Good morning. Trade policy uncertainty, competitive pressures, and supply chain disruptions are pushing chief financial officers to rethink how they set prices.

Deloitte’s latest

North American CFO Signals survey finds that 95% of finance chiefs have adjusted their pricing strategies in the past six months, and 86% expect pricing to play an even greater role in financial performance over the next year.

Those are striking numbers, Steve Gallucci, global and U.S. leader of Deloitte’s CFO Program, told me. “You can say with conviction that those statements are unequivocally true,” Gallucci said.

The six-month window roughly aligns with the introduction of new reciprocal tariffs earlier this year—one of several factors prompting CFOs to revisit pricing strategies. However, according to the survey, competitive pressure is the top factor influencing pricing decisions, cited by 50% of CFOs. Thirty-four percent said trade policy uncertainty, and 43% said supply chain disruptions (in some cases, triggered by trade policy).

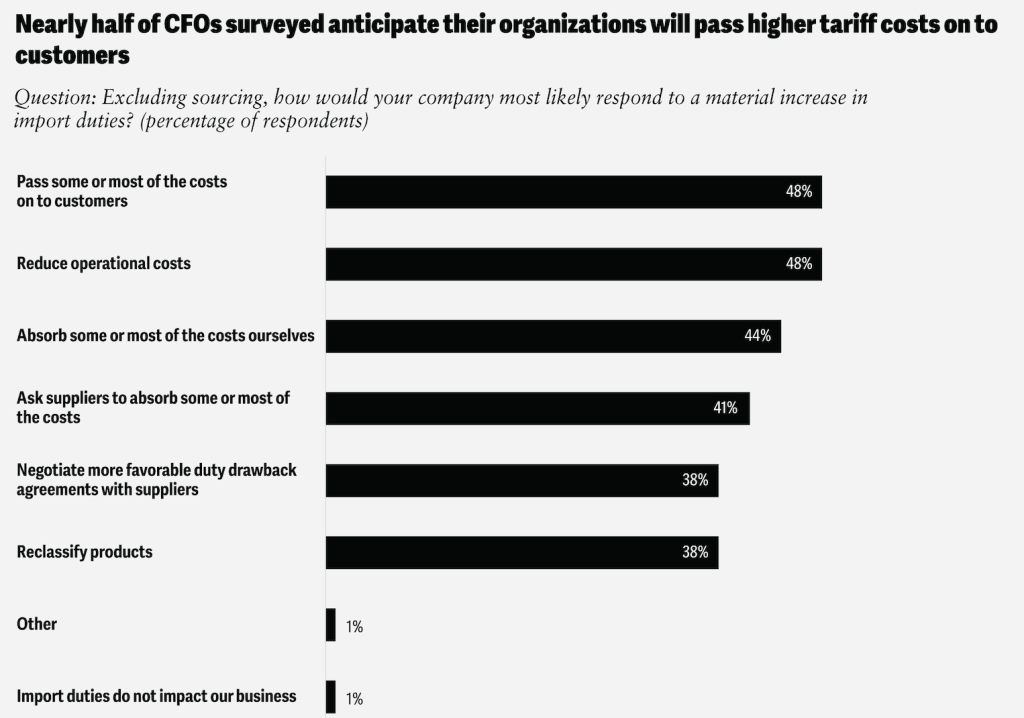

The research found that 44% of CFOs said their companies plan to absorb some or most tariff costs, while 48% expect to pass them on to consumers, and another 48% plan to offset them through operational savings. The findings are based on a survey of 200 North American CFOs from companies with revenues above $1 billion.

Courtesy of Deloitte

Courtesy of DeloitteAs companies navigate higher costs and market volatility, CFOs are playing a more direct role in pricing strategy, Gallucci said. The shift reflects how the finance chief’s role continues

to evolve, increasingly encompassing aspects of commercial leadership. Pricing decisions now demand input from finance, operations, and marketing alike, as companies weigh margin protection against customer retention, he said.

In reviewing earnings so far this week, I think that the

Coca-Cola Company’s (

No. 97 on the Fortune 500)

third-quarter 2025 results illustrate the trend. Net revenues rose 5% year over year to $12.5 billion, with organic revenue up 6%. A 6% price/mix gain—driven by four points of pricing actions and two points of favorable mix—was a key contributor, President and CFO John Murphy said on Tuesday’s earnings call. Although inflationary pressures have largely eased, the company continues to benefit from disciplined revenue growth management and a balanced product mix, Murphy noted.

In the quarter, Coca-Cola benefitted from stronger performance among premium brands such as Smartwater and Topo Chico, which the company noted were favored by higher-income consumers—an indicator that those segments may have been more willing or able to accept higher price points.

Data and strategyWhen asked about the main challenges to adjusting prices quickly, more than half of the respondents said a lack of accurate or accessible data and the absence of a cohesive pricing strategy would be obstacles. Moving fast without solid data can be just as risky as moving too slowly, Gallucci said.

However, 81% of CFOs describe their organizations’ pricing processes as mature or very mature, which could be a sign that many finance teams are investing in better systems, data analytics, and coordination across functions.

For many finance chiefs, pricing is about more than responding to tariffs—it’s a core measure of business health.

Sheryl Estradasheryl.estrada@fortune.com