| Read in browser | ||||||||||||

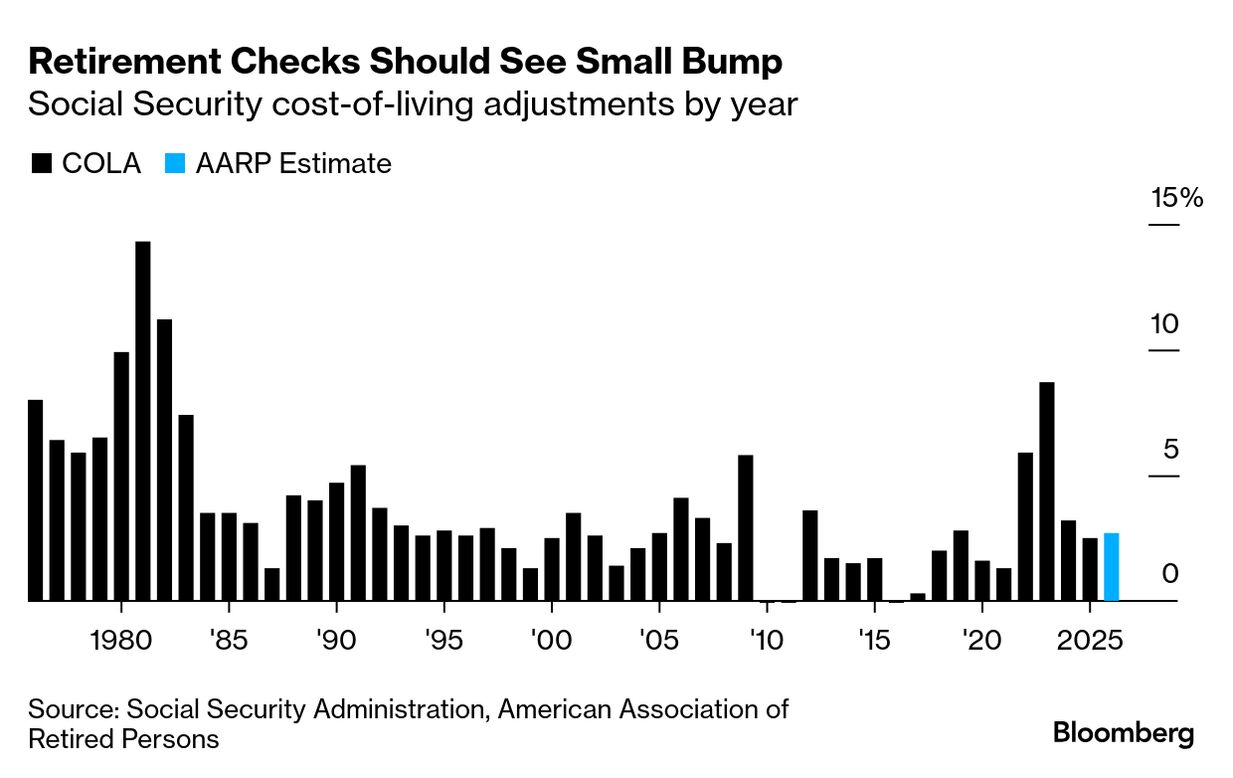

This is Washington Edition, the newsletter about money, power and politics in the nation’s capital. Today, White House correspondent Lauren Dezenski looks at the president’s drive to strike a deal. Sign up here. Email our editors here. The PlaybookThere’s one throughline in President Donald Trump’s strategies for his biggest foreign policy challenges: Let’s make a deal. Take China. If there was any question whether Trump’s latest tariff broadside against Beijing was more negotiating ploy than firm policy, the president answered this morning. ″It’s not sustainable,” Trump said of his threatened 145% tariffs on goods from the world’s second-biggest economy. “It could stand, but they forced me to do that,” he added in an interview with Fox Business.  He later also dialed back on a veiled threat in a Truth Social post last week to cancel a meeting with Chinese President Xi Jinping at a meeting of Asia-Pacific leaders later this month. “We’d like to meet,” Trump said about Xi during a meeting this afternoon with Ukrainian President Volodymyr Zelenskiy at the White House. Read More: US-China Trade Talks Seen Next Week as Trump Plays Down Tariffs That was all very soothing to Wall Street, where fears about a new tit-for-tat trade war between Washington and Beijing had triggered sharp market swings. Trump’s hunger for dealmaking also is likely to have him heading to Budapest for a meeting with Russian President Vladimir Putin in the coming weeks. He announced that plan a day before his face-to-face discussions with Zelenskiy, which the Ukrainians had hoped would result in the US providing the country with Tomahawk missiles. Getting the weaponry, which could reach deep inside Russian territory, is seen as a way to escalate pressure on Putin to negotiate an end to his war against Ukraine. Trump, though, was noncommittal. Trump is reading from a familiar script with both Russia and China: threaten a major escalation, dial back and count on a face-to-face meeting to close the deal. However, Trump’s dealings with Xi have yet to result in a firm resolution of the ongoing trade disputes, and he left his last meeting with Putin empty-handed. Asked whether Putin was just stalling him, the author of The Art of the Deal gave an answer that could apply to both situations. “I’ve been played all my life by the best of them and I came out really well,” Trump said. “I think that I’m pretty good at this stuff. I think he wants to make a deal.” — Lauren Dezenski Don’t MissTrump asked the Supreme Court to let him immediately deploy National Guard troops in Chicago after a federal appeals court refused the administration’s request. Former national security adviser John Bolton pleaded not guilty at a Maryland federal courthouse to charges in an 18-count indictment alleging that he mishandled classified materials.  Bolton arrives at the US district courthouse in Greenbelt, Maryland, earlier today. Photographer: Eric Lee/Bloomberg Trump said the US military struck a submarine designed for drug trafficking, amid reports that some aboard the vessel had survived — a first in the administration’s offensive against purported narco-traffickers. White House officials are meeting with the leaders of several colleges that have yet to respond to the Trump administration’s proposed preferential funding compact, as well as with representatives of additional schools. The Federal Reserve is ready to cut interest rates again this month, because right now a weakening job market outweighs inflation fears. But that balance may not hold for very long. Credit-card purchases in the US have increasingly been driven by borrowers with high scores, as less creditworthy consumers cut back on spending, a report from the Federal Reserve Bank of Philadelphia shows. Trump refiled a streamlined version of his $15 billion defamation lawsuit against the New York Times, stripping out the “repetitive,” “superfluous” and “florid” language that resulted in a federal judge tossing it out last month. The world’s shipping regulator postponed a decision on adopting a landmark charge on vessel emissions, a shock move that highlights the Trump administration’s efforts to disrupt international climate diplomacy. Among the impacts of the government shutdown is delayed release of new craft beers, wines and exotic spirits, like a new chocolate and peanut butter flavored whiskey, that need Treasury Department approvals. Watch & ListenToday on Bloomberg Television’s Balance of Power early edition at 1 p.m., host Joe Mathieu interviewed Ben Jensen, senior fellow for the Defense and Security Department at the Center for Strategic and International Studies, about Ukraine’s request for US Tomahawk missiles.  On the program at 5 p.m., Joe and Julie Fine talk with retired Lieutenant Colonel Alexander Vindman, a former director for European Affairs at the National Security Council, about the Zelenskiy meeting and Trump’s plan for a second summit with Putin. On the first episode of The Mishal Husain Show, a new podcast from Bloomberg Weekend, Mishal is joined by Canadian Prime Minister Mark Carney, who talks about trade battles, Putin’s miscalculations and what he’s learned from Trump. Make sense of the world with one essential conversation every weekend with The Mishal Husain Show, available on Apple, Spotify or wherever you get your podcasts.  Chart of the Day Next Friday, the Bureau of Labor Statistics will release the September consumer price data that have been delayed by the government shutdown. Those data are important to central bankers, government policymakers and private businesses, but there’s only one constituency important enough to bring 123 furloughed BLS employees back to work: Social Security recipients. The Social Security Administration needs the CPI data to compute the annual cost-of-living adjustment — specifically, the year-over-year increase in the third-quarter consumer price index for urban wage earners and clerical workers, or CPI-W. Independent estimates from the American Association of Retired Persons and the Senior Citizens League see a 2.7% increase in benefits starting in January — just a little more than last year’s COLA. Other major BLS data releases remain paused. — Gregory Korte What’s NextExisting home sales for September will be reported by the National Association of Realtors on Oct. 23. The delayed consumer price index for September is set to be released on Oct. 24. The University of Michigan’s final read of consumer sentiment for the month will be released Oct. 24. The summit of the Association of Southeast Asian Nations opens Oct. 26 in Malaysia. The Federal Reserve’s rate-setting committee meets Oct. 28-29. The Asia-Pacific Economic Cooperation leaders summit opens Oct. 31. Seen Elsewhere

More From BloombergLike Washington Edition? Check out these newsletters:

Explore all newsletters at Bloomberg.com. We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Washington Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|