| Read in browser | ||

In this week’s Hong Kong Edition, we check the scorecard on the city’s economic performance, examine gold’s rapid comedown and talk to the unlikely hero of a bird call contest. For the Review, we check out a buzzy new Sheung Wan izakaya. To subscribe to this weekly newsletter for free, click here. Bouncing back?We’re in the home stretch of what many hoped would be a year of rebound for the city’s economy, finally making up some of the ground lost over a difficult half decade. Much of that optimism, though, originates from a now quaint-seeming time before Donald Trump returned to the White House and unleashed the most turbulent period for global trade in living memory. Hong Kong is of course caught in the crosswinds of the US-China tussle, which is hewing close to one of the worst-case scenarios we explored when Trump took over. But there have been some unexpected wins for the city and deals are booming again, giving some justification for a more positive outlook. And China remains on track to hit its growth target as the export machine continues to defy tariffs as well as expectations. Chief Executive John Lee — who is looking to stamp his economic management credentials as he makes his case for another term — last week sounded confident that the government can reach its goal of 2% to 3% growth this year. With a mere 10 weeks left in 2025, we look at the key industries and markets for a guide to where the city has been able to hit its benchmarks and where it’s fallen behind. Retail and TourismTo gauge Hong Kong’s comeback story — or the lack of one — few things are as visceral as packed malls and long lines at Bakehouse. This was backed up by recent official data showing four straight months of retail sales growth, with the latest August reading reporting receipts increasing 3.8%, the most since December 2023. China’s Golden Week holiday brought 1.4 million mainland visitors into the city, a 15% increase from last year. That’s still below the peak just before the pandemic. Chinese arrivals make up the bulk of tourists in Hong Kong, and thus the fortunes of the retail, accommodation and food service industries — responsible for half a million jobs, or 13% of the workforce — are closely tied to the outlook of the mainland’s economy.  Visitors on Victoria Peak. Photographer: Paul Yeung/Bloomberg Unfortunately, the mood to shop up north remains subdued, with retail sales growing at the slowest pace since November. But there might be more policy support to turn things around as Chinese officials gather this week for the so-called Fourth Plenum in Beijing, where party leaders are expected to outline a plan to steer the economy toward more spending and, well, partying. PropertyResidential sales have broadly picked up, but prices are still trundling at bottom as developers fight to clear inventories. The city recorded 45,647 residential transactions in the first nine months, about 86% of last year’s total, according to data from Cushman & Wakefield. Developers are trying to slash their bloated inventories by offering new homes at lower prices. It will still take some time for the market to digest the stock of available homes, hindering price growth in the near term. The limited upside has also driven more people to choose leasing over buying, sending rents to record highs.  Prospective buyers look at a model of the Deep Water Pavilia project. Photographer: Lam Yik/Bloomberg For commercial real estate, the landlords of office towers and shopping malls are not having a great time either. Rents are still dropping, though at a slower pace. Banks are weighing options for seizing assets from global funds and wealthy investors, as the rate of non-performing loans rises. But thanks to the HKMA’s rate cut last month and the prospect of more easing, commercial property owners are likely to have more breathing room. At the same time, all distressed landlords are hoping to find more cash-rich mainland buyers like Alibaba and Ant Group to acquire properties in Hong Kong. TechHong Kong’s tech economy is looking up compared with this time last year. First, the government has in recent weeks vowed to accelerate the development of the city’s Northern Metropolis tech hub. Policy makers hope building out the massive area near Shenzhen in the years to come will attract new high tech companies, such as those working in AI. A key story in that sector has been the surprising global emergence of China’s DeepSeek, with Hong Kong consumers flocking to the service in the absence of American rivals like OpenAI’s ChatGPT.  The city is also finally becoming more hospitable to ride-hailing services like Uber. Lawmakers last week passed a bill setting out new rules for the platforms, which have for years operated in a legal gray area. The move is a win for Uber and the many consumers who prefer it to the city’s taxis. It’s also good news for other companies expanding in the city, such as China’s Didi Global, Alibaba’s Amap and Singapore-based Tada, since they’ll now be able to operate with more regulatory certainty. WealthHong Kong’s wealth industry is also seeing a resurgence with rising inflows, a stark reversal from the Covid period, when the city was grappling with an exodus of people and Chinese money was moving to Singapore. Assets in private banking and wealth rose 15% to HK$10.4 trillion ($1.3 trillion) as of December 2024, boosted by net inflows of HK$384 billion. Hong Kong’s private wealth under management could nearly double to $2.6 trillion by 2031 and is on track to overtake Switzerland as the world’s largest cross-border center this year, according to Bloomberg Intelligence. FinanceFinancial markets are surging, with the city reclaiming a top three spot for global IPOs so far this year with major listings like CATL and Zijin Gold. Daily stock trading volume more than doubled from the year prior, hitting an average of HK$240 billion and setting a record of HK$621 billion on the first trading day after Trump announced global tariffs.  Chairman Zeng Yuqun bangs the gong to start CATL’s trading debut. Photographer: Paul Yeung/Bloomberg The boom has fueled hiring, adding 592 licensed financial professionals in the first six months to bring the total past 49,000. Broker and margin financier profits climbed 14% to HK$28.9 billion in the first half of 2025 compared with the second half of 2024, while assets under management rose 13% to HK$35.1 trillion as of December 2024. DealsIt took three years, but Hong Kong equity capital markets bankers can finally say they’ve turned a corner. Share sales in the city — be it IPOs, block trades or follow-ons — have fetched almost $61 billion so far this year, the most since the record haul of 2021. But perhaps most encouragingly, that figure is above the 10-year average of $56 billion pre-Covid. The pipeline for next year is building nicely too in another promising sign. It’s a far cry from this time last year when just $13.8 billion had been raised, and the wave of second listings in Hong Kong by companies traded in the mainland has just begun with appliance giant Midea. The Hang Seng Index has rallied 31% from an April low, and now dozens of Chinese corporates traded onshore are lining up to list in Hong Kong. Beyond ECM, bankers have been flat out on M&A with transactions in China and Hong Kong. Take-privates have recently picked up, while some of the biggest conglomerates from Hutchison to New World and Jardine have also been exploring deals. Multinationals such as Starbucks are evaluating options for their China assets, and Chinese firms such as JD.com are pursuing cross-border acquisitions. The volume of deals is up 22% in China and almost 10% in Hong Kong. —Balázs Penz, Alan Wong, Venus Feng, Newley Purnell, Denise Wee, Kiuyan Wong, Julia Fioretti and Manuel Baigorri Five Minutes With: BirdmanBob Chan works in higher education and is very, very good at imitating different sounds. In August, he was crowned champion at the Hong Kong Bird Call Contest, the first ever such competition organized by the Hong Kong Bird Watching Society. He won mimicking the ubiquitous small brown Eurasian sparrow, which he chose in part because its name in Cantonese (maa4 zoek2) is homonymous with the city’s ubiquitous pastime, mahjong. You can watch his highlight reel from the contest here. I wanted to know Chan’s backstory. We met last month at a restaurant called Blue Birds (his pick). —Mary Hui  Bob Chan during the Hong Kong Bird Watching Society’s bird call competition on Aug. 23. Photographer: Leung Man Hei/AFP/Getty Images How did you get into bird calling? I really enjoy imitating sounds. But I don’t know very much about birds, and am not very familiar with bird calls. I wanted to check out the Hong Kong Bird Call Contest, though. An audience ticket cost HK$120, so I thought, why not try signing up for the competition, to see if I can make the finals and watch the contest for free? About 90 participants signed up and submitted a recording, imitating a sample soundtrack of several birds. From that, 20 competitors were shortlisted. Luckily, I made it to the finals. I had two weeks to prepare. How did you prepare for the competition? I borrowed a friend’s mic and speaker setup. I knew that on the day, we would use mics on stage, and imitating sounds with and without a mic can be quite different. I used to do some beatboxing. I knew that how far the mic is, how much air there is in my mouth, whether my hand is in the way — all these things matter. So I thought I should use a mic and experiment a bit. Even small changes in the position of the mic can make a big difference. So I spent two evenings, about eight hours in total, practicing like this. I have about three different techniques for imitating bird calls. One is to use my actual voice, as with the Asian koel. Another is whistling, which allows for a higher pitch, but there is less oscillation and not much melody. And lastly, I use my lips and teeth to produce plosive sounds. I started with these three techniques as a base, then studied how I could make tweaks to improve my bird calls. When did realize you were good at imitating sounds? In primary to early secondary school. Imitating sounds came quite naturally to me, and I thought I was pretty good. I would perform in front of friends, and they found it funny, so I kept at it. Maybe I’m also naturally quite a close listener, and can quickly convert what I hear into something I can imitate. Once, for a school performance, I did oral storytelling. I created sound effects on stage in real time: steps, heart beats, bats, dripping water. I asked the audience to close their eyes and use their imagination. I ended up winning the gold medal. That was the first time I presented my sound imitations in front of a crowd. What other sounds do you like to imitate? One New Year’s Eve, I was out along the harbor with a friend to watch the fireworks, and I imitated the sound of the fireworks for fun. Or sometimes I would be walking around with friends, and in dark passageways I would imitate the sound of a door opening and closing. What’s next for you? I might set up an Instagram page and put up some videos, maybe teach people how to imitate sounds. But life is busy and I might not get around to doing this. Chart of the Week: DeglitteringBefore we get into gold’s crazy drop midweek, let me first rant about one of my runs this week. I totally messed up a threshold session. Went out too hard and quick on the first few reps, my heart rate and lactate spiked, and because of that, I totally bonked and struggled through the last two, three reps. Running 101: Threshold pace is the one you could probably hold for about an hour before your body shuts down. Well, lesson learned: It’s called threshold pace for a reason. But what does that have to do with gold? To use that endurance analogy, think of the relative strength indicator as heart rate and lactate. The rally strayed too far beyond the threshold for too long. The nine-week run resulted not just in extremely overbought conditions, but also an environment that remained overbought for nearly two months.  Gold overheated and bonked. That was the one consistent takeaway from the analysts we spoke to on The China Show on Wednesday. Second: Be ready to buy the dip, but give it a few days for a more visible floor to form. The rout was a necessary reset to cooler conditions. Like this week’s drop to cooler temperatures, we’re set up for the next run (if you listen to gold bulls or overeager world-class athletes like myself). —David Ingles The Review: Room for ImprovementWe scope out the dining scene to let you know where to eat — everything from hole-in-the-wall joints to establishments with three Michelin stars. Read all our reviews here. Censu, the mod-Japanese restaurant on Gough Street, was one of the hardest places to book back in the hazy Covid-trapped days. While it’s much easier to get in now, the restaurant group owned by chef Shun Sato has parlayed that following into a big expansion, including a new casual izakaya-slash-teppanyaki joint called Siu Siu in Sheung Wan.  Rolling yakiniku. Photographer: Rachel Chang/Bloomberg People in Hong Kong generally have such low service expectations that it borders on an emotionally abusive relationship with the city’s F&B staff. Even by that low bar, Siu Siu got off on the wrong foot with my two guests and me. We were placed at the bar counter without forewarning or choice — despite a reservation — and then told that we could have a table if we gave it up in an hour. We agreed, assuming we would be moved back to the counter if we weren’t done. Instead, the waiter presented us the bill when time was up, even though some dishes had yet to be served. We spent HK$1,907 on dinner for a variety of mains and smaller dishes, plus a couple highballs. Even discounting for the bad taste the service left, Siu Siu’s food was a pale imitator of its elegant parent. Many dishes felt smart in concept but unfinished in execution: a stronger pickle element would have better balanced the rich, greasy “cheeseburger” (HK$88) (imagine a spring roll with a beef-and-cheese filling); the lobster tamago could have used less tomato and more ginger (HK$208); the rolling yakiniku’s (HK$208) eggplant filling was too mushy and its flavor profile overwhelmingly smoky. In short, I would take an evening at Censu any time, at least until Siu Siu moves past its growing pains.  The “Censu Cheeseburger?” has a beef-and-cheese filling. Photographer: Rachel Chang/Bloomberg The vibe: It’s a small space with a teppanyaki grill, so there’s smoke in the air — good for the vibes, bad for anyone with post-dinner plans. To be fair, there was definitely an izakaya bonhomie in the air when I visited, and the bad service and mid food did not prevent a good time had by all. Can you conduct a meeting here? Yes, but only if you can secure one of the few tables available (the reservation site now specifies bar counter or dining table options) and don’t mind a bit of smoke in the eyes. Who’s next to you: A young, chic local crowd, all cigarettes and highballs and Tokyo street style. It’s clearly become another see-and-be-seen place like other restaurants in the family.  Siu Siu parfait. Photographer: Rachel Chang/Bloomberg What we’d order again: The pickled kabu (HK$68) was a perfect appetize that underscored the freshness of Japanese produce, while the crab cup udon (HK$138) had the most depth of flavor of everything we ordered (perhaps no coincidence that this dish is also on Censu’s menu). The parfait (HK$98) is a lovely mix of textures and tastes, and the perfect level of non-sweetness that light up all the reward centers in Asian brains. Need to know: Siu Siu is located on the ground floor of The Strand at 49 Bonham Strand in Sheung Wan. It is open for dinner from 6 p.m. every day except Sundays. You can make bookings on its Instagram profile or WhatsApp at +852 6604 9083 and a deposit of HK$100 per diner is required for weekend dinner bookings. —Rachel Chang Read more reviews of Sheung Wan restaurants: Italian date-night spot Primo Posto, another izakaya Always Joy and Lasagna Factory. Are there any restaurants you think we should check out? Let us know at hkedition@bloomberg.net. See all our reviews here. Here’s What Else Is In the News

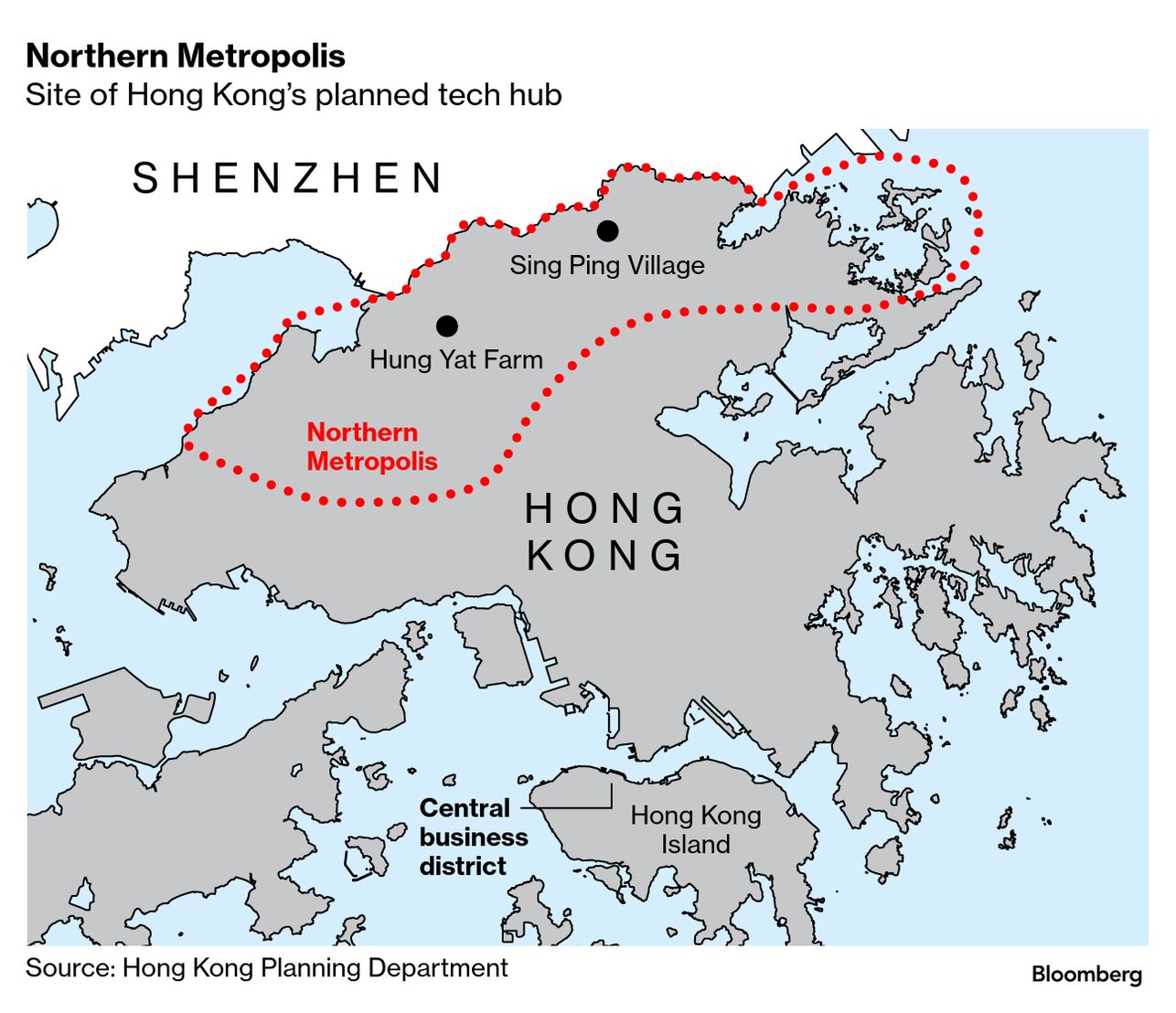

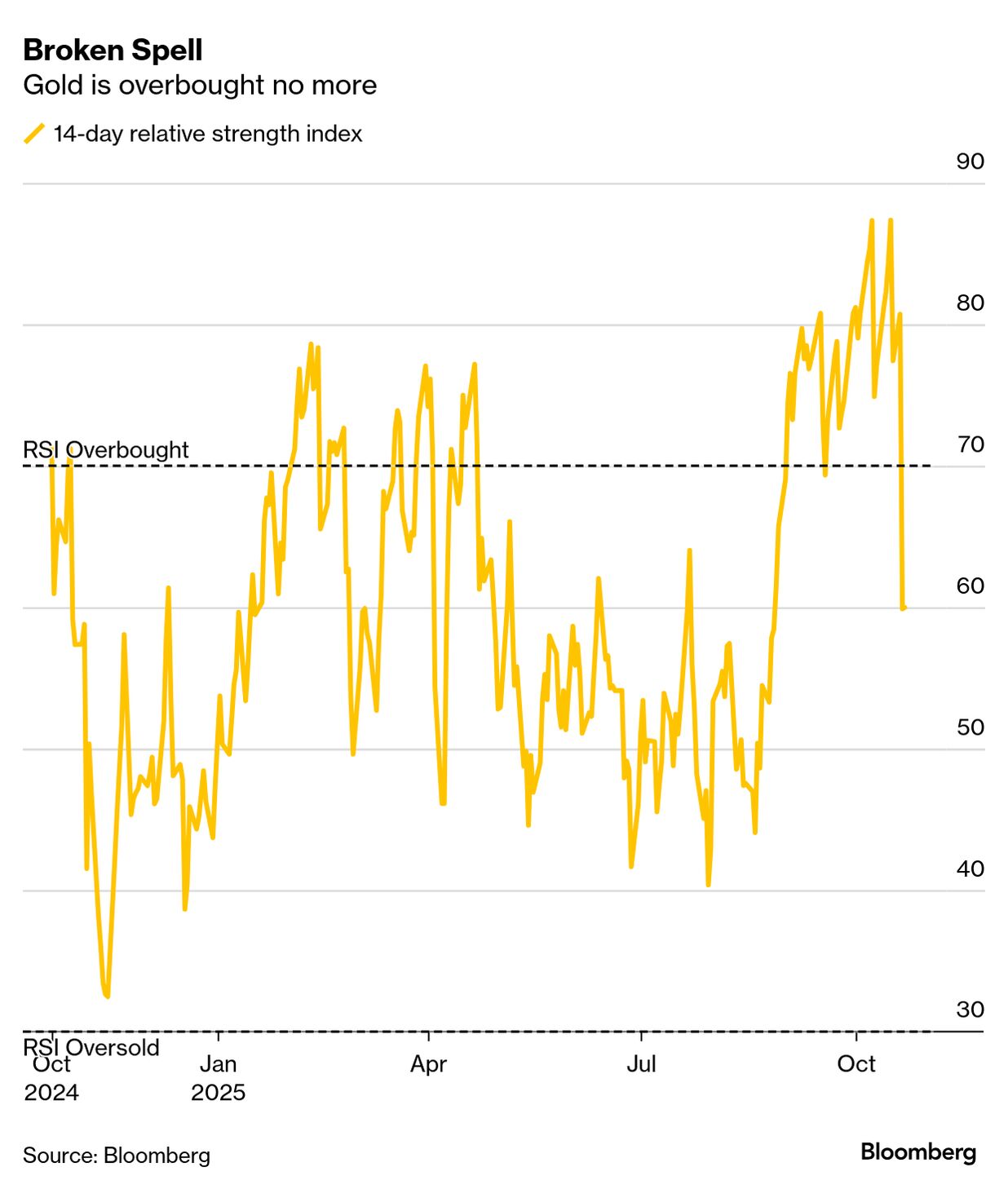

|