Evening Briefing: Asia

| Bloomberg Evening Briefing Asia | | | | It’s looking like a rough end to a volatile week for stock investors amid deepening doubts over the credit health of regional US banks. US equity-index futures fell 1%, while Hong Kong’s Hang Seng Index capped its worst week since April. A gauge for European banking stocks dropped 3% and US banks extended their slide in premarket trading. Wall Street’s chief fear gauge, the Cboe Volatility Index, or VIX, jumped to its highest level since US President Donald Trump roiled markets in April with his tariff policies. Traditional safe havens such as Treasuries and the yen rose. The moves underscore concerns about the American credit market as the fallout from the collapse of auto-parts supplier First Brands ripples through the lending industry. That’s adding to a list of investor worries, from the US government shutdown to fears of an AI bubble and renewed US-China trade tensions. Attention will quickly turn to the latest crop of earnings in the US, with several large regional banks set to report before the bell in New York. Some analysts downplayed Friday’s moves as a knee-jerk reaction rather than a sign of systemic risk, calling comparisons to the start of the financial crisis overblown. An index of European banking stocks for instance is still up more than 40% this year. But strategists including those at Citigroup and Societe Generale say European equities will struggle to post further material gains this year as risks like trade tensions hobble sentiment. —Richard Frost | | What You Need to Know Today | | | With stocks in turmoil, Bitcoin is failing to live up to its billing as a safe haven asset. Once cast as a hedge against market turmoil, the original cryptocurrency continued its slump on Friday, dropping as much as 3% to about $105,000. That’s down from an all-time high of $126,251 earlier this month. Ether, the second-largest token, slipped under $3,800 — and has now retreated more than 20% from its August peak. Meanwhile, the Binance-linked token BNB tumbled as much as 11% on Friday. Cryptocurrencies have struggled since crashing last week after a fresh US-China trade spat. “More than anything, I think crypto is acting like a canary in the coal mine suggesting the market is on edge because of emerging credit worries,” said Matthew Hougan, chief investment officer at Bitwise. | |

| | Coca-Cola is considering taking its Indian bottling unit public in a deal that may fetch $1 billion, according to people familiar with the matter. The company has met with bankers in recent weeks to discuss the possible IPO of Hindustan Coca-Cola Beverages, which would value the unit at about $10 billion, the people said. The deal would bring the beverage maker to India’s hot IPO market, which is on track for a record month and possibly its best year ever. | |

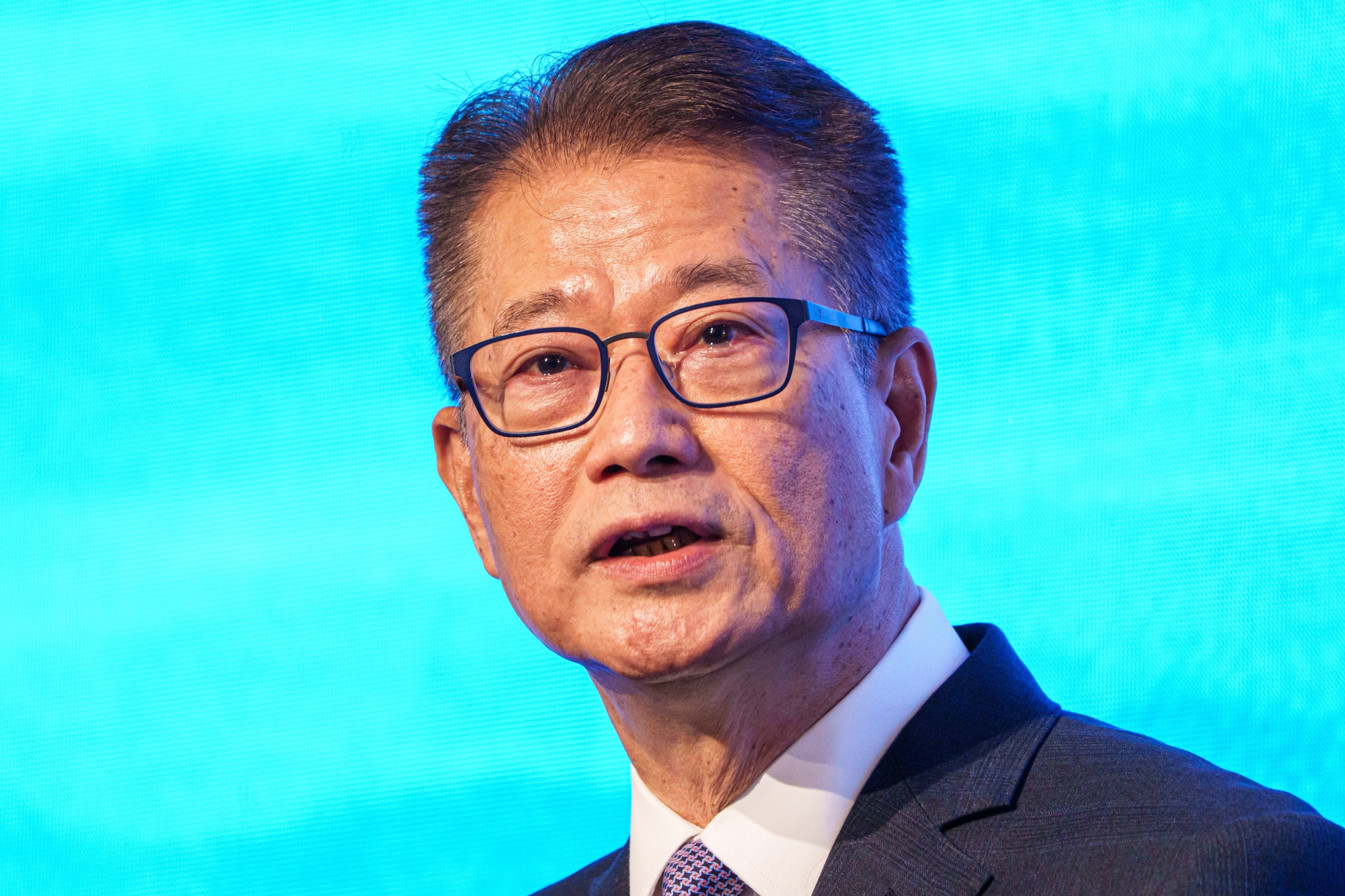

| | HSBC has vowed to invest billions of dollars over the next few years and not conduct any layoffs as part of the lender’s proposed deal to take its troubled Hong Kong subsidiary Hang Seng Bank private, the city’s Financial Secretary Paul Chan told Bloomberg Television. The investment will be spent over the next few years in areas like customer services, technology and boosting the private wealth business, he said. Separately, more than 200 firms are lining up to go public in Hong Kong, Chan said.  Paul Chan Photographer: Lam Yik/Bloomberg | |

| | China’s economy likely expanded at the slowest in a year last quarter despite a boom in exports. Weakness in investment, industrial output and retail sales is undermining the momentum from record sales abroad at a time when trade tensions are escalating with the US. Data due Monday will show gross domestic product grew 4.7% in the third quarter from a year earlier, according to the median estimate in a Bloomberg survey, down from 5.2% in the prior three months. | |

| | Nintendo has asked suppliers to produce as many as 25 million units of the Switch 2 by the end of March 2026, setting the company up for record first-year sales of the console. The Japanese company is asking its manufacturing partners to ramp up output, counting on demand to persist over the coming holidays and into the new year, according to people familiar with the matter. Sales of the console have helped boost shares of Nintendo by more than 50% over the past year.  The Nintendo Switch 2 during its sales launch in Madrid in June. Photographer: Claudia Paparelli/Bloomberg | |

| | Sanae Takaichi, who is vying to become Japan’s next prime minister, opted not to pray at a shrine in Tokyo that some Asian countries see as glorifying Japan’s wartime past, ahead of potential summit meetings including one with Trump. The foreign policy hawk is set to forgo a visit to the Yasukuni shrine on the first day of the traditional autumn festival on Friday, according to a person with knowledge of the matter, breaking with her usual pattern of frequent visits. Yasukuni shrine in central Tokyo honors millions of Japanese war dead, including 14 men convicted as Class A war criminals after World War II. | |

| | Novo Nordisk and Eli Lilly shares fell after Trump said the price of the diabetes drug Ozempic could come down to just $150 a month. The US list price of Ozempic, which the president called “the fat loss drug,” is roughly $1,000 for a month’s supply. Trump told reporters on Thursday that the cost of the drug, made by Novo, will soon be “much lower.” Lilly sells similar treatments, including Mounjaro and Zepbound. “Those are going to be $150 out of pocket,” he said. | | What You’ll Need to Know Tomorrow | | | | | | | For anyone working through their bucket list of must-play courses in golf-obsessed Scotland, dozens of venues line the eastern seaboard—with St. Andrews invariably at the top of the pile. But Inverness, the nation’s northernmost city with a population of less than 50,000, is developing into a destination of choice for those wanting successive days of high-end golf, premium dining and quality accommodation. Improved travel connections and a marketing push to get more vacation companies to add the Highlands to their golf-inclusive packages have now lured more tourism dollars to one of the more remote corners of Europe. Read more here.  The Old Petty course in Scotland. Source: Cabot Highlands | | | Enjoying Evening Briefing? Check out these newsletters: - Markets Daily for what’s moving in stocks, bonds, FX and commodities

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

| | |