| | A so-called ‘kill list’ shared with Semafor details billions of dollars in additional potential cuts͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Net Zero |  |

| |

|

- More US cuts on the table

- REC market tightens

- Discount Teslas unveiled

- Trump revives Alaska road

- China limits rare earth exports

Assessing the danger at Europe’s biggest nuclear power plant. |

|

The energy transition is all about continuous reinvention, and that applies to us too: Net Zero is getting a makeover. Starting next week, this briefing will come to you under a new title — Energy — which will bring it into closer stylistic harmony with the rest of Semafor’s lineup and better communicate what we’re here to focus on. The basic format will remain the same, and we’ll continue to serve up more of the scoops, analysis, and data you know and love. “Net Zero” as a framing was always a little uncomfortable, even if the socio-economic revolution implied by “net zero” hasn’t stopped. Marijn van Diessen, CEO of the commodities trading firm STX Group, put it well when I spoke to him this week: “What we generally see is an incredible amount of noise. But if you look at the facts, then a lot of the forces that underpin decarbonization are still very much in play.” Energy is the locus of the most interesting challenges facing the world economy. None of our goals for economic development, living standards, global trade, AI, or peace and justice are possible without more, better, cheaper, less-polluting energy. It’s also a word that captures the feeling of urgency on this beat at this moment: Whether you’re a tree-hugging, Impressionist-masterpiece-vandalizing eco-warrior or a stalwart, IPCC-shredding foot soldier for King Coal — and our audience includes both, with many shades in between — everyone in this space is tangibly energized. As always, I’m very open to and grateful for your feedback. Please drop me a line to let me know what you think about all of this. Stay tuned on Tuesday for the first look. And if you’re in DC, come share your thoughts with me in person at our next World Economy Summit! |

|

| |  | Tim McDonnell |

| |

Kent Nishimura/Reuters Kent Nishimura/ReutersThe Trump administration is considering cancelling an additional $12 billion in funding for clean energy projects beyond what it announced last week, according to a list of targeted projects reviewed by Semafor. The “kill list,” as it was described to Semafor by a source who reviewed it, would amount to an escalation of the Trump administration’s assault on clean energy. The projects on this list bring the total of DOE funding targeted for cuts to nearly $24 billion. The list includes major carbon removal and clean hydrogen efforts that had been approved by the Department of Energy under the Biden administration, as well as projects focused on areas that, in other contexts, the Trump administration has been vocally supportive of, including strengthening the electric grid and driving more investment into domestic manufacturing. And whereas the earlier tranches of cuts focused primarily on projects in Democrat-majority states, the expanded list includes large projects in Texas and other Republican-majority states. It’s not clear whether, or when, the full list of cancellations will be enacted, or if President Donald Trump is instead looking to use them as leverage in negotiations over the shutdown. |

|

| |  | Tim McDonnell |

| |

Erol Dogrudogan/Reuters Erol Dogrudogan/ReutersThe market for credits linked to renewable energy projects is about to get a lot tighter, driving a spike in prices that could make it more expensive for high-emitting companies to meet their decarbonization goals, the CEO of the largest environmental commodities trading firm told Semafor. Renewable energy credits, known in Europe as guarantees of origin, allow power consumers to claim the electricity they use as green even if the actual electrons come from a non-renewable source. In the past 18 months, REC prices fell as a rush of new renewables projects hit the market, driven by government incentives in Europe and the US. Now that trend is reversing, said Marijn van Diessen, CEO of STX Group. The withdrawal of wind and solar tax credits in the US, inflation in equipment prices, and several other factors are undermining the economics of renewable power projects just as a host of new prospective REC buyers — tech companies chief among them — are looking to buy. That’s a recipe for price spikes. And before too long, he said, high REC prices will act to bring the market back into balance. “A very tight renewable power market should create new incentives for people to start developing renewables again,” he said. “Because these projects are really the quickest way to meet additional power demand.” |

|

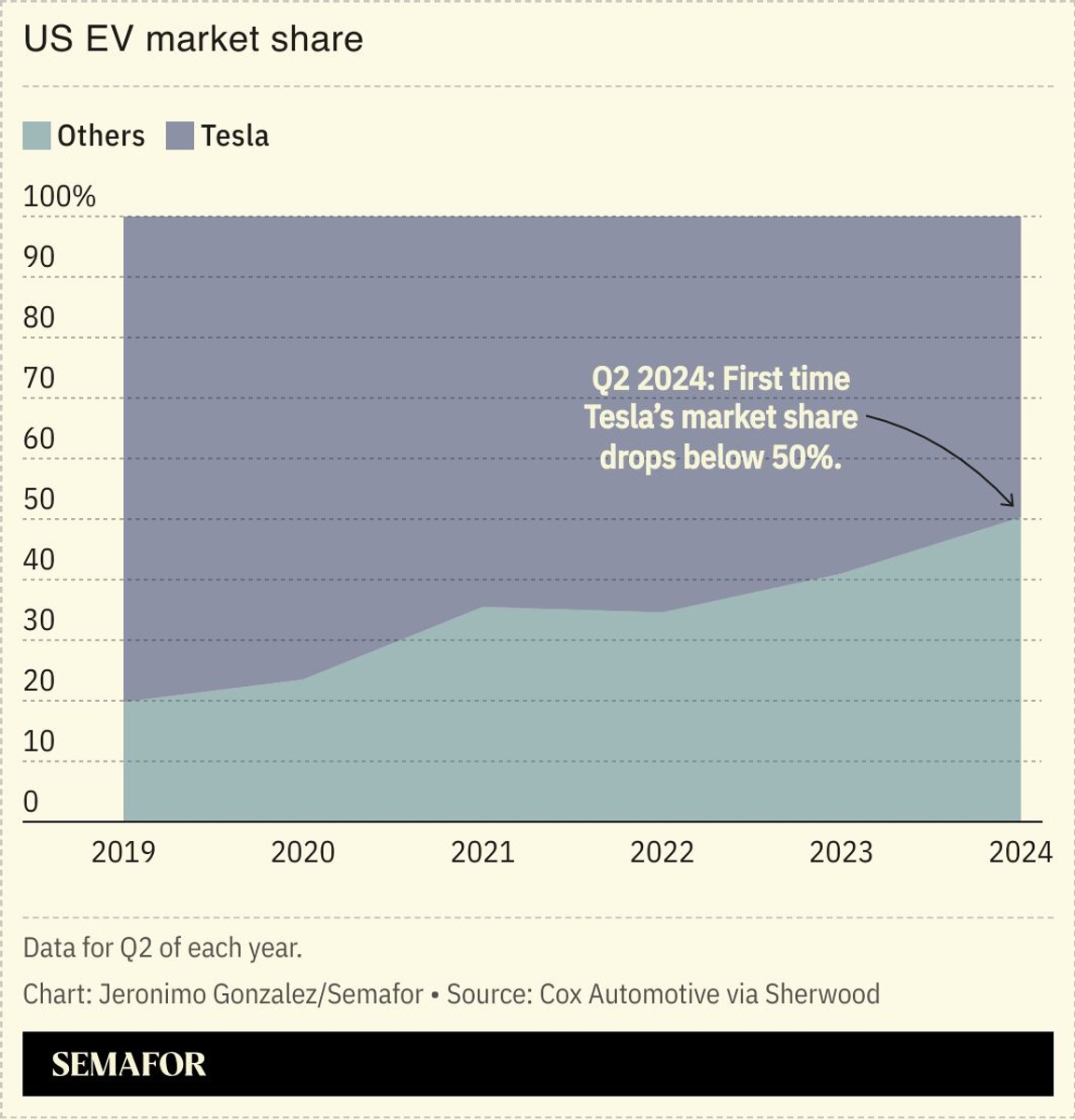

Tesla unveiled lower-cost versions of its most popular models in order to boost flagging sales in the face of Chinese dominance in the global EV sector. The end of US subsidies has hit the industry, and carmakers around the world are “falling back in love with petrol,” the Financial Times reported. Ford, General Motors, and Honda are all betting on a longer future for internal combustion engines, while calls are growing for an EU ban on petrol by 2035 to be relaxed. Only China continues to go all-in on electric cars, raising fears that the West could fall behind: Tesla’s moves left investors underwhelmed. |

|

Alexander Paterakis, Deputy CEO, Public Power Corporation, will join the Fall Edition of Semafor’s World Economy Summit on Oct. 15. The session will explore how energy technologies and digital systems are driving a more sustainable, interconnected future amid rising AI-driven demand. Oct. 15 & 16, 2025 | Washington, DC | Request Invitation |

|

Trump revives Alaska road |

The distance of a newly approved road that will cut through Alaskan wilderness to reach a proposed copper and zinc mine. The Ambler Access Project was initially approved by US President Donald Trump during his first term, but later blocked by President Joe Biden after research found it would threaten wildlife and harm Alaska’s Indigenous tribes. Now, with Trump back in office, Washington is reviving the project as part of a broader push to reduce reliance on China for critical minerals. The move follows the White House’s recent decision to acquire a 10% stake in Trilogy Metals, a Canadian mining company that is looking to develop the Alaskan site. While Trump supports, “drill, baby, drill,” he also believes in “mine, baby, mine,” Interior Secretary Doug Burgum said during a signing ceremony in the Oval Office. — Natasha Bracken |

|

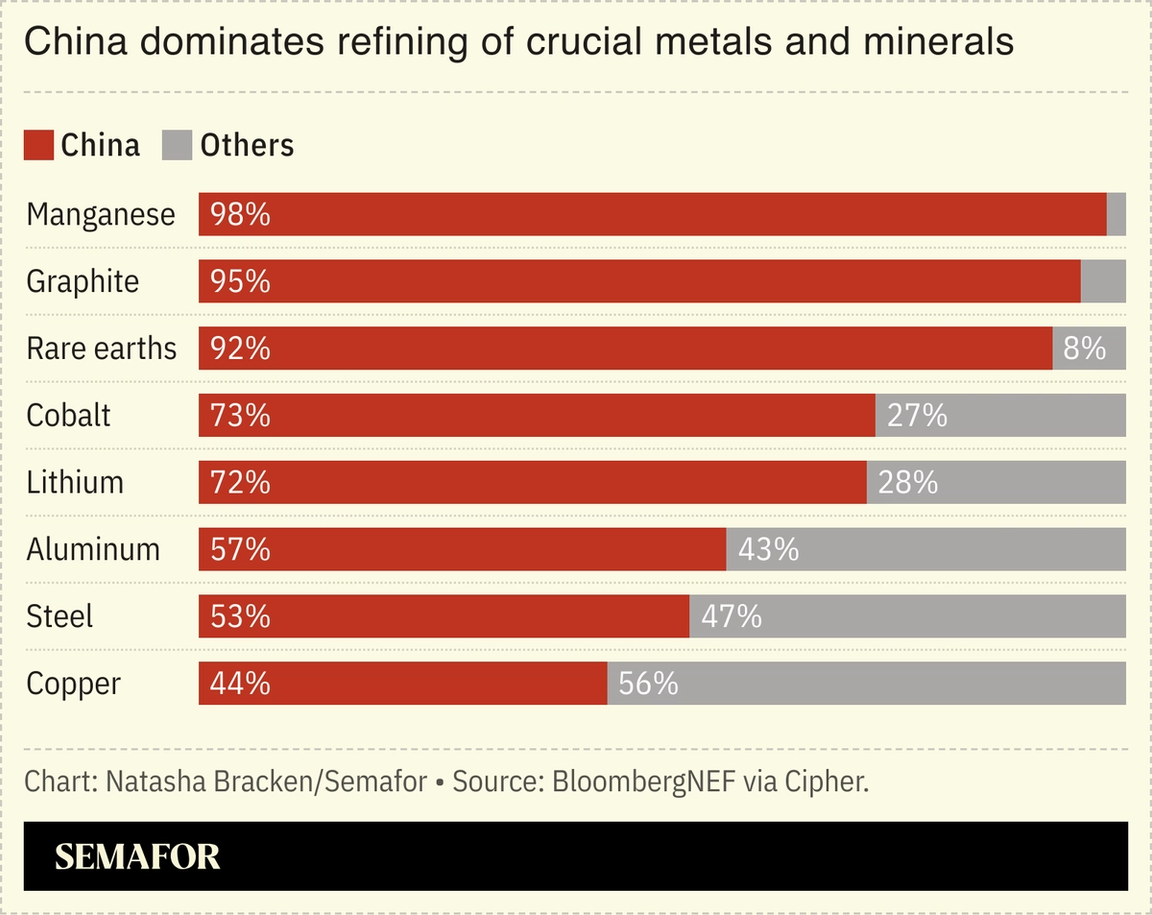

China limits rare earth exports |

China tightened export controls on rare earths, giving Beijing a major bargaining chip ahead of a potential meeting between Chinese leader Xi Jinping and US President Donald Trump this month. The move threatens to reverse a thaw in relations between Beijing and Washington, which have traded punitive tariffs in recent months. China produces and refines the vast majority of the world’s supply of rare earths, key to several industries, including defense and semiconductor manufacturing. Aware of its dependency on China, the US recently unveiled a $5 billion fund to secure access to rare earths elsewhere, though experts fear the move comes too late to close the gap, the South China Morning Post reported. |

|

Fossil Fuels Chen Aizhu/Reuters Chen Aizhu/ReutersTech- China built the world’s first underwater data center to help lower temperatures and reduce the energy consumption required for cooling.

- The Nobel Prize in Chemistry was awarded for the creation of metal-organic frameworks, molecular structures that can capture CO2, filter pollutants from water, or trap moisture from desert air.

Politics & Policy- The US is demanding the EU scrap requirements for non-EU companies to provide “climate transition plans,” the Financial Times reported.

EVsFood & Agriculture |

|

|