| | In this edition: Praise for Kenya’s new crypto law, Africa’s oil opportunity, and Cabo Verde’s histo͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- Kenya crypto law praised

- Focus on renewables

- A $31B infrastructure goal

- Africa’s oil opportunity

- Cabo Verde’s historic win

- Weekend Reads

The South African drama series rewriting the narrative on a legendary Zulu king. |

|

The engine of financial inclusion in Africa continues to be mobile money. The story of M-Pesa’s rise in Kenya has been told many times, but its impact on the rest of the continent is often underestimated: Recent World Bank data showed that 40% of adults in sub-Saharan Africa now have a mobile money account — up from 27% just three years ago — and that growth has spread across West, Central, and southern Africa. It’s the only region where mobile-led finance outpaces traditional banks. Financial inclusion isn’t just about ticking a box of human wellbeing indicators, it’s key to building a nation’s wealth, through savings essential to economic development. The World Bank found formal saving through mobile money has jumped to 23% of African adults, up 10 percentage points since 2021, and digital merchant payments are spreading fast, from Kenya to Ghana and Senegal. But it’s important to note the gender gap persists: Women in Africa lag behind men by 12 percentage points in account ownership. And affordability, literacy barriers, and a lack of identity documentation are blocking faster progress. That’s why we’ll be digging into the link between financial inclusion, connectivity, and investment in our first Next 3 Billion on Tour event in Abuja on Wednesday, Oct. 22, with the World Bank, Nigerian government agencies, and the fintech community. If you’re in town, you can register to attend here. |

|

Fintech firm lauds Kenya’s crypto law |

Chris Maurice. Paul Morigi/Getty Images for Semafor. Chris Maurice. Paul Morigi/Getty Images for Semafor.Kenya’s newly passed law to regulate crypto assets is one of “the most comprehensive” of its kind in the world, said the co-founder and CEO of Yellow Card, a cryptocurrency startup. Speaking at Semafor’s World Economy Summit in Washington, DC, Chris Maurice pointed to the legislation as an example of regulators “learning from some of the mistakes that have been made” in the US and Europe. Yellow Card has rapidly expanded on the continent, raising $33 million in new venture capital funding from Blockchain Capital and other investors last year. It has capitalized on the growing use of stablecoins in Africa, with people using cryptocurrencies beyond cross-border trade in areas such as remittances, savings, and payroll systems. In a recent report, the company said its operations in 20 African countries — particularly Kenya, Nigeria, and South Africa — as well as other emerging markets have seen it process $6 billion in transactions, mostly in Tether and USD Coin. “There was no better part of the world to start a company in stablecoins, and in crypto more broadly, than Africa” last year ahead of the US election, Maurice said, pointing to what he said was “a very hostile environment” in America at that time. — Preeti Jha |

|

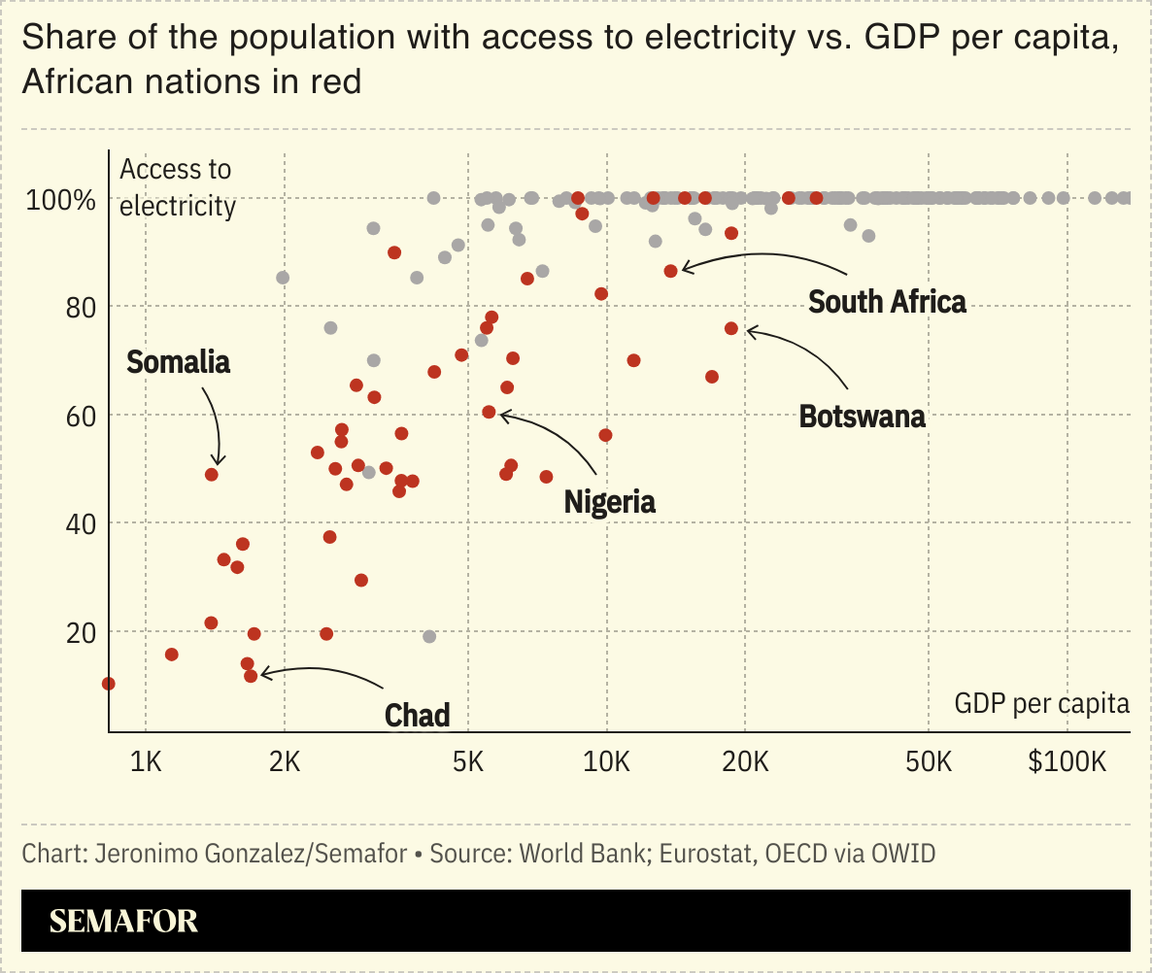

World Bank retains renewables focus |

The World Bank isn’t changing its approach to climate finance because of pressure from the Trump administration, Anna Bjerde, the bank’s managing director of operations, said. Global progress on reducing the number of people who lack access to electricity has stalled, with the number in sub-Saharan Africa stuck at 600 million for two decades. Bjerde said at the World Economy Summit that she is confident of hitting a goal to connect at least 300 million people in the next five years. About half of the power for those people will come from small-scale solar, she said. The rest will come from a mix of sources, including natural gas. But the bank is still committed to increasing its share of total financing going to projects with climate benefits, even though that’s out of favor with its largest shareholder, she said: “I don’t feel like we are in any way discouraged from doing smart development.” — Tim McDonnell |

|

Kenya’s infrastructure ambition |

The amount that Kenya plans to invest in infrastructure development over the next decade. President William Ruto said funds from the budget, state asset sales, and private sector resources would be pooled to build new roads, rail, and power projects. Ruto’s administration inherited a debt crisis upon taking office three years ago and has struggled to reduce its budget financing gap. Planned tax hikes prompted deadly protests last year that forced Ruto to row back on some economic plans. And the government’s tax collector missed its revenue target by more than $370 million for the year ending in July. While this year’s budget is “on track,” Kenya’s future spending plans are being drawn up “against persistent fiscal challenges, including revenue shortfalls, rising public debt and debt servicing costs,” the treasury said last month. |

|

View: African oil gets Trump bump |

Edgar Su/Reuters Edgar Su/ReutersUS President Donald Trump’s support for fossil fuels presents an opportunity for African states sitting on vast but underdeveloped energy reserves, Amena Bakr, head of Middle East Energy & OPEC+ research at global commodities data firm Kpler, wrote in a Semafor column. “If African governments can create predictable regulatory frameworks, strengthen governance, and maintain security, they could attract significant capital amid Washington’s new energy pragmatism,” Bakr wrote. “The global transition to cleaner energy will continue, but in the short term, Trump’s fossil-fuel agenda gives Africa breathing space to monetize its resources and escape energy poverty.” |

|

Person of Interest: Roberto ‘Pico’ Lopes |

Cristiano Barbosa/Sportsfile via Getty Images Cristiano Barbosa/Sportsfile via Getty ImagesRoberto ‘Pico’ Lopes, a defender for Irish football team Shamrock Rovers, this week helped Cabo Verde make history by qualifying for next year’s World Cup. The island nation of around 525,000 people became the second-smallest nation to reach the tournament after beating Eswatini 3-0 on Monday. A former Blue Sharks coach first reached out to Lopes — born in Dublin to a Cabo Verdean father and Irish mother — via LinkedIn in 2019. It has been a journey onto football’s biggest world stage but also a deeply personal one for the 33-year-old center-back, who has spent the last six years learning Portuguese and understanding more about his heritage. More than half of Cabo Verde’s squad are drawn from the diaspora, particularly the Netherlands and Portugal. “We’re all over the world. It’s great what we can achieve when we’re together,” Lopes told the BBC. |

|

- Ivorian fintech company Djamo has become one of the leading credit card issuers in Francophone Africa, but it’s now wrestling with difficult decisions in an increasingly competitive market. Offering a profile of a company that is emblematic of Africa’s growing financial technology power, the Financial Times asks what Djamo should do next. Expand regionally or increase its services for its solid consumer base in Côte d’Ivoire? “Choosing the wrong trade-offs could slow momentum in a market that is finally attracting global fintech interest,” the newspaper wrote.

- The Benin Bronzes are often seen as figureheads in the push to return stolen African artifacts from Western museums to the continent. However, when the new Museum of West African Art opens in Benin in November, touted as including the “most comprehensive display [of Benin Bronzes] in the world,” many will in fact be clay replicas, as long-standing logistical and diplomatic issues still prevent their display. “If the looting of the original bronzes took place in the context of what has been called the ‘scramble for Africa’... restitution has in part resembled a scramble in reverse,” The Guardian writes, arguing that in their moral haste, Western institutions have failed to consider the nuances that restitution involves.

- The race for critical minerals in Africa is creating immense opportunities but also risks, writes the head of an African risk advisory firm. As countries work to secure supplies of copper, lithium, and rare earth metals — resources essential for electric vehicles, renewable energy, and AI — “some [African] countries will manage to convert their mineral wealth into durable and inclusive growth, while others may once again see promise dissipate,” argues Ronak Gopaldas in Africa in Fact. “The global economy cannot decarbonise without Africa’s minerals. That creates leverage, but also responsibility,” Gopaldas says.

- Leading British Nigerian cultural figures discuss the growing influence of their heritage on the world stage in a feature for The Guardian. Ben Okri, author of the Booker Prize-winning novel The Famished Road, points to the “primal energy” unleashed in the years leading up to independence from Britain. Historian Alayo Akinkugbe, politician Chi Onwurah, and artist Joy Labinjo are among those who contribute perspectives. “I think part of the reason that British-Nigerians are so overrepresented in the creative industries is because, for many of us, success was the only option,” said artist Yinka Shonibare. “Your parents certainly didn’t bring you to the UK to fail.”

|

|

On the first stop of The Next 3 Billion Tour, Semafor will bring the conversation to Abuja, spotlighting Nigeria — one of Africa’s most influential innovation hubs. With its fast-growing economy, vibrant tech sector, and young, connected population, Nigeria is at the heart of the continent’s digital transformation. Join Lasbery Chioma Oludimu, Vice President of Global Operations and Managing Director, Yellow Card; Uche Amaonwu, Country Director for Nigeria, Gates Foundation; Serah Makka, Executive Director for Africa, ONE; and Raliat Sunmonu, Vice President, Middle East and Africa, Accion, as they discuss how Nigeria’s fintech innovation, evolving regulations, and entrepreneurial energy can drive financial inclusion and open new pathways for equitable growth. Request an invitation here: https://events.semafor.com/n3babuja |

|

Business & Macro |

|

|