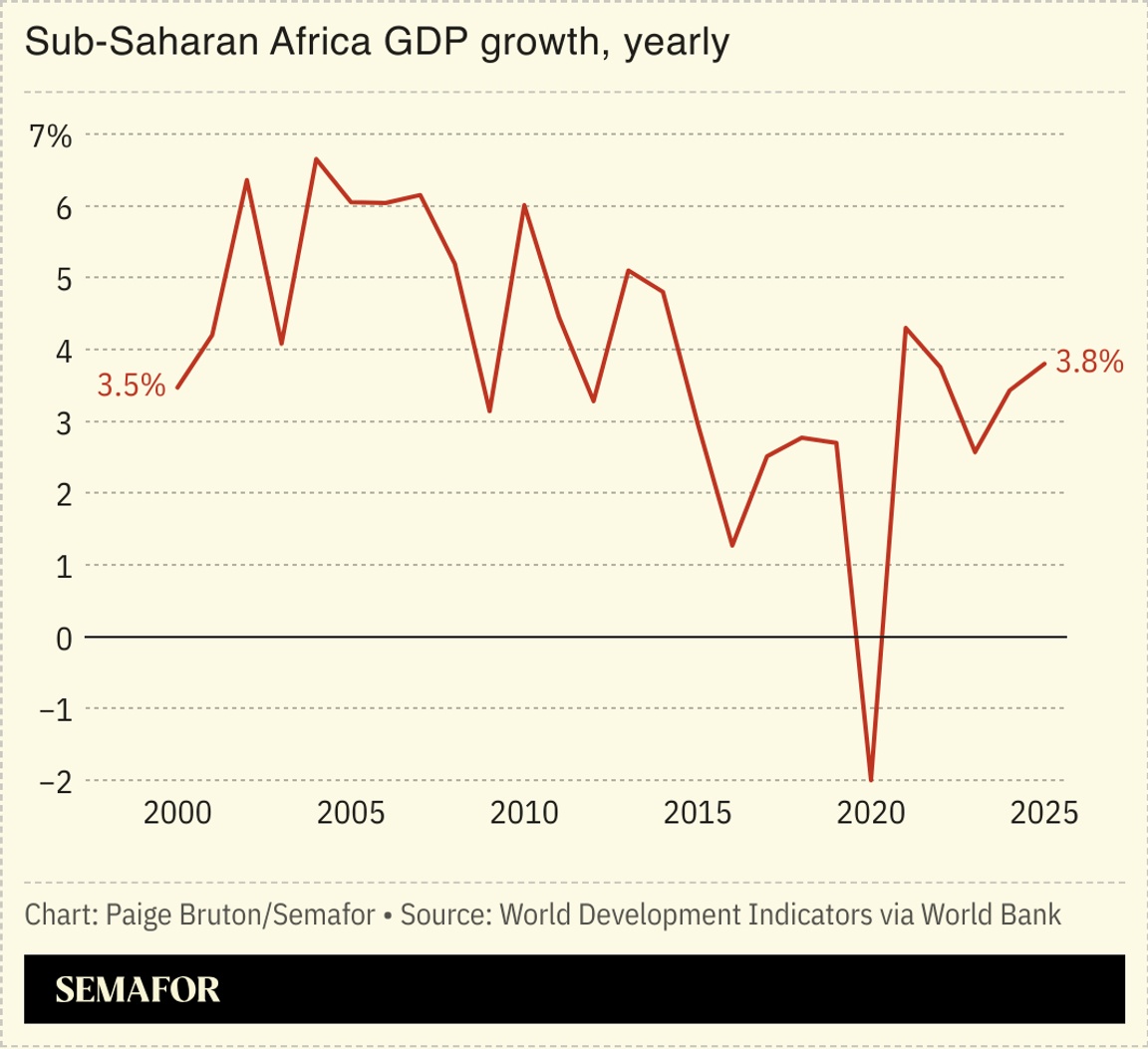

The World Bank raised its forecast for economic growth in sub-Saharan Africa, largely thanks to stable prices that have prompted easing by policymakers. The region is forecast to grow 3.8% this year, up from a prior projection of 3.5%, with Côte d’Ivoire, Ethiopia, and Nigeria among 30 countries on the continent whose growth forecasts were increased. The bank said the overall growth picture had improved due to slowing inflation, interest rate cuts, currency stabilization — “in some cases, appreciation” — and better intra-African trade. These conditions are already producing “a recovery in private consumption and investment,” it said. A combination of favorable commodity prices and a weak US dollar has helped curb inflation, the bank said, and those conditions are crucial for the trend to continue: Inflation will stay at or below 4% over the next year, it forecast, after rising above 9% in 2022. — Alexander Onukwue |

|

Angola returns to eurobonds |

Eric Lafforgue/Art in All of US via Getty Images Eric Lafforgue/Art in All of US via Getty ImagesAngola raised $1.75 billion through a eurobond offering, its first issue in three years, making it the latest African nation to sell dollar-denominated debt. Kenya’s $1.5 billion eurobond sale last week was almost five times oversubscribed, which points to the demand for high-yielding bonds from African issuers. A number of African countries are considering debt offers at a time when the region’s improving economic outlook is likely to reduce perceptions of risk among global investors. Nigeria is looking to raise $2.8 billion in new loans that would include a $500 million Islamic bond sold to international markets, while DR Congo is also preparing to raise $1.5 billion by issuing a eurobond to finance infrastructure projects. However, at least 23 countries in sub-Saharan Africa are in debt distress or at high risk of distress, the World Bank’s recent assessment noted, with public debt in nominal terms and as a share of GDP nearly doubling over the last decade. The still elevated risk of sovereign defaults carries “significant implications for fiscal stability and development outcomes,” the bank said. |

|

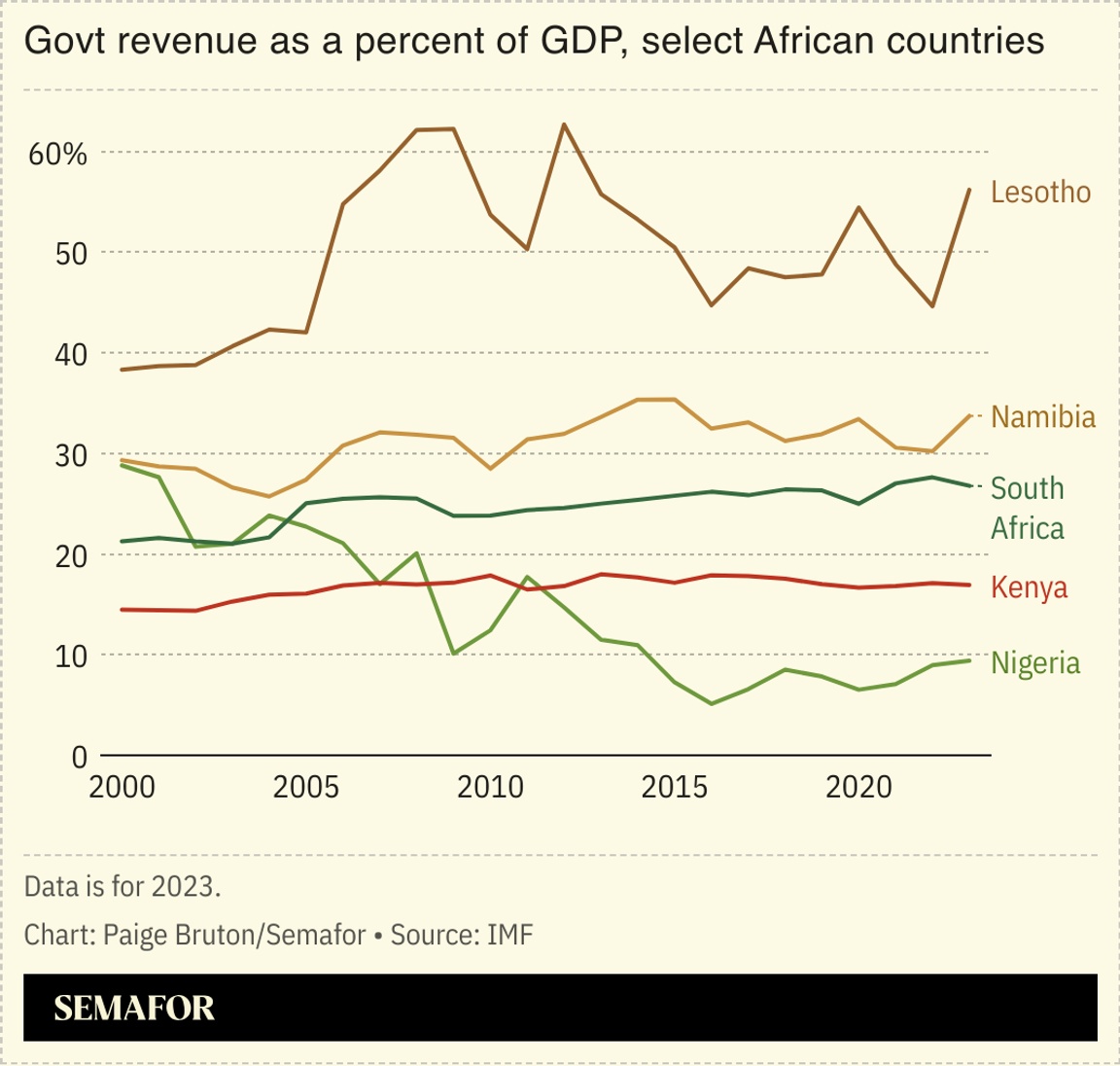

Call to boost domestic resources |

African countries must mobilize more domestic resources — particularly via taxation — in order to finance development spending as foreign aid declines, a new report argued. The continent has the lowest tax-to-GDP ratio in the world, with Ethiopia, Niger, Nigeria, and Sudan among the bottom 10 countries when it comes to raising such revenues, according to research published by the African Development Bank, African Union, UN Development Programme, and Economic Commission for Africa. The report’s authors recommended investing in digitized tax systems, including electronic filing and tax tools, to “improve compliance and transparency,” in turn boosting domestic revenue. Innovative financing mechanisms — such as blended finance, diaspora bonds, and climate-related instruments — should also be used to draw private capital, it said. — Preeti Jha |

|

Call for Somaliland recognition |

| |  | Mohammed Sergie |

| |

Right to left: DP World Chairman Sultan Ahmed bin Sulayem, Somaliland President Abdirahman Mohamed Abdilahi, Semafor Gulf Editor Mohammed Sergie. Courtesy of The Africa Debate. Right to left: DP World Chairman Sultan Ahmed bin Sulayem, Somaliland President Abdirahman Mohamed Abdilahi, Semafor Gulf Editor Mohammed Sergie. Courtesy of The Africa Debate.One of the world’s leading ports and logistics firms said it would support Somaliland’s campaign for independence, boosting the region’s fledgling campaign to be recognized as a sovereign state. The remarks from DP World’s Group Chairman and CEO Sultan Ahmed bin Sulayem follow support from several senior US politicians for Somaliland, which declared independence from Somalia in 1991, but whose claim to sovereignty has not been recognized by any other state. Somaliland’s supporters in Washington cast it as a potential US ally in the Horn of Africa, whereas DP World — which runs a port in Somaliland — made an economic argument for independence, arguing that businesses were interested in the territory’s minerals and agriculture resources, along with it being a strategically located transit hub. |

|

AI fintech eyes S. Africa IPO |

The Johannesburg Stock Exchange. Siphiwe Sibeko/Reuters. The Johannesburg Stock Exchange. Siphiwe Sibeko/Reuters.AI-powered fintech company Optasia plans to raise $365 million by selling shares in South Africa and using the proceeds to acquire new companies amid growing demand for digital financial services, Bloomberg reported. The Dubai-based firm — which operates in 38 countries, mostly in Africa, Asia, and the Middle East — uses AI to assess creditworthiness in order to offer microloans and cash advances to underbanked customers. It operates through mobile partners, including MTN and Vodacom, with Nigeria and South Africa among its largest markets. Around 1.3 billion adults globally don’t have a bank account, the World Bank’s Global Findex 2025 survey found. Fintech companies have expanded in recent years to reach unbanked people who could access digital financial services via a mobile phone. Optasia, which processes more than 30 million credit decisions daily, has about 120 million active users. |

|

On the first stop of The Next 3 Billion Tour, Semafor will bring the conversation to Abuja, spotlighting Nigeria — one of Africa’s most influential innovation hubs. With its fast-growing economy, vibrant tech sector, and young, connected population, Nigeria is at the heart of the continent’s digital transformation. Join Lasbery Chioma Oludimu, Vice President of Global Operations and Managing Director, Yellow Card; Uche Amaonwu, Country Director for Nigeria, Gates Foundation, and Semafor Africa Editor Yinka Adegoke as they discuss how Nigeria’s fintech innovation, evolving regulations, and entrepreneurial energy can drive financial inclusion and open new pathways for equitable growth. Oct. 22 | Abuja, Nigeria | Request Invitation |

|

Madagascar appoints army general as PM |

Military general Ruphin Fortunat Zafisambo, the new prime minister of Madagascar. Siphiwe Sibeko/Reuters. Military general Ruphin Fortunat Zafisambo, the new prime minister of Madagascar. Siphiwe Sibeko/Reuters.Madagascar’s president appointed an army general as prime minister, days after expressing fears of a coup, as anti-government protests entered a third week. The rallies organized by Gen Z Mada, a movement that began online, have taken inspiration from other youth-led protests around the world including in Morocco, Nepal, and Peru. The unrest on the island nation, triggered by power cuts and water shortages, has grown to reflect wider public anger over inequality, a cost-of-living crisis, and unemployment. Protesters are calling for President Andry Rajoelina to resign. Madagascar is one of the poorest countries in sub-Saharan Africa: GDP per capita fell from $812 in 1960 to $461 in 2025, according to the World Bank. The bank estimates that two-thirds of the population are living in extreme poverty — less than $3 a day. |

|

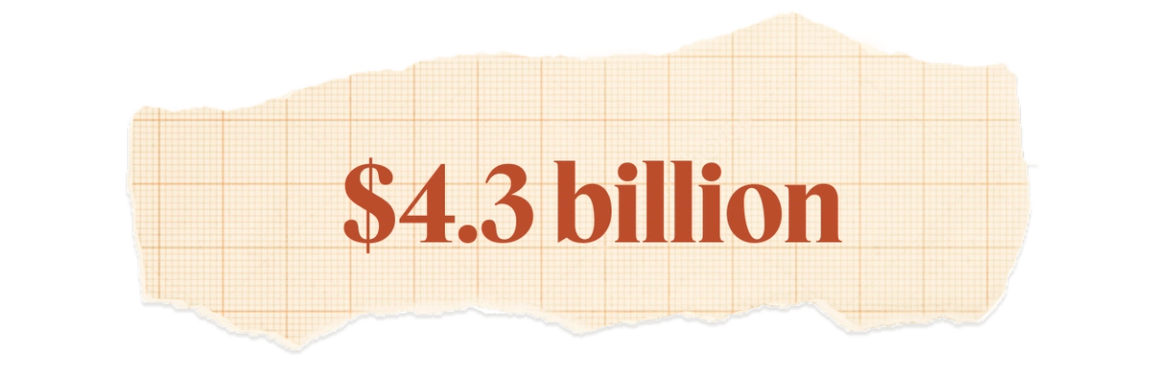

Tanzanian gold exports surge |

The value of gold exports from Tanzania in the year to August, 36% up on a year ago, according to the country’s central bank, as the precious metal surged to record highs. The price of gold topped $4,000 per ounce for the first time on Tuesday — 50% higher than last year, an increase that helped gold become the country’s top export earner. However, analysts warned that a reliance on foreign investors and joint ventures mean a large part of gold export revenues leave Tanzania’s economy. “The long-term goal should be building local capacity,” Gorah Abdallah, a lecturer at the Tanzania Institute of Accountancy, told The Citizen. The price of gold, a safe haven asset in times of global uncertainty, has been driven up by factors including expectations of a US Federal Reserve rate cut and the US government shutdown. |

|

Business & Macro |

|

|