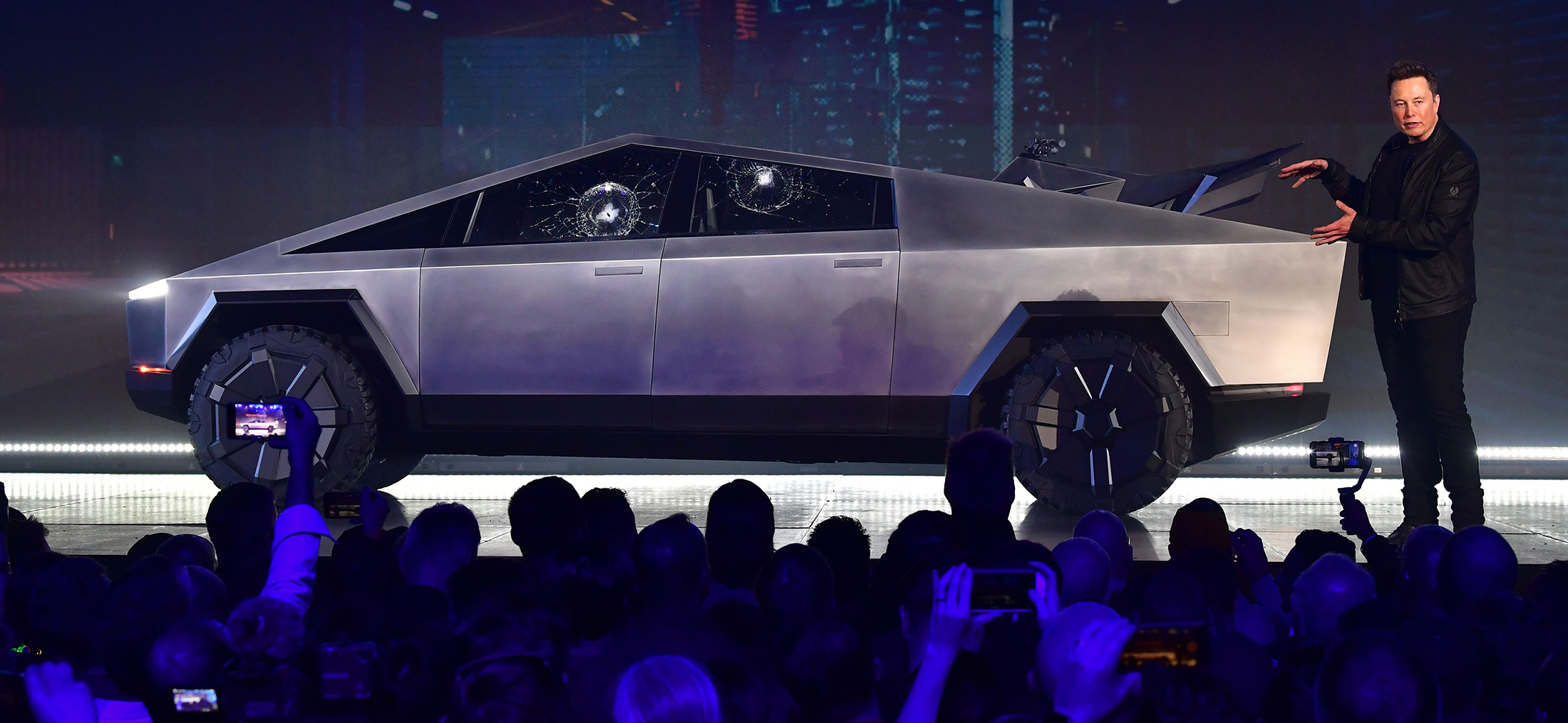

| A social media post showing a wheel was enough to spin up some theories among Tesla fans earlier this week. Businessweek senior reporter Max Chafkin writes that the reality announced Tuesday didn’t match the hopes. Plus: Africa is positioning itself as a pivotal player in global agriculture, and British Columbia’s natural gas has attracted energy producers. If this email was forwarded to you, click here to sign up. Elon Musk is, no matter your feelings about the guy, a master at the art of the product launch. For two decades, he’s used a mix of showmanship and a willingness to mix it up on social media to stoke interest in Tesla products years ahead of their intended delivery. In the company’s early days, this was something close to the business model: Tesla Inc. would announce a product and do something funny or weird to generate anticipation. (See, for instance, the 2019 Cybertruck launch, when designer Franz von Holzhausen threw a large steel ball into a side window in an attempt to prove that the window was unbreakable. It broke, the preorders still rolled in, and Tesla even turned the failure into a merch opportunity.) Even when the introductions didn’t go perfectly, customers would get excited, and Tesla would collect millions of dollars in deposits from future buyers, using that interest-free financing to pay the bills.  Musk at the Cybertruck presentation in 2019. Photographer: Frederic J. Brown/AFP/Getty Images Given this history, yesterday’s launch of what Musk has been calling Tesla’s new “affordable model” felt a bit limp. Three days ago, Tesla’s X account posted a video showing a close-up of what looked like a spinning wheel. Anyone who’d been following the company closely knew that this was almost certainly a teaser for a stripped-down version of the Model Y, though that didn’t stop superfans from dreaming bigger. Maybe the wheel was actually a downforce fan from Tesla’s forthcoming Roadster (which the company announced eight years ago, taking $50,000 deposits from buyers who are still waiting for their supercars). Maybe it was part of a Tesla artificial intelligence chip–and therefore proof that Musk was aiming to compete head-to-head with the computing giant Nvidia Corp. Maybe it was a Tesla air conditioner, or a drone, or a flying car. The stock spiked on Monday as anticipation built. On Tuesday, the excitement deflated when Tesla revealed, via another X post, that yes, this was the wheel of a car that looks more or less like one that Tesla has already been selling. The new Model Y Standard version starts at roughly $40,000, or about 11% less than what the cars cost before the price cut. The Model 3 Standard, a sedan version of Tesla’s top-selling compact SUV, is $37,000, 13% less. Investors were disappointed, and Tesla stock dropped by more than 4%. Part of this was because, well, a cheaper version of the car you already sell seems a lot less cool than a flying one. The other factor was that Tesla’s cost-cutting comes days after the expiration of $7,500 federal electric-vehicle tax credits, which were eliminated with the passage of Donald Trump’s One Big Beautiful Bill. Musk complained mightily about the legislation—which ultimately led to a feud with Trump and Musk’s exit from the White House—and it’s easy to see why. In September the cheapest Model Y was less than $38,000, if you included the tax credit; now the lowest price version of the car costs $2,000 more. (Other EV manufacturers have been trying to avoid raising prices, either by kicking in the cash themselves or via a financing maneuver that will allow customers to take advantage of the credit for a few more months.) Worse, to get the cost of its new model down, Tesla’s designers had to drastically pare back an already pared-back interior. The faux leather seats have been cheapened with a bit of fabric. The distinctive glass roof has been covered over, and the second screen in the back seat has been removed. The cheaper cars no longer have an FM radio, and the power mirrors from the old version have to be folded manually. Last week’s cheap Model Y—the one that cost $38,000, post tax credit—had all of these things, and came with autosteer, a driver-assistance technology; if you want that technology today you’ll have to pay $8,000 more for the package Tesla calls “full self-driving.”  Tesla Model Y EVs at a dealership in Colma, California, in July. Photographer: David Paul Morris/Bloomberg As disappointing as these compromises may feel, there was a deeper reason for investor angst. The new, more affordable Model Y represents a final acknowledgement that Musk is moving away from his long-term goal of making electric cars that are cheaper and better than the cheapest gasoline-powered cars. For years, Musk had teased the possibility of a “very compelling $25,000 electric vehicle that’s also fully autonomous,” as he put it at an investor event in 2020. Tesla fans took to calling the supposed $25,000 car the “Model 2,” and investors began building the idea into their financial models. Musk, however, seemed to lose interest, deciding at some point that inexpensive cars would, essentially, be pointless in a world where car ownership gives way to self-driving robotaxis. Last year, Reuters reported that Musk had killed the Model 2. Musk denied the report, and has repeatedly said that Tesla was developing new, more affordable models, while also insisting that he no longer views Tesla as primarily a car company. Instead he sees it as an AI and robotics company. This is arguably sensible at a time when AI valuations are soaring and optimism about automation is at an all-time high. Meanwhile, Tesla has fallen way behind competitors, especially Chinese ones, when it comes to selling inexpensive EVs. BYD’s low-end model, the Seagull, sells for less than $10,000 in China. The cheapest car it sells in Europe costs about $25,000—and other manufacturers are scrambling to offer similar models at about that price. Volkswagen is preparing to release a $30,000 car in Europe. Even in the US, the cheapest electric SUV is no longer the Model Y. It’s a Chevy Equinox EV, which costs about $35,000. Musk is rightfully credited with helping to kick-start a revolution in affordable electric cars. But, as far as Musk is concerned, that revolution is over. Related: OpenAI, Nvidia Fuel $1 Trillion AI Market With Web of Circular Deals Listen to Everybody’s Business: Max Chafkin and his co-host, Stacey Vanek Smith, take a look at the week’s business news and break down what you need to know, with the help of Bloomberg Businessweek journalists, experts and the people and businesses trying to navigate the economy every day. Sign up here for new episodes of the podcast, available Fridays. |